ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

State Rundown 6/27: States Look at Raising Incomes at the Bottom, Taxes at the Top

June 27, 2019 • By ITEP Staff

Low-income working families got good news and bad news this week, as Earned Income Tax Credit (EITC) enhancements passed in California and advanced in Oregon, while minimum wage increases failed in Pennsylvania, Rhode Island, and Wisconsin. Meanwhile, the momentum for taxing wealth and the very rich continued to grow, as more one-percenters called for enacting progressive taxes, and Inequality.org held a star-studded conference on why and how to do so.

State Rundown 6/19: Juneteenth Highlights Role of State Policy in Racial Equity Fight

June 19, 2019 • By ITEP Staff

As Americans observe Juneteenth today–the day two years after the Emancipation Proclamation on which news of the end of the Civil War and slavery reached some of the last slaves in Texas—most people’s attention should be on celebrating victories, remembering losses, gathering strength to continue the fight for racial justice, and the accompanying Congressional reparations hearings. In comparison, state tax debates over matters such as reluctance to invest in infrastructure in Michigan and Missouri, approval of income tax cuts in Wisconsin, and a budget standoff in New Jersey may seem unimportant and irrelevant. But we encourage our readers to think about how state policies often serve to enrich and empower white and wealthy households, and…

State Rundown 6/12: Progress in Taxing the Rich, Expanding EITCs, and Taming Tax Subsidies

June 12, 2019 • By ITEP Staff

This week saw lawmakers in Ohio propose significant harmful tax cuts, leaders in California and Oregon work toward strengthening the state Earned Income Tax Credits (EITCs), and governors in Missouri and Kansas declare a truce to end the practice of bribing businesses in the Kansas City area with tax cuts to move from one side of the state line to the other. Meanwhile, Massachusetts leaders are discussing ways of raising taxes on their richest households, which our latest Just Taxes blog post notes is a promising trend this year across many states.

Illinois made big news in several tax and budget areas recently, including sending a graduated income tax amendment to voters in 2020, as well as legalizing and taxing cannabis and updating gas and cigarette taxes for infrastructure improvements. Connecticut made smaller waves with sales tax reforms, a plastic bag tax, and a progressive mansion tax. Property tax credits were proposed in both Maine and New Jersey. And Nevada extended a business tax to give teachers a raise. And our What We’re Reading section is brimming with good reads on how states are doing with recovering from the Great Recession, funding…

Like certain recent controversially concluded television shows, tax and budget debates can end in many ways and often receive mixed reviews. Illinois leaders, for example, ended on a cliffhanger by approving a historic constitutional amendment to create a graduated income tax in the state, whose ultimate conclusion will be crowdsourced by voters next November. Arizona’s fiscal finale fell flat with many observers due to corner-cutting on needed investments and a heavy focus on tax cuts. Texas legislators went for crowd-pleasing property tax cuts and school funding increases but left a gigantic “but how will we pay for this” plot hole…

State Rundown 5/22: (Some) State Lawmakers Can (Partly) Relax This Weekend

May 22, 2019 • By ITEP Staff

Lawmakers and advocates can enjoy their barbeques with only one eye on their work email this weekend in states that have essentially finished their budget debates such as Alaska, Minnesota, Nebraska, and Oklahoma, though both Alaska and Minnesota require special sessions to wrap things up. Getting to those barbeques may be a bumpy ride in Louisiana, Michigan, and other states still working to modernize outdated and inadequate gas taxes.

State Rundown 5/16: Tensions Remain High Over Budgets and School Finances in Several States

May 16, 2019 • By ITEP Staff

Tax and budget negotiations remain at standstills in Louisiana and Minnesota, as school funding debates and teacher protests again captured headlines in several states. Oregon lawmakers, for example, finally passed a mixed-bag tax package that won’t improve tax equity but will raise much-needed revenue for education. Meanwhile their counterparts in Nebraska continue to debate highly […]

State Rundown 5/9: Illinois Moves Closer to a Progressive Income Tax

May 9, 2019 • By ITEP Staff

Lawmakers in Illinois and Ohio have advanced major tax proposals but cannot rest just yet, as they must still get past the other legislative chamber. Their counterparts in Michigan, Minnesota, Nebraska, and Oregon, meanwhile, are all at impasses over education funding, as those in Texas left their school funding disagreement unresolved at least until they reconvene...in 2021. And in an era of many states pre-empting smaller jurisdictions by revoking local decision-making powers, leaders in Colorado and Delaware made moves in the opposite direction, entrusting cities and school districts with more local control.

Tax and budget debates are now mostly complete in Alabama, Arkansas, and Colorado, but just starting or just getting interesting in several other states. Delaware and Massachusetts lawmakers, for example, are looking at progressive income tax increases on wealthy households, and New Hampshire may use a progressive tax on capital gains to simultaneously improve its upside-down tax code and invest in education. Nebraska and Texas, on the other hand, are also looking to improve school funding but plan to do so on the backs of low- and middle-income families through regressive sales tax increases. Fiscal debates are heating up in…

State Rundown 4/11: An Estate Tax Win, Opioid Progress, and Teacher Uprising Updates

April 11, 2019 • By ITEP Staff

Hawaii made progress in pushing back against the increasing concentration of wealth and power by beefing up its estate tax. Delaware, New Jersey, and Rhode Island all took steps toward taxing opioid producers to raise funds to address the ongoing opioid crisis. Oregon lawmakers continue to try to address their chronic school underfunding with a $2 billion annual investment, in contrast to some of their counterparts in North Carolina who are responding to similar issues with the opposite approach, proposing to slash taxes in the face of their school funding issues – just as research highlighted in our What We’re…

State Rundown 4/4: Ohio Gas Tax and Maryland Minimum Wage Get Needed Updates

April 4, 2019 • By ITEP Staff

Transportation funding was a hot topic this week, as OHIO lawmakers responsibly voted to update their gas tax and offset some of its impact on lower-income families with an Earned Income Tax Credit (EITC) boost, while NEW YORK enacted the nation’s first “congestion pricing” charge, and LOUISIANA and VIRGINIA leaders looked at gas tax updates as well—a trend ITEP’s Carl Davis explored in depth today here. Broad tax packages are also being hashed out in LOUISIANA, NEBRASKA, OREGON, and TEXAS. And MARYLAND became the sixth state with a $15 minimum wage on the horizon.

State Rundown 3/27: Spring Bringing Smart State Tax Policy So Far

March 27, 2019 • By ITEP Staff

Though a long winter and a rough start to spring weather have wreaked havoc in much of the country, lawmakers are off to a good start in the world of state fiscal policy so far. In the last week, a progressive revenue package was passed in the nick of time in NEW MEXICO, a service-sapping tax cut was vetoed in KANSAS, and a regressive and unsustainable tax shift was soundly defeated in NORTH DAKOTA. Meanwhile, gas tax updates are on the table in MAINE, MINNESOTA, and OHIO. And exemptions for feminine hygiene products and diapers were enacted in VIRGINIA and introduced in MISSOURI.

More than three billion dollars could be raised under a major progressive tax plan proposed by Illinois Gov. J.B. Pritzker this week, the point being to simultaneously improve the state’s upside-down tax code and address its notorious budget gap issues. One state, Utah, may already be looking at a special session to revisit the sales tax reform debate that ended this week without resolution, in contrast to Alabama and Arkansas, where leaders finally resolved years-long debates over gas taxes and infrastructure funding. And lawmakers in four states – California, Florida, Minnesota, and North Carolina – introduced legislation to expand or…

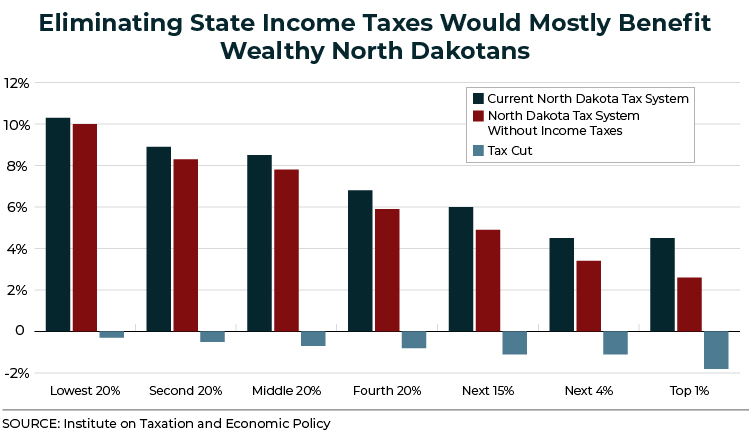

North Dakota Senate Should Put the Freeze on House Tax-Cut Plan

March 11, 2019 • By Dylan Grundman O'Neill

Lawmakers in Bismarck were treated last weekend to the largest single day of snowfall the city has ever seen. As state senators begin weighing a bill recently passed by the House that would replace the state's income taxes with oil revenue, they might want to reflect on how similar oil revenue is to the snow: although both are in extreme abundance right now, both are volatile and unpredictable and will melt away sooner than later. Lawmakers should also consider how eliminating the state's income taxes might warm the hearts of wealthier North Dakotans but would leave most North Dakota families…

State Rundown 3/6: March Tax Debates Contain Sanity Amid Usual Madness

March 6, 2019 • By ITEP Staff

State policymakers around the nation this week served up a handful of harmful and upside-down tax proposals, but these were refreshingly outnumbered by sound tax and budget policy proposals in several other states. NEW JERSEY Gov. Phil Murphy made tax fairness an explicit priority in his budget address, the NEW MEXICO House passed progressive reforms to improve the state’s schools and tax code, states such as VERMONT are looking to raise funds from legalized cannabis and put it to good use, and many states, including ALABAMA, ARKANSAS, OHIO, and WISCONSIN, are seriously considering much-needed gas tax updates to improve their…

State Rundown 2/27: Temperatures and Tax Fights Continue to Polarize

February 27, 2019 • By ITEP Staff

As another polar vortex heads for large swaths of the country, state tax debates this week were highly polarized in another way. Lawmakers and advocates in MICHIGAN, OHIO, OREGON, UTAH, and elsewhere fought to enact or improve state Earned Income Tax Credits to give a boost to low- and middle-income working families. But the opposite extreme was heavily represented as well, as others pushed for regressive tax cuts for wealthy individuals and corporations, including in KANSAS, NEBRASKA, NORTH DAKOTA, OHIO, UTAH, and WEST VIRGINIA. Even our “What We’re Reading” section has informative reading on how education funding policy continues to…

State Rundown 2/20: February and Regressive Tax Cuts, The “Meanest Moons of Winter”

February 20, 2019 • By ITEP Staff

Tom Robbins called February “the meanest moon of winter, all the more cruel because it will masquerade as spring, occasionally for hours at a time, only to rip off its mask with a sadistic laugh and spit icicles into every gullible face, behavior that grows quickly old.” Observers of state fiscal debates might think he was writing about similarly tiresome regressive tax cut proposals, which recently succeeded in Arkansas and advanced in North Dakota despite improved public understanding of the upside-down nature state tax systems, ineffectiveness of supply-side trickle-down tax cuts, and importance of investing in education. But like February…

Happy Valentine’s Day to all lovers of quality research, sound fiscal policy, and progressive tax reforms! This week, some leaders in ARKANSAS displayed their infatuation with the rich by advancing regressive tax cuts, but others in the state are trying to show some love to low- and middle-income families instead. WISCONSIN lawmakers are devoted to tax reductions for the middle class but have not yet decided how to express those feelings. NEBRASKA legislators are playing the field, flirting with several very different property tax and school funding proposals. And VIRGINIA’s legislators and governor just decided to settle for a flawed…

State Rundown 1/31: Governors and Teachers Dominate Headlines, Much More in Fine Print

January 31, 2019 • By ITEP Staff

Gubernatorial addresses and the prospect of teacher strikes continued to take center stage in state fiscal news this week, as governors of Connecticut, Maryland, and Utah gave speeches that all included significant tax proposals. Meanwhile, teachers walked out in Virginia, and many other states debated school funding increases to avoid similar results. State policymakers have many other debates on their hands as well, including what to do with online sales tax revenue, how to cut property taxes without undermining schools, whether and how to legalize and tax cannabis, and whether to update gas taxes for infrastructure investments.

State Rundown 1/24: States Reflect on MLK’s Dream and Teacher Uprisings

January 24, 2019 • By ITEP Staff

This week, as Americans in every state celebrated Martin Luther King Jr. Day and reflected on his dream of peaceful protest and racial and economic justice, many eyes were on the teachers’ strike pressing for parts of this dream amid the “curvaceous slopes of California.” Governors and lawmakers in many states—including Arizona, Georgia, Indiana, Louisiana, Nevada, New Mexico, South Carolina, and Wisconsin—discussed ways to raise pay for teachers and/or enhance education investments generally.

State Rundown 1/18: Governors’ Speeches Kick Off State Fiscal Debates

January 18, 2019 • By ITEP Staff

Gubernatorial speeches and budget proposals dominated state fiscal news this week, as governors proposed a wide array of policies including positive reforms such as Earned Income Tax Credit (EITC) enhancements in CALIFORNIA, a capital gains tax on wealthy households in WASHINGTON, and investments in education in several states. Proposals to exempt more retirement income from tax, particularly for veterans, are a common theme so far this year, having been raised in multiple states including MARYLAND, MICHIGAN, and SOUTH CAROLINA. And NEW JERSEY became the fourth state with a $15 minimum hourly wage. Those wishing to better understand and influence important debates about equitable tax policy should mark their…

State Rundown 1/10: States Should Resolve to Pursue Equitable Tax Options

January 10, 2019 • By ITEP Staff

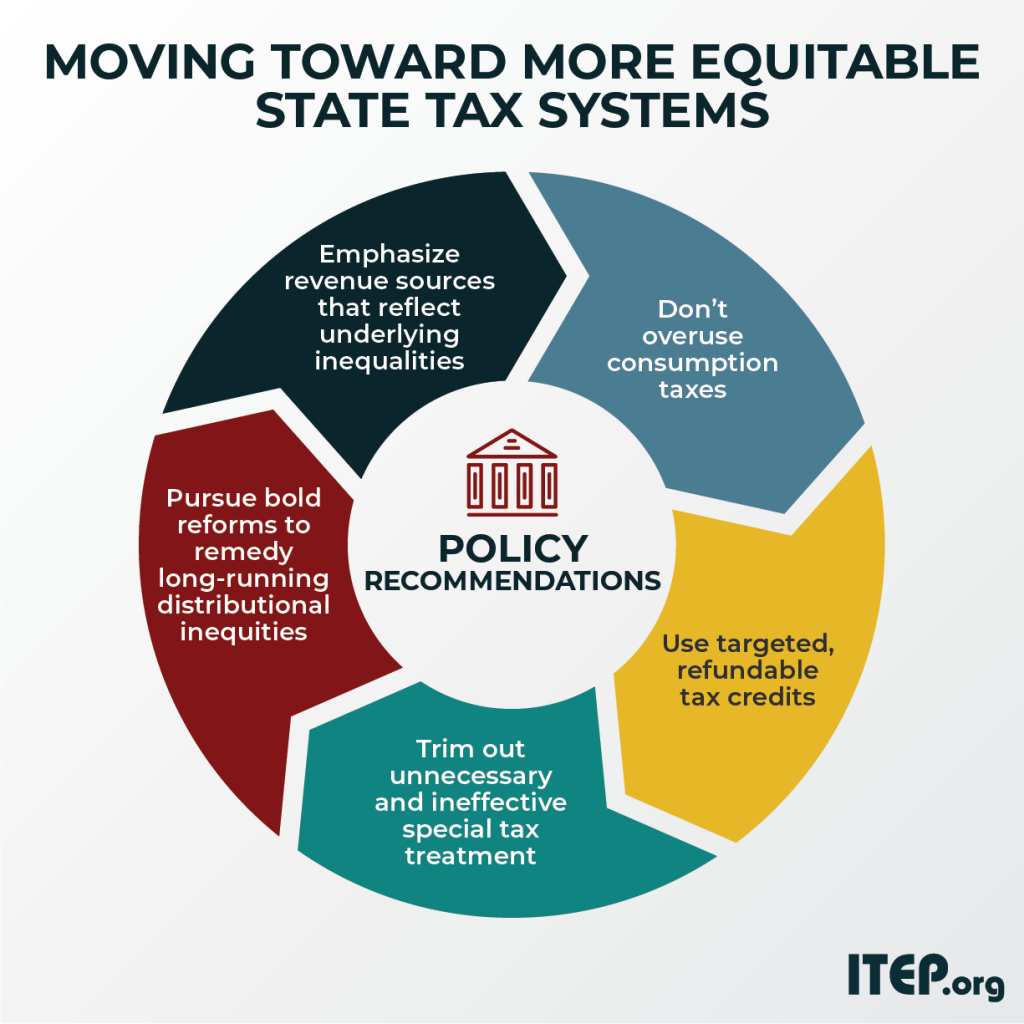

This week we released a handy guide of policy options for Moving Toward More Equitable State Tax Systems, and are pleased to report that many state lawmakers are promoting policies that are in line with our recommendations. For example, Puerto Rico lawmakers recently enacted a targeted EITC-like credit for working families, and leaders in Virginia and elsewhere are working toward similar improvements. Arkansas residents also saw their tax code improve as laws reducing regressive consumption taxes and enhancing income tax progressivity just went into effect. And there is still time for governors and legislators pushing for regressive income tax cuts…

For those looking to start improving on these inequitable tax systems today, we now also offer a helpful companion to “Who Pays?” called "Moving Toward More Equitable State Tax Systems." This new report distills the findings of “Who Pays?” into a set of policy recommendations – from the foundational to the aspirational – that residents of every state can draw from and start work on now.

State Rundown 12/19: Time to Rest and Recharge for Big Year Ahead

December 19, 2018 • By ITEP Staff

With many people enjoying time off over the next couple weeks, and the longest nights of the year coming over the weekend, now is a good time to get plenty of rest and relaxation in advance of what is likely to be a very busy 2019 for state fiscal policy and other debates. Among those debates, Kentucky lawmakers will be returning to topics they could not resolve in a brief special session held this week, New Jersey and New York will both be deciding how to legalize and tax cannabis, and gas tax updates will be on the agenda in…

State Rundown 12/5: Familiar Questions Returning to Fore as 2019 Approaches

December 5, 2018 • By ITEP Staff

State lawmakers are preparing their agendas for 2019 and looking at all sorts of tax and budget policies in the process, raising many familiar questions. Oregon legislators, for example, will try to fill in the blanks in a proposal to boost investments in education that left out detail on how to fund them, while their counterparts in Texas face the inverse problem of a proposed property tax cut that fails to clarify how schools could be protected from cuts. Similar school finance debates will play out in many other states. Alabama, Kansas, and Louisiana will look at gas tax updates,…