ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

States and Localities are Making Progress on Curbing Unjust Fees and Fines

July 18, 2023 • By Andrew Boardman

Too many state and local governments tap legal-system collections, rather than adequate tax systems, to fund shared essentials like public safety and education. But a growing number of states and localities are choosing a better approach. Momentum for change has continued to build in 2023, with no fewer than seven states enacting substantial improvements.

‘Fair Share Act’ Would Strengthen Medicare and Social Security Taxes

July 11, 2023 • By Joe Hughes, Steve Wamhoff

The Medicare and Social Security Fair Share Act would reform the taxes that Americans pay to finance these two important programs so that the richest 2 percent of Americans pay these taxes on most of their income the way that middle-class taxpayers already do.

Corporations Reap Billions in Tax Breaks Under ‘Bonus Depreciation’

June 29, 2023 • By Matthew Gardner, Steve Wamhoff

Since TCJA expanded tax breaks for “accelerated depreciation” starting in 2018, it has reduced taxes by nearly $67 billion for the 25 profitable corporations that benefited the most. Congress is now looking at extending this policy.

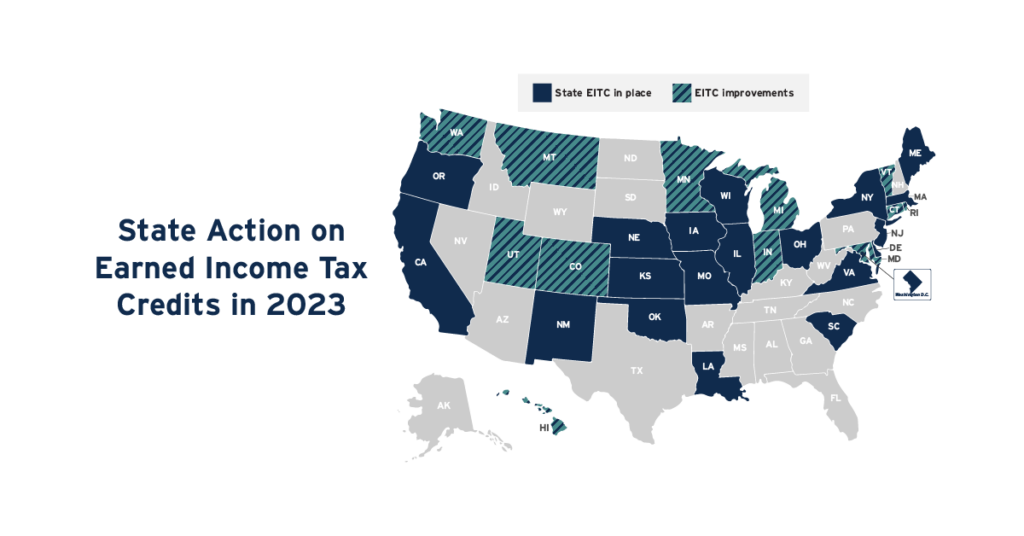

State Action on Child Tax Credits and Earned Income Tax Credits in 2023

June 28, 2023 • By ITEP Staff

In 2023 so far, 17 states have either adopted or expanded a Child Tax Credit or Earned Income Tax Credit. Both these policies can help bolster the economic security of low- and middle-income families and position the next generation for success.

Summer is here and many states nearing the end of their legislative sessions. Temperatures are rising in more ways than one in some state legislatures while others seem to be cooling off.

Expanding the Child Tax Credit Would Help Nearly 60 Million Kids, Especially Those in Families with Low Incomes

June 13, 2023 • By Joe Hughes

Restoring the federal Child Tax Credit to 2021 levels would benefit nearly 60 million children. Three-quarters of the benefit would go to families in the bottom three quintiles, consisting of households with less than $86,600 in income.

Trio of GOP Tax Bills Would Expand Corporate Tax Breaks While Doing Little for Americans Who Most Need Help

June 11, 2023 • By Steve Wamhoff

The trio of tax bills that cleared the House Ways and Means Committee in June include tax cuts that would mostly benefit the richest one percent of Americans and foreign investors.

Letter to IRS on Section 1001 Regulation in 2023-2024 Priority Guidance Plan

June 9, 2023 • By ITEP Staff

Read as PDF Re: Recommendation for Inclusion of Section 1001 Regulation in 2023-2024 Priority Guidance Plan To Whom It May Concern, We are writing to respectfully urge that the IRS return to the work it left unfinished in 2019 when it issued final regulations on “Contributions in Exchange for State or Local Tax Credits” (RIN: […]

This op-ed was originally published by Route Fifty and co-written by ITEP State Director Aidan Davis and Center on Budget and Policy Priorities Senior Advisor for State Tax Policy Wesley Tharpe. There’s a troubling trend in state capitols across the country: Some lawmakers are pushing big, permanent tax cuts that primarily benefit the wealthy and […]

Debt-Limit Deal’s Provision to Let Tax Cheats Off the Hook Will Increase the Deficit

June 1, 2023 • By Jon Whiten

The latest debt-limit bill in Congress includes a provision to claw back important IRS funding meant to crack down on wealthy tax cheats. This cut in funding would actually increase the deficit while continuing the rig the system in favor of the most well-off.

Short-sighted tax cuts continue to make their way to Governors’ desks this week. In Florida, Gov. DeSantis signed a $1.3 billion tax cut package with $550 million of the tax cuts from sales tax holidays, alone. The Nebraska legislature also sent $6.4 billion in tax cuts to Gov. Pillen’s desk which includes an enormous personal income tax cut that will reduce taxes on the top 1 percent by tens of thousands of dollars.

Congress Should Consider Attaching Work Requirements to the Biggest Tax Break for the Rich

May 25, 2023 • By Steve Wamhoff

Instead of focusing on low-income people who are already mostly employed or facing significant barriers to employment, lawmakers who want to encourage labor force participation should revisit existing tax breaks subsidizing wealthy individuals who live off their assets rather than work.

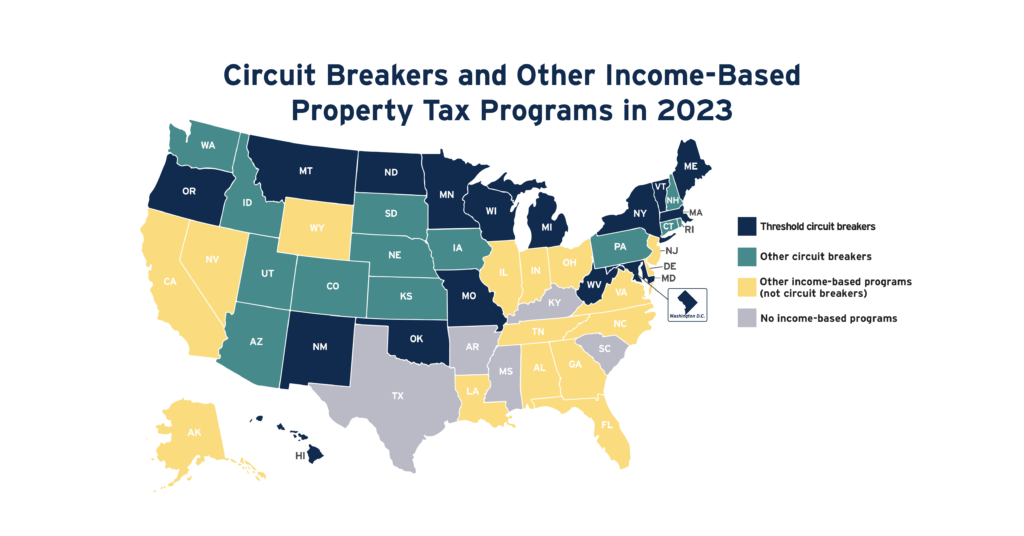

Circuit Breakers and Other Income-Based Property Tax Programs in 2023

May 19, 2023 • By ITEP Staff

No tax cut offers a more targeted solution to property tax affordability problems than circuit breaker credits. This is because circuit breakers are the only tools for reducing property taxes that measure the affordability of property taxes relative to families’ ability to pay. Circuit breakers protect families from property tax “overload” much like how traditional […]

States are Talking About the Wrong Kind of Property Tax Cuts

May 11, 2023 • By Brakeyshia Samms, Carl Davis

Concerns over property tax affordability have been at the forefront this year as housing prices have climbed and property tax bills have often increased along with them. As lawmakers mull a range of property tax cuts, circuit breakers are the best possible approach—and these policies are receiving far too little attention in the states.

Preventing an Overload: How Property Tax Circuit Breakers Promote Housing Affordability

May 11, 2023 • By Brakeyshia Samms, Carl Davis

Circuit breaker credits are the most effective tool available to promote property tax affordability. These policies prevent a property tax “overload” by crediting back property taxes that go beyond a certain share of income. Circuit breakers intervene to ensure that property taxes do not swallow up an unreasonable portion of qualifying households’ budgets.

Congress Should Raise Taxes on the Rich, But That’s a Totally Separate Issue from the Debt Ceiling

May 9, 2023 • By Steve Wamhoff

Congress absolutely should raise taxes on the rich and on corporations to generate revenue and improve the fairness of our tax code. President Biden has several proposals to do exactly that. But this is an entirely separate question from whether we should raise the debt ceiling to honor the debts the nation has already incurred and avoid an economic apocalypse.

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

Kansas Avoids Flat Tax Proposal: Narrow Victory a Cautionary Tale for Other States

April 27, 2023 • By Brakeyshia Samms

Kansas lawmakers failed to override Gov. Laura Kelly’s veto of a damaging flat tax package. In doing so, the state narrowly avoided traveling again down the same disastrous yet well-worn path of deep income tax cuts. States across the country can learn from Kansas’s experience by rethinking tax policy decisions and broader statewide priorities.

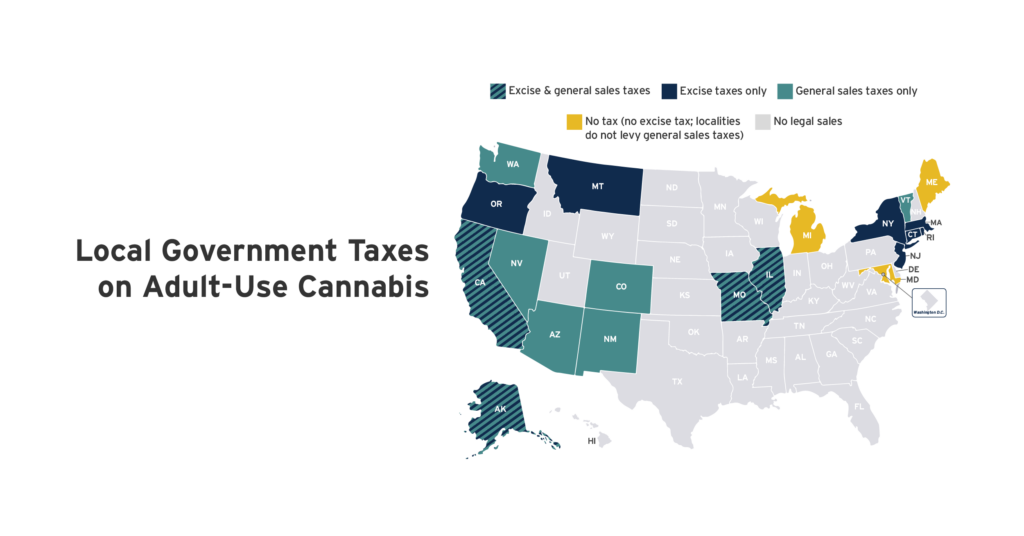

How is Adult-Use Cannabis Taxed by Your Local Government?

April 19, 2023 • By Carl Davis, Eli Byerly-Duke

Twenty states have legalized the sale of cannabis for general adult use. Cannabis taxes vary considerably depending on local authority. Some states allow local governments to levy standalone excise taxes applying narrowly to cannabis purchases. Most local excise taxes on cannabis are levied in states that do not permit local governments to levy general sales taxes.

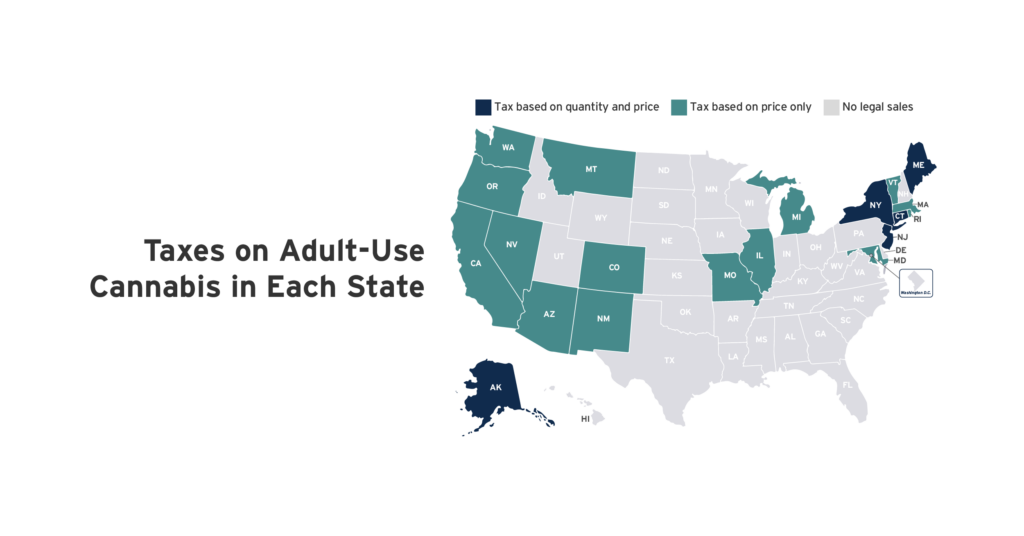

Twenty states have legalized cannabis sales for general adult use. Every state allowing legal sales applies a cannabis tax based on the product’s quantity, its price, or both. ITEP research indicates that taxes based on quantity will be more sustainable over time because prices are widely expected to fall as the cannabis industry matures.

Why is My Refund So Much Smaller This Year? Only the Good (Tax Credits) Die Young.

April 18, 2023 • By Joe Hughes

This year millions of American families are finding that their refunds are much smaller than last year—or that they even owe taxes back to the government—because of the expiration of the expanded Child Tax Credit and Earned Income Tax Credit that were in effect in 2021. The lapse of the expanded credits affects a majority of the middle class, but lower-income households are particularly likely to feel the sting.

Deep Public Investment Changes Lives, Yet Too Many States Continue to Seek Tax Cuts

April 12, 2023 • By Aidan Davis

When state budgets are strong, lawmakers should put those revenues toward building a stronger and more inclusive society for the long haul. Yet, many state lawmakers have made clear that their top priority is repeatedly cutting taxes for the wealthy.

As Tax Day approaches, it’s worth thinking about not only the taxes that we individually pay but the overall condition of our tax code as well. State tax codes, while perhaps less discussed than the federal system, are critically important. Depending on how they are designed, state taxes can improve or worsen economic and racial […]

Every state with a personal income tax offers tax subsidies for seniors that are unavailable to younger taxpayers. The best academic research suggests that the median state asks senior citizens to pay about one-third less in personal income tax than younger families with similar incomes. The majority of these subsidies are costly and poorly targeted. […]

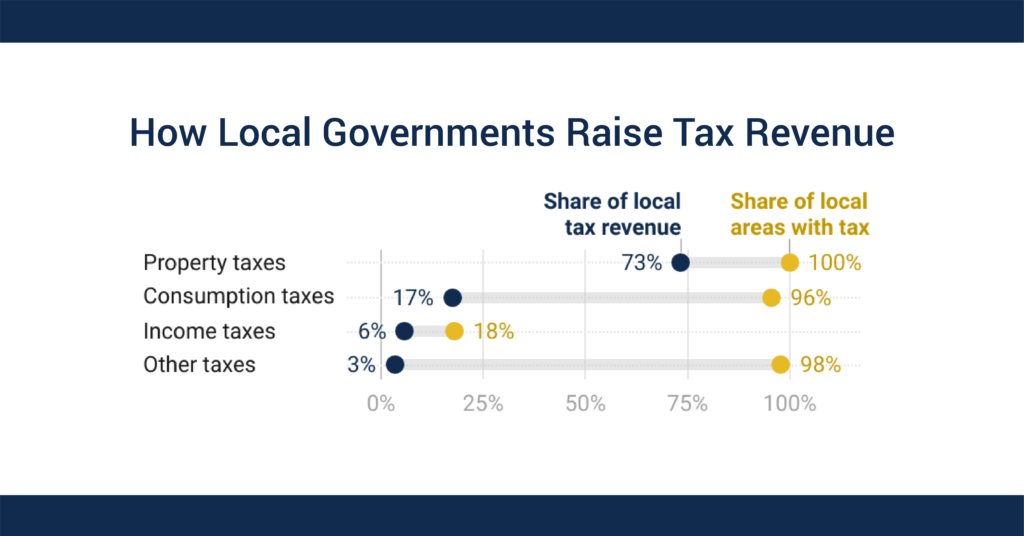

How Local Governments Raise Revenue—and What it Means for Tax Equity

March 30, 2023 • By Andrew Boardman, Kamolika Das

Most local tax systems are falling short of their potential. Well-structured local tax policies support communities by facilitating important investments and advancing fairness, but the tax revenue sources most utilized by local governments tend to disproportionately weigh on households with fewer resources. Learning from these realities can inform the path to improved tax policies and stronger communities.