ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

How to Better Tax the Rich Men North (and South) of Richmond

September 7, 2023 • By Amy Hanauer

When you examine tax policy through the lens of how much working (and poor) people are taxed compared to rich men north (and south) of Richmond, it’s hard not to take Oliver Anthony's runaway hit as a jumping off point to amplify some important facts.

New York Times: New Corporate Minimum Tax Ushers In Confusion and a Lobbying Blitz

September 7, 2023

The new corporate minimum tax was one of the most significant changes to the U.S. tax code in decades. Its logic rested on the idea that rich companies should not be able to find loopholes and other accounting maneuvers in order to pay lower tax rates than their workers. But making the tax operational has become a […]

Mother Jones: The Struggle to Tax the Rich Isn’t Done Yet—In Some States It’s Actually Happening

August 24, 2023

Under an overcast sky, Patty Flores led a group of colleagues to an empty lot in the mobile home park where she lived. A bare patch of grass traced the outline of a home set ablaze in an electrical fire. She saw it as a symptom of a larger problem, one that connected to her rising […]

Mother Jones: “The Wealthy Tend to Always Look Out for Themselves”—The Attack on State Taxes By Outside Groups

August 22, 2023

Amia Edwards lives here because she wants to make a difference. But in this majority-Black city, long starved for funding by the state’s mostly white Legislature, that’s proved a steep challenge. Read more.

Chicago Fed: Electric Vehicles, Motor Fuel Taxes, and Road Funding in the Seventh District and Beyond

August 17, 2023

State and federal highways are currently funded by a combination of motor fuel taxes (MFTs), general fund transfers, fees, tolls, property taxes, and bond revenues. Read more.

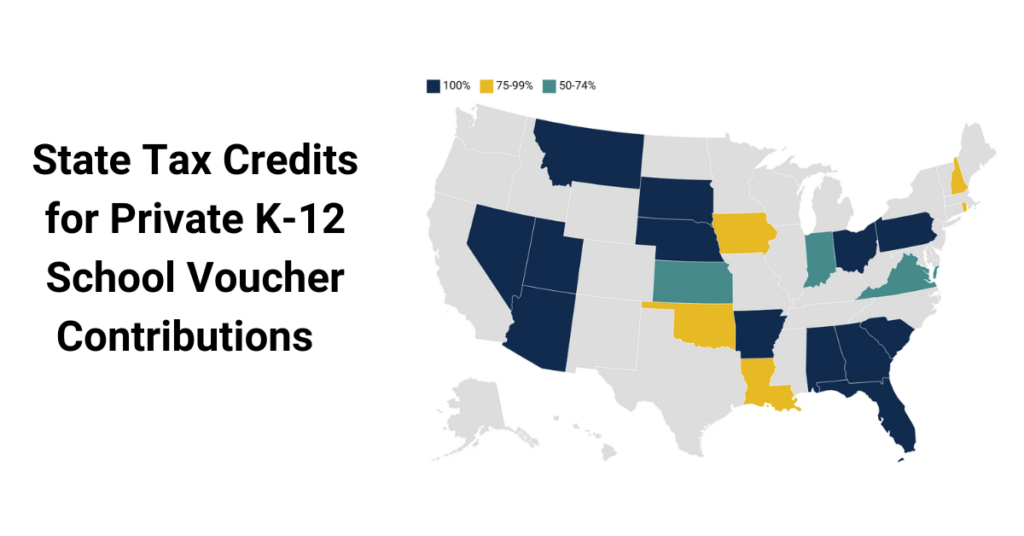

Does Your State Offer Tax Credits for Private K-12 School Voucher Contributions?

August 15, 2023 • By Carl Davis

Twenty-one states provide public support to private and religious K-12 schools through school voucher tax credits.

Editorial: Back-to-School Sales Tax Holiday is Mostly Hype

August 15, 2023

It’s just about back-to-school time, and Gov. Phil Murphy and other Democratic state leaders are showing their love for New Jersey families by offering this special giveaway: 20 cents in sales tax savings off a $3 notebook. Or 13 cents off $2 box of pencils. Wow, right? Read more.

Washington Post: Biden Wants Rich Companies to Pay Higher Taxes. Some Are Fighting Back.

August 14, 2023

It was a simple idea: Major U.S. corporations should pay at least a 15 percent tax on their income, ending an era when some of the country’s most profitable firms owed the federal government little or nothing at all. Instead, the policy championed by President Biden remains bogged down in Washington amid growing legal uncertainty […]

Celebrating One Year Since the Landmark Inflation Reduction Act

August 14, 2023 • By Joe Hughes

The Inflation Reduction Act was a course correction from decades of tax cuts that primarily went to the richest Americans and left the rest of us with budget shortfalls that conservative lawmakers now seek to plug with cuts to Social Security and Medicare. For the first time in generations we are finally asking those who have benefited the most from our economy to contribute back.

City of Seattle Revenue Stabilization Workgroup: Final Report

August 10, 2023

Seattle strives to support a social safety net for people in need and to uplift our diverse communities. Those services are too often financed by putting a disproportionate burden on those least able to afford it. Washington State ranks as having the most regressive tax system in the country. It doesn’t need to be that […]

Video: ITEP’s Carl Davis Presents ‘Tax Policy to Reduce Racial Retirement Wealth Inequality’ at UPenn’s Wharton School

August 8, 2023

ITEP Research Director Carl Davis presents “Tax Policy to Reduce Racial Retirement Wealth Inequality,” coauthored with ITEP’s Brakeyshia Samms, at the 2023 Pension Research Council Symposium “Diversity, Inclusion, and Inequality: Implications for Retirement Income Security and Policy.”

New York Times: What’s the Matter With Miami?

August 4, 2023

For a couple of years after the pandemic struck, there was considerable buzz to the effect that much of the financial industry might leave New York for Miami. After all, state and local taxes on the richest one percent are much lower in Florida than in New York — about nine points lower as a percentage of income, according […]

Gimmicky Sales Tax Holidays to Cost States & Localities $1.6 Billion This Year

August 3, 2023 • By ITEP Staff

Sales tax holidays are bad policies that have too often been used as a substitute for more meaningful, permanent reform.

A Lot for A Little: Gimmicky Sales Tax Holidays Are an Ineffective Substitute for Real Sales Tax Reform

August 3, 2023 • By Marco Guzman

This year, 19 states will forgo a combined $1.6 billion in tax revenue on sales tax holidays—politically popular, yet ultimately ineffective gimmicks with minimal benefits and significant downsides.

Chalkboard News: Some States Offer Back-to-School Tax Holidays. Do They Work?

August 2, 2023

As back-to-school shopping is expected to cost consumers an all-time high, some states have implemented sales-tax holidays aimed at providing some relief. Read more.

Charlotte Observer: NC Republicans Aren’t Worried About the Effects of Tax Cuts. You Should Be.

July 28, 2023

In mid-summer, the state capital is experiencing an odd mix of anxiety and content. Democratic Gov. Roy Cooper is warning that plans by Republican state lawmakers to expand private school vouchers and further cut income taxes have forced our public schools into a state of emergency. Read more.

The Lever: The Magical Math Behind Disney’s Content Purge

July 26, 2023

As Hollywood actors and writers strike together for the first time since 1960 over pay, working conditions, and job security, Disney has purged dozens of original TV shows and movies from its streaming platforms, in a move that hurts workers and gives subscribers fewer options to watch. Disney claims it needs to destroy the content […]

Video: How Google, UPS & Amazon Avoid Paying Billions in Taxes

July 19, 2023

ITEP Senior Fellow Matt Gardner appeared on The Freedom Side to discuss corporate tax breaks and "bonus depreciation."

Video: ITEP Executive Director Amy Hanauer Featured on The Young Turks Segment on Social Security

July 17, 2023

This Young Turks segment on Senator Ron Johnson's comments on Social Security features his exchange with ITEP Executive Director Amy Hanauer as well as ITEP data.

The Hill: Progressive Groups Tell Dems To Back Out of Debt Ceiling Handshake Deal

July 17, 2023

Progressive groups are arguing a handshake agreement on spending struck by Republicans and Democrats while raising the debt ceiling is null and void. Read more.

Yahoo Finance: Could Social Security Be Saved by the ‘Buffett Rule?’

July 12, 2023

Among the chief proposals to fix Social Security before a major funding source runs out of money is to have wealthy Americans pitch in through higher taxes and lower benefits. One way to do that is through the so-called “Buffett Rule,” named after mega-billionaire investor Warren Buffett. Read more.

We can make modest reforms to better tax those who are taking a larger share of our wealth and income in order to reinforce a major pillar of our promise to Americans.

Sacramento Bee: Biden, Democrats Want to Increase Tax Break for Parents. It Could Help 15 million Californians

July 12, 2023

The increased tax credit would help an estimated 14.7 million Californians, according to the Institute on Taxation and Economic Policy, a progressive Washington-based research group. While the proposed increase has a long way to go legislatively, and is likely to change, it’s one of several tax cuts under serious discussion. Read more

Video: ITEP’s Matt Gardner Talks Corporate Tax Breaks on Scripps News Live

July 11, 2023

ITEP Senior Fellow Matt Gardner talks about "bonus depreciation" and our new report that finds that this tax break has saved nearly $67 billion for 25 of the corporations that benefited most.

Nearly one-third of states took steps to improve their tax systems this year by investing in people through refundable tax credits, and in a few notable cases by raising revenue from those most able to pay. But another third of states lost ground, continuing a trend of permanent tax cuts that overwhelmingly benefit high-income households and make tax codes less adequate and equitable.