ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Kansas Reflector: Analysis Show Kansas Chamber’s Flat Tax Proposal Costs $1.5B, Favors Top 20% of Wage Earners

January 30, 2023

Assessments by the Kansas budget director and an independent tax policy institute Monday showed the flat tax proposal by the Kansas Chamber would reduce the state budget by $1.5 billion per year and primarily benefit the state’s most affluent wage earners. Read more.

The Geographic Distribution of Extreme Wealth in the U.S.

January 30, 2023 • By Carl Davis

Excessive concentration of wealth runs counter to our national aspiration for genuine equality of opportunity, and it saps the vitality of our democracy through the consolidation of power and influence. Tax policy offers a powerful means of beginning to address our nation’s stark level of inequality, but current law is clearly falling short of its […]

Center for Public Integrity: How Will a Divided Government Affect Taxes?

January 27, 2023

House Republicans want tax changes that experts say would increase inequality and aren’t likely to pass the Senate. In a gridlocked federal landscape, states may hold the key. Read more.

Idaho Statesman: A Warning About Cutting Taxes in States Like Idaho That are Flush with Cash

January 27, 2023

During his State of the State address this year, Idaho Gov. Brad Little quoted Lt. Gov. Scott Bedke’s piece of ranch family wisdom. “It won’t be the bad years that put you out of business; it’s what you did in the good years that sets you up for failure or success.” Flush with cash, too […]

The American Prospect: Reanimating the Taxman

January 26, 2023

At its core, the Internal Revenue Service (IRS) is the federal government’s revenue collector and benefits administrator. Yet with Congress inclined to run virtually every function of the government through the tax code in some form, the agency is equivalent to the central processing unit of every electronic device on the planet. Read more.

Wisconsin Examiner: Tax Analyst Says Flat-Rate System Will Benefit Wealthy at the Expense of the Majority

January 26, 2023

The wealthiest Wisconsin residents already pay a smaller share of their incomes in state taxes than the rest of the population, and replacing the state’s current graduated-rate income tax structure with a flat tax would increase that disparity, a national tax expert says. Read more.

Newsweek: The GOP’s 30 Percent Sales Tax Plan Is Tearing the Republican Party Apart

January 26, 2023

Republicans in the House of Representatives appear divided over a proposed national sales tax that would replace income taxes, with Democrats using the issue to attack the GOP. Read more.

Kentucky Center for Economic Policy: Reducing the Income Tax Will Weaken the Commonwealth

January 25, 2023

House Bill 1 in the 2022 Kentucky General Assembly is the next step in a legislative effort to phase down and even eliminate Kentucky’s income tax. This policy path is quite likely the most dangerous ever considered in the modern history of the commonwealth. It marches toward elimination of the source of 41% of state […]

Yahoo Money: The Fair Tax Act Aims to Abolish the IRS and Set a National Sales Tax. Here’s How It Would Work

January 25, 2023

Imagine this: Instead of paying federal taxes to the IRS, you pay them to your local cafe every time you buy a latte or to your supermarket when you make a grocery run — or to countless other businesses when you make purchases. Read more.

Yahoo News: Flat Income Taxes: Who Are the Biggest Winners and Losers?

January 25, 2023

From Kansas to Wisconsin to Nebraska, the conversation surrounding a flat tax has picked up as of late, with more state legislators pushing for as much. Read more.

Open Sky Policy Institute: Major Tax and Education Plans Would Quickly Drain Flush State Coffers

January 23, 2023

The cost of high-profile K-12 finance and tax packages introduced this week would entirely consume the projected $1.9 billion that lawmakers have to enact new legislation in the current two-year budget cycle and then some. Read more.

KUOW Seattle: WA Democrats Join Nationwide Rollout of ‘Wealth Tax’ Proposals

January 20, 2023

Washington state Democrats Sen. Noel Frame and Rep. My-Linh Thai announced legislation Thursday to create a state wealth tax on financial assets in excess of $250 million. They say it could generate an estimated $3 billion per year to fund housing and education, and decrease the tax burden on working-class people. Read more.

Lawmakers in seven states will introduce legislation this week to tax wealth in a new coordinated effort to combat ever-increasing income and wealth inequality. The bills couldn’t come at a better time, as those at the very top continue to pull apart from the rest of us and far too many states contemplate piling on to this runaway inequality with seemingly endless tax cuts for those at the top.

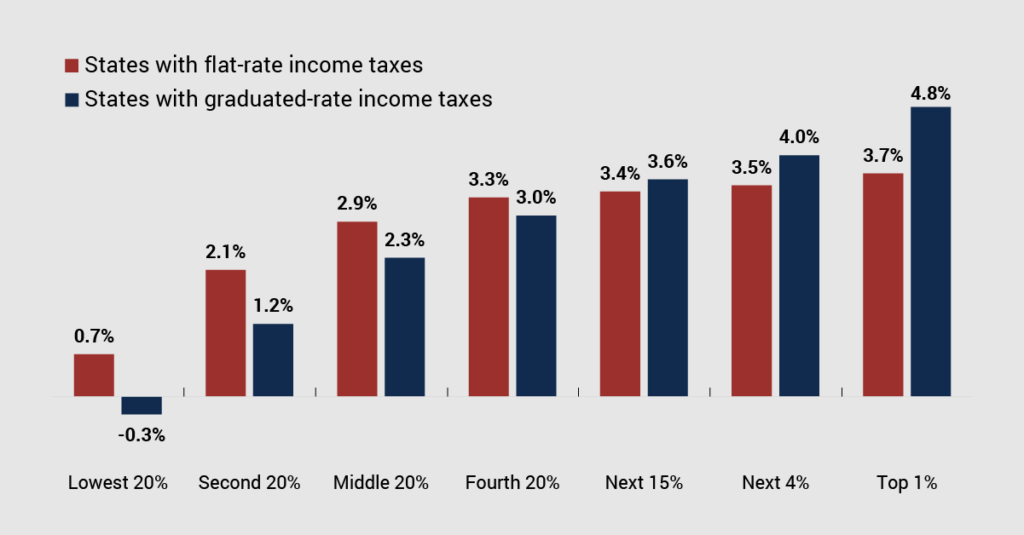

Two-thirds of states with broad-based personal income tax structures have a graduated rate, while one-third have flat taxes.

The Commonwealth Institute: Support Virginia Families Through a Commonwealth Kids Credit

January 17, 2023

True economic prosperity means that families are doing well and have the resources and opportunity to thrive. By coming together, people in Virginia have won an improved Earned Income Tax Credit (EITC), increased minimum wage, and expanded workers rights in recent years — policy wins that lift families up. Yet more must be done to […]

While most states have a graduated rate income tax, some state lawmakers have recently become enamored with the idea of moving away from graduated rate personal income taxes and toward flat rate taxes instead. But flat taxes create problems for ordinary families and let the wealthy off the hook. When faced with a flat income […]

CBS News: As Tax Season Nears, a Backlogged IRS Faces GOP Push to Stamp It Out

January 13, 2023

The IRS is gearing up for another tax season amid a slew of challenges, according to a new report. Most pressing is the need to upgrade its “antiquated” systems and hire more workers to provide better service, a watchdog group within the IRS found. Yet the agency’s leadership also faces another test: repelling the latest […]

New House Rules: Low Taxes for the Wealthy on Cruise Control, Tax Credits for Working People Face Roadblock

January 10, 2023 • By Joe Hughes

Two new rules will hamper the new Congress’s ability to pass tax legislation in the next two years. One requires a supermajority for legislation that increases income tax rates, and the other requires cuts to mandatory spending programs—like Medicare, Social Security, veterans’ benefits or unemployment insurance—in exchange for changes to the Child Tax Credit or Earned Income Tax Credit that would mostly help low-income families.

The “Family and Small Business Taxpayer Protection Act” would rescind 90 percent of the new funding for the IRS included in last year’s Inflation Reduction Act. This would eliminate the new law’s $45.6 billion to enforce the tax code for people making more than $400,000 and repeal an additional $26 billion in IRS funding that would include, among other things, a pilot for a free e-file program to make it easier for people with relatively simple tax returns to file. The slash-and-burn bill comes just weeks after Republicans forced a 2 percent cut in annual IRS funding as part of…

Newsweek: Wealthy Tax Cheats Set To Benefit From Republicans’ Defunding of IRS

January 10, 2023

Now that Kevin McCarthy has finally been elected House speaker, and a new congressional term sworn in, the GOP has already voted on one of its key promises made during last year’s midterm elections: to target the Internal Revenue Service. Read more.

Governing: The Biggest Issues to Watch in 2023

January 10, 2023

State coffers are overflowing, but inflation could put a pinch on spending plans and tax cuts. The labor market remains tight just when the demand for more teachers is skyrocketing. And then there are the ongoing culture wars. Welcome to 2023. Read more.

Better Wyoming: Want to Slow Wyo’s Boom-and-Bust Cycle? Tax Jackson.

January 6, 2023

According to a new report by the Institute on Taxation and Economic Policy (ITEP), Wyoming has several options to generate new tax revenue from our ultra-wealthy residents and decrease the state’s reliance on boom-and-bust fossil fuels—even while keeping taxes low on the middle class. All we need to do is tax Jackson. Read more.

Vox: The Ultrarich are Getting Cozy in America’s Tax Havens at Everyone Else’s Expense

January 4, 2023

More states are slashing or eliminating taxes, lessening the burden mostly for the wealthy. What does that cost the rest of us? Read more.

Los Angeles Times: You’re Not Getting Child Tax Credit Checks Anymore. Here’s Why

January 3, 2023

If you raised children during the pandemic, you probably remember something remarkable: getting checks in the mail, every month, from the federal government. The expanded child tax credit provided a few hundred dollars to help pay for your son’s braces or your daughter’s ballet lessons — or to ease the stress over whether you had […]

The Hill: Trump Tax Returns Raise Alarms About Fairness of US Tax Code

January 3, 2023

A preliminary review of the thousands of pages of Donald Trump’s tax returns released by a key congressional committee on Friday confirms that the former president was using business losses in the tens of millions of dollars to reduce his annual tax liability, in some cases all the way down to zero. Read more.