Blog

1298 posts

Covering federal, state, and corporate tax work, here are our top 5 charts of 2022. It’s worth noting that the biggest tax news of 2022 – the adoption of a federal 15 percent corporate minimum tax in the Inflation Reduction Act – should make some of these charts look much better after the new law is implemented.

State Rundown 12/15: State Priorities for 2023 Begin to Take Shape

December 15, 2022 • By ITEP Staff

State leaders have begun to release budget projections for 2023 and a familiar theme has emerged once again: big revenue surpluses, which have many state lawmakers pushing for another round of tax cuts despite the monumental challenges that we as a country face that call for sustainable revenues...

Any tax legislation enacted before this Congress ends should prioritize policies that have a proven track record of helping workers and children rather than policies that cut taxes for corporations or for individuals who are already well-off. It's not clear right now whether lawmakers will do that - or whether they will enact any tax legislation at all before the year ends, but here we take a look at the key tax issues that lawmakers are discussing.

Lawmakers Seek to Extend Tax Break for “Research” that Corporations Use to Develop Frozen Foods, New Beer Flavors, Casino Games and Tax Avoidance

December 8, 2022 • By Steve Wamhoff

If Congress creates a tax break to encourage businesses to conduct research that benefits society, should Netflix be eligible for it? There is no shame in binge-watching Stranger Things or Bridgerton or The Crown, but how many of us really think Netflix deserves a tax break for whatever “research” the company did to provide this […]

Reversing the Stricter Limit on Interest Deductions: Another Huge Tax Break for Private Equity

December 6, 2022 • By Steve Wamhoff

Private equity is doing fine on its own and does not need another tax break. Congress should keep the stricter limit on deductions for interest payments —one of the few provisions in the 2017 tax law that asked large businesses to pay a little bit more.

Bipartisan Retirement Proposals Are Mostly Just More Tax Cuts for the Wealthy

December 5, 2022 • By Steve Wamhoff

The EARN Act and SECURE Act 2.0, two bipartisan retirement bills working their way through Congress, are major disappointments. They would mainly provide more tax breaks for the well-off who will most likely retire comfortably regardless of what policies Congress enacts. The bills would provide modest assistance for those who really need help to save.

State Rundown 11/30: ‘Lame Duck’ December Could Have Major Tax Implications

November 30, 2022 • By ITEP Staff

As federal lawmakers begin their lame duck deliberations, the revival of the expanded child tax credit remains a strong possibility...

Child Tax Credit Expansion Would Shrink the Racial Wealth Gap

November 21, 2022 • By ITEP Staff

Extending the expanded Child Tax Credit would benefit nearly every child in low- and middle-income families. Under current rules, 24% of white children, 45% of Black children, and 42% of Hispanic children will not receive the full credit in 2023 because their families make too little. These figures would drop to zero if the provisions were extended, helping families of all races and disproportionately helping families of color.

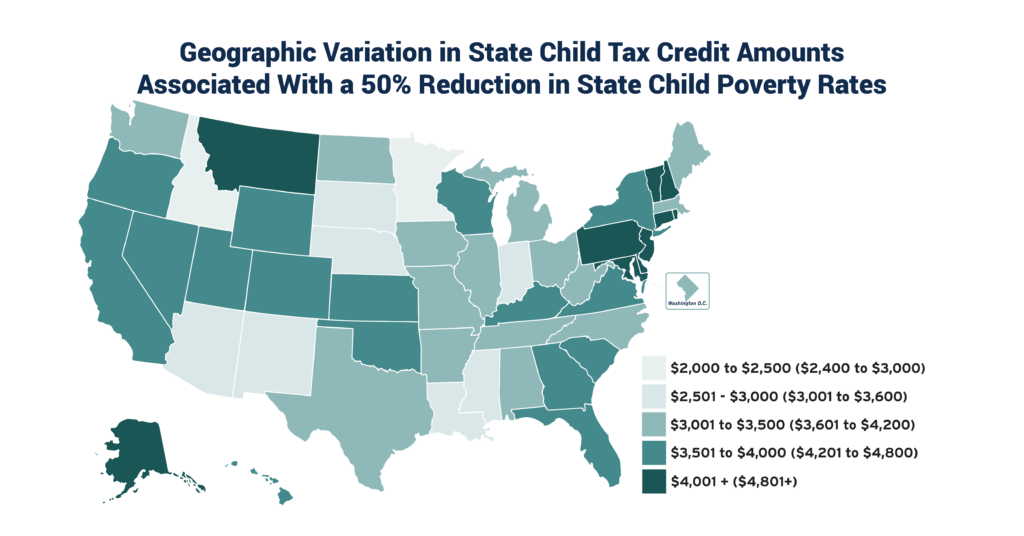

State policymakers have the tools they need to drastically reduce child poverty within their borders. A new ITEP report, coauthored with Columbia University’s Center on Poverty and Social Policy, explores state Child Tax Credit (CTC) options that would reduce child poverty by up to 50 percent. Temporary expansion of the federal CTC in 2021 reduced […]

As states continue to tally the remaining votes and the news stories roll out at a breakneck pace, the unofficial results of the 2022 midterm elections have brought with it significant changes across the state tax policy landscape...

Election Day in the States: Voters Deliver Important Victories for Tax Justice

November 10, 2022 • By Jon Whiten

Voters in Massachusetts and Colorado raised taxes on their wealthiest residents to fund schools, public transportation and school lunches for kids while making their tax codes more equitable. And voters in West Virginia defeated a proposal to deeply cut taxes, mostly for businesses, and drain the coffers of county and local governments.

Massachusetts Voters Score Win for Tax Fairness with ‘Fair Share Amendment’

November 9, 2022 • By Marco Guzman

In a significant victory for tax fairness, Massachusetts voters approved Question 1—commonly known as the Fair Share Amendment—Tuesday night with 52 percent of the vote. The new constitutional amendment creates a 4 percent surcharge on income over $1 million, and the revenue will specifically fund education and transportation projects in the Bay State.

Key Republicans Say Negligible Decline in Economic Growth Outweighs Enormous Drop in Child Poverty

November 3, 2022 • By Joe Hughes

The expanded Child Tax Credit reduced child poverty dramatically and immediately. There is no debate or murkiness on this. Some lawmakers have decided that cutting child poverty in half is not worth the cost if it means an ambiguous and negligible decline in GDP growth. This view is not just cruel, it is bad economics.

Next Tuesday, voters will head to the polls to not only elect local and national leaders, but also let their voices be heard on a range of tax policy issues that could improve or worsen their state tax codes...

Tax Foundation’s ‘State Business Tax Climate Index’ Bears Little Connection to Business Reality

October 31, 2022 • By Carl Davis, Matthew Gardner

The big problem with the Index is that it peddles a solution that not only falls short of the goal of generating business investment, but one that actively harms state lawmakers’ ability to provide the kinds of public goods – like good schools and modern, efficient transportation networks – that businesses need and want.

Measures on the November Ballot Could Improve or Worsen State Tax Codes

October 26, 2022 • By Jon Whiten

In a couple of weeks, voters in a handful of states will weigh in on several tax-related ballot measures that could make state tax codes more equitable and raise money for public services, or take states in the opposite direction, making tax systems less fair and draining state coffers of dollars needed to maintain critical […]

Although the weather is beginning to cool down in parts of the country, the same cannot be said for many state economies, which are still running hot. That, however, doesn’t mean that the good times are guaranteed to last...

Congress Should Not Leave Children Out of Possible Year-End Tax Deal

October 3, 2022 • By Steve Wamhoff

If lawmakers believe it’s worthwhile to extend corporate tax breaks, then it would be entirely unreasonable for them to not conclude the same about tax provisions that help low-income children.

Do you remember/the big tax news innn September? Well, if not, we at ITEP got you covered...

Census Data Shows Need to Make 2021 Child Tax Credit Expansion Permanent

September 14, 2022 • By Joe Hughes

The Child Tax Credit expansion led to a 46 percent decline in childhood poverty. That it could be accomplished during the largest economic disruption in most of our lifetimes underscores a basic fact: thoughtful, decisive government action to combat poverty works.

Billionaires Should Pay Taxes on Their Income Every Year Like the Rest of Us

September 13, 2022 • By Steve Wamhoff

The Inflation Reduction Act signed by President Biden last month will crack down on corporate tax dodgers and strengthen enforcement of tax laws already on the books, raising hundreds of billions of dollars to be spent on climate, health and other priorities. But these reforms will not directly raise taxes on even the wealthiest individuals. […]

State Rundown 9/7: Labor Day Week Provides Sobering Reminder of Steps Forward, Back

September 7, 2022 • By ITEP Staff

Though Labor Day has passed, advocates on the ground in states across the country are continuing to uphold the spirit of the labor movement...

Romney Child Tax Credit Plan Would Leave Millions of Children Worse Off and Raise Taxes for the Average Black Family

September 7, 2022 • By Steve Wamhoff

Sen. Romney’s plan would expand the Child Tax Credit and offset the costs by scaling back other tax benefits. All told, it would raise taxes on a fourth of all kids in the U.S. This includes about a fourth of the children among the poorest fifth of U.S. families.

Four Tax Policy Wins in the Inflation Reduction Act and Four More That Can Build on This Progress

August 22, 2022 • By Joe Hughes, Jon Whiten

With four major tax policy provisions, the IRA takes a huge step toward a fairer tax code and a more equitable economy. But as always, there are more steps lawmakers should take to build on this progress.

Putting Cleveland and the Nation on a Path Toward Tax and Climate Justice

August 22, 2022 • By Amy Hanauer

Editor’s note: This originally ran as an opinion piece in the Cleveland Plain Dealer. When I left Cleveland to work on federal tax policy after 20 years running Policy Matters Ohio, I knew Ohio would stay in my heart and fuel my work. Accustomed to an America that often ignores our toughest problems, I understood […]