ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

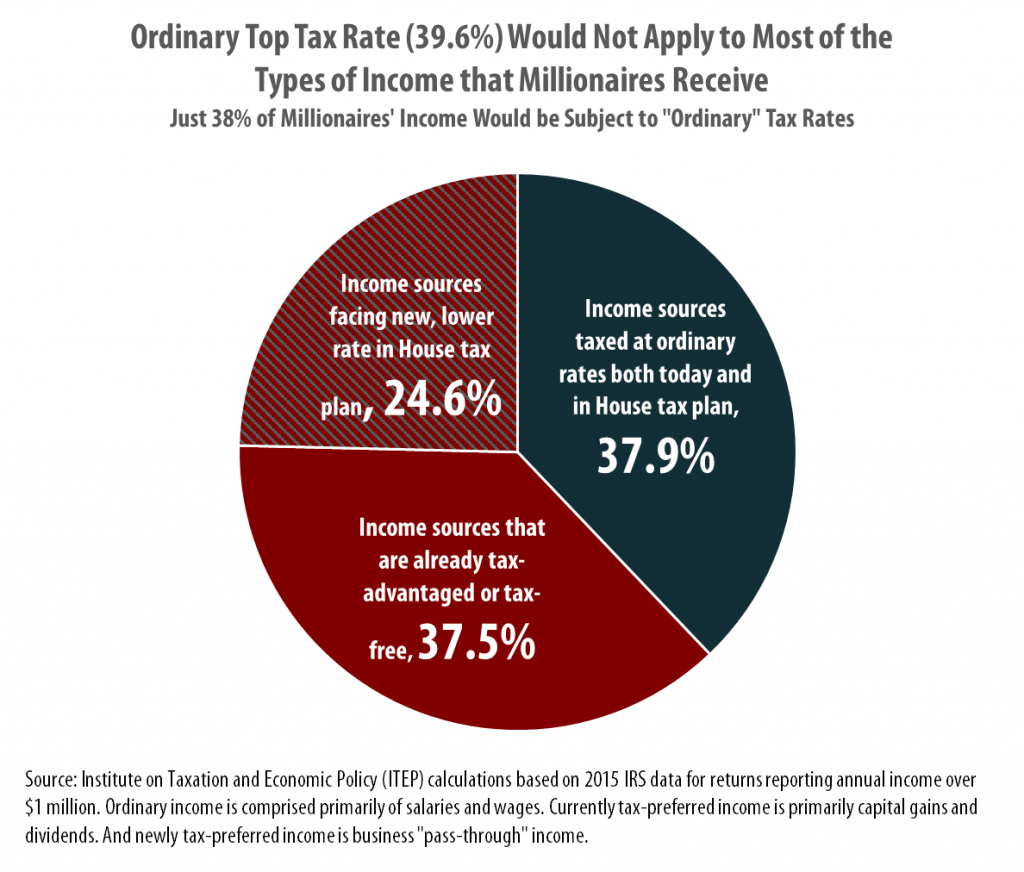

House Tax Plan Will Keep 39.6% Top Rate, But That Won’t Matter for Most Types of Income Going to the Rich

November 1, 2017 • By Carl Davis

In recent days, news that House tax writers will not seek to cut the top personal income tax rate below 39.6 percent on taxable income above $1 million has led some to question whether the newest iteration of the Trump-GOP tax plan will provide a major windfall to the wealthy—a fact that has so far been widely understood. Unfortunately, this second-guessing is unnecessary.

State Rundown 11/1: Connecticut Balances Budget, Leaves Tax Code Out of Whack

November 1, 2017 • By ITEP Staff

This week a "historic" but highly problematic budget agreement was finally reached in Connecticut, Michigan lawmakers banned localities from taxing any food or beverages, and Nebraska and North Dakota both got unpleasant news about future revenues. Also see our "what we're reading" section for news on 11 states that have run up long-term fiscal deficits since 2002 and the impacts of flooding on local tax bases.

State Rundown 10/25: Marijuana Taxes a Bright Spot amid Underperforming State Revenues

October 25, 2017 • By ITEP Staff

This week in state tax news saw Alaska begin yet another special session, Louisiana lawmakers holding meetings to begin preparing for the state’s looming (self-imposed) fiscal cliff, and Alabama policymakers beginning a study of school finance (in)adequacy and (in)equity. Meanwhile, state revenue performance is poor well into 2017 in many states, though Montana, Nevada, and Oregon are all enjoying modest but welcome revenue bumps from legalized marijuana.

State Rundown 10/18: Ballot Initiative Efforts Being Finalized

October 18, 2017 • By ITEP Staff

Ballot initiatives relating to taxes made news around the country this week, with Oregon voters to consider reversing new health care taxes, Washingtonians to vote on improving education funding, and Nebraskans to potentially vote on a state tax credit for school property taxes. Meanwhile, multiple states are finalizing their proposals to lure Amazon to build a new headquarters in their state, often through the use of massive tax subsidies. And in our "What We're Reading" section we have sobering news from Moody's Investors Service on states' struggles to fund their infrastructure and save for the next recession.

Commonwealth Institute: Average Virginian Families Provided a Pittance from GOP-Trump Tax Plan, Top 1% Would See Windfall

October 17, 2017

Who in Virginia would benefit from the type of tax cuts proposed by the Trump administration and congressional Republicans? New analysis by the Institute on Taxation and Economic Policy released in October shows that nearly 80 percent of all of the tax cuts in Virginia would go to the top 1 percent–households with an average of income of $1.7 million...

Wisconsin Budget Project: What the Trump Tax Plan Means for Wisconsin Taxpayers, in Six Charts

October 17, 2017

The tax plan being advanced by President Trump and Republican members of Congress would mostly benefit the extremely rich, despite initial claims by proponents that it would be targeted at members of the middle class...Using data from an analysis by the Institute on Taxation and Economic Policy, we have prepared six charts that show how the Trump-GOP tax framework would affect Wisconsin taxpayers:

State Rundown 10/13: Soda Taxes, Business Subsidies, and Gas Taxes Considered in Several States

October 13, 2017 • By ITEP Staff

A comprehensive tax study is underway in Arkansas this week as other states hone in on more specific issues. Soda taxes hit setbacks in Illinois and Michigan, business tax subsidies faced scrutiny in Iowa and Missouri, and gas tax update efforts are underway in Mississippi and North Dakota.

State Rundown 10/4: Wildfires in Montana and Tax Cuts in Kansas Wreak Budget Havoc

October 4, 2017 • By ITEP Staff

This week, Kansas's school funding was again ruled unconstitutionally low and unfair, while Montana lawmakers indicated they'd rather let historic wildfires burn a hole through their budget than raise revenues to meet their funding needs. Meanwhile, a struggling agricultural sector continues to cause problems for Iowa and Nebraska, but legalized recreational marijuana is bringing good economic news to both California and Nevada.

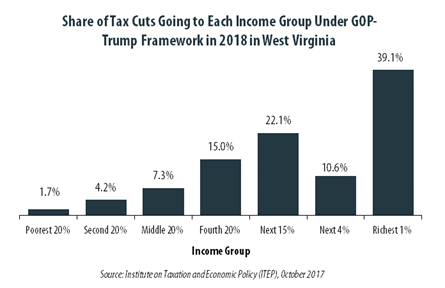

GOP-Trump Tax Framework Would Provide Richest One Percent in West Virginia with 39.1 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in West Virginia equally. The richest one percent of West Virginia residents would receive 39.1 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $358,800 next year. The framework would provide them an average tax cut of $27,800 in 2018, which would increase their income by an average of 3.5 percent.

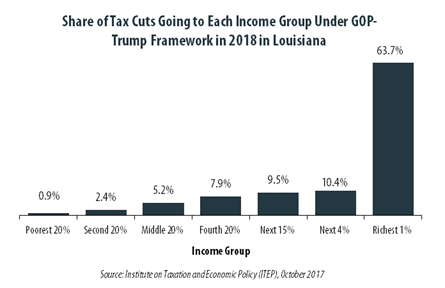

GOP-Trump Tax Framework Would Provide Richest One Percent in Louisiana with 63.7 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Louisiana equally. The richest one percent of Louisiana residents would receive 63.7 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $568,200 next year. The framework would provide them an average tax cut of $97,200 in 2018, which would increase their income by an average of 6.4 percent.

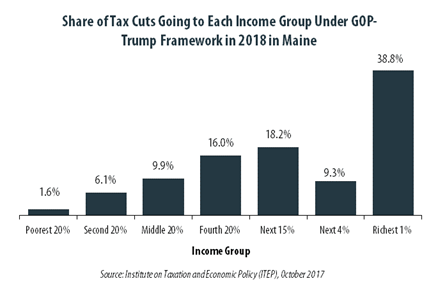

GOP-Trump Tax Framework Would Provide Richest One Percent in Maine with 38.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Maine equally. The richest one percent of Maine residents would receive 38.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $473,000 next year. The framework would provide them an average tax cut of $30,390 in 2018, which would increase their income by an average of 2.5 percent.

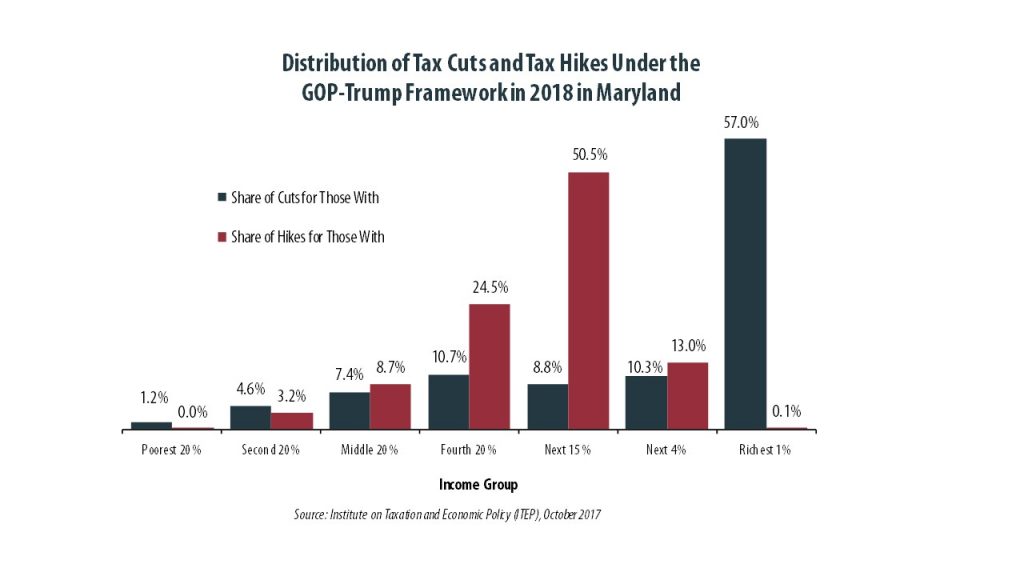

30% of Marylanders Would Pay More Under GOP-Trump Tax Framework, But the State’s Richest 1% Would Pay Less

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Maryland equally. More than 30 percent of Maryland households would have higher tax bills, but nearly everyone among the richest one percent of the state’s residents would receive a tax cut.

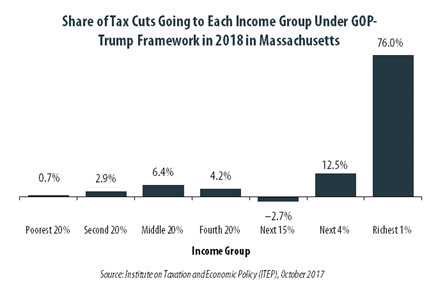

GOP-Trump Tax Framework Would Provide Richest One Percent in Massachusetts with 76.0 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Massachusetts equally. The richest one percent of Massachusetts residents would receive 76.0 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $771,800 next year. The framework would provide them an average tax cut of $136,960 in 2018, which would increase their income by an average of 4.5 percent.

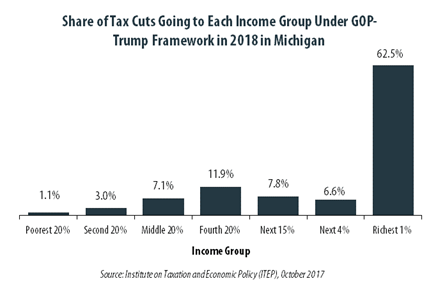

GOP-Trump Tax Framework Would Provide Richest One Percent in Michigan with 62.5 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Michigan equally. The richest one percent of Michigan residents would receive 62.5 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $502,500 next year. The framework would provide them an average tax cut of $76,560 in 2018, which would increase their income by an average of 4.7 percent.

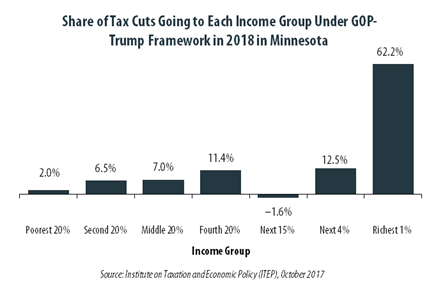

GOP-Trump Tax Framework Would Provide Richest One Percent in Minnesota with 62.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Minnesota equally. The richest one percent of Minnesota residents would receive 62.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $632,000 next year. The framework would provide them an average tax cut of $65,780 in 2018, which would increase their income by an average of 2.5 percent.

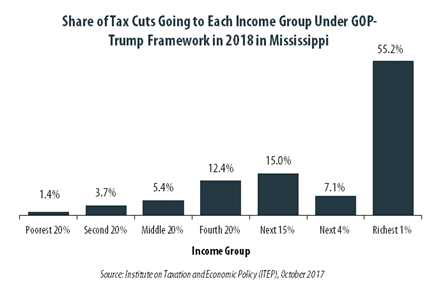

GOP-Trump Tax Framework Would Provide Richest One Percent in Mississippi with 55.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Mississippi equally. The richest one percent of Mississippi residents would receive 55.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $404,300 next year. The framework would provide them an average tax cut of $42,060 in 2018, which would increase their income by an average of 3.6 percent.

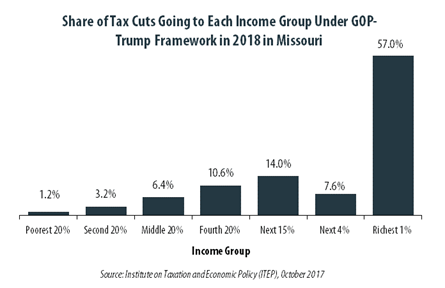

GOP-Trump Tax Framework Would Provide Richest One Percent in Missouri with 57.0 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Missouri equally. The richest one percent of Missouri residents would receive 57.0 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $480,200 next year. The framework would provide them an average tax cut of $62,970 in 2018, which would increase their income by an average of 4.0 percent.

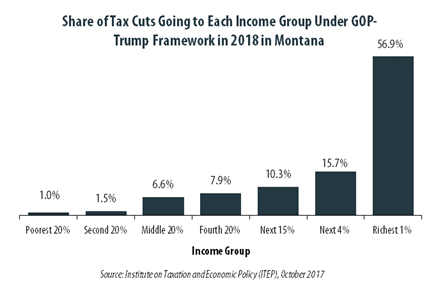

GOP-Trump Tax Framework Would Provide Richest One Percent in Montana with 56.9 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Montana equally. The richest one percent of Montana residents would receive 56.9 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $535,400 next year. The framework would provide them an average tax cut of $68,950 in 2018, which would increase their income by an average of 3.8 percent.

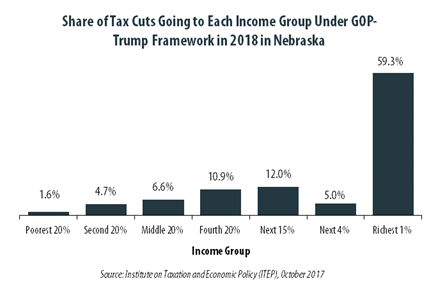

GOP-Trump Tax Framework Would Provide Richest One Percent in Nebraska with 59.3 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Nebraska equally. The richest one percent of Nebraska residents would receive 59.3 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $521,300 next year. The framework would provide them an average tax cut of $80,910 in 2018, which would increase their income by an average of 5.1 percent.

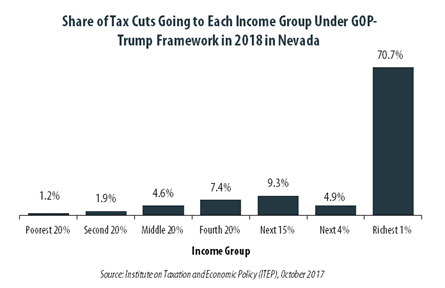

GOP-Trump Tax Framework Would Provide Richest One Percent in Nevada with 70.7 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Nevada equally. The richest one percent of Nevada residents would receive 70.7 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $538,200 next year. The framework would provide them an average tax cut of $113,840 in 2018, which would increase their income by an average of 4.5 percent.

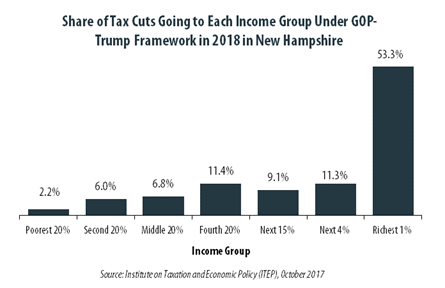

GOP-Trump Tax Framework Would Provide Richest One Percent in New Hampshire with 53.3 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in New Hampshire equally. The richest one percent of New Hampshire residents would receive 53.3 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $545,600 next year. The framework would provide them an average tax cut of $69,390 in 2018, which would increase their income by an average of 4.2 percent.

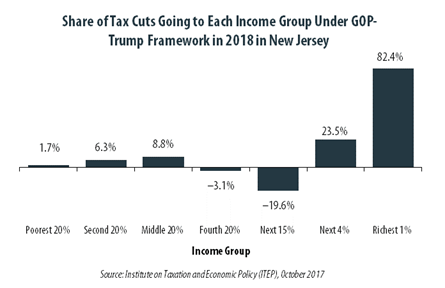

GOP-Trump Tax Framework Would Provide Richest One Percent in New Jersey with 82.4 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in New Jersey equally. The richest one percent of New Jersey residents would receive 82.4 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $1,105,200 next year. The framework would provide them an average tax cut of $73,950 in 2018, which would increase their income by an average of 2.3 percent.

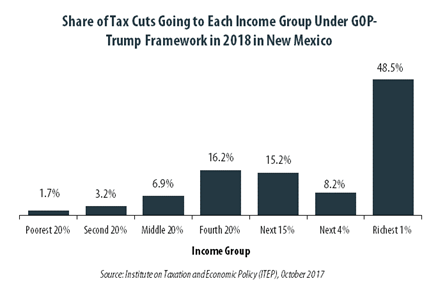

GOP-Trump Tax Framework Would Provide Richest One Percent in New Mexico with 48.5 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in New Mexico equally. The richest one percent of New Mexico residents would receive 48.5 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $443,700 next year. The framework would provide them an average tax cut of $45,910 in 2018, which would increase their income by an average of 3.6 percent.

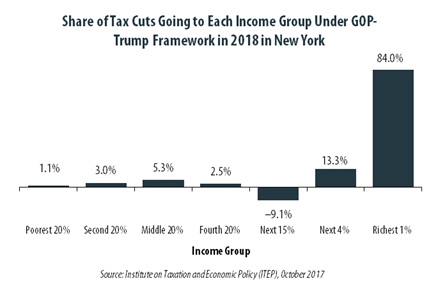

GOP-Trump Tax Framework Would Provide Richest One Percent in New York with 84.0 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in New York equally. The richest one percent of New York residents would receive 84.0 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $872,200 next year. The framework would provide them an average tax cut of $103,660 in 2018, which would increase their income by an average of 3.2 percent.

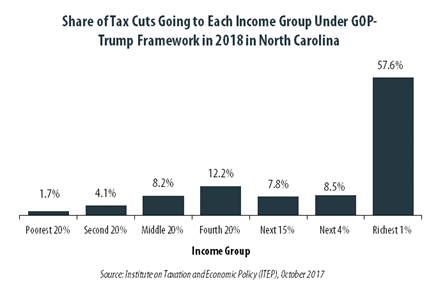

GOP-Trump Tax Framework Would Provide Richest One Percent in North Carolina with 57.6 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in North Carolina equally. The richest one percent of North Carolina residents would receive 57.6 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $512,000 next year. The framework would provide them an average tax cut of $50,440 in 2018, which would increase their income by an average of 3.2 percent.