Blog

1298 posts

The Working Families Tax Relief Act Would Boost Incomes and Economic Security for Workers and Children

April 10, 2019 • By Steve Wamhoff

Sens. Sherrod Brown, Michael Bennet, Richard Durbin, and Ron Wyden (along with the backing of most of the Democratic caucus in the Senate) today rolled out a new proposal to expand the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC). Called the Working Families Tax Relief Act (WFTRA), the proposal would provide a substantial benefit, especially to low-income working families.

State Rundown 4/4: Ohio Gas Tax and Maryland Minimum Wage Get Needed Updates

April 4, 2019 • By ITEP Staff

Transportation funding was a hot topic this week, as OHIO lawmakers responsibly voted to update their gas tax and offset some of its impact on lower-income families with an Earned Income Tax Credit (EITC) boost, while NEW YORK enacted the nation’s first “congestion pricing” charge, and LOUISIANA and VIRGINIA leaders looked at gas tax updates as well—a trend ITEP’s Carl Davis explored in depth today here. Broad tax packages are also being hashed out in LOUISIANA, NEBRASKA, OREGON, and TEXAS. And MARYLAND became the sixth state with a $15 minimum wage on the horizon.

A chorus is building and calling on our elected officials to tax the rich. And pundits and policymakers are seriously debating proposals calling for higher income taxes and a wealth tax instead of attempting to shut down the conversation by labeling such proposals as class warfare.

Sen. Ron Wyden of Oregon, the ranking Democrat on the Senate Finance Committee, announced that he would soon release a proposal to eliminate massive tax breaks enjoyed by the wealthy on their capital gains income. If successful, the proposal would ensure that income from wealth is taxed just like income from work.

What to Watch for When the IRS Releases Its SALT Workaround Regulations

April 1, 2019 • By Carl Davis

The Treasury Department and IRS last summer proposed regulations that would make it more difficult for taxpayers to avoid the $10,000 cap on deductions for state and local taxes (SALT). Now, likely days away from the unveiling of the final version of IRS regulations on SALT cap workarounds, Carl Davis recaps the finer points ITEP will be watching for when the regulations become public.

This month in tax policy news: Corporate profits soar while corporate tax collections plummet. Also inside: A look at regressive state tax policies and progressive remedies and the continued unpackaging of the Tax Cuts and Jobs Act. It's ITEP's March 2019 Monthly Digest.

The Trump Tax Law Further Tilted an Already Uneven Playing Field

March 27, 2019 • By Jessica Schieder

Proponents sold the Tax Cuts and Jobs Act (TCJA) as a way to spur new investment, increase workers’ paychecks, and reverse the off-shoring of jobs. Testimony presented during a House Ways and Means hearing held today reflected on how—more than a year after the law’s passage—each of those pitches ring hollow.

State Rundown 3/27: Spring Bringing Smart State Tax Policy So Far

March 27, 2019 • By ITEP Staff

Though a long winter and a rough start to spring weather have wreaked havoc in much of the country, lawmakers are off to a good start in the world of state fiscal policy so far. In the last week, a progressive revenue package was passed in the nick of time in NEW MEXICO, a service-sapping tax cut was vetoed in KANSAS, and a regressive and unsustainable tax shift was soundly defeated in NORTH DAKOTA. Meanwhile, gas tax updates are on the table in MAINE, MINNESOTA, and OHIO. And exemptions for feminine hygiene products and diapers were enacted in VIRGINIA and introduced in MISSOURI.

Data released Friday by the U.S. Treasury Department should give great pause to all who care about the federal government’s ability to raise revenue in a fair, sustainable way. In the wake of the 2017 corporate tax overhaul, corporate tax collections have fallen at a rate never seen during a period of economic growth.

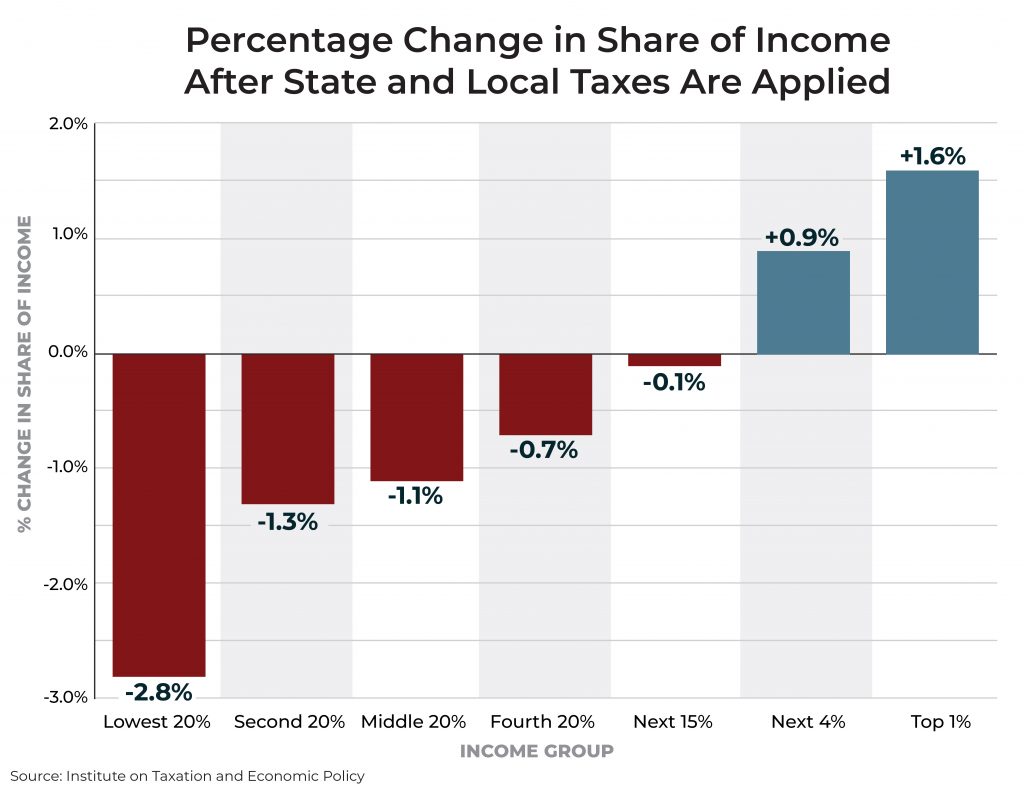

A 2019 ITEP analysis found that Black and Latinx households are overrepresented in the lowest-income quintiles; while they represent about 22 percent of overall tax returns, they account for 30 percent of the poorest quintile of taxpayers.

Rep. Doggett and Sen. Whitehouse Reintroduce Bill to End Offshore Tax Avoidance

March 15, 2019 • By Lorena Roque

On Thursday, Representative Lloyd Doggett and Senator Sheldon Whitehouse announced that they are reintroducing the “No Tax Breaks for Outsourcing Act.” Our international corporate tax rules have been a mess for a long time, and Tax Cuts and Jobs Act (TCJA) failed to resolve the problems. The old rules and the new rules under TCJA both tax offshore corporate profits more lightly than domestic corporate profits, but in different ways. The No Tax Breaks for Outsourcing Act would create rules that tax domestic profits and foreign profits in the same way.

More than three billion dollars could be raised under a major progressive tax plan proposed by Illinois Gov. J.B. Pritzker this week, the point being to simultaneously improve the state’s upside-down tax code and address its notorious budget gap issues. One state, Utah, may already be looking at a special session to revisit the sales tax reform debate that ended this week without resolution, in contrast to Alabama and Arkansas, where leaders finally resolved years-long debates over gas taxes and infrastructure funding. And lawmakers in four states – California, Florida, Minnesota, and North Carolina – introduced legislation to expand or…

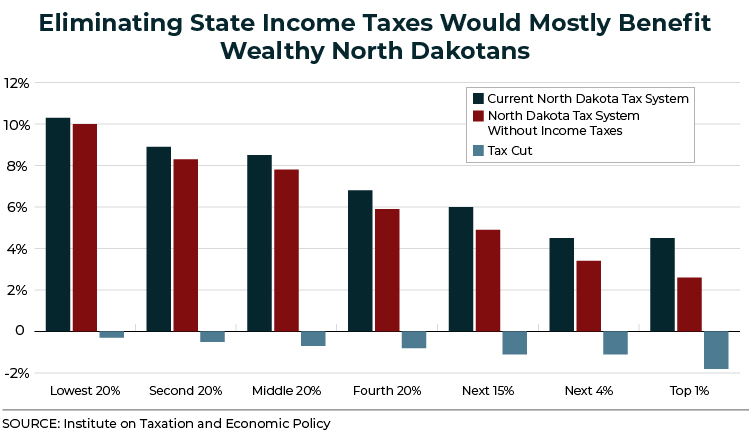

North Dakota Senate Should Put the Freeze on House Tax-Cut Plan

March 11, 2019 • By Dylan Grundman O'Neill

Lawmakers in Bismarck were treated last weekend to the largest single day of snowfall the city has ever seen. As state senators begin weighing a bill recently passed by the House that would replace the state's income taxes with oil revenue, they might want to reflect on how similar oil revenue is to the snow: although both are in extreme abundance right now, both are volatile and unpredictable and will melt away sooner than later. Lawmakers should also consider how eliminating the state's income taxes might warm the hearts of wealthier North Dakotans but would leave most North Dakota families…

State Rundown 3/6: March Tax Debates Contain Sanity Amid Usual Madness

March 6, 2019 • By ITEP Staff

State policymakers around the nation this week served up a handful of harmful and upside-down tax proposals, but these were refreshingly outnumbered by sound tax and budget policy proposals in several other states. NEW JERSEY Gov. Phil Murphy made tax fairness an explicit priority in his budget address, the NEW MEXICO House passed progressive reforms to improve the state’s schools and tax code, states such as VERMONT are looking to raise funds from legalized cannabis and put it to good use, and many states, including ALABAMA, ARKANSAS, OHIO, and WISCONSIN, are seriously considering much-needed gas tax updates to improve their…

The nation is currently engaging in serious discourse about how to expand economic opportunity and remedy income inequality via the federal tax code. State tax systems are also important and have a dismal effect on the growing economic divide. In a new report, Fairness Matters: A Chart Book on Who Pays State and Local Taxes, we further parse our Who Pays? data.

State Rundown 2/27: Temperatures and Tax Fights Continue to Polarize

February 27, 2019 • By ITEP Staff

As another polar vortex heads for large swaths of the country, state tax debates this week were highly polarized in another way. Lawmakers and advocates in MICHIGAN, OHIO, OREGON, UTAH, and elsewhere fought to enact or improve state Earned Income Tax Credits to give a boost to low- and middle-income working families. But the opposite extreme was heavily represented as well, as others pushed for regressive tax cuts for wealthy individuals and corporations, including in KANSAS, NEBRASKA, NORTH DAKOTA, OHIO, UTAH, and WEST VIRGINIA. Even our “What We’re Reading” section has informative reading on how education funding policy continues to…

State tax policy can be a contentious topic, but one issue on which lawmakers largely agree is that higher gas tax rates are necessary to keep our nation’s infrastructure operating safely and efficiently. Lawmakers in 27 states have approved gas tax increases since 2013.

State Rundown 2/20: February and Regressive Tax Cuts, The “Meanest Moons of Winter”

February 20, 2019 • By ITEP Staff

Tom Robbins called February “the meanest moon of winter, all the more cruel because it will masquerade as spring, occasionally for hours at a time, only to rip off its mask with a sadistic laugh and spit icicles into every gullible face, behavior that grows quickly old.” Observers of state fiscal debates might think he was writing about similarly tiresome regressive tax cut proposals, which recently succeeded in Arkansas and advanced in North Dakota despite improved public understanding of the upside-down nature state tax systems, ineffectiveness of supply-side trickle-down tax cuts, and importance of investing in education. But like February…

Happy Valentine’s Day to all lovers of quality research, sound fiscal policy, and progressive tax reforms! This week, some leaders in ARKANSAS displayed their infatuation with the rich by advancing regressive tax cuts, but others in the state are trying to show some love to low- and middle-income families instead. WISCONSIN lawmakers are devoted to tax reductions for the middle class but have not yet decided how to express those feelings. NEBRASKA legislators are playing the field, flirting with several very different property tax and school funding proposals. And VIRGINIA’s legislators and governor just decided to settle for a flawed…

The Tax Cuts and Jobs Act (TCJA), enacted by President Trump and Congressional Republicans at the end of 2017, has caused quite a bit of confusion, and a recent “Fact Checker” column by the Washington Post’s Glenn Kessler does not help. TCJA created real problems that can't be resolved without real tax reform. To begin that process fact checkers, lawmakers, and everyone else need to be clear about what TCJA did, and did not, do to our tax system.

Fear, Not Facts: Netflix Misleads Media Reporting on Corporate Tax Avoidance

February 13, 2019 • By Matthew Gardner

In an age when even the most incontrovertible facts are routinely dismissed as “fake news,” reporting on corporate taxes can be a daunting challenge for members of the media. ITEP’s recent analysis of the income tax disclosures made by Netflix in its annual financial report last week provide an excellent reminder of this.

On Monday a group of Senators and Representatives from the Northeast announced their latest proposal to repeal the cap on deductions for state and local taxes (SALT), this time offsetting the costs by restoring the top personal income tax rate to 39.6 percent. This is an improvement over previous proposals to repeal the cap on SALT deductions without offsetting the costs at all. But the new approach does not improve our tax system overall. Instead, it trades one tax cut for the rich (a lower top income tax rate) for another (repeal of the cap on SALT deductions).

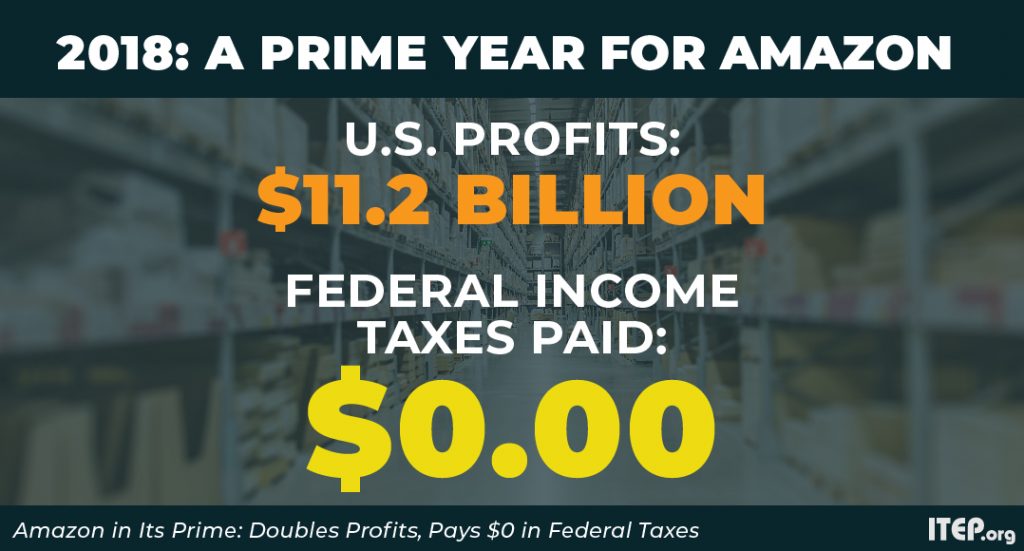

Amazon in Its Prime: Doubles Profits, Pays $0 in Federal Income Taxes

February 13, 2019 • By Matthew Gardner

Amazon, the ubiquitous purveyor of two-day delivery of just about everything, nearly doubled its profits to $11.2 billion in 2018 from $5.6 billion the previous year and, once again, didn’t pay a single cent of federal income taxes.

A Tale of Two States: How State Tax Systems Perpetuate Income Inequality

February 11, 2019 • By ITEP Staff

To explain how state tax systems make income inequality worse, we compared tax systems in New Jersey and Texas which, before taxes, have similar levels of income inequality. This comparison provides an example of how policymakers’ decisions affect the economic wellbeing of their constituents.

This year is full of opportunity for state policymakers and advocates seeking to improve upside-down tax systems and generate needed funding for shared priorities. In a series of blog posts, ITEP staff summarize key trends we are watching in statehouses this year, with special attention to the many efforts underway to reduce racial and economic inequities and better prepare state budgets for the next recession and reduced federal investments. Along the way, we’ll also draw attention to some of the more destructive policy ideas to watch for in 2019.