Blog - Federal Policy

525 posts

Given how much more exclusively this deduction now benefits the highest-income households, its continued existence is hard to justify. Even when the credit was available to a larger swath of families, it was ineffective at promoting homeownership.

Taxing Offshore Profits and Domestic Profits Equally Could Curb Corporate Tax Dodging

August 9, 2019 • By Steve Wamhoff

In recent days, presidential candidates Sen. Kamala Harris and New York Mayor Bill DeBlasio have called for taxing corporate profits the same whether they are earned in the United States or abroad. These calls echo the position of Sen. Bernie Sanders, who has long had a proposal along these lines. As ITEP has explained, correcting […]

Opportunity Zones Have Nothing to Do with Reparations, Except …

August 2, 2019 • By Jenice Robinson

Among other things, this blog highlights how federal, state and local policies systematically work to reinforce the racial wealth gap by, for example, using the tax code to redistribute the nation’s wealth to billionaire developers and keeping low-income people of color in a perpetual cycle of debt through fines and fees to fund local governments. Opportunity zones and the top-heavy 2017 tax law are emblematic of a long history of policymaking that advantages wealthy white families.

A direct federal tax on wealth, as described in a January report from ITEP and proposed by Sen. Elizabeth Warren, could raise substantial revenue to make public investments, curb rising inequality, and is supported by a large majority of Americans. But would it work? Recent research highlighted in a new academic paper outlines approaches that would make it easier than you might think.

If a future Congress and president enact a real tax reform, one that requires corporations to pay their fair share and ends TCJA’s various corporate breaks for offshore profits, then companies will use inversions and other tactics to dodge taxes once again—if lawmakers let them. That’s why any real tax reform will include something like the Stop Corporate Inversions Act, introduced last week by Sens. Dick Durbin and Jack Reed to block inversions.

Why Trump Administration’s Plan to Index Capital Gains to Inflation Is Just Another Giveaway to the Wealthy

June 28, 2019 • By Steve Wamhoff

The White House is reported to be planning to unilaterally adjust the way capital gains are assessed to benefit the wealthiest Americans. The proposal would adjust capital gains for inflation, reducing taxes disproportionately for the wealthiest households who own most assets by limiting their taxable gains to those above and beyond the inflation rate.

Wealth Tax Is Supported by Basically Everyone Who Is Not a Politician

June 27, 2019 • By Steve Wamhoff

A February survey found that 61 percent of registered voters supported a wealth tax proposal, including 51 percent of Republican voters. And it’s not just the non-rich wanting to tax the very rich. A June survey found that 60 percent of millionaires support the idea.

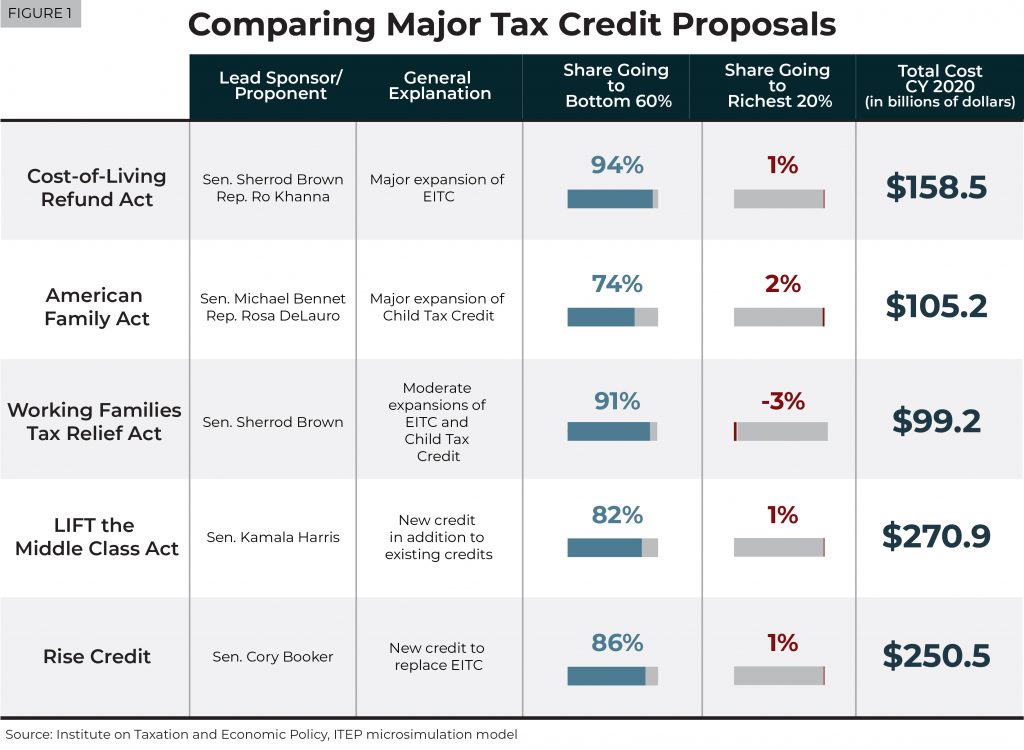

A refundable tax credit proposed by Rep. Rashida Tlaib (D-MI) would be more expansive than other recent tax credit proposals, new estimates from ITEP show. Rep. Tlaib’s proposal, unlike others, does not require households to work to receive the benefit.

What to Watch for on Tax Policy During the Presidential Primary

June 25, 2019 • By Steve Wamhoff

America needs a new tax code. The Democratic presidential debates beginning this week present an opportunity for candidates to make clear how they would address inequality or to raise enough revenue to make public investments that make the economy work for everyone. Here are some of the big tax issues that we hope they will touch on.

The SALT Cap Isn’t Harming State and Local Revenues. Myths About It May Be.

June 24, 2019 • By Carl Davis

A House Ways and Means subcommittee hearing on Tuesday will explore a highly controversial provision of the Tax Cuts and Jobs Act (TCJA) that prevents individuals and families from writing off more than $10,000 in state and local tax (SALT) payments on their federal tax forms each year. The focus of the hearing will be whether the cap negatively affects state and local revenue streams that fund schools, firefighters, and other services. There are at least three ways this could happen though only one of those is plausible, and it’s not the one that the organizers of this hearing likely…

New SALT Workaround Regulations Narrow a Tax Shelter, but Work Remains to Close it Entirely

June 11, 2019 • By Carl Davis

Today the Internal Revenue Service (IRS) released its final regulations cracking down on a tax shelter long favored by private and religious K-12 schools, and more recently adopted by some “blue state” lawmakers in the wake of the 2017 Trump tax cut. The regulations come more than a year after the IRS first announced the […]

After states implemented laws that allow taxpayers to circumvent the new $10,000 cap on deductions for state and local taxes (SALT), the IRS has proposed regulations to address this practice. It’s a safe bet the IRS will try to crack down on the newest policies that provide tax credits for donations to public education and other public services, but it remains to be seen whether new regulations will put an end to a longer-running practice of exploiting tax loopholes in some states that allow public money to be funneled to private schools.

File Under “No Surprise”: Wealthiest Taxpayers Use Offshore Tax Shelters More Than the Rest of Us, New Research Finds

June 4, 2019 • By Matthew Gardner

Tax evasion matters. It drains needed revenues from the public treasury, and saps public confidence in rules of the game. A recent Pew Research poll finds that 60 percent of Americans are bothered “a lot” by the feeling that the best-off don’t pay their fair share of taxes. And now, thanks to a new report, […]

Unlike Trump-GOP Tax Law, There Are Tax Plans That Would Actually Deliver on Promise to Help Working People

May 24, 2019 • By Alan Essig

Using the tax code to boost the economic security of low- and moderate-income families is a proven strategy. These bold proposals would go much further than any policy currently on the books, and their approach directly contrasts with longstanding supply-side theories that call for continual tax cuts to those who are already economically faring far better than everyone else.

Proposals for Refundable Tax Credits Are Light Years from Tax Policies Enacted in Recent Years

May 22, 2019 • By Steve Wamhoff

A new ITEP report examines five big proposals that have been announced this year to create or expand tax credits to address inequality and help low- and middle-income households.

Policymakers and the public widely agree that economic inequality is the social policy problem of our age. It threatens the livelihoods of millions of children and adults, and it even threatens our democracy. Although some say Americans could fix it themselves by simply rolling up their sleeves, as a sub-headline in a March U.S. News and World Report column implied, the reality is different.

In early April, a diverse but mostly black crowd took to the streets in the Shaw neighborhood of Washington D.C. to protest T-Mobile’s decision to order Metro PCS to cease playing gogo music. This tale is a shining example of why economic investment—especially taxpayer-incentivized investment—in underserved communities is fraught with controversy. Who ultimately benefits after developers pour millions of dollars into these communities? And, as this controversy reveals, are the usually black and brown denizens of these neighborhoods and businesses that may have catered to them no longer welcome once economic development reaches a critical mass?

$4.3 Billion in Rebates, Zero-Tax Bill for 60 Profitable Corps Directly Related to Loopholes

April 12, 2019 • By Matthew Gardner

Meet the new corporate tax system, same as the old corporate tax system. That’s the inescapable conclusion of a new ITEP report assessing the taxpaying behavior of America’s most profitable corporations. The report, Corporate Tax Avoidance Remains Rampant Under New Law, released earlier this week, finds that 60 Fortune 500 corporations disclose paying zero in federal income taxes in 2018 despite enjoying large profits.

A chorus is building and calling on our elected officials to tax the rich. And pundits and policymakers are seriously debating proposals calling for higher income taxes and a wealth tax instead of attempting to shut down the conversation by labeling such proposals as class warfare.

Sen. Ron Wyden of Oregon, the ranking Democrat on the Senate Finance Committee, announced that he would soon release a proposal to eliminate massive tax breaks enjoyed by the wealthy on their capital gains income. If successful, the proposal would ensure that income from wealth is taxed just like income from work.

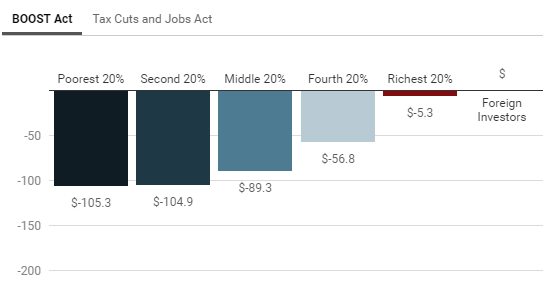

The Trump Tax Law Further Tilted an Already Uneven Playing Field

March 27, 2019 • By Jessica Schieder

Proponents sold the Tax Cuts and Jobs Act (TCJA) as a way to spur new investment, increase workers’ paychecks, and reverse the off-shoring of jobs. Testimony presented during a House Ways and Means hearing held today reflected on how—more than a year after the law’s passage—each of those pitches ring hollow.

Data released Friday by the U.S. Treasury Department should give great pause to all who care about the federal government’s ability to raise revenue in a fair, sustainable way. In the wake of the 2017 corporate tax overhaul, corporate tax collections have fallen at a rate never seen during a period of economic growth.

Rep. Doggett and Sen. Whitehouse Reintroduce Bill to End Offshore Tax Avoidance

March 15, 2019 • By Lorena Roque

On Thursday, Representative Lloyd Doggett and Senator Sheldon Whitehouse announced that they are reintroducing the “No Tax Breaks for Outsourcing Act.” Our international corporate tax rules have been a mess for a long time, and Tax Cuts and Jobs Act (TCJA) failed to resolve the problems. The old rules and the new rules under TCJA both tax offshore corporate profits more lightly than domestic corporate profits, but in different ways. The No Tax Breaks for Outsourcing Act would create rules that tax domestic profits and foreign profits in the same way.

The Tax Cuts and Jobs Act (TCJA), enacted by President Trump and Congressional Republicans at the end of 2017, has caused quite a bit of confusion, and a recent “Fact Checker” column by the Washington Post’s Glenn Kessler does not help. TCJA created real problems that can't be resolved without real tax reform. To begin that process fact checkers, lawmakers, and everyone else need to be clear about what TCJA did, and did not, do to our tax system.

Fear, Not Facts: Netflix Misleads Media Reporting on Corporate Tax Avoidance

February 13, 2019 • By Matthew Gardner

In an age when even the most incontrovertible facts are routinely dismissed as “fake news,” reporting on corporate taxes can be a daunting challenge for members of the media. ITEP’s recent analysis of the income tax disclosures made by Netflix in its annual financial report last week provide an excellent reminder of this.