ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

On July 15, the U.S. Treasury will begin mailing monthly checks to families with children who are eligible for the Child Tax Credit. Previously, the maximum credit was $2,000 per child, but for 2021, President Biden’s American Rescue Plan broadened the credit to $3,600 for each child under six and $3,000 for children over six. The expansion also made eligible children whose parents' incomes were too low to qualify for the previous credit, both addressing a fundamental policy flaw and taking a significant step to reduce child poverty. This is the first time that the federal government is sending advanced…

ITIN Filer Data Gap: How Changing Laws, Lack of Data Disaggregation Limit Inclusive Tax Policy

June 17, 2021 • By Emma Sifre

Like U.S. citizens, noncitizens who live, work, or invest in the United States must file local, state and federal taxes. But in order to file personal income taxes, they must first be issued a processing number called an Individual Taxpayer Identification Number (ITIN) by the IRS. These numbers are issued to both legal permanent residents and nonresidents who are not eligible for Social Security numbers. ITINs do not imply immigration status, nor can they be used for immigration enforcement purposes, but they can be used to create burdensome barriers that make it difficult for ITIN holders to file taxes and…

The Rockefeller Foundation: The Untold Benefits of State EITCs on Child Welfare

June 16, 2021

With the passing of the American Rescue Plan in March, more than 5 million children are projected to be lifted out of poverty this year, cutting child poverty by more than half, through Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) expansions. But what about state tax codes? What can states do to […]

Child Tax Credit Is a Critical Component of Biden Administration’s Recovery Package

June 11, 2021 • By Aidan Davis

Nearly one in seven children in the United States live in poverty and about 6 percent of all children live in deep poverty. President Joe Biden’s American Families Plan would tackle child poverty in an immediate, meaningful way. It is expected to extend the one-year Child Tax Credit (CTC) enhancements included in the March 2021 American Rescue Plan (ARP) through 2025. Next year alone, this would provide around a $110 billion collective income boost to roughly 88 percent of children in the United States.

Fortune: Biden’s plan will stop Jeff Bezos and Elon Musk from avoiding billions in taxes

June 9, 2021

FORTUNE: COMMENTARY | TAXES BY STEVE WAMHOFF It is no surprise that billionaires pay little in federal taxes relative to their incomes, but the level of detail provided by ProPublica Tuesday about how 25 billionaires pulled this off is astonishing. It is also an argument for one of President Joe Biden’s key tax proposals—taxing so-called unrealized capital gains […]

U.S. Should Pursue Biden’s Tax Legislation and International Tax Agreement on Separate Tracks

June 9, 2021 • By Steve Wamhoff

The agreement announced over the weekend from the finance leaders of the Group of 7 (G7) countries to allow governments to tax some corporate profits based on the location of sales and to implement a 15 percent global minimum tax is a major step forward—but in no way changes the need for Congress to enact President Joe Biden’s tax reforms right now.

ITEP: ProPublica’s Expose on Billionaires’ Taxes Is Another Wake-up Call

June 8, 2021 • By Amy Hanauer

The explosive ProPublica report released today confirmed what we have known for quite some time: the wealthy and powerful play by a different set of rules than the rest of us. Following is a statement by Amy Hanauer, executive director of the Institute on Taxation and Economic Policy, regarding the report: “ProPublica’s reporting today on the details of how 25 billionaires pay little to nothing in federal tax relative to their incomes is a wakeup call: the nation needs tax reform that will impart some balance to our tax system."

State Rundown 6/7: Remaining State Legislative Sessions Are Heating up as Budget Deadlines Loom

June 7, 2021 • By ITEP Staff

Just as an early summer heatwave brought soaring temperatures this past weekend through much of the lower 48 states, several state legislative sessions are heating up as legislators scramble to make tough budget decisions. Massachusetts lawmakers are voting on a fiery new "millionaires' tax" that would support transportation and education revenue needs, and Connecticut will likely restore its state Earned Income Tax Credit (EITC) back to 30 percent. Illinois’s decision to cut back corporate tax breaks also provided a breath of fresh air. Unfortunately, we'd give other state tax proposals a more lukewarm reception: New Hampshire, North Carolina, and Ohio…

The Week: Biden’s new $1 trillion infrastructure offer reportedly swaps in 15 percent minimum corporate tax for tax hike

June 4, 2021

“Corporations have paid a declining share in federal taxes since the 2017 GOP tax law dramatically slashed the corporate tax rate,” the Post reports, and 55 Fortune 500 corporations paid no federal income tax in 2020, according to the left-leaning Institute of Taxation and Economic Policy. Biden’s minimum tax proposal was originally part of a […]

CBS News: Biden emphasizes taxes on richest companies to fund infrastructure proposal

June 4, 2021

“Unless you think corporations shouldn’t pay any tax at all — and we’ll leave that to others to speak to — then there should be a way to find a path to agreement,” Psaki said. According to an analysis by the Institute on Taxation and Economic Policy, a left-leaning nonprofit tax policy organization, at least […]

Washington Post: Biden offers tax concession in infrastructure talks with key Republican

June 3, 2021

Members of both parties have expressed concern with the number of large corporations paying little to nothing in federal income taxes. Fifty-five corporations in the Fortune 500 paid no federal income tax in 2020, according to a report by the Institute of Taxation and Economic Policy, a left-leaning think tank. Corporations have paid a declining […]

Biden’s Budget Signals the End of Trickle-Down Economics Era

May 28, 2021 • By Amy Hanauer, ITEP Staff

President Joe Biden’s 2022 budget proposal released today signals a commitment to transformational policy solutions that not only invest in people and communities but also ensure corporations and rich people contribute more in taxes to support the economy that makes their wealth and profits possible, the Institute on Taxation and Economic Policy (ITEP) said today.

State Rundown 5/27: State Legislatures Step Back, Advocates Push Forward

May 27, 2021 • By ITEP Staff

As more and more state legislatures wrap up their sessions and we reflect on the whirlwind that is this past year, it’s easy to focus on the steps back that states like Oklahoma have taken and Nebraska, North Carolina, and Arizona are trying to take. We have had some significant wins in states over the course of the year, but not every development will be a good one. However, we know advocates are on the ground, working tirelessly to help states maintain equity and progressivity in their tax codes. And for that, we have many of you—our intrepid readers of…

The Arizona Center for Economic Progress: Flat Tax Exacerbates Inequalities for Households of Color

May 26, 2021

Arizona’s elected leaders have created a tax code that is upside down and regressive– meaning that those with low incomes pay a much higher share of their income in taxes compared to Arizona’s highest income earners. Our state’s tax code is both a product of and perpetrator of stark racial inequities. The cumulation of Arizona’s […]

The Treasury Department released a report explaining what the administration’s tax enforcement plan would do—and how it fits into the president’s overall plan to collect more revenue from profitable corporations and individuals making more than $400,000 a year.

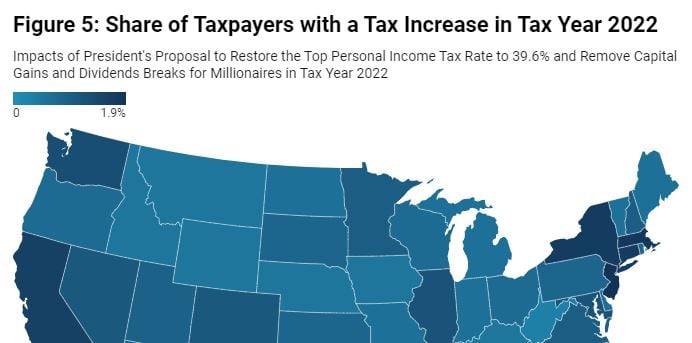

Income Tax Increases in the President’s American Families Plan

May 25, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s American Families Plan includes revenue-raising proposals that would affect only very high-income taxpayers.[1] The two most prominent of these proposals would restore the top personal income tax rate to 39.6 percent and eliminate tax breaks related to capital gains for millionaires. As this report explains, these proposals would affect less than 1 percent of taxpayers and would be confined almost exclusively to the richest 1 percent of Americans. The plan includes other tax increases that would also target the very well-off and would make our tax system fairer. It would raise additional revenue by more effectively enforcing tax…

Emma Sifre

May 24, 2021 • By ITEP Staff

Emma Sifre joined ITEP in 2021. As a Senior Data Analyst, Emma supports ITEP’s microsimulation model and conducts research on the different effects of tax policy changes on race, income, and geography. Prior to joining ITEP, Emma researched domestic social policy at the Congressional Research Service.

New Hampshire Fiscal Policy Institute: Elimination of the Interest and Dividends Tax Would Disproportionately Benefit High-Income Individuals

May 21, 2021

A new analysis of the proposed elimination of New Hampshire’s Interest and Dividends Tax shows nearly nine out of every ten dollars of the tax reduction would flow to the top 20 percent of income earners in New Hampshire, and almost half of the benefits would flow to the top one percent of income earners. […]

IRS Clock Runs Out, Saving 14 Large Companies $1.3 Billion

May 18, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

Each year, corporations publicly state that some of the tax breaks they claim are unlikely to withstand scrutiny from tax authorities. And each year, corporations report that they will keep some of the dubious tax breaks they declared in previous years simply because the statute of limitations ran out before tax authorities made any conclusions. This suggests that, perhaps because of cuts to its enforcement budget, the IRS is not even investigating corporations that publicly announce they have claimed tax breaks that tax authorities would likely find illegal.

Take a minute on this Tax Day to reflect on all that you survived, accomplished, and contributed to the collective good this past year, and be proud. There is always more work to be done to build the communities we desire, and paying your share is what allows that work to continue.

Taxes not only provide revenue so we can have a functioning government, they also shape broader society. Currently economic inequality is one of the most pressing challenges of our time. ITEP has produced research over the years that shows the nation’s overall tax system (local, state and federal combined) is barely progressive. With real tax reform that centers ordinary people, tax policy can help create a more equitable society.

AZ Central: Flat tax plan could decimate Arizona revenue, benefit a few. Don’t buy it

May 17, 2021

This is not a tax plan that will benefit most Arizonans. According to an analysis of the plan by the Institute on Taxation and Economic Policy, 53% of the tax cuts would go to the wealthiest 1% of taxpayers, while the bottom 80% would receive only 8% of the tax cuts. Read more

Massachusetts Budget & Policy Center: Ending the Tax Penalty Against Working Immigrants: MA Should Follow Other States Extending EITC to Immigrant Tax Filers

May 17, 2021

The Earned Income Tax Credit (EITC) is a key program for reducing poverty in the United States. Together with the federal Child Tax Credit, these low-income federal credits lifted 7.5 million households above the poverty line in 2019, more than any other program except Social Security. In Massachusetts, the EITC provides support to more than […]

Business Insider: Jeff Bezos’ support for Biden’s corporate tax hike means nothing if Amazon can still dodge paying their fair share in taxes

May 16, 2021

This number should not come as a shock; some of the most profitable companies – often those that represent the future of the economy – have long looked for ways to skirt their tax bill. A recent study by the Institute on Taxation and Economic Policy, for example, found that 55 of the largest corporations […]

Mississippi Today: Mississippi could help long-neglected poor with Rescue Plan payments

May 16, 2021

For instance, those earning less than $16,100 pay 10.2% of their income on state and local taxes, primarily because of Mississippi’s high sales tax rate, which includes the 7% tax on groceries. Those in the middle — earning between $43,000 and $77,500 pay — pay 9.2% of their income on state and local taxes, while […]