ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Sacramento News&Review: U-Turn on Taxes

August 16, 2018

In 2015, a report from the Institute on Taxation and Economic Policy found that heavy reliance on sales taxes is a characteristic of the most regressive tax systems. The half-cent sales tax increase would bring Sacramento’s sales tax rate to 8.75 percent, on par with the city of Isleton for the highest in the region. […]

Gannette: NJ Suit Over SALT Deduction Would Help the State’s Richest 1.5 Percent the Most

August 15, 2018

That reality has led some who joined Democrats in complaining about way tax cuts were distributed to criticize efforts to overturn the SALT cap. “The Trump tax law gives away the store to the rich. Why pile on and make the situation worse?” said Steve Wamhoff of the Institute on Taxation and Economic Policy. This may be a moot […]

CNBC: Tax Holidays May Not Be the Bargain You Think They Are

August 9, 2018

Everyone loves a bargain. Except when the bargain doesn’t really save you money. It may feel great not to pay tax for back-to-school clothes and backpacks, but the Institute on Taxation and Economic Policy says sales-tax holidays do little to help students, teachers and public schools. The lift on taxes can last an entire week […]

Kiplinger: Online Shopping Could Get Pricier

August 1, 2018

Generally, shoppers who buy from midsize online retailers will be the hardest hit, says Carl Davis, research director for the Institute on Taxation and Economic Policy. South Dakota’s rule requires remote sellers to collect tax if they have at least $100,000 in sales or 200 transactions in South Dakota. Other states are imposing similar thresholds. […]

The Courier Journal: Three More Reasons the Tax Cut Is Bad for Kentucky

August 1, 2018

Reason No. 2: HB487 raises very little “net” revenue. The nearly $900 million in new taxes will only net the state about $180 million per year because the rest is being given back in tax cuts and credits. The Institute on Taxation and Economic Policy reports that the top 5 percent of earners will receive net tax […]

The Columbus Dispatch: Ohio’s tax-free shopping weekend is Friday through Sunday

August 1, 2018

But the tax holiday isn’t necessarily as much of a plus for everyone as its proponents say, said Dylan Grundman of the Institute on Taxation and Economic Policy, a nonprofit, nonpartisan think tank that works on state and federal tax policy issues. “One of the key problems is, the benefits are so dispersed beyond the […]

The Tennessean: Where Are The Tax Cuts Going?

July 30, 2018

So where has the money gone? Many companies won’t say or are scant on specifics. Several publicly traded companies in Tennessee have issued press releases announcing bonuses or minimum wage increases, but few have offered details on the size and scope of those raises. Meanwhile, privately held companies in Tennessee have been reticent to share any of their […]

The Hill: Tax Breaks for Wealthy Paid for with Deep Cuts to Medicare, Medicaid and Social Security

July 30, 2018

They say that we don’t have a choice and can’t afford these earned benefits for Americans on a fixed or limited income without making drastic cuts. A recent report by the nonpartisan Institute on Taxation and Economic Policy points out why they are scrambling to take away these benefits: they have already given the money […]

Washington Post: IRS Outsources Debt Collection to Private Firms, and the Poor Feel the Sting

July 23, 2018

“The private firms appear, at least in some cases, to be ignoring this constraint,” said Matt Gardner, an analyst at the left-leaning Institute on Taxation and Economic Policy. “When they farm this out to private debt collectors, those debt collectors are not legally bound by the same standards. It’s utterly inconsistent.” Read more

WAMU: Amazon Doesn’t Need the Money

July 19, 2018

But analyses by nonpartisan think tanks Brookings Institution and the Upjohn Institute for Employment Research — as well as the Institute on Taxation and Economic Policy, which studies the impact of tax policy on working people — suggest incentives can come at a large public cost. That cost can be obscured when incentives take the form of foregone tax revenue, not line items on a budget. Read […]

Vermont Business: Auditor Can’t Quantify Benefit of Economic Incentives

July 15, 2018

The Institute on Taxation and Economic Policy ranks Vermont’s tax system as one of the most progressive in the country because of the steeply graduated income tax, the State earned income tax credit, and the income-sensitized education property tax. But our reliance on regressive sales and municipal property taxes means that higher income Vermonters pay […]

Cedar Rapids Gazette: Tax Cuts Can’t Ease Trade Fears

July 14, 2018

That’s likely because, as a report published Wednesday by the Institute on Taxation and Economic Policy notes, income inequality has soared, and such measures are making it worse. The wealthy are far head of everyone, while the upper-middle-class is widening a gap between itself and the working class and poor. The latest tax cut is […]

The lack of investment in public school systems is a problem in jurisdictions throughout the country. So, at this time of year when many states across the country are temporarily suspending sales taxes to provide a break to taxpayers who have to purchase back-to-school supplies, it’s worth examining whether this is the most effective use of resources.

Politico: The History of 21st Century Tax Cuts

July 12, 2018

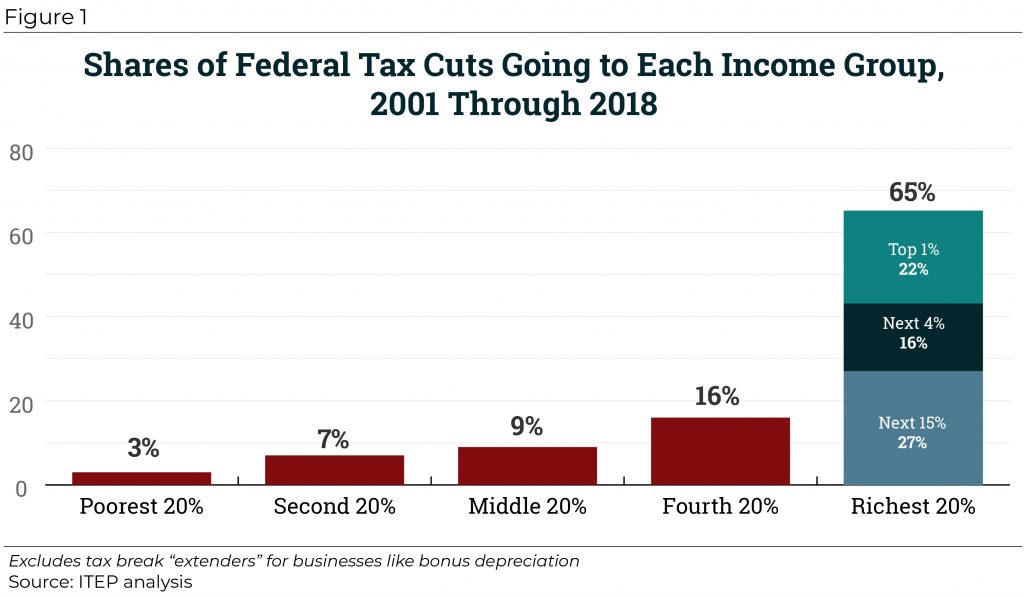

The history of 21st-century tax cuts in the U.S. involves the top end getting most of the proceeds, Pro Tax’s Toby Eckert reports off of a new report from the liberal Institute on Taxation and Economic Policy. In all, the top quintile of households took in about 65 percent of the tax cut benefits since […]

New York Times: $111 Billion in Tax Cuts for the Top 1 Percent

July 11, 2018

Think of it this way: Income inequality has soared in recent decades, with the wealthy pulling away from everyone else and the upper-middle-class doing better than the working class or poor. Yet our federal government has responded by aggravating these trends. It has handed huge tax cuts to the small segment of Americans who need […]

Mother Jones: Guess Who Benefits from Republican Tax Cuts?

July 11, 2018

In news that will shock no one, the Institute for Taxation and Economic Policy has tallied up the results of all the Republican tax cuts since 2000 and concluded that … most of it went to the rich. The average rich household today pays nearly $100,000 less in taxes than they would under the Clinton-era […]

Vox: America’s Getting $10 Trillion in Tax Cuts, and 20% of Them Are Going to the Richest 1%

July 11, 2018

The first analysis, from the Institute on Taxation and Economic and Policy, a liberal-leaning think tank, found that from 2001 through 2018, changes to the federal tax code have reduced revenue by $5.1 trillion. Sixty-five percent of the savings have gone to the richest fifth of Americans, with 22 percent of them going exclusively to […]

The Hill: The GOP Tax Bill Rewards Offshoring – Here’s What We Can Do to Stop It

July 11, 2018

The new law allows companies to pay half or less of the corporate tax rate on profits earned abroad as they would here at home, while also exempting from tax entirely a 10 percent return on tangible investments – such as plants and equipment – that are made overseas. As experts from the Tax Policy […]

Bloomberg Law: $5.1 Trillion Revenue Reduction

July 11, 2018

Significant federal tax changes from 2001 through 2018 have reduced revenue by $5.1 trillion, according to an Institute on Taxation and Economic Policy analysis published July 11. “By the end of 2025, the tally of tax cuts will grow to $10.6 trillion. Nearly $2 trillion of this amount will have gone to the richest 1 […]

The Hill: Tax Cuts Since 2000 Have Mostly Benefited High Earners

July 11, 2018

Households in the top fifth of income levels have received 65 percent of the value of tax changes enacted since 2000, according to a report released Wednesday by the left-leaning Institute on Taxation and Economic Policy (ITEP). The report looked at significant tax cuts and increases enacted during the administrations of George W. Bush, Barack […]

Yahoo! Finance: The Steep Cost of Tax Cuts Since 2001

July 11, 2018

Tax cuts enacted since the turn of the 21st century have added nearly $6 trillion to the deficit while disproportionately benefiting wealthy households, according to a new study from the Institute on Taxation and Economic Policy. Since President George W. Bush took office in 2001, “significant federal tax changes have reduced revenue by $5.1 trillion, […]

65 Percent of Federal Tax Cuts Since 2000 Have Gone to Richest 20 Percent

July 11, 2018 • By ITEP Staff

Since 2000, Congress has passed several rounds of tax cuts that have increased the federal deficit by nearly $6 trillion and disproportionately benefited the top 20 percent of households, which received nearly two-thirds (65 percent) of the value of all tax changes.

San Jose Mercury News: If California Gas Prices Take Their Seasonal Tumble, Will That Save the Gas Tax?

July 10, 2018

Just so you know, California isn’t the only state raising gasoline taxes. As 2018’s second half starts, drivers in seven states face just-raised taxes on fuel, according to the Institute on Taxation and Economic Policy. In fact, 27 states nationwide have increased gasoline taxes in the past five years – with Missouri voters facing an […]

Washington Post: At State Level, GOP Renews Push to Require ‘supermajorities’ for Tax Hikes, Imperiling Progressive Agenda

July 9, 2018

In three additional states — Florida, Oregon and North Carolina — conservative lawmakers and business groups are currently advancing similar measures, said Meg Wiehe, a tax analyst at the Institute on Taxation and Economic Policy, a left-leaning think tank. Read more

Orange County Register: California Isn’t the Only State Hiking Gas Taxes

July 6, 2018

Just so you know, California isn’t the only state raising gasoline taxes. As 2018’s second half starts, drivers in seven states face just-raised taxes on fuel, according to the Institute on Taxation and Economic Policy. In fact, 27 states nationwide have increased gasoline taxes in the past five years – with Missouri voters facing an Election […]