Blog - Federal Policy

525 posts

Zoom Video Communications, the company providing a platform used by remote workers and school children across the country during the pandemic, saw its profits increase by more than 4,000 percent last year but paid no federal corporate income tax on those profits.

Rep. Doggett and Sen. Whitehouse Introduce Bill to Crack Down on Offshore Corporate Tax-Dodging

March 11, 2021 • By Steve Wamhoff

The 2017 tax law simply replaced one set of loophole-ridden rules that favored offshore profits over domestic profits with a new set of loophole-ridden rules doing the same thing. A bill introduced today by Rep. Lloyd Doggett and Sen. Sheldon Whitehouse would finally fix this to follow a simple principle: we should tax the offshore profits and domestic profits of our corporations the same way.

With the onslaught of news about billionaire wealth soaring while low- and moderate-income families have trouble making ends meet, a federal wealth tax makes good economic and fiscal sense—and the public supports it. One poll found that 64 percent of respondents favor the idea, including a majority of Republicans.

The federal minimum wage is almost comically low. At $7.25 an hour, it is 29 percent below its inflation-adjusted peak in the 1960s. Raising the minimum wage to $15 an hour would lift 900,000 Americans out of poverty. A solid 61 percent of voters support the idea. A majority of lawmakers in both the House and Senate support at least some version of a minimum wage hike. The popular $1.9 trillion American Rescue Plan includes a measure that would raise the minimum wage over the next few years to $15. So, what is the problem? And why are lawmakers now…

Should lawmakers enact laws that they believe are sensible and constitutional, or should they shape their legislative agenda around what they believe ideological Supreme Court justices will allow? This is a dilemma facing Americans who support a federal wealth tax.

CARES Act Helps Create $4.6 Billion Tax Cut for Health Care Companies Paying Opioid Settlements

February 12, 2021 • By Matthew Gardner

Talk about a one-two punch. A new report from the Washington Post reveals that the U.S. public is set to pay for the opioid crisis again. Already, communities across the country have paid a heavy price via the devastating public health toll. Now, it appears taxpayers will be on the hook for billions in corporate tax breaks as four pharmaceutical companies exploit a loophole in the Trump-GOP tax law and a CARES Act tax provision meant for companies facing pandemic-related profit losses.

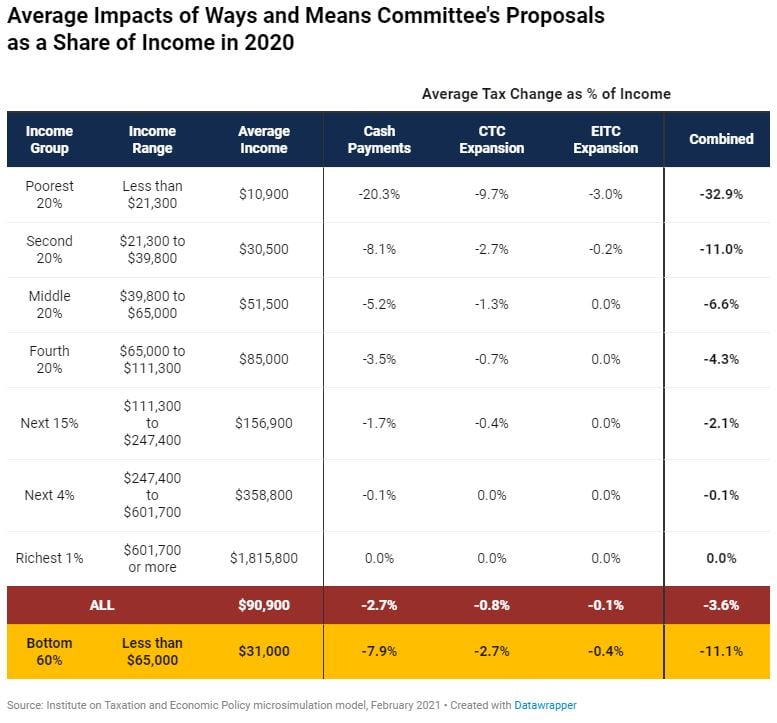

Details of House Democrats’ Cash Payments and Tax Credit Expansions

February 9, 2021 • By Steve Wamhoff

The House Ways and Means Committee published its proposal for the cash payments, tax provisions and other changes that would make up part of the $1.9 trillion COVID relief legislation that President Joe Biden called for a few weeks ago.

Faulty Fact Check on Tax Breaks for the Rich and Corporations

February 5, 2021 • By Amy Hanauer

When it comes to tax policy, the details are complicated, but the story is often simple. For example, President Trump’s so-called Tax Cuts and Jobs Act (TCJA) disproportionately benefits the rich. This is not controversial. Yet some opinion makers with large megaphones get lost in the details and come to conclusions that only create more confusion.

The public and the Biden administration say corporations should contribute to the public infrastructure that lets them earn so much. We agree. It’s the least we can ask, in a pandemic and at all other times too.

Amazon Has Record-Breaking Profits in 2020, Avoids $2.3 Billion in Federal Income Taxes

February 3, 2021 • By Matthew Gardner

Amazon’s winning streak in its battle against the U.S. tax system remains intact. This week the retail giant announced record-breaking sales and income for 2020, and an effective federal income tax rate of just 9.4 percent, less than half the statutory corporate tax of 21 percent. If Amazon had paid 21 percent of its profits in federal income tax, that would have come to $4.1 billion. The company’s reported current tax of $1.8 billion was less than half that, meaning last year Amazon avoided $2.3 billion in taxes.

President Biden’s Child Tax Credit Proposal Could Right a Historical Wrong

February 2, 2021 • By ITEP Staff, Jenice Robinson, Meg Wiehe

Many 1990s policies were grounded in harmful, erroneous ideas such as financial struggles are due to personal shortcomings and less government is better. Lawmakers didn’t apply these ideas consistently, however. For example, there was no drive to reduce corporate welfare even as policymakers slashed the safety net and disinvested in lower-income communities. So, it’s not surprising that a bipartisan group of lawmakers concluded during that era that the CTC was an appropriate vehicle to give higher-income households a tax break while leaving out poor children.

Immediate Action State Lawmakers Can Take to Support Families and Children

February 2, 2021 • By Aidan Davis

If Congress does act and enact President Biden’s CTC expansion, states could simply couple to that federal change. The changes, while temporary, could become the foundation of a permanent state-level credit over the long-term. But state lawmakers need not wait for legislative action in DC. They can take immediate steps to ensure that their state’s most vulnerable children are positioned to succeed.

Ever since it was enacted as part of the Trump-GOP tax law, some Democrats in Congress have been pushing to repeal the cap on federal tax deductions for state and local taxes (SALT). Recently several Democratic members have suggested that repeal of the cap should be part of COVID relief legislation. While the cap on SALT deductions is problematic, repealing it without making other reforms would result in larger tax breaks for the rich. Instead, lawmakers should consider ITEP’s proposal to replace the SALT cap with a broader limit on tax breaks for the rich that would accomplish Biden’s goal…

Pandemic Profits: Netflix Made Record Profits in 2020, Paid a Tax Rate of Less than 1 Percent

February 1, 2021 • By Matthew Gardner

Netflix’s “current” federal income tax for 2020 was $24 million, which equals just 0.9 percent of the company’s pretax income for the year. This is another way of saying Netflix paid an effective federal income tax rate of just 0.9 percent in 2020. If the company paid the statutory rate, its tax bill would be $572 million.

Disaggregating Data Illuminates a Path to Equitable Policy

January 27, 2021 • By Jessica Schieder

The Biden administration’s move last week to establish an interagency working group to examine how well data is broken down, or disaggregated, within public sector data sources is welcome news. The executive order specifically names the limited availability of datasets disaggregated “by race, ethnicity, gender, disability, income, veteran status, [and] other key demographic variables.”

Happy Double Take: A President Who Takes Economic Challenges Seriously

January 15, 2021 • By Amy Hanauer

After a solid year of federal policy doing too little to combat staggering job loss, spiking poverty, a raging pandemic and nearly 400,000 COVID deaths, we are ready for a leader who wants to hunker down and get to work on behalf of the people. So we did a happy double take when President-elect Joe Biden outlined his economic plan last night.

How the Proposed $2,000 Cash Payments Compare to the $600 Already Provided by Congress

January 6, 2021 • By Steve Wamhoff

On Dec. 28, the House of Representatives passed the Caring for Americans with Supplemental Help (CASH) Act of 2020, which would increase the cash payment recently provided by Congress from $600 per person to $2,000 per person, among other changes. New estimates from ITEP compare the impacts of $2,000 payments to $600 payments.

National and State-by-State Estimates of New $600 Cash Payments

December 21, 2020 • By Steve Wamhoff

The House and Senate are about to pass the first COVID-19 relief legislation since the CARES Act was enacted in March. The new relief package includes, among other provisions, cash payments of $600 per person, which is half as large as the payments provided under the CARES Act, but also extends payments to spouses and children of certain undocumented immigrants who were left out of the previous payments.

A Second Round of Direct Cash Payments Could Provide an Average $1,550 to the Poorest Families

December 8, 2020 • By Jenice Robinson

It will not magically become easier for families to put food on the table or make their next rent payment. Policymakers must act. People are struggling because they are either out of work, involuntarily working part-time, trying to financially catch up after being out of work for a spell, or squeaking by because we live in a wealthy democracy that fails to guarantee basics such as access to affordable housing, health care, food, and jobs that pay living wages.

McConnell Balked at More Stimulus Aid to States, Betting Red States Wouldn’t Need It. Now?

December 4, 2020 • By Meg Wiehe

It is December 2020. Sen. McConnell has denied states—and their residents—relief for months. Congress must act now. Even if it does, it is unlikely to provide the robust aid needed to keep communities afloat and positioned for healthy recovery. Lawmakers across the country should be prepared to return to state capitals and city halls in the new year with plans to raise revenue not just to weather this crisis, but also to invest in long-term recovery.

These EITC Reforms Would Help Struggling Families Now and Address Systemic Challenges

December 4, 2020 • By Aidan Davis

The tepid economic recovery is leaving millions behind. The nation still has nearly 10 million jobs less than it did in February, according to the latest jobs report. The number of people living in or near poverty is rising. Twelve million workers are about to lose their unemployment insurance, roughly four in 10 people report experiencing food insecurity for the first time, and conditions are likely to deteriorate further in the weeks ahead as we brace for another deadly surge in COVID cases and new or tightened restrictions on business and personal activity.

COVID-19 Containment Is Key to Recovery—So Is Another Round of Stimulus

December 3, 2020 • By Aidan Davis

You can learn a lot about our leaders from how they act during times of crisis. This December, we are in our 10th month of the pandemic in the United States. With COVID cases climbing, deaths exceeding 270,000 and hospitalizations surpassing 100,000 for the first time, some states have halted reopening plans and imposed new restrictions. Containment of the virus is key to sustained economic recovery. As is another round of federal stimulus.

Biden’s Economic Policy Agenda Deserves Serious Debate, Not Obstruction

November 12, 2020 • By Jenice Robinson

Obstructing policies that improve economic well-being should not be on any party’s legislative agenda, especially when so many are barely keeping their heads above water.

Trump Says Taxes Will Be Too High on the 2% Who Pay More Under Biden’s Plan

October 22, 2020 • By Steve Wamhoff

The Trump campaign has failed to convince the public that large numbers of Americans would face tax hikes under Democratic presidential nominee Joe Biden’s tax plan. The claim has been widely discredited. For example, ITEP found that the federal taxes that people pay directly would rise for just 1.9 percent of taxpayers in the U.S., and that number does not vary much by state. So, Fox News and other conservative voices are trying out a new argument: Biden’s tax plan would be too burdensome for that 1.9 percent.

Supreme Court Would Provide Massive Tax Cut for the Rich if It Strikes Down Affordable Care Act

October 13, 2020 • By Steve Wamhoff

If the Supreme Court strikes down the Affordable Care Act (ACA), as argued for by the Trump administration and the president’s nominee to the court, Amy Coney Barrett, one under-appreciated result will be a tax break of roughly $40 billion annually for about 3 percent of Americans, who all have incomes of more than $200,000.