Blog

1298 posts

Corporate tax avoidance boosts companies’ bottom lines, and this benefits the owners of corporate stocks, which are mostly concentrated in the hands of the well-off. The cost of corporate tax dodging is borne by everyone, in several different ways.

More of the Same: Corporate Tax Avoidance Hasn’t Changed Much Under Trump-GOP Tax Law

December 16, 2019 • By Matthew Gardner

A new report from ITEP released today shows that, based on the first year of financial reports released by companies operating under the new tax law, tax avoidance appears to be every bit as much of a problem under the new tax system as it was before the Trump tax law took effect.

New ITEP Reports Call for the Repeal of Opportunity Zones and Urge States to Decouple

December 12, 2019 • By Lorena Roque

Two new ITEP reports lay bare the irreparable flaws of the federal Opportunity Zones program, created by the Tax Cuts and Jobs Act signed into law by President Trump in 2017.

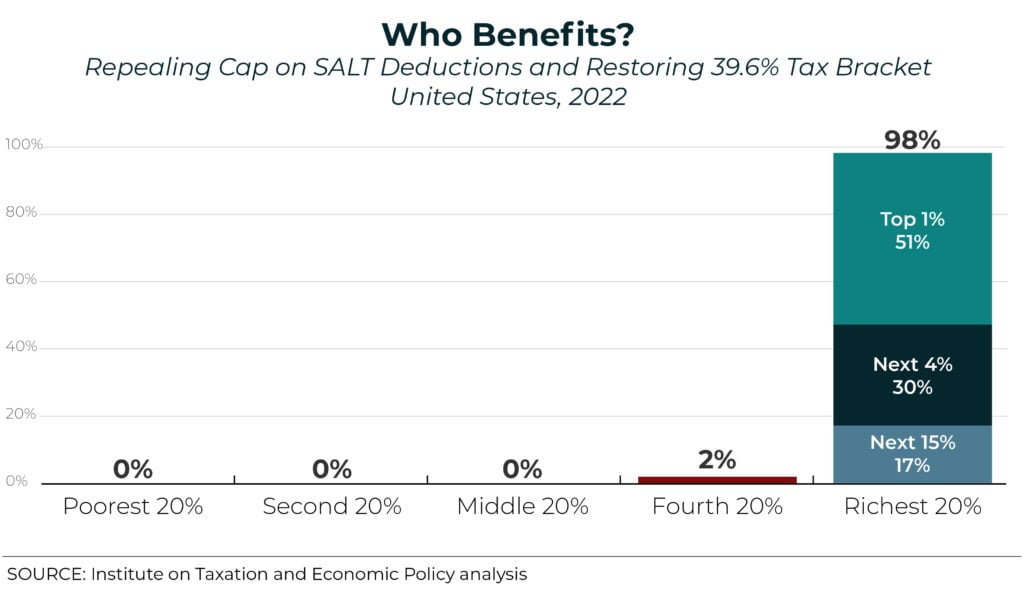

House Democrats’ Latest Bill on SALT Deductions Would Mean Bigger Tax Cuts for the Rich

December 11, 2019 • By Steve Wamhoff

ITEP estimates show that if the House Democrats' proposal was in effect in 2022, it would have a net cost of $81 billion in that year alone. The estimates also show that 51 percent of the benefits would go to the richest 1 percent of taxpayers in the U.S. Clearly, lawmakers concerned about the SALT cap need to go back to the drawing board.

Earlier this year, Amazon and Netflix made headlines when ITEP reported findings that these and at least 58 other companies paid no federal income taxes in 2018. One of the tax breaks they use to manage this feat is related to stock options. Some companies saved hundreds of millions, and in some cases more than a billion dollars, in taxes in 2018 alone with this break. It’s time for Congress to eliminate the stock options tax dodge.

A new ITEP report explains that an income tax cut for cannabis businesses embedded in the MORE Act is probably larger than the new 5 percent sales tax. This means that the average cannabis retailer—and its customers—could expect to pay LESS tax if the MORE Act is signed into law. Congress might have good reasons for structuring legalization this way, but it is an underappreciated aspect of the bill that should be made clearer as this debate progresses.

In the last few weeks, Florida Gov. Ron DeSantis has served up his budget proposal, which advocates are eager to dig into and hoping to contribute to with a delectable Earned Income Tax Credit proposal of their own. Utah lawmakers have been cooking up tax ideas as well, but haven’t yet decided when to come to the table to debate them. And Maryland leaders finalized their menu of needed education reforms, now moving on to assigning responsibilities for funding them. With respect to dividing up the pie, our “What We’re Reading” section below includes reporting on evidence that corporate tax…

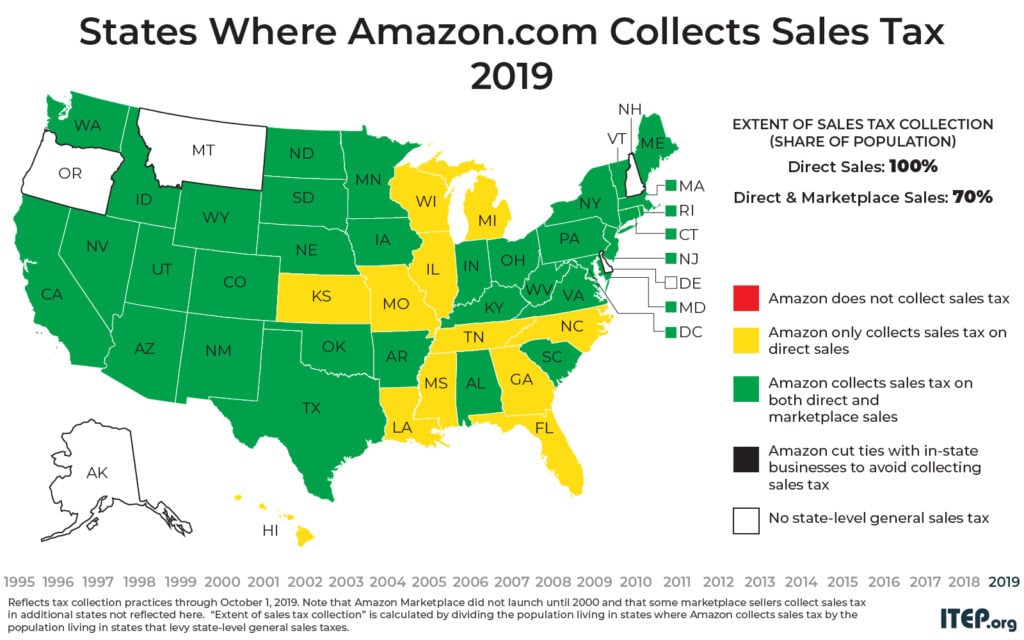

A Lump of Coal for 12 States Not Collecting Marketplace Sales Taxes this Holiday Season

November 25, 2019 • By Carl Davis

The last few years have brought major improvements in how states enforce their sales tax laws on purchases made over the Internet. Less than a decade ago, e-retailers almost never collected the sales taxes owed by their customers. The result was a multi-billion dollar drain on state coffers and a competitive disadvantage for local businesses. But this holiday season looks a bit different.

State Rundown 11/6: State Voters Show Readiness to Fix Broken Tax Codes

November 6, 2019 • By ITEP Staff

Many of yesterday’s Election Day votes came down to questions of whether or not to improve on upside-down and often inadequate state and local tax systems. The status quo was maintained in Colorado, where voters failed to approve a proposition to allow the state to invest tax revenue in education and other needs, and in Texas, where a constitutional amendment was approved to prohibit the state from creating an income tax. But voters supported important reforms in other states by approving needed funding for schools in Idaho, opting to legalize and tax recreational cannabis in California. And for more on…

Sen. Warren Proposes Sweeping Tax Changes to Finance Medicare for All

November 1, 2019 • By Steve Wamhoff

Senator and presidential candidate Elizabeth Warren released a plan today to offset the costs of Medicare for All, a publicly funded single-payer health care program. While ITEP has not crunched the numbers, it seems likely overall that her proposals would raise trillions of dollars and leave costs and taxes either unchanged or lower for most low- and middle-income people.

Several Democratic candidates have proposed raising the statutory corporate tax rate from its current level of 21 percent to fund their spending proposals. Political reporters and observers may read a great deal into the different corporate rates proposed by candidates, but the truth is that rates mean very little on their own.

A Financial Transaction Tax Could Raise Revenue, Curb Inequality

October 28, 2019 • By Steve Wamhoff

A new report from ITEP explains the potential benefits of a financial transaction tax (FTT), which is supported by several presidential candidates. Few proposals can be said to raise revenue for public investments, make our tax code more progressive, and improve the efficiency of our financial system all at the same time. An FTT can do all of that.

State Rundown 10/24: State Tax Talk Makes Like a Tree and Gets Colorful

October 24, 2019 • By ITEP Staff

As autumn brings a colorful display of foliage to many states, so too are tax proposals taking on interesting hues as states move from the summer off-season toward 2020 legislative sessions. Ohio lawmakers are blue in the face from debating and re-debating tax and budget issues there. Maryland residents again showed they can’t be called yellow-bellied when it comes to footing the bill for needed education improvements, showing their broad support for higher taxes to fund those needs even despite a hefty price tag. Alaska, Michigan, and other states are giving the green light to laws implementing their new ability…

House Passes Landmark Bipartisan Bill to Crack Down on Shell Companies Used for Tax Evasion and Other Crimes

October 24, 2019 • By Steve Wamhoff

On Tuesday night, 25 Republicans joined nearly all the chamber’s Democrats to approve the Corporate Transparency Act, a bill that would require those creating a company to report its owners to the federal government. The White House expressed support but called for the House and Senate to work on certain details, creating the possibility that the measure could be enacted.

Depreciation Tax Breaks Are a Problem that Deserves More Attention

October 18, 2019 • By Steve Wamhoff

Sen. Bernie Sanders’ recently released corporate tax plan would shut down the major breaks and loopholes that allow corporations to dodge taxes. The reforms in his plan that are most likely to get attention are proposals to shut down offshore tax dodging, as ITEP has long called for.

Emmanuel Saez and Gabriel Zucman’s New Book Reminds Us that Tax Injustice Is a Choice

October 15, 2019 • By Steve Wamhoff

Cue Emmanuel Saez and Gabriel Zucman. In their new book, The Triumph of Injustice, the economists, who already jolted the world with their shocking data on exploding income inequality and wealth inequality, tell us to stop acting like we are paralyzed when it comes to tax policy. There are answers and solutions. And in about 200 surprisingly readable pages, they provide them.

State Rundown 10/10: Always Something Old, Something New in State Tax Debates

October 10, 2019 • By ITEP Staff

Creative thinking from Pennsylvania lawmakers has helped them discover that the Wayfair ruling allowing states to collect sales tax from online retailers can also help them identify and tax corporate profits earned in their borders. Similarly, New York leaders had the vision to put bold environmental goals in place and identify a carbon price as a potential pay-for. Gubernatorial candidates in Mississippi and Kentucky showed less ingenuity, proposing tax cuts even though Mississippi is still phasing in a massive tax cut from a few years ago and Kentucky’s next election isn’t until 2020. Meanwhile, the old idea of eliminating income…

A New York Times article explained that proponents of a federal wealth tax hope to address exploding inequality but then went on to list the fears of billionaires and economic policymakers, finding that “the idea of redistributing wealth by targeting billionaires is stirring fierce debates at the highest ranks of academia and business, with opponents arguing it would cripple economic growth, sap the motivation of entrepreneurs who aspire to be multimillionaires and set off a search for loopholes.” A wealth tax will not damage our economy and instead would likely improve it. Here’s why.

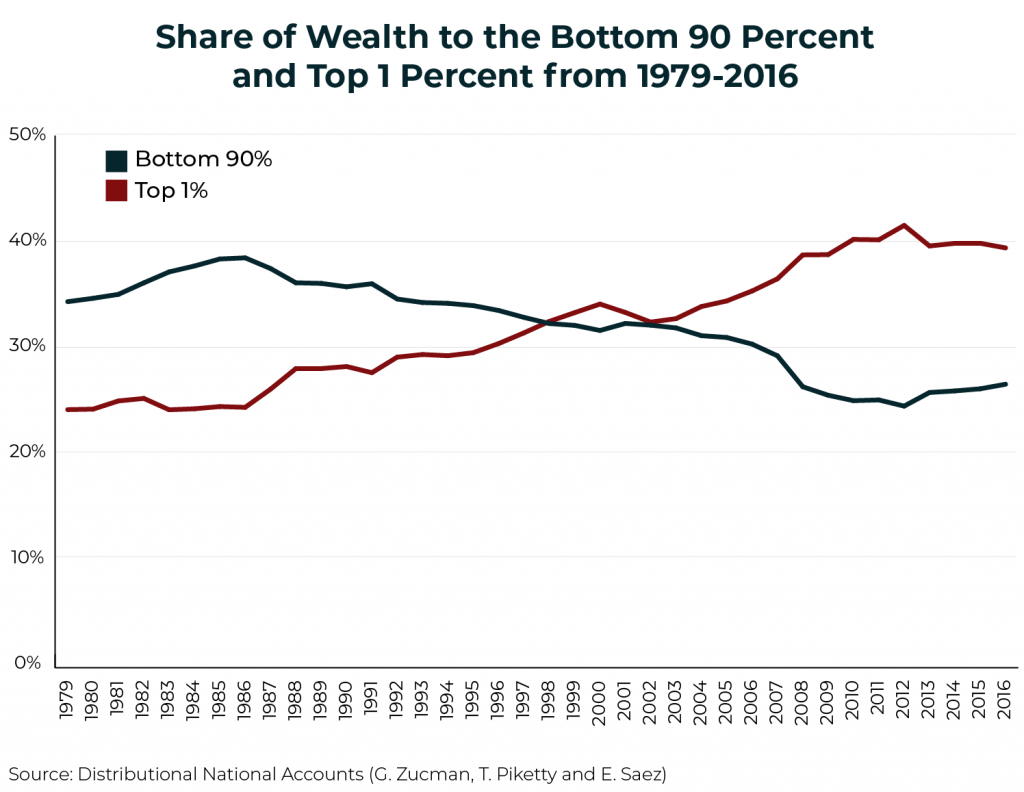

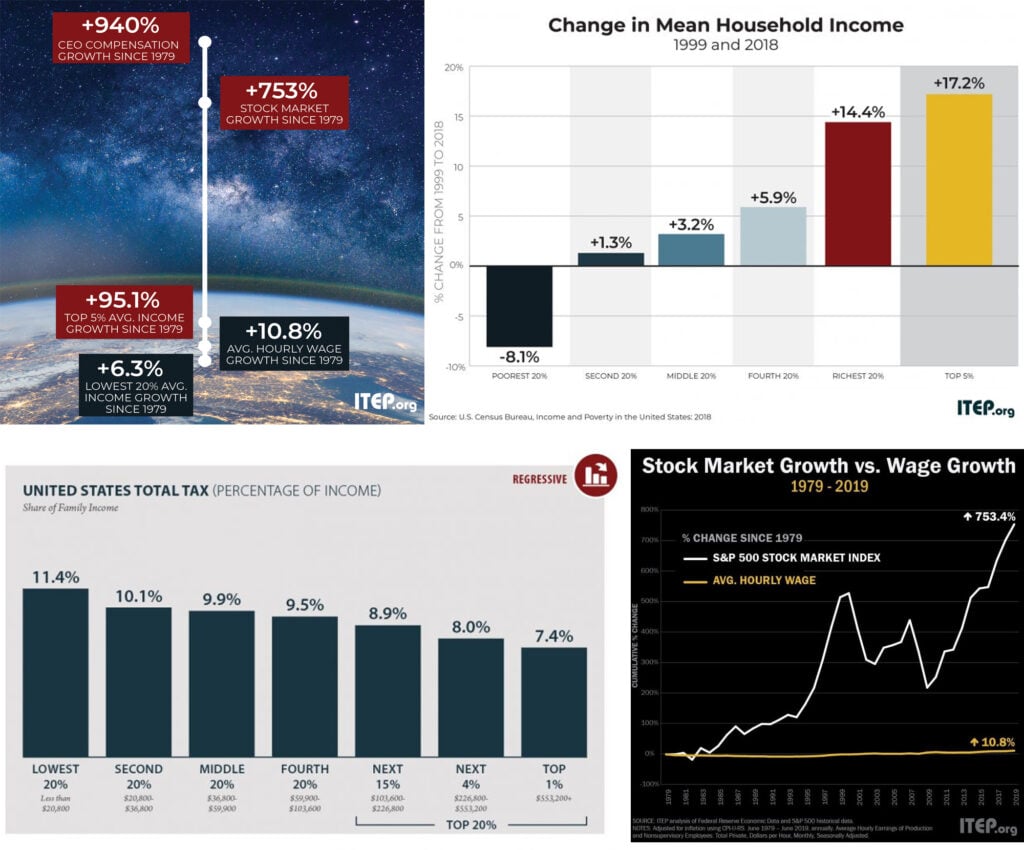

The Nation’s Income Inequality Challenge Explained in Charts

September 27, 2019 • By Stephanie Clegg

Income inequality has reached its highest level since the U.S. Census Bureau began tracking the measure more than 50 years ago, according to recent data. While recent Census data show modest increases in median household income and average hourly wages—numbers anti-tax politicians and pundits have used to deny rising inequality—a deeper look at some of the latest numbers reveals a decades-long trend of widening economic inequality.

State Rundown 9/26: Shady State Business Tax Subsidies Coming to Light

September 26, 2019 • By ITEP Staff

Lawmakers in Michigan and New Hampshire made progress toward enacting their state budgets, though Michigan may yet end up in a government shutdown. Leaders in Wyoming advanced a proposal to create a limited tax on large corporations to raise some revenue and add a progressive element to their state’s tax code. Georgia agencies are forced to recommend their own funding cuts amid state income tax cuts. And business tax subsidies are looking particularly bad in Maryland, where subsidy money has been handed out without verification that companies were creating jobs, and New Jersey, where a false threat to leave the…

A Well-Designed Carbon Tax Could Curb Emissions, Offset Costs for Many Families

September 26, 2019 • By Carl Davis

A well-designed carbon tax package—that is, levied at a sufficiently high rate and paired with equitable offsets for lower- and middle-income families—could improve both our environment and the fairness of our tax system.

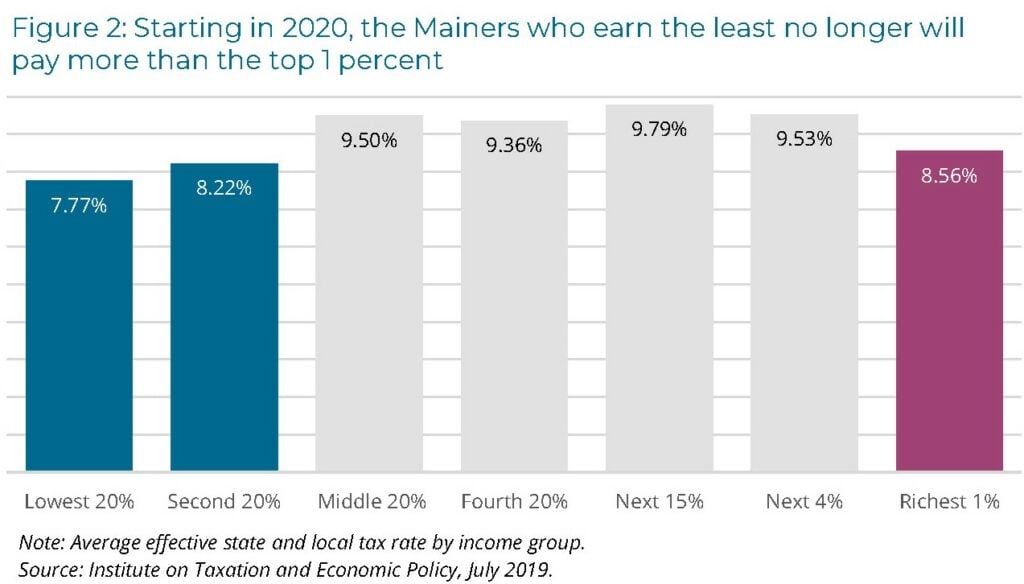

Lawmakers in Maine this year took bold steps toward making the state’s tax system fairer. Their actions demonstrate that political will can dramatically alter state tax policy landscape to improve economic well-being for low-income families while also ensuring the wealthy pay a fairer share.

Wealth Tax Proposals from Warren and Sanders: What You Should Know

September 25, 2019 • By Steve Wamhoff

Earlier this year, Sen. Elizabeth Warren proposed a federal wealth tax on a handful of U.S. households with the highest net worth. Sen. Bernie Sanders has just announced his own wealth tax proposal, which is similar to Warren’s. A few other presidential candidates say they support the concept although they have not provided any details. Here's what you need to know about the potential for a federal wealth tax.

Business Roundtable Members’ Social Responsibility Pledges are Easily Made, and Easily Broken

September 20, 2019 • By Matthew Gardner

It was this side of last month that the Business Roundtable made headlines by announcing its new vision of the purpose of a corporation. More than 180 corporate leaders signed the statement, which declared corporations will prioritize the communities in which they work—instead of shareholder value. But for some corporations, the Business Roundtable statement is yesterday’s news, and they are commencing with business as usual.

One of the most glaring sources of unfairness in the federal tax code are rules that tax capital gains, which mostly go to the rich, less than wages and other types of income that most of us depend on. The capital gains tax breaks have for decades been comfortably ensconced behind trenches filled with special interests who would defend them until the end. But the end is now conceivable.