ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Mother Jones: How Hillary Can Rein in Big Finance

August 12, 2016

“Sales and excise taxes are the most regressive element in most state and local tax systems,” says the Institute on Taxation and Economic Policy, which examines state tax systems every year. Last year, it claimed Washington had the most unfair tax system in the country, largely because the state, which lacks an income tax, raises […]

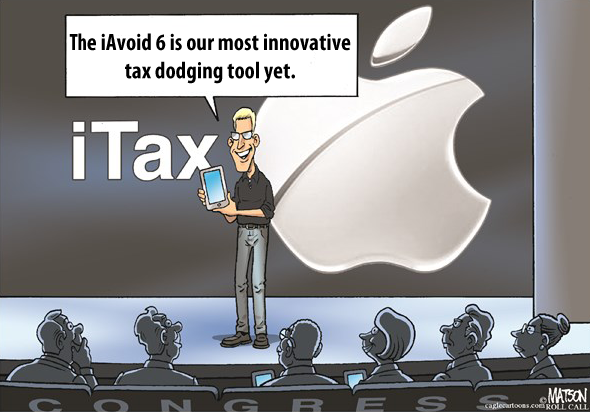

Tim Cook’s Disingenuous Argument to Justify Apple’s $215 Billion Offshore Cash Hoard

August 9, 2016 • By Jenice Robinson

Tim Cook is a persuasive CEO. In a wide-ranging interview published earlier this week in the Washington Post, he discussed his vision for the company, thoughts about leadership succession, and humbly admitted he has made mistakes. So it would be very easy to view as reasonable his declaration that Apple will not repatriate its offshore […]

Chattanooga Times Free Press: Tennessee Now Holds Sales Tax Holiday on Same Weekend as Georgia

August 8, 2016

Seventeen states, primarily in the Southeast, stand to lose more than $300 million in tax revenue because they waive sales taxes on back-to-school items and other goods, including hunting gear, energy-efficient appliances and severe weather preparedness, according to the Institute on Taxation and Economic Policy, a nonprofit, nonpartisan research organization with offices in Washington, D.C., […]

The Daily Progress: Three-days sales tax holiday on certain items starts Friday

August 5, 2016

The Institute on Taxation and Economic Policy, meanwhile, says that while the idea for the sales tax holiday as a way for families to save money sounds good, it doesn’t do much in the long run. “However, a two- to three-day sales tax holiday for selected items does nothing to reduce taxes for low- and […]

Oklahoman: State-wide Tax Free Holiday Approaches

August 5, 2016

The Institute on Taxation and Economic Policy, a Washington, D.C.-based nonprofit, nonpartisan research organization, recently issued a statement about problems with such programs. “Policy makers tout sales tax holidays as a way for families to save money,” the release said. “On the surface, this sounds good. However, a two- to three- day sales tax holiday […]

The Atlanta Journal Constitution: Sales Tax Weekend a Mini Black Friday

August 5, 2016

But the 17 states that will host a sales-tax “holiday” this year will lose a total of about $300 million in tax revenue, according to the Institute on Taxation and Economic Policy.Read more

The Jackson Clarion Ledger

August 5, 2016

The Institute on Taxation and Economic Policy lists Mississippi’s taxes as 21st for “most unfair” or regressive, with people’s incomes less equal after state and local taxation. This is largely because of the state’s reliance on sales taxes and it being one of only two states that levies its full sales tax on groceries with […]

New York Times: The Path to Prosperity Is Blue

August 5, 2016

Ranking the states by social and economic indicators. Source: Institute on Taxation and Economic Policy, etc. Read more

Santa Fe New Mexican: Statewide Tax-Free Holiday Approaches

August 5, 2016

The Institute on Taxation and Economic Policy, a Washington, D.C.-based nonprofit, nonpartisan research organization, recently issued a statement about problems with such programs. “Policy makers tout sales tax holidays as a way for families to save money,” the release said. “On the surface, this sounds good. However, a two- to three- day sales tax holiday […]

Houston Public Media: Houston Becomes an Official Welcoming City

August 5, 2016

According to the Institute on Taxation and Economic Policy, foreign-born residents contributed over $116 billion into the local economy in 2014. Wu says the Energy Corridor is the perfect example of immigration working in Houston. Read more or listen to the segment

Houston Public Media: Five Reasons Tax-Free Weekend Might Be a Bad Idea

August 5, 2016

Check out this map of all the U.S. sales tax holidays, back to school and otherwise, from the Institute on Taxation and Economic Policy.

Politico: The Problem for Energy States

August 5, 2016

The liberal Institute on Taxation and Economic Policy is out with a new paper arguing that energy-rich states cut corners and relied too heavily on their wealth of natural resources, instead of setting up tax systems based on more solid footing. States like Alaska and Louisiana, ITEP writes, showered tax cuts on both individuals and […]

Ackron Beacon Journal: What you need to know about Ohio’s sales-tax holiday beginning Friday

August 5, 2016

The Institute on Taxation and Economic Policy again this year called sales-tax holidays ineffective with minimal benefits for low-and moderate-income taxpayers. “Sales tax holidays fall short because they are poorly targeted, cost revenue, can easily be exploited and create administrative difficulties,” the institute said. Read more

Waco Tribune: Local stores prepare for statewide sales tax holiday

August 5, 2016

“Sales tax holidays are political gimmicks that fail to deliver on their grand promises,” said Dylan Grundman with the Institute on Taxation and Economic Policy. “They may give consumers a short break from sales taxes on certain items, but they don’t change regressive state tax systems. Policymakers should instead consider policies that make our tax […]

New York Times: Back-to-School Sales Tax Holidays May Be Skimpier This Year

August 5, 2016

Many tax policy experts, however, look askance at the sales tax holiday phenomenon. “They’re really mostly just a political gimmick,” said Meg Wiehe, state tax policy director at the Institute on Taxation and Economic Policy. Elected officials, she said, like the opportunity to talk about how the holidays save voters money. But in reality, she […]

Minnesota Politics: Strapped states cancel sales-tax holidays

August 5, 2016

The Bay State isn’t the only state to forgo its sales-tax holiday in order to raise additional funds. Kansas, North Carolina, Nebraska, Rhode Island and Wisconsin, state legislators are among those that have also decided against holding new tax holidays or reinstating them during the last few years, and they’ll be saving money as a […]

The Washington Times: First state back-to-school sales tax holiday kicks off at end of July

July 28, 2016

“For its part, the liberal Institute on Taxation and Economic Policy in a July 11 policy brief likewise questioned the propriety of sales tax holidays, concluding they do little to help the working poor, result in less tax revenue and administrative headaches for state tax collectors and provide an opening for “unscrupulous” merchants to “increas[e] […]

Phoenix Business Journal: Why pay-by-the-mile fees are on the horizon across the country

July 28, 2016

“The shortfall is dramatic. The Institute on Taxation and Economic Policy found that in 2013, the purchasing power of gas tax dollars had declined 22 percent since 1997, plus alternative fuel and fuel-efficient vehicles drained the purchasing power another 6 percent.” Read more

Chattanooga Times Free Press: Tennessee now holds sales tax holiday on same weekend as Georgia

July 28, 2016

“Seventeen states, primarily in the Southeast, stand to lose more than $300 million in tax revenue because they waive sales taxes on back-to-school items and other goods, including hunting gear, energy-efficient appliances and severe weather preparedness, according to the Institute on Taxation and Economic Policy, a nonprofit, nonpartisan research organization with offices in Washington, D.C., […]

Coalition fights to repeal personal property tax

July 28, 2016

“Matt Gardner, executive director of the Institute on Taxation and Economic Policy, argued in a recent blog that repealing the law would be adverse for homeowners who might have to make up the difference in higher real estate taxes.” Read more

Forth Worth Star Telegram: Texas sales tax holiday for back- to- school shopping is Aug. 5-7

July 27, 2016

“Sales tax holidays are political gimmicks that fail to deliver on their grand promises,” according to a recent memo by Dylan Grundman with the Institute on Taxation and Economic Policy.” Read more

Latin Post: Immigration Advocates Blast Donald Trump’s RNC Speech as ‘Pure Hatred’

July 27, 2016

“Indeed, a recent Institute on Taxation and Economic Policy (ITEP) “Undocumented Immigrants’ State & Local Tax Contributions study found that undocumented immigrants residing in the U.S. pay out an estimated $11.64 billion in annual taxes.” Read more

Christian Science Monitor: Are sales tax holidays good for anyone?

July 27, 2016

“But as the Washington-based research organization Institute on Taxation and Economic Policy (ITEP) points out, no new states introduced tax holidays this year. In fact several states have reduced or canceled theirs recently.” Read more

Tax-News: US Sales Tax Holidays Said To Be ‘Ineffective’

July 27, 2016

“In a recent paper, the Institute on Taxation and Economic Policy (ITEP) concluded that US sales tax holidays are “poorly targeted and too temporary to meaningfully change the regressive nature of a state’s tax system.”” Read more

The Olympian: Support Olympia by supporting Opportunity for Olympia

July 27, 2016

“The Institute on Taxation and Economic Policy notes that Washington state has the most regressive tax structure in the country. The poorest 20 percent pay 16.8 percent of their income in state and local taxes while the richest 1 percent pay only 2.4 percent.” Read more