Blog

1298 posts

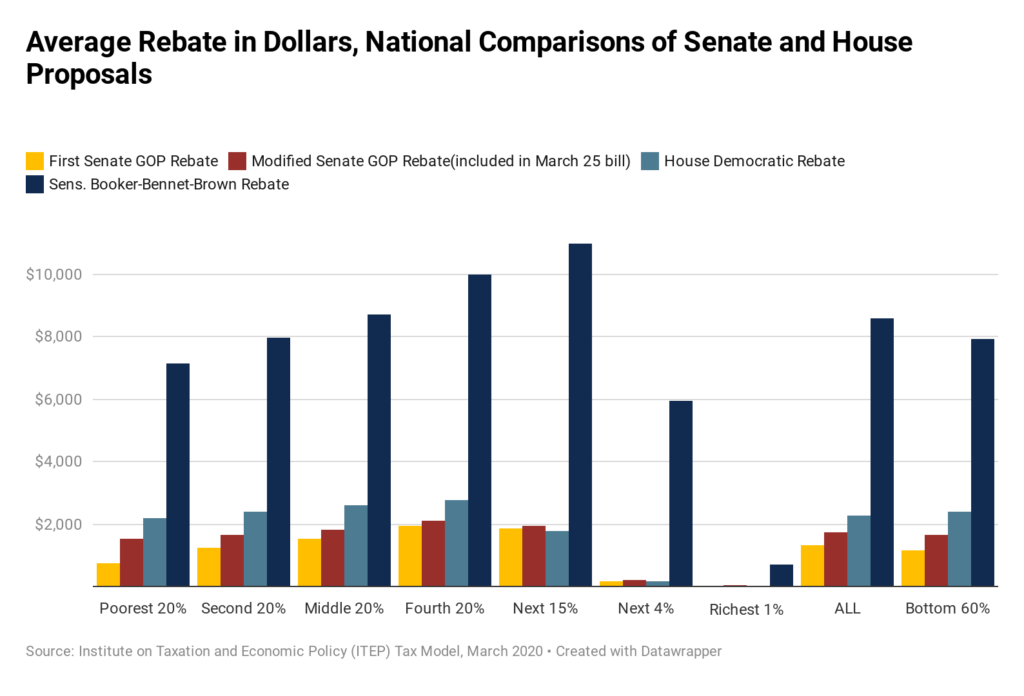

How the Tax Rebate in the Senate’s Bill Compares to Other Proposals

March 25, 2020 • By Steve Wamhoff

Congress is poised to pass a $2 trillion plan that includes $150 billion in fiscal aid to states, $150 billion in health care spending, large expansions of unemployment compensation and more. These measures are clearly needed as the economy teeters on the brink. As the Senate votes on its stimulus/COVID19 bill, one provision ITEP has deeper insights on is the payments to households in the form of tax rebates. ITEP has provided several analyses over the past few days showing that the rebate in the current bill is an improvement over a previous GOP proposal but still falls short of…

COVID-19 and the Case for Race-Forward Economic Policy Prescriptions

March 24, 2020 • By Jenice Robinson

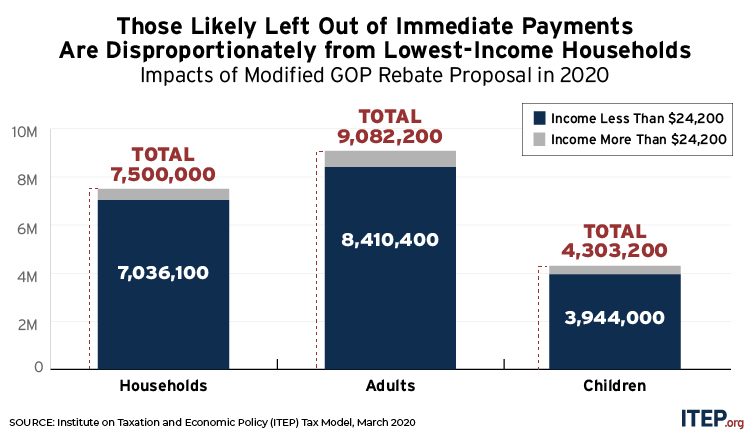

Unconscious bias runs deep. Legislative proposals to assuage the exploding economic crisis are advancing and changing quickly, but initial GOP proposals are consistent with the nation’s long history of ostensibly race-neutral policies that are discriminatory in their outcomes.

NEW ANALYSIS: House Democratic Stimulus Bill Explained

March 24, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

Breaking ITEP analysis explains how a newly-introduced House Democrats' proposal—far more comprehensive and better targeted than the recently failed GOP Senate bill—combines overdue expansion of the Earned Income Tax Credit and Child Tax Credit with direct rebates to reach workers and families across all income groups.

New State-by-State Estimates: Modified Senate GOP Stimulus Bill Still Falls Short

March 23, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

The GOP Senate stimulus bill voted down yesterday is a slight improvement over the first GOP proposal released Thursday, but it still fails to prioritize workers and families or provide fast relief to those who need it most.

Why the GOP Senate Bill Fails to Address the Crisis, and Why a Democratic Bill Looks More Promising

March 20, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

National and state-by-state data available for download By Steve Wamhoff and Meg Wiehe On Thursday night, Senate Majority Leader Mitch McConnell released a bill that reportedly cost more than $1 trillion, most of which would go toward breaks for corporations and other businesses. A provision in the bill to provide payments to families would cost […]

State Rundown 3/19: Spring Is Here but States Brace for Long Winter

March 19, 2020 • By ITEP Staff

As the COVID-19 pandemic continues to disrupt more and more aspects of life and cause greater and greater harms to public health and the economy, information is changing by the hour. State policymakers, if they are even able to convene, are wholly focused on how to respond to the crisis. The pandemic is certain to pose a series of fiscal challenges for states and their economies, and this week’s Rundown focuses on the most helpful resources and the latest state-by-state updates available.

It’s Time for Some State Fiscal Policy Triage

March 18, 2020 • By Carl Davis, Dylan Grundman O'Neill, ITEP Staff

The COVID-19 novel coronavirus’s effects on public health and economies at all scales are creating a daunting situation for state budgets as well. Lawmakers can choose and prioritize their responses through a straightforward approach similar to that taken by health professionals: marshal and reinforce available resources, triage response options to prioritize the most vital services and most vulnerable people, and enact or strengthen the policies that will help address longer-term issues as well as immediate emergencies.

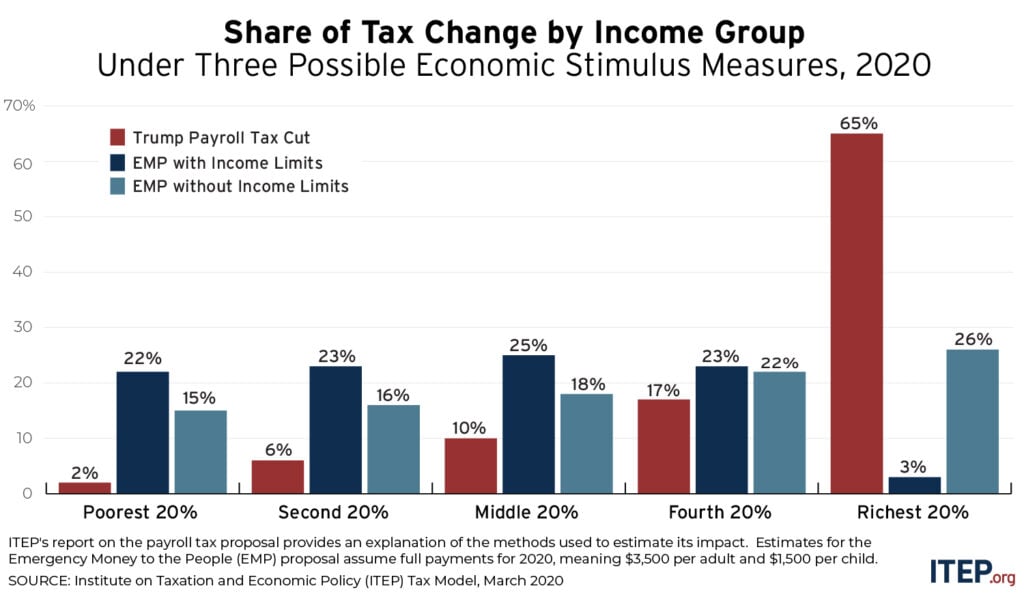

A payroll tax cut would help those lucky enough to keep their job and would provide a bigger break to those with more earnings. Sending checks to every household would be a far more effective economic stimulus because it would immediately put money in the hands of everyone who would likely spend it right away, pumping it back into the economy.

New ITEP Report on President’s Misguided Payroll Tax Proposal

March 13, 2020 • By Steve Wamhoff

Earlier this week, ITEP analyzed what would happen if Congress and the President repeated the 2 percentage-point cut in the Social Security payroll tax that was enacted for two years during the last recession. Little did we know that President Trump was about to propose something far more radical: eliminating all Social Security and Medicare […]

An Overload of Pie Graphs and Metaphors for Pi Day

March 13, 2020 • By ITEP Staff, Jenice Robinson, Stephanie Clegg

For Pi Day, we’re doubling down on the pie metaphor to reiterate the compelling case for progressive tax policies to ensure more of us have an opportunity to share a slice of this nation’s economic pie.

State Rundown 3/11: Georgia Bucks Trend of Cautious Policymaking Amid Crises

March 11, 2020 • By ITEP Staff

With all eyes on the potential effects of the oil price war and COVID-19 coronavirus on lives, communities, and economies, Georgia House lawmakers this week crammed through a regressive and costly tax cut for the rich with essentially no debate, information, or transparency. Most states are proceeding much more responsibly, assessing the ramifications for their service provision needs and revenues to fund those needs.

The Trump administration is floating a cut in the Social Security payroll tax as a measure to counteract a potential economic downturn related to the COVID-19 virus. It should go without saying that a public health crisis requires government interventions that have nothing to do with taxes. But even if policymakers want to find ways to stimulate the economy beyond solving the health crisis, the payroll tax cut is not likely to be very effective.

COVID-19 Is No Excuse for Airline Industry or Any Other Corporate Tax Cut

March 10, 2020 • By Matthew Gardner

Trump administration officials have reportedly floated the idea of including tax breaks for the airline industry in its package of COVID-19-related stimulus proposals, which would allow airline companies to defer income taxes into the future. This is an odd policy choice since most of the biggest airlines are already using deferral to zero out most or all of their federal income taxes on billions of dollars in profits.

Some problems can only be solved when public officials have the resources to act. Today’s public health crisis is that kind of problem. Unfortunately, the Trump administration’s deep tax cuts leave our health infrastructure knee-capped, just when we need it most.

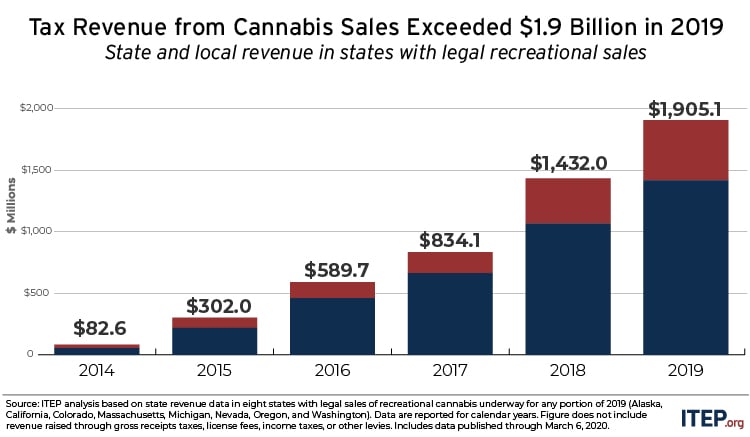

State and Local Cannabis Tax Revenue Jumps 33%, Surpassing $1.9 Billion in 2019

March 10, 2020 • By Carl Davis

Excise and sales taxes on cannabis raised more than $1.9 billion in 2019. This represents a jump of nearly half a billion dollars, or 33 percent, compared to a year earlier. These are the findings of an ITEP analysis of newly released tax revenue data from the eight states where legal sales of adult-use cannabis took place last year.

TurboTax Is a Case Study for Why the IRS Should Administer Free File Program

March 9, 2020 • By Jenice Robinson

TurboTax and other online tax preparation companies rely on complicating tax filing and limiting competition as part of their business model.

Alaska’s tax system underwent major changes in the 1970s when oil was found at Prudhoe Bay. Lawmakers repealed the state’s personal income tax (making Alaska the only state ever to do so) and began balancing the state’s budget primarily with oil tax and royalty revenue instead. But as oil prices and production levels have declined, a yawning gap has opened between state revenues and the cost of providing vital public services.

State Rundown 3/4: Sun Shining on Progressive Tax Efforts This Week

March 4, 2020 • By ITEP Staff

Wisconsin’s expansion of a capital gains tax break for high-income households represents a dark spot on this week’s state fiscal news, and the growing threat of COVID-19 is casting an ominous shadow over all of it, but otherwise the picture is pleasantly sunny, featuring small steps forward for sound, progressive tax policy. An initiative to create a graduated income tax in Illinois, for example, got a vote of confidence from a major ratings agency, while a similar effort went public in Michigan and two progressive income tax improvements were debated in Rhode Island. Gas tax updates made encouraging progress in…

Administration Once Again Touts Misleading Information on 2017 Tax Law

March 3, 2020 • By Matthew Gardner

The Trump administration has remained consistently on message about its 2017 Tax Cuts and Jobs Act. More than two years after the passage of the law, Treasury Secretary Steve Mnuchin is still forlornly attempting to portray it as a boon for working families, despite mounds of evidence to the contrary. Earlier this week the Treasury […]

Anti-tax activists’ convoluted claims that the rich pay too much in taxes broke new ground with an op-ed published last week in the Wall Street Journal. Penned by former Texas Sen. Phil Gramm and John Early, a former official of the Bureau of Labor Statistics, the piece is particularly misleading. The so-called evidence in support of their argument against raising taxes on the rich fails to correctly calculate effective tax rates.

This weekend’s Leap Day should be a welcome extra day for state lawmakers, advocates, and observers who care about tax and budget policy, as there is an overflow of proposals and information to digest. Most importantly, as emphasized in our “What We’re Reading” section, there are never enough days in a month to do justice to the importance of Black History Month and Black Futures Month. In state-specific debates, Oregon and Washington leaders are hoping to take a leap forward in raising funds for homelessness and housing affordability measures. Lawmakers in West Virginia and Wisconsin could use a day to…

Lawmakers should keep in mind that transportation funding woes can be traced to the federal government’s extremely outdated gas tax rate, which has not been raised in more than 26 years—not even to keep up with inflation.

Tax Cuts Floated by White House Advisors Are an Attempt to Deflect from TCJA’s Failings

February 21, 2020 • By ITEP Staff, Jenice Robinson, Steve Wamhoff

Now that multiple data points reveal the current administration, which promised to look out for the common man, is, in fact, presiding over an upward redistribution of wealth, the public is being treated to pasta policymaking in which advisors are conducting informal public opinion polling by throwing tax-cut ideas against the wall to see if any stick. But the intent behind these ideas is as transparent as a glass noodle.

State Rundown 2/20: Property Taxes and School Finance Take Center Stage

February 20, 2020 • By ITEP Staff

Property taxes and education funding are a major focus in state fiscal debates this week. California voters will soon vote on borrowing billions of dollars to fill just part of the funding hole created in large part by 1978’s anti-property-tax Proposition 13. Nebraska lawmakers are debating major school finance changes that some fear will create similar long-term fiscal issues. And Idaho and South Dakota leaders are looking to avoid that fate by reducing property taxes in ways that will target the families who most need the help. Meanwhile, Arkansas, Nevada, and New Hampshire are taking close looks at their transportation…

How Democratic Presidential Candidates Would Raise Revenue

February 19, 2020 • By Steve Wamhoff

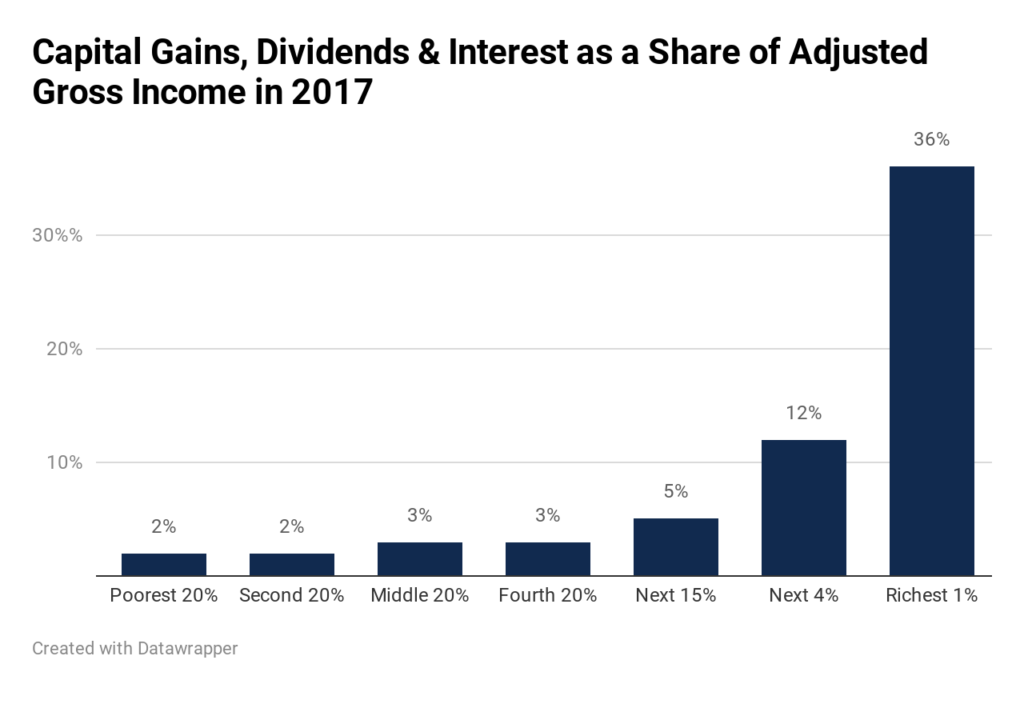

One of the biggest problems with the U.S. tax code in terms of fairness is that investment income, which mostly flows to the rich, is taxed less than the earned income that makes up all or almost all of the income that working people live on.