COVID-19

Lawmakers continue to examine how to respond to the continually evolving economic crisis, precipitated by COVID-19. ITEP’s unique contribution to the policy debate is its rapid analyses of economic stimulus and relief plans. Decisions made now will have short- and long-term implications for families, communities and state and local governments. We are committed to providing distributional analyses of how all proposals affect people across the income spectrum. When possible, we also will provide analyses for all 50 states.

In Drive to Cut Taxes, States Blow an Opportunity to Invest in Underfunded Services

July 7, 2021 • By Marco Guzman

Many states find themselves in a peculiar fiscal situation right now: federal pandemic relief money has been dispersed to states and revenue projections have exceeded expectations set during the pandemic. Meanwhile, more and more workers are returning to jobs as vaccines roll out and typical economic activity resumes. Some states, however, have decided to squander their unexpected fiscal strength on tax cuts.

President Joe Biden's American Families and Jobs plans intend to “build back better” and create a more inclusive economy. To fully live up to this ideal, the final plan must include undocumented people and their families.

Young workers are confronting a harsh economic reality filled with student loan debt and far too few good-paying jobs. The pandemic reinforced this group’s long history of not receiving proper benefits, such as health insurance, from their employers. They also are often overlooked when it comes to policies that promote economic wellbeing. The federal Earned Income Tax Credit (EITC), for example, is a glowing success story. It lifted 5.8 million people out of poverty in 2018, including 3 million children. But a key shortcoming of the federal EITC: working adults without children in the home receive little to no benefit.

Read as PDF Note: This report is adapted from written testimony submitted by Amy Hanauer before testifying in person to the Senate Budget Committee on March 25, 2021. In 2020, the pandemic killed hundreds of thousands of Americans and unemployment soared to levels not seen since the Bureau of Labor Statistics started collecting data in […]

Zoom Video Communications, the company providing a platform used by remote workers and school children across the country during the pandemic, saw its profits increase by more than 4,000 percent last year but paid no federal corporate income tax on those profits.

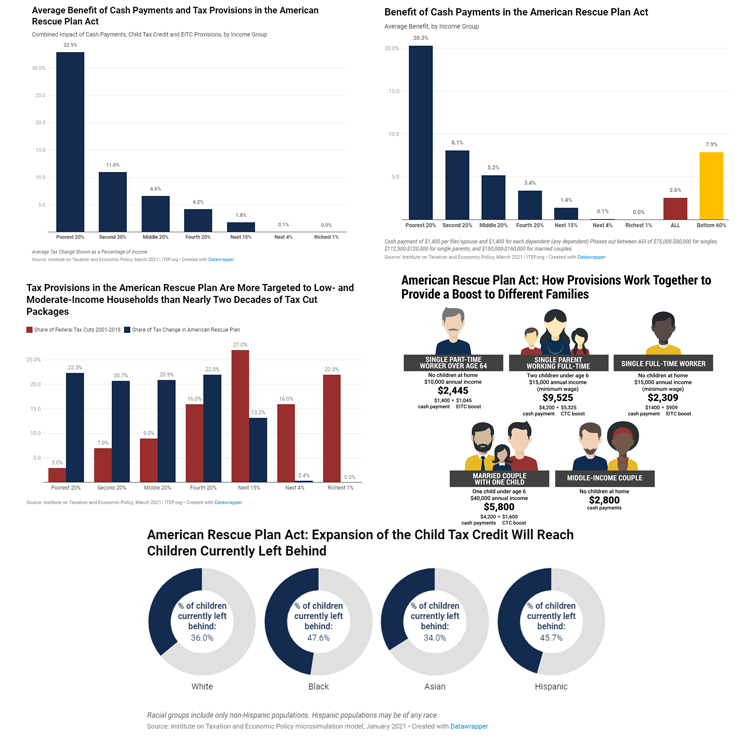

Targeted Relief and the American Rescue Plan in Five Charts

March 10, 2021 • By Stephanie Clegg

The American Rescue Plan Act is unique in that it employs the tax code to deliver relief to those struggling most. These five charts provide a glimpse of how the plan helps families across the income spectrum and also targets economic relief to low- and moderate-income families in the form of cash payments and expansions to the Child Tax Credit and Earned Income Tax Credit.

American Rescue Plan Uses Government Muscle to Tackle Big Economic Problems

March 10, 2021 • By Amy Hanauer

Media contact Following is a statement by Amy Hanauer, executive director of The Institute on Taxation and Economic Policy, regarding the American Rescue Plan, which has cleared both houses of Congress and President Biden is expected to sign. “The American Rescue Plan is a monumental first step toward President Joe Biden’s pledge to build back […]

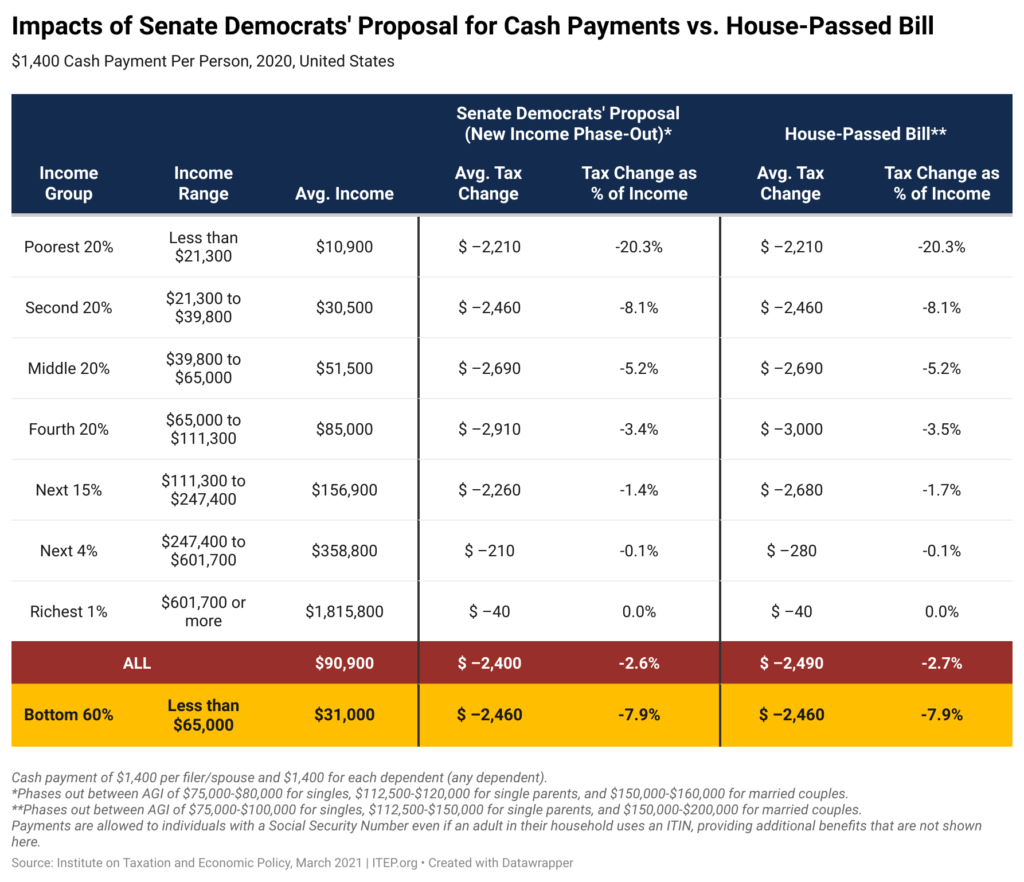

Estimates of Cash Payment and Tax Credit Provisions in American Rescue Plan

March 7, 2021 • By Steve Wamhoff

Update: On March 10, the House passed the Senate version of the COVID relief bill, called the American Rescue Plan Act, and sent it to President Biden for his signature. This means that the Senate version of the bill described herein is the final legislation enacted into law.

As the Senate takes up the COVID relief bill passed by the House last week, Senate Democrats have proposed to lower the income level at which the $1,400 cash payments would be phased out. New estimates from ITEP demonstrate that, for most people, the change would make no difference.

Senators and representatives can look to recent history—the 2007-2009 recession—for lessons on how to best address the current economic crisis. If we do too little, the economy will stay weak much longer, hurting all of us.

The federal minimum wage is almost comically low. At $7.25 an hour, it is 29 percent below its inflation-adjusted peak in the 1960s. Raising the minimum wage to $15 an hour would lift 900,000 Americans out of poverty. A solid 61 percent of voters support the idea. A majority of lawmakers in both the House and Senate support at least some version of a minimum wage hike. The popular $1.9 trillion American Rescue Plan includes a measure that would raise the minimum wage over the next few years to $15. So, what is the problem? And why are lawmakers now…

An Unequal Recession Will Breed Unequal Recovery Without Bold Investments

February 26, 2021 • By Stephanie Clegg

Without bold investments now, experts predict a longer, more unequal recovery. President Biden's American Rescue Plan, the framework for legislation expected to pass this week in the House, would boost economic well-being for those whose livelihoods were most affected by the pandemic-induced economic crisis.

While the federal EITC provides a great deal of support for families with children, its impact is limited for those without children or who are not raising children in their homes. Childless workers under 25 and over 64 have for far too long received no benefit from the federal credit. And workers aged 25 to 64 have received very little value from the existing credit (the maximum credit is much smaller and the income limits more restrictive). The federal EITC’s meager benefits for just some childless adults lead to an inequitable outcome: the federal income tax system—which is ostensibly based…

CARES Act Helps Create $4.6 Billion Tax Cut for Health Care Companies Paying Opioid Settlements

February 12, 2021 • By Matthew Gardner

Talk about a one-two punch. A new report from the Washington Post reveals that the U.S. public is set to pay for the opioid crisis again. Already, communities across the country have paid a heavy price via the devastating public health toll. Now, it appears taxpayers will be on the hook for billions in corporate tax breaks as four pharmaceutical companies exploit a loophole in the Trump-GOP tax law and a CARES Act tax provision meant for companies facing pandemic-related profit losses.

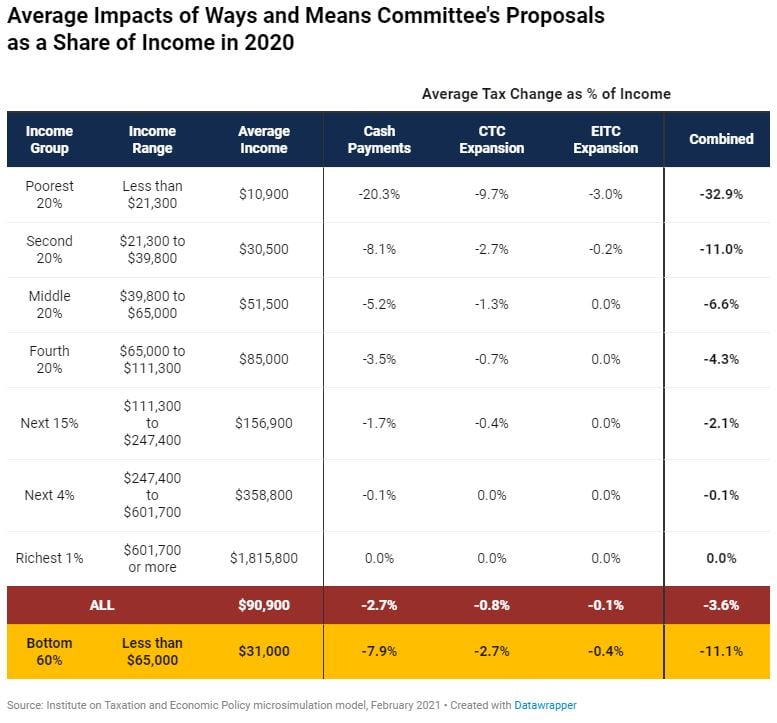

Details of House Democrats’ Cash Payments and Tax Credit Expansions

February 9, 2021 • By Steve Wamhoff

The House Ways and Means Committee published its proposal for the cash payments, tax provisions and other changes that would make up part of the $1.9 trillion COVID relief legislation that President Joe Biden called for a few weeks ago.

States Are Finally Going Bold with Progressive Tax Efforts

February 4, 2021 • By Dylan Grundman O'Neill

Advocates, lawmakers, study commissions, and even governors in some states are proposing bold tax policy reforms that look beyond pandemic-induced budget shortfalls and the “K-shaped recovery” to address underlying inequities and underfunding that gave rise to them. These efforts include proposals to: end or reverse regressive tax policies like the preferential treatment of income derived from wealth over income earned through work; restore or strengthen estate and inheritance taxes to slow the concentration of wealth in ever-fewer hands; raise revenue and slow inequality with progressive income taxes; and many other ideas to right upside-down tax codes while raising the revenue…

The public and the Biden administration say corporations should contribute to the public infrastructure that lets them earn so much. We agree. It’s the least we can ask, in a pandemic and at all other times too.

Amazon Has Record-Breaking Profits in 2020, Avoids $2.3 Billion in Federal Income Taxes

February 3, 2021 • By Matthew Gardner

Amazon’s winning streak in its battle against the U.S. tax system remains intact. This week the retail giant announced record-breaking sales and income for 2020, and an effective federal income tax rate of just 9.4 percent, less than half the statutory corporate tax of 21 percent. If Amazon had paid 21 percent of its profits in federal income tax, that would have come to $4.1 billion. The company’s reported current tax of $1.8 billion was less than half that, meaning last year Amazon avoided $2.3 billion in taxes.

President Biden’s Child Tax Credit Proposal Could Right a Historical Wrong

February 2, 2021 • By ITEP Staff, Jenice Robinson, Meg Wiehe

Many 1990s policies were grounded in harmful, erroneous ideas such as financial struggles are due to personal shortcomings and less government is better. Lawmakers didn’t apply these ideas consistently, however. For example, there was no drive to reduce corporate welfare even as policymakers slashed the safety net and disinvested in lower-income communities. So, it’s not surprising that a bipartisan group of lawmakers concluded during that era that the CTC was an appropriate vehicle to give higher-income households a tax break while leaving out poor children.

Pandemic Profits: Netflix Made Record Profits in 2020, Paid a Tax Rate of Less than 1 Percent

February 1, 2021 • By Matthew Gardner

Netflix’s “current” federal income tax for 2020 was $24 million, which equals just 0.9 percent of the company’s pretax income for the year. This is another way of saying Netflix paid an effective federal income tax rate of just 0.9 percent in 2020. If the company paid the statutory rate, its tax bill would be $572 million.

ANALYSIS: Cash and Tax Provisions in Biden’s Economic Recovery Plan

January 15, 2021 • By Steve Wamhoff

The $1.9 trillion economic recovery plan, known as the American Rescue Plan, announced by President-elect Biden contains, among other provisions, expanded cash payments and changes to the Child Tax Credit (CTC) and the Earned Income Tax Credit (EITC).

Happy Double Take: A President Who Takes Economic Challenges Seriously

January 15, 2021 • By Amy Hanauer

After a solid year of federal policy doing too little to combat staggering job loss, spiking poverty, a raging pandemic and nearly 400,000 COVID deaths, we are ready for a leader who wants to hunker down and get to work on behalf of the people. So we did a happy double take when President-elect Joe Biden outlined his economic plan last night.

New Leadership Should Seize Tax Justice Mandate; Cash Payments Offer On-ramp

January 8, 2021 • By Amy Hanauer

With the victory of Senators-elect Raphael Warnock and Jon Ossoff in Georgia, Democrats now control all three branches of government. New leaders should seize this moment to create a tax code that does much more to reduce inequality and to resource long-overdue investments in climate, health, education and other essentials. Most immediately, the historic election shifts power, making it easier to deliver on the promise to increase the recently enacted $600 cash payments to $2,000 per person.

How the Proposed $2,000 Cash Payments Compare to the $600 Already Provided by Congress

January 6, 2021 • By Steve Wamhoff

On Dec. 28, the House of Representatives passed the Caring for Americans with Supplemental Help (CASH) Act of 2020, which would increase the cash payment recently provided by Congress from $600 per person to $2,000 per person, among other changes. New estimates from ITEP compare the impacts of $2,000 payments to $600 payments.

COVID Relief Bill Will Help Families Now; Bigger, Bolder Package Needed in 2021

December 21, 2020 • By Amy Hanauer

Following is a statement from Amy Hanauer, executive director of the Institute on Taxation and Economic Policy, regarding the COVID-19 relief deal reached Sunday night.