Tax Analyses

Options to Reduce the Revenue Loss from Adjusting the SALT Cap

August 26, 2021 • By Carl Davis, ITEP Staff, Matthew Gardner, Steve Wamhoff

If lawmakers are unwilling to replace the SALT cap with a new limit on tax breaks that raises revenue, then any modification they make to the cap in the current environment will lose revenue and make the federal tax code less progressive. Given this, lawmakers should choose a policy option that loses as little revenue as possible and that does the smallest amount of damage possible to the progressivity of the federal tax code.

Child Tax Credit Is a Critical Component of Biden Administration’s Recovery Package

June 11, 2021 • By Aidan Davis

Nearly one in seven children in the United States live in poverty and about 6 percent of all children live in deep poverty. President Joe Biden’s American Families Plan would tackle child poverty in an immediate, meaningful way. It is expected to extend the one-year Child Tax Credit (CTC) enhancements included in the March 2021 American Rescue Plan (ARP) through 2025. Next year alone, this would provide around a $110 billion collective income boost to roughly 88 percent of children in the United States.

Effects of the President’s Capital Gains and Dividends Tax Proposals by State

May 6, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s proposal to eliminate the lower income tax rate on capital gains (profits from selling assets) and stock dividends for millionaires would affect less than half of one percent (0.4 percent) of U.S. taxpayers if it goes into effect in 2022. The share of taxpayers affected would be less than 1 percent in every state.

SALT Cap Repeal Would Worsen Racial Income and Wealth Divides

April 20, 2021 • By Carl Davis, ITEP Staff, Jessica Schieder

A bipartisan group of 32 House lawmakers banded together to form the “SALT Caucus,” demanding elimination of the SALT cap. None of their arguments in favor of repeal change the fact that it would primarily benefit the rich and, according to new research, exacerbate racial income and wealth disparities.

Not Worth Its SALT: Tax Cut Proposal Overwhelmingly Benefits Wealthy, White Households

April 20, 2021 • By Carl Davis, ITEP Staff, Jessica Schieder

A previous ITEP analysis showed the lopsided distribution of SALT cap repeal by income level. The vast majority of families would not benefit financially from repeal and most of the tax cuts would flow to families with incomes above $200,000. This report builds on that work by using a mix of tax return and survey data within our microsimulation tax model to estimate the distribution of SALT cap repeal across race and ethnicity. It shows that repealing the SALT cap would be the latest in a long string of inequitable policies that have conspired to create the vast racial income…

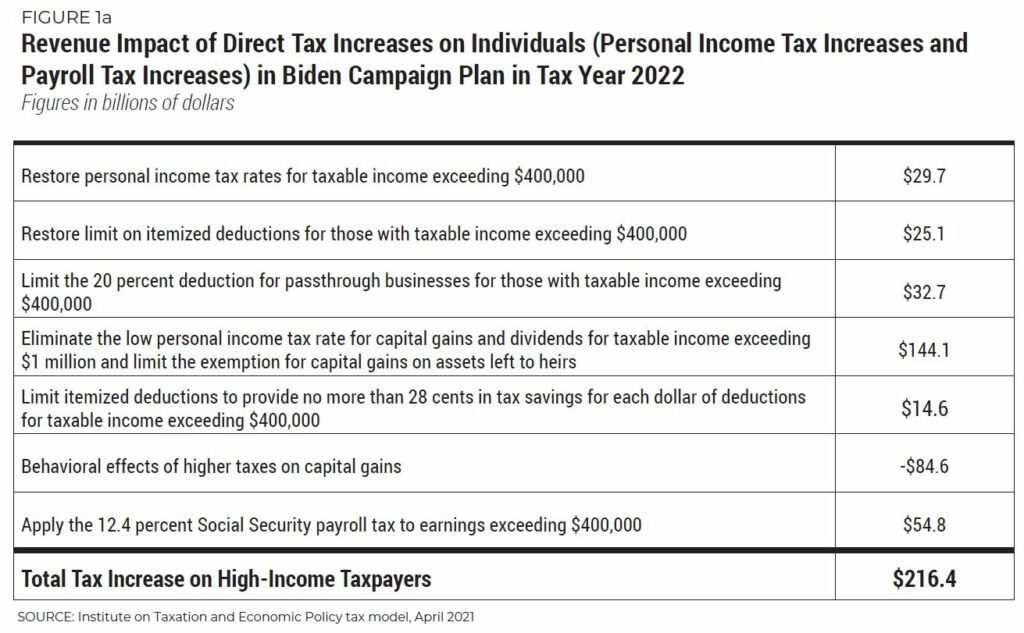

National and State-by-State Estimates of President Biden’s Campaign Proposals for Revenue

April 8, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

During his presidential campaign, Joe Biden proposed to change the tax code to raise revenue directly from households with income exceeding $400,000. More precisely, Biden proposed to raise personal income taxes on unmarried individuals and married couples with taxable income exceeding $400,000, and he also proposed to raise payroll taxes on individual workers with earnings exceeding $400,000. Just 2 percent of taxpayers would see a direct tax hike (an increase in either personal income taxes, payroll taxes, or both) if Biden’s campaign proposals were in effect in 2022. The share of taxpayers affected in each state would vary from a…

Estimates of Cash Payment and Tax Credit Provisions in American Rescue Plan

March 7, 2021 • By Steve Wamhoff

Update: On March 10, the House passed the Senate version of the COVID relief bill, called the American Rescue Plan Act, and sent it to President Biden for his signature. This means that the Senate version of the bill described herein is the final legislation enacted into law.

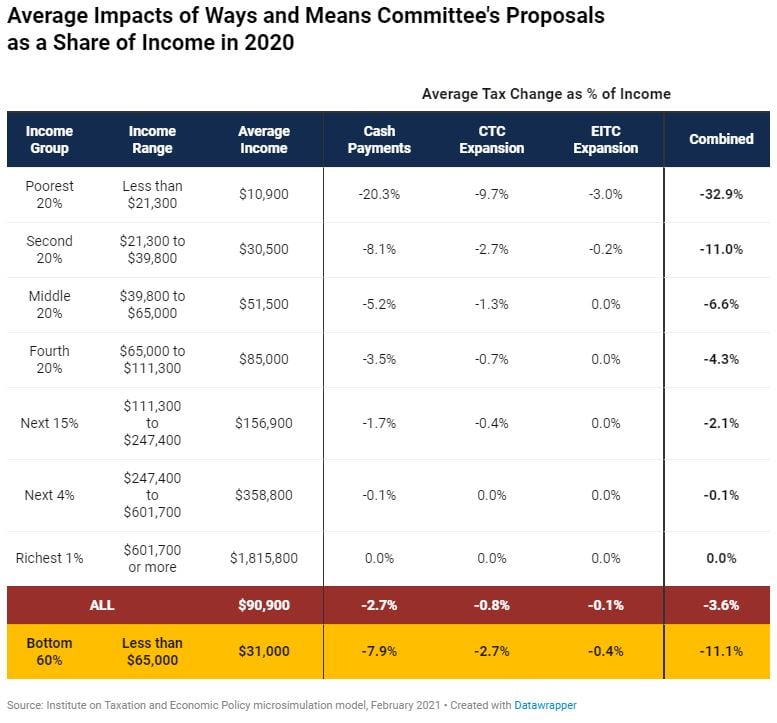

Details of House Democrats’ Cash Payments and Tax Credit Expansions

February 9, 2021 • By Steve Wamhoff

The House Ways and Means Committee published its proposal for the cash payments, tax provisions and other changes that would make up part of the $1.9 trillion COVID relief legislation that President Joe Biden called for a few weeks ago.

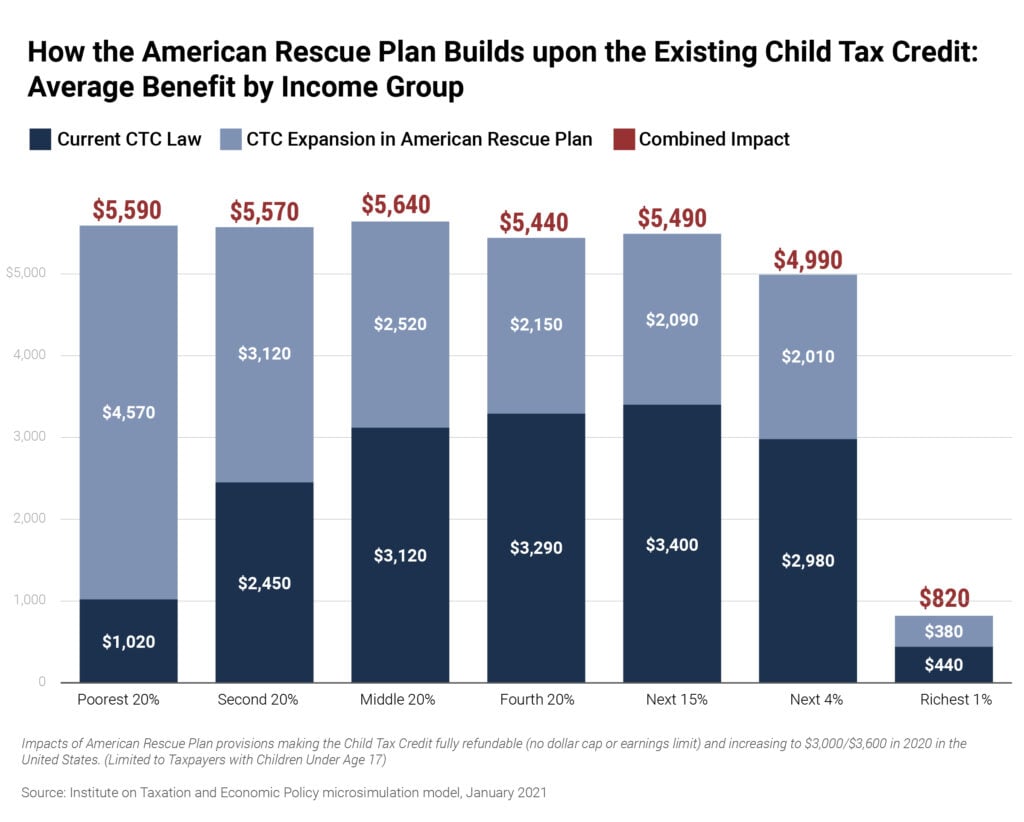

Child Tax Credit Enhancements Under the American Rescue Plan

January 26, 2021 • By Aidan Davis, Jessica Schieder

President Joe Biden’s coronavirus relief package, the American Rescue Plan, includes a significant expansion of the Child Tax Credit (CTC). The president’s proposal provides a $125 billion boost in funding for the program, which would essentially double the size of the existing federal credit for households with children. Combined with existing law, the CTC provisions in Biden's plan would provide a 37.4 percent income boost to the poorest 20 percent of families with children who make $21,300 or less a year.

ANALYSIS: Cash and Tax Provisions in Biden’s Economic Recovery Plan

January 15, 2021 • By Steve Wamhoff

The $1.9 trillion economic recovery plan, known as the American Rescue Plan, announced by President-elect Biden contains, among other provisions, expanded cash payments and changes to the Child Tax Credit (CTC) and the Earned Income Tax Credit (EITC).

How the Proposed $2,000 Cash Payments Compare to the $600 Already Provided by Congress

January 6, 2021 • By Steve Wamhoff

On Dec. 28, the House of Representatives passed the Caring for Americans with Supplemental Help (CASH) Act of 2020, which would increase the cash payment recently provided by Congress from $600 per person to $2,000 per person, among other changes. New estimates from ITEP compare the impacts of $2,000 payments to $600 payments.

National and State-by-State Estimates of New $600 Cash Payments

December 21, 2020 • By Steve Wamhoff

The House and Senate are about to pass the first COVID-19 relief legislation since the CARES Act was enacted in March. The new relief package includes, among other provisions, cash payments of $600 per person, which is half as large as the payments provided under the CARES Act, but also extends payments to spouses and children of certain undocumented immigrants who were left out of the previous payments.

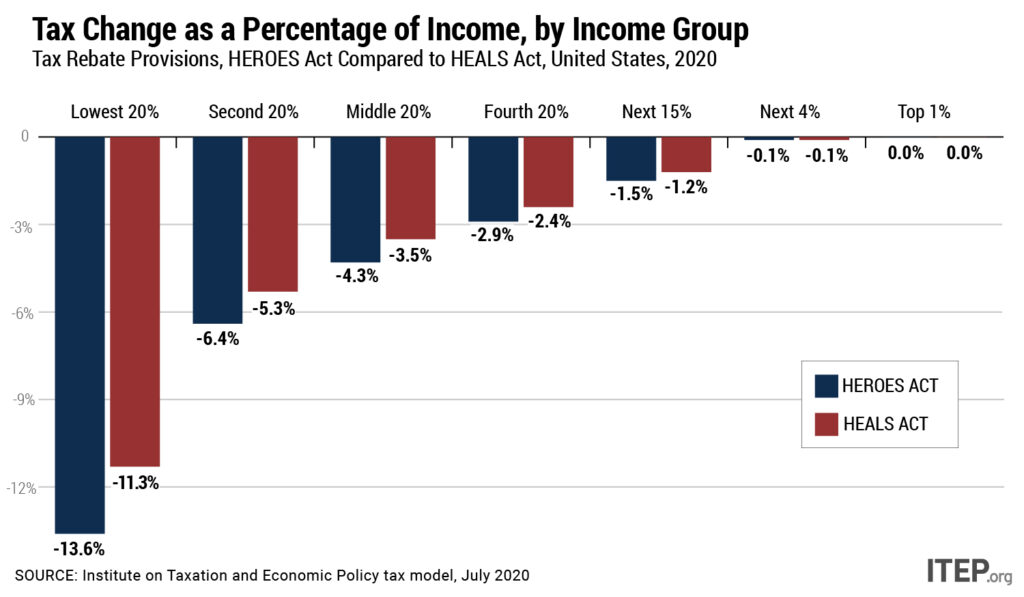

New Analysis Compares HEROES Act and HEALS Act, Disaggregates Data by Race and Income

July 28, 2020 • By ITEP Staff, Jessica Schieder, Meg Wiehe, Steve Wamhoff

The Health, Economic Assistance, Liability Protection and Schools (HEALS) Act released by Senate Republicans Monday includes a tax rebate that is slightly more generous than the one provided under the March CARES Act, but fails to correct most of the earlier act’s problems. House Democrats addressed these shortcomings in the May HEROES Act, a better starting place for negotiations over the next round of COVID-19 relief. ITEP has analyzed both acts to provide a detailed comparison of how the tax rebate provisions would affect families across the income spectrum and by race. Both measures would provide cash payments to a…

SALT Cap Repeal Has No Place in COVID-19 Legislation: National and State-by-State Data

July 17, 2020 • By Steve Wamhoff

The Trump-GOP tax law enacted at the end of 2017 includes a $10,000 cap on the amount of state and local taxes (SALT) that people can deduct on their federal tax returns, and this is one of the few limits the law places on tax breaks for high-income people. Unfortunately, it is also the provision that some Democrats are most determined to remove.

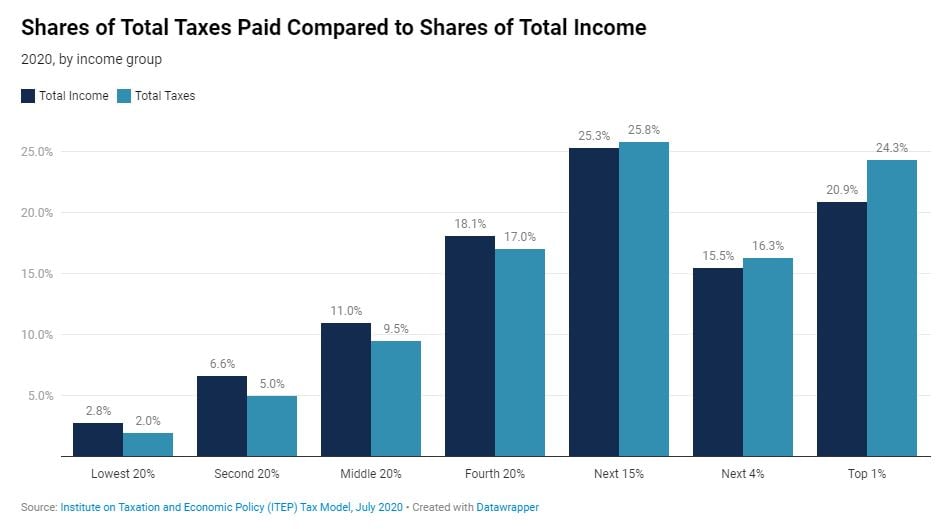

Who Pays Taxes in America in 2020?

July 14, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

Having a sound understanding of who pays taxes and how much is a particularly relevant question now as the nation grapples with a health and economic crisis that is devastating lower-income families and requiring all levels of government to invest more in keeping individuals, families and communities afloat. This year, the share of all taxes paid by the richest 1 percent of Americans (24.3 percent) will be just a bit higher than the share of all income going to this group (20.9 percent). The share of all taxes paid by the poorest fifth of Americans (2 percent) will be just…

NEW ANALYSIS: House Democratic Stimulus Bill Explained

March 24, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

Breaking ITEP analysis explains how a newly-introduced House Democrats' proposal—far more comprehensive and better targeted than the recently failed GOP Senate bill—combines overdue expansion of the Earned Income Tax Credit and Child Tax Credit with direct rebates to reach workers and families across all income groups.

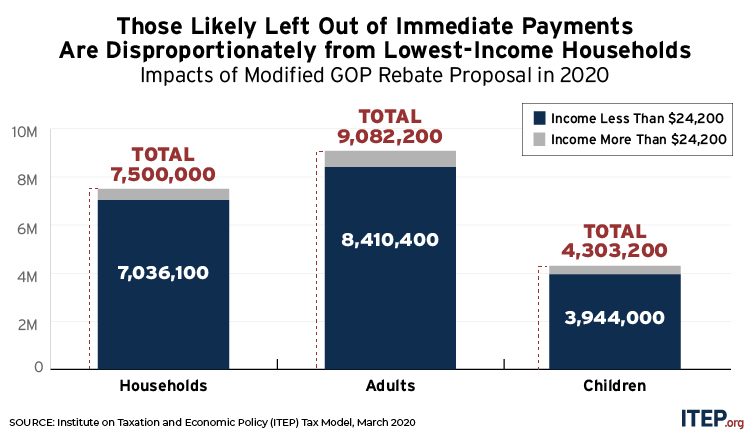

New State-by-State Estimates: Modified Senate GOP Stimulus Bill Still Falls Short

March 23, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

The GOP Senate stimulus bill voted down yesterday is a slight improvement over the first GOP proposal released Thursday, but it still fails to prioritize workers and families or provide fast relief to those who need it most.

Why the GOP Senate Bill Fails to Address the Crisis, and Why a Democratic Bill Looks More Promising

March 20, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

National and state-by-state data available for download By Steve Wamhoff and Meg Wiehe On Thursday night, Senate Majority Leader Mitch McConnell released a bill that reportedly cost more than $1 trillion, most of which would go toward breaks for corporations and other businesses. A provision in the bill to provide payments to families would cost […]

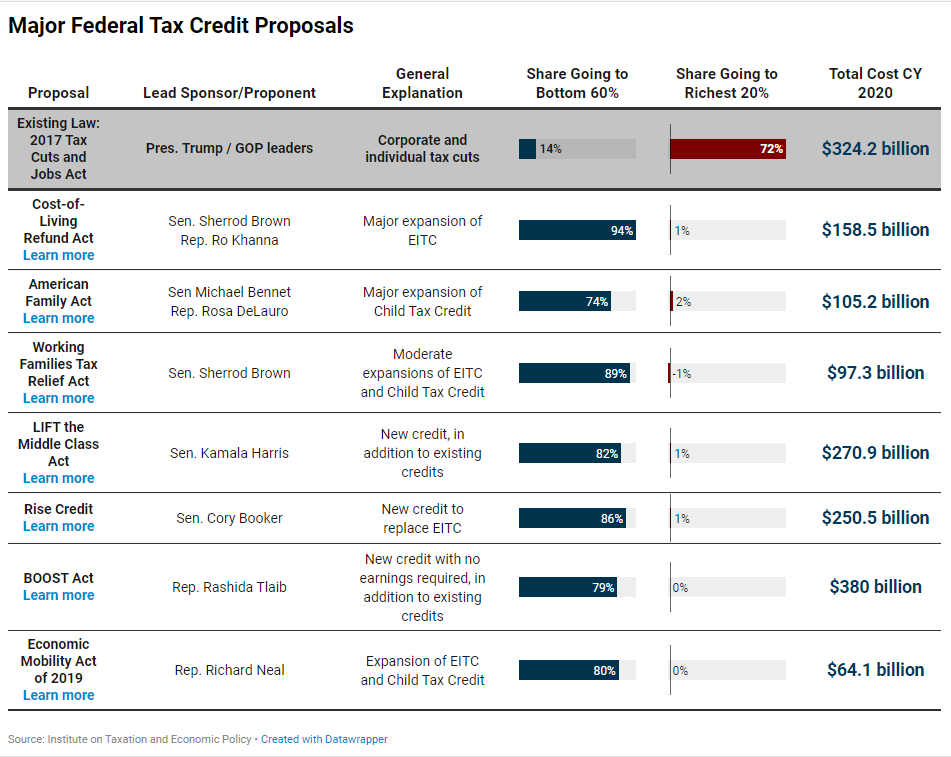

Mayor Pete Buttigieg's proposal An Economic Agenda for American Families: Empowering Working and Middle Class Americans to Thrive would expand the Earned Income Tax Credit (EITC) as modeled by the Working Families Tax Relief Act.

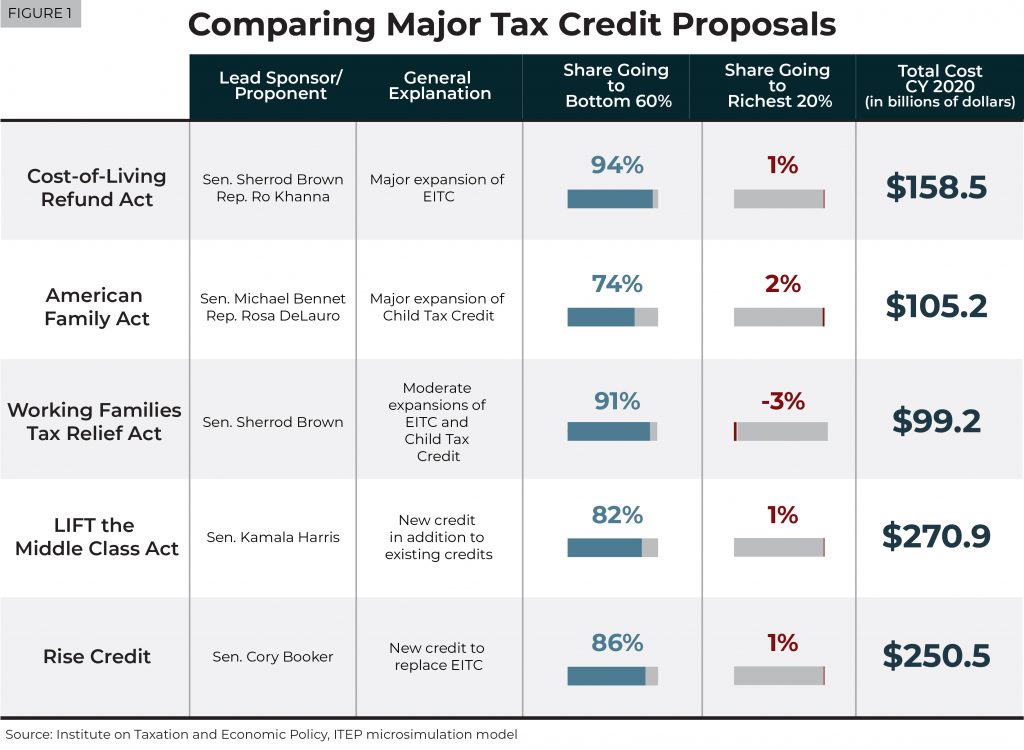

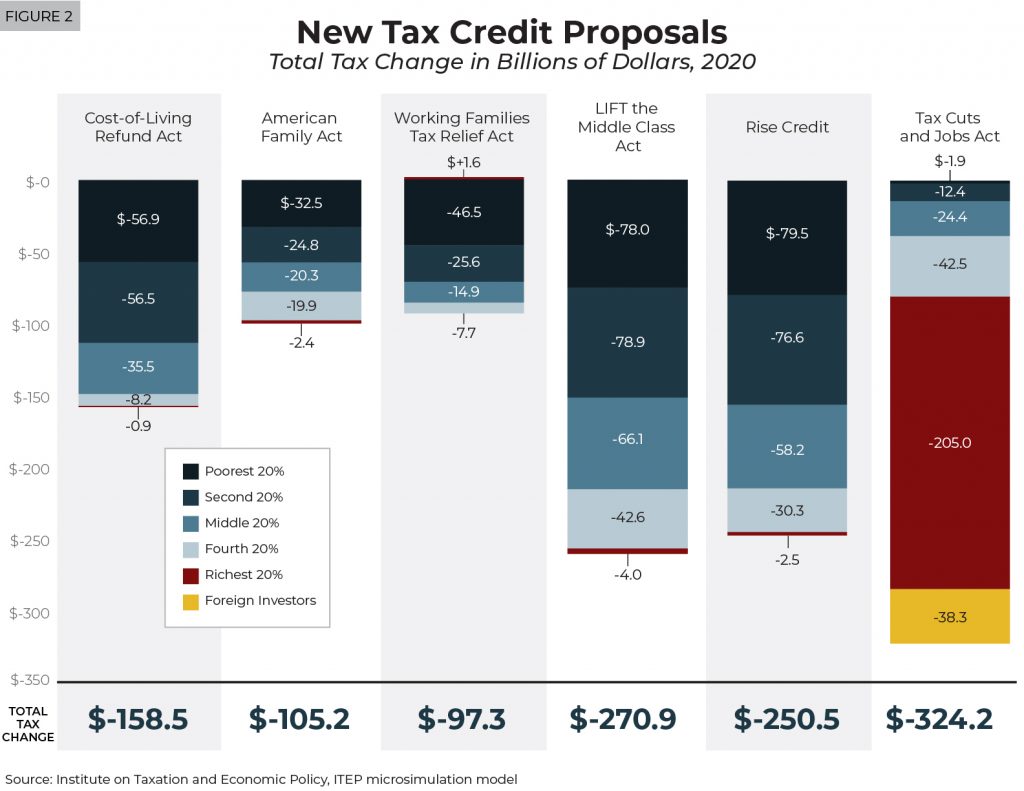

In 2019, several federal lawmakers have introduced tax credit proposals to significantly expand existing tax credits or create new ones to benefit low- and moderate-income people. While these proposals vary a great deal and take different approaches, all build off the success of the EITC and CTC and target their benefits to families in the bottom 60 percent of the income distribution who have an annual household income of $70,000 or less.

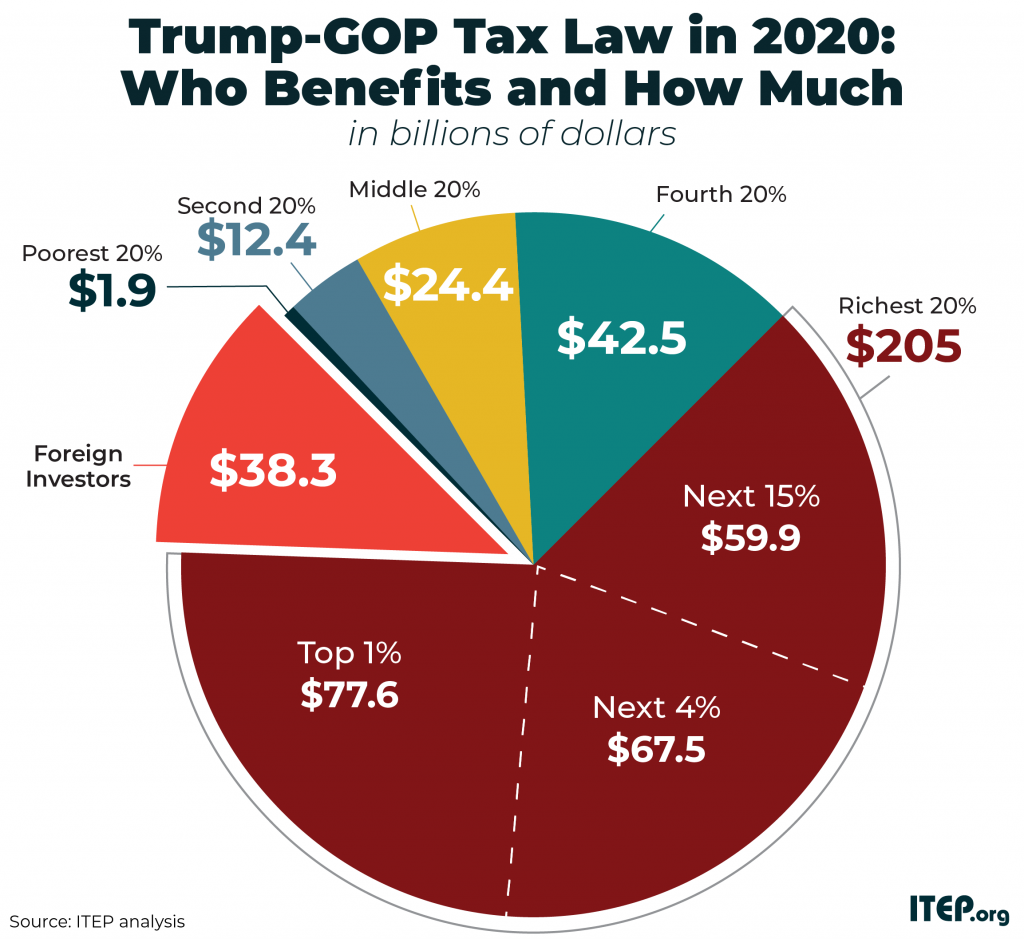

The Tax Cuts and Jobs Act (TCJA), signed into law by President Trump at the end of 2017, includes provisions that dramatically cut taxes and provisions that offset a fraction of the revenue loss by eliminating or limiting certain tax breaks. This page includes estimates of TCJA’s impacts in 2020.

The BOOST Act would provide a new tax credit of up to $3,000 for single people and up to $6,000 for married couples, which would be in addition to existing tax credits. Income limits would prevent well-off households from receiving the credit. Unlike other refundable tax credit proposals, the BOOST Act would not be limited to people with earnings or people with children.

Unlike Trump-GOP Tax Law, There Are Tax Plans That Would Actually Deliver on Promise to Help Working People

May 24, 2019 • By Alan Essig

Using the tax code to boost the economic security of low- and moderate-income families is a proven strategy. These bold proposals would go much further than any policy currently on the books, and their approach directly contrasts with longstanding supply-side theories that call for continual tax cuts to those who are already economically faring far better than everyone else.

Proposals for Refundable Tax Credits Are Light Years from Tax Policies Enacted in Recent Years

May 22, 2019 • By Steve Wamhoff

A new ITEP report examines five big proposals that have been announced this year to create or expand tax credits to address inequality and help low- and middle-income households.

Federal lawmakers have recently announced at least five proposals to significantly expand existing tax credits or create new ones to benefit low- and moderate-income people. While these proposals vary a great deal and take different approaches, all would primarily benefit taxpayers who received only a small share of benefits from the Tax Cuts and Jobs Act.

ITEP staff uses the ITEP Microsimulation model to produce quantitative analyses of current and proposed federal tax policies, creating distributional analyses (analyzing the effect on taxpayers according to their income group), producing revenue estimates (how much a tax policy would affect annual federal revenue collection), and even breaking down the impact of federal policies on each of the 50 states and the District of Columbia.