COVID-19

Lawmakers continue to examine how to respond to the continually evolving economic crisis, precipitated by COVID-19. ITEP’s unique contribution to the policy debate is its rapid analyses of economic stimulus and relief plans. Decisions made now will have short- and long-term implications for families, communities and state and local governments. We are committed to providing distributional analyses of how all proposals affect people across the income spectrum. When possible, we also will provide analyses for all 50 states.

Last week, President Trump destroyed everyone’s coronavirus press conference bingo card by announcing that a conversation he had with celebrity chef Wolfgang Puck inspired him to propose restoring a corporate tax deduction for business entertainment expenses. Trump’s own signature tax plan repealed this break two years ago.

Returning to the Economic Status Quo After COVID-19 Crisis Should Not Be an Option

April 6, 2020 • By Jenice Robinson

It will take immense imagination, unyielding political will and a fundamental reordering of our policy priorities to adequately address the problems of this moment and unrig our economy.

Federal Relief Bill Doesn’t Go Far Enough: Q&A with Meg Wiehe

April 2, 2020 • By ITEP Staff, Meg Wiehe, Stephanie Clegg

The final version of the Coronavirus Aid, Relief and Economic Security (CARES) Act enacted last week included rebate provisions that will reach most low-, moderate- and middle-income adults and children, but not everyone. Meg Wiehe sits down for a Q&A to discuss who benefits from the rebate provision, who is excluded and how states can respond to support communities.

Sales Taxes and Social Distancing: State and Local Governments May Face Their Steepest Sales Tax Decline Ever

April 2, 2020 • By Carl Davis, ITEP Staff, Meg Wiehe

One pressing question is what will an economic downturn in which consumers are anxious, facing job loss, or simply spending their time sheltering in place and not spending money in typical ways, mean for states’ ability to raise revenue?

Boeing “CARES” A Lot About its Shareholders—But What about the Rest of Us?

April 1, 2020 • By Matthew Gardner

The gigantic Coronavirus-related tax and spending bill enacted last week, the so-called “CARES Act,” sets aside $17 billion in loans for “businesses critical to maintaining national security.” It’s generally understood that the bill’s authors want much, if not all, of this $17 billion to go to a single company: Boeing. So it behooves us to ask whether Boeing benefits America and its economy in ways that merit this largesse.

Temporarily modifying the structure of the EITC to reflect the realities of our current economy could provide a vital lifeline to low-income workers who have seen their incomes disappear during this crisis. What follows are a few such ideas which could be implemented at either the federal or state levels, or both.

House Democrats’ Suggestion of Retroactively Repealing SALT Cap is a Poor Emergency Relief Measure

March 31, 2020 • By Steve Wamhoff

The House Democrats have plenty of ideas to help workers and families and boost the economy, but Speaker Nancy Pelosi’s recent idea to repeal the cap on deductions for state and local taxes (SALT) is not one of them. The 2017 Trump-GOP tax law includes many provisions that should be repealed. Unfortunately, Congressional Democrats have long made it clear that they want to start by repealing the $10,000 cap on SALT deductions, which is one of the law's few provisions that restrict tax breaks for the rich.

Congress “CARES” for Wealthy with COVID-19 Tax Policy Provisions

March 31, 2020 • By Matthew Gardner

At a time when record numbers of Americans are facing unemployment, state and local governments are facing a perfect storm of growing public investment needs and vanishing tax revenues, and small business owners are struggling to avoid even more layoffs, lavishing tax breaks on the top 1 percent in this way shouldn’t be in anyone’s top 20 list of needed tax changes.

The Job Is Not Yet Done: ITEP Statement on the $2 Trillion Relief Package

March 27, 2020 • By Amy Hanauer

Following is a statement by Amy Hanauer, executive director of the Institute on Taxation and Economic Policy, regarding the $2 trillion relief package expected to be enacted today. ITEP’s distributional analysis of how the rebate checks will affect individuals and families is here and here. “Crisis and unprecedented are overused words at a time like […]

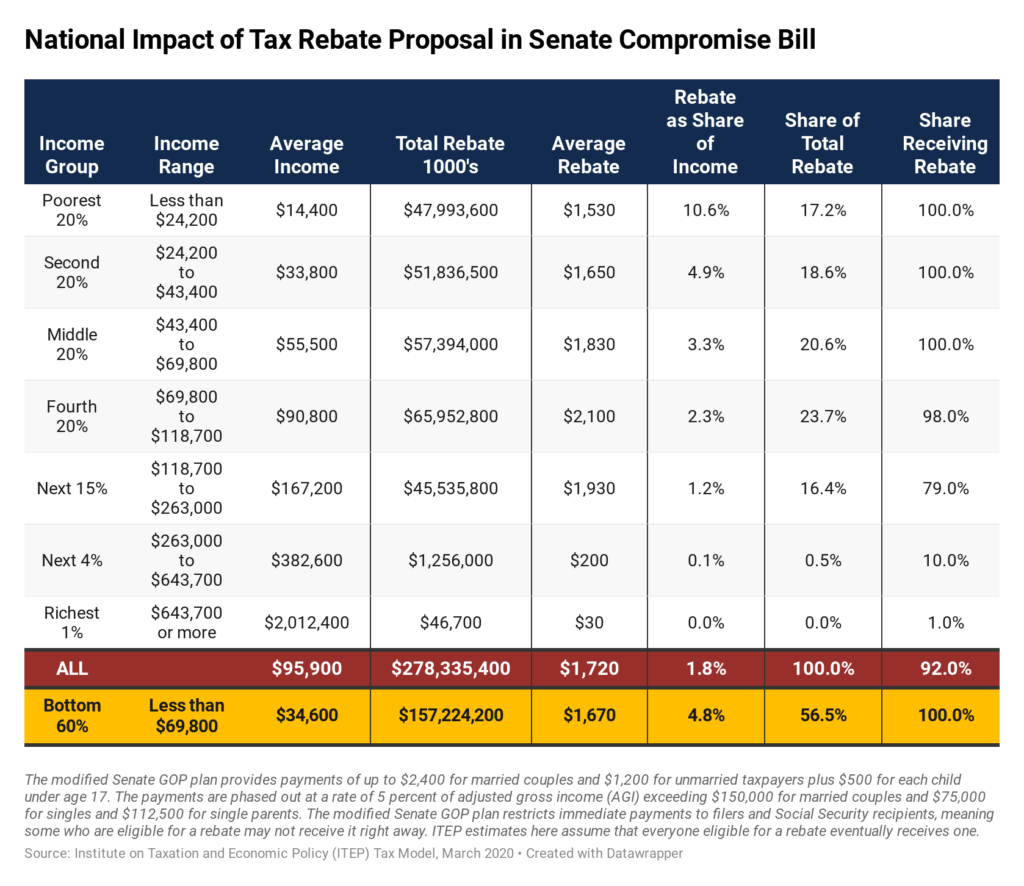

Data available for download Congress passed and the president signed a $2 trillion plan that includes $150 billion in fiscal aid to states, $150 billion in health care spending, large expansions of unemployment compensation and more. These measures are clearly needed as the economy teeters on the brink. Though the bill improves on flaws in […]

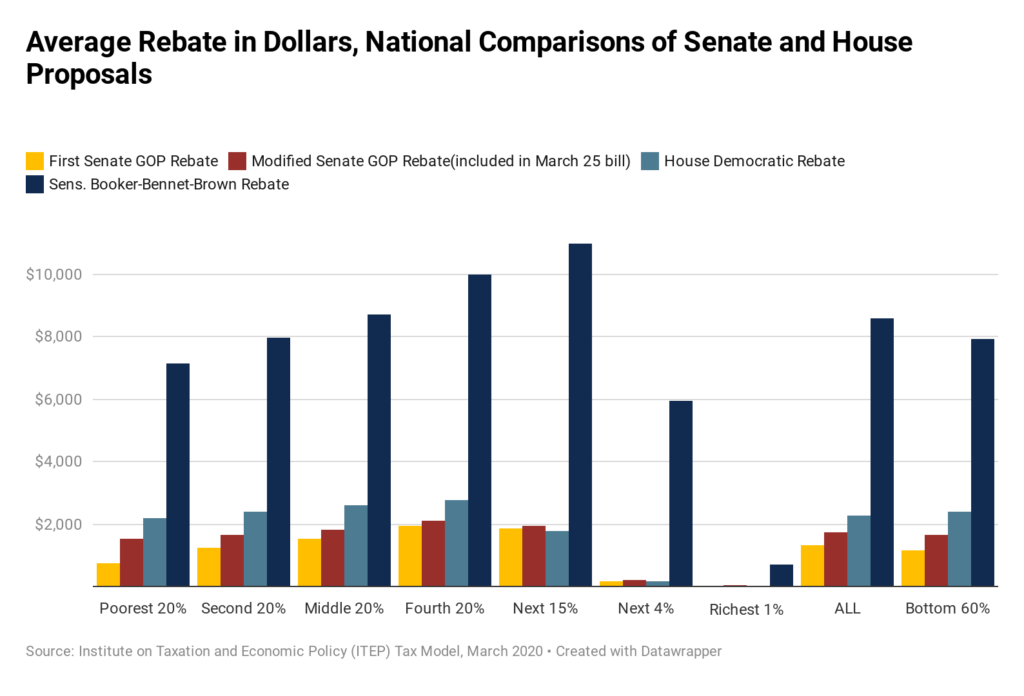

How the Tax Rebate in the Senate’s Bill Compares to Other Proposals

March 25, 2020 • By Steve Wamhoff

Congress is poised to pass a $2 trillion plan that includes $150 billion in fiscal aid to states, $150 billion in health care spending, large expansions of unemployment compensation and more. These measures are clearly needed as the economy teeters on the brink. As the Senate votes on its stimulus/COVID19 bill, one provision ITEP has deeper insights on is the payments to households in the form of tax rebates. ITEP has provided several analyses over the past few days showing that the rebate in the current bill is an improvement over a previous GOP proposal but still falls short of…

New Analysis Shows Average Rebate for Families in the Stimulus Bill

March 25, 2020 • By ITEP Staff

The Senate agreed to a compromise stimulus bill last night that improves on flaws in its initial bill but still fails to go as far as other proposals and leaves out immigrants who file taxes via Individual Taxpayer Identification Numbers (ITIN), the Institute on Taxation and Economic Policy said today.

COVID-19 and the Case for Race-Forward Economic Policy Prescriptions

March 24, 2020 • By Jenice Robinson

Unconscious bias runs deep. Legislative proposals to assuage the exploding economic crisis are advancing and changing quickly, but initial GOP proposals are consistent with the nation’s long history of ostensibly race-neutral policies that are discriminatory in their outcomes.

NEW ANALYSIS: House Democratic Stimulus Bill Explained

March 24, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

Breaking ITEP analysis explains how a newly-introduced House Democrats' proposal—far more comprehensive and better targeted than the recently failed GOP Senate bill—combines overdue expansion of the Earned Income Tax Credit and Child Tax Credit with direct rebates to reach workers and families across all income groups.

New Analysis: Revised GOP Stimulus Proposals Still Fails to Meet Critical Needs

March 23, 2020 • By ITEP Staff

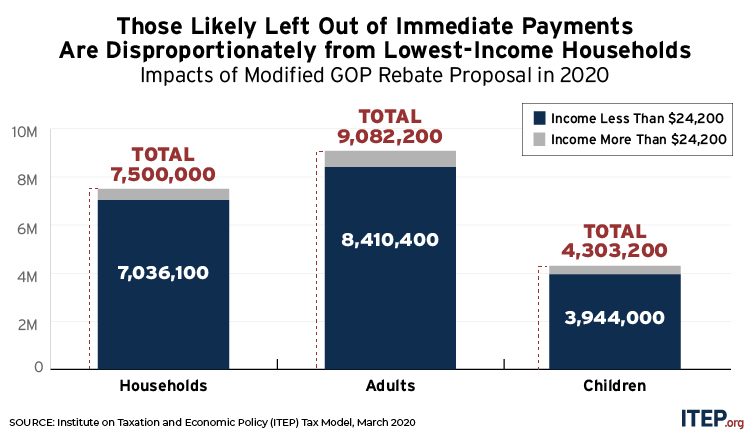

Media Contact The revised GOP stimulus proposal still fails to do enough for struggling families while providing a no-strings-attached bailout to corporations, the Institute on Taxation and Economic Policy said today. ITEP today released an analysis of the revised plan. Among its key findings: The revised proposal could leave 7.5 million households without access to […]

New State-by-State Estimates: Modified Senate GOP Stimulus Bill Still Falls Short

March 23, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

The GOP Senate stimulus bill voted down yesterday is a slight improvement over the first GOP proposal released Thursday, but it still fails to prioritize workers and families or provide fast relief to those who need it most.

Why the GOP Senate Bill Fails to Address the Crisis, and Why a Democratic Bill Looks More Promising

March 20, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

National and state-by-state data available for download By Steve Wamhoff and Meg Wiehe On Thursday night, Senate Majority Leader Mitch McConnell released a bill that reportedly cost more than $1 trillion, most of which would go toward breaks for corporations and other businesses. A provision in the bill to provide payments to families would cost […]

Senate Bill Addresses Unprecedented Health and Economic Crisis with Wrong-Headed Corporate Tax Cuts

March 19, 2020 • By Amy Hanauer

Following is a statement by Amy Hanauer, ITEP’s executive director, regarding the GOP aid plan introduced today by the Senate:

State Rundown 3/19: Spring Is Here but States Brace for Long Winter

March 19, 2020 • By ITEP Staff

As the COVID-19 pandemic continues to disrupt more and more aspects of life and cause greater and greater harms to public health and the economy, information is changing by the hour. State policymakers, if they are even able to convene, are wholly focused on how to respond to the crisis. The pandemic is certain to pose a series of fiscal challenges for states and their economies, and this week’s Rundown focuses on the most helpful resources and the latest state-by-state updates available.

It’s Time for Some State Fiscal Policy Triage

March 18, 2020 • By Carl Davis, Dylan Grundman O'Neill, ITEP Staff

The COVID-19 novel coronavirus’s effects on public health and economies at all scales are creating a daunting situation for state budgets as well. Lawmakers can choose and prioritize their responses through a straightforward approach similar to that taken by health professionals: marshal and reinforce available resources, triage response options to prioritize the most vital services and most vulnerable people, and enact or strengthen the policies that will help address longer-term issues as well as immediate emergencies.

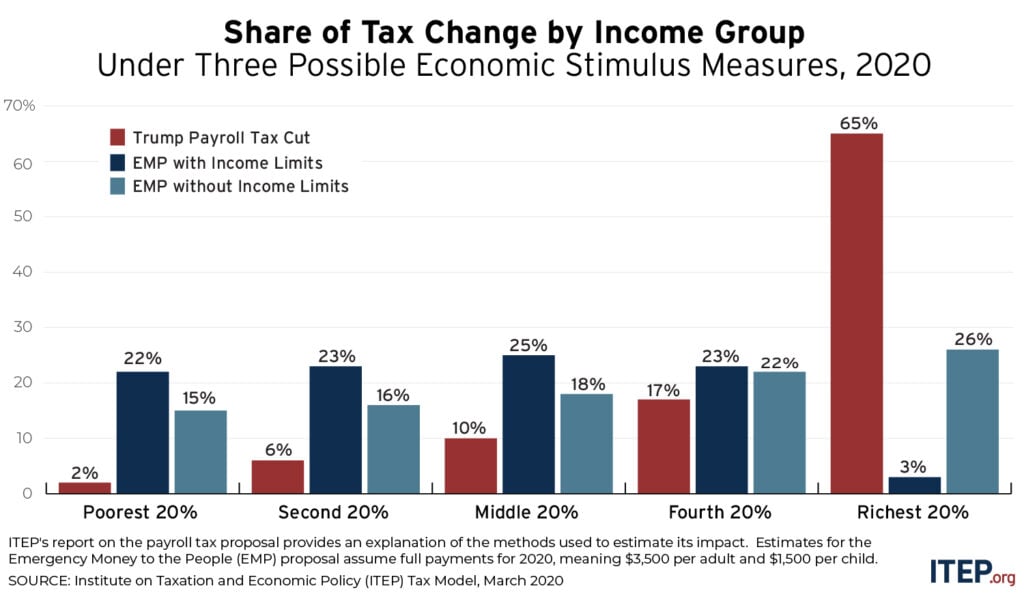

A payroll tax cut would help those lucky enough to keep their job and would provide a bigger break to those with more earnings. Sending checks to every household would be a far more effective economic stimulus because it would immediately put money in the hands of everyone who would likely spend it right away, pumping it back into the economy.

New ITEP Report on President’s Misguided Payroll Tax Proposal

March 13, 2020 • By Steve Wamhoff

Earlier this week, ITEP analyzed what would happen if Congress and the President repeated the 2 percentage-point cut in the Social Security payroll tax that was enacted for two years during the last recession. Little did we know that President Trump was about to propose something far more radical: eliminating all Social Security and Medicare […]

President Trump has proposed to eliminate payroll taxes that fund Social Security and Medicare through the end of the year. ITEP estimates that this would cost $843 billion and 65 percent of the benefits would go to the richest 20 percent of taxpayers, as illustrated in the table below.

The Trump administration is floating a cut in the Social Security payroll tax as a measure to counteract a potential economic downturn related to the COVID-19 virus. It should go without saying that a public health crisis requires government interventions that have nothing to do with taxes. But even if policymakers want to find ways to stimulate the economy beyond solving the health crisis, the payroll tax cut is not likely to be very effective.

COVID-19 Is No Excuse for Airline Industry or Any Other Corporate Tax Cut

March 10, 2020 • By Matthew Gardner

Trump administration officials have reportedly floated the idea of including tax breaks for the airline industry in its package of COVID-19-related stimulus proposals, which would allow airline companies to defer income taxes into the future. This is an odd policy choice since most of the biggest airlines are already using deferral to zero out most or all of their federal income taxes on billions of dollars in profits.