ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

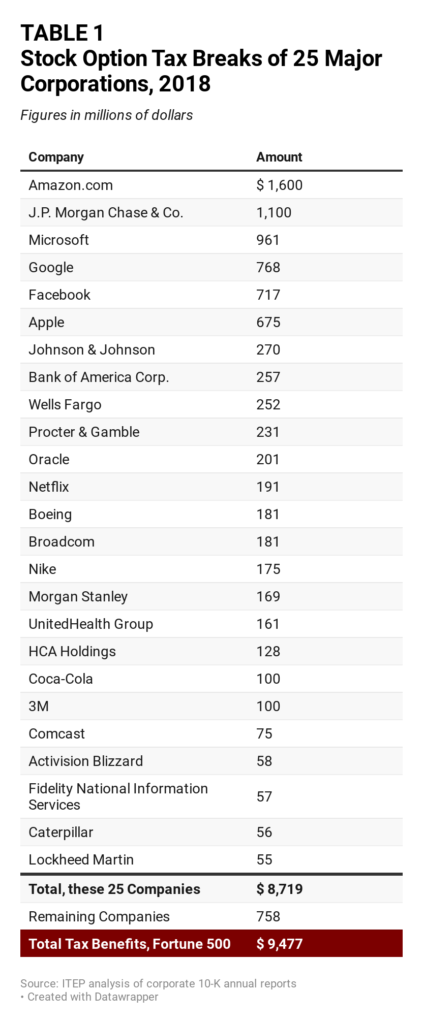

Earlier this year, Amazon and Netflix made headlines when ITEP reported findings that these and at least 58 other companies paid no federal income taxes in 2018. One of the tax breaks they use to manage this feat is related to stock options. Some companies saved hundreds of millions, and in some cases more than a billion dollars, in taxes in 2018 alone with this break. It’s time for Congress to eliminate the stock options tax dodge.

How Congress Can Stop Corporations from Using Stock Options to Dodge Taxes

December 10, 2019 • By ITEP Staff

The stock option rules in effect today create a problem because they allow corporations to report a much larger expense for this compensation to the IRS than they report to investors. The result is that corporations can report larger profits to investors but smaller profits to the IRS, undermining the fundamental fairness of the tax system.

A new ITEP report explains that an income tax cut for cannabis businesses embedded in the MORE Act is probably larger than the new 5 percent sales tax. This means that the average cannabis retailer—and its customers—could expect to pay LESS tax if the MORE Act is signed into law. Congress might have good reasons for structuring legalization this way, but it is an underappreciated aspect of the bill that should be made clearer as this debate progresses.

Understanding the full tax consequences of cannabis legalization requires evaluating not only the excise taxes proposed in most legalization bills, but also the effects on the federal income tax liability of cannabis businesses.

The News Tribune: Washington State Leaders Must Tax the Way to a Just Society

December 7, 2019

The inequalities in our state’s tax code are well known, and have gained us the ignoble designation of “the most unfair state and local tax system in the country.” This medal of dishonor from the Institute on Taxation and Economic Policy is based on ITEP’s assessment of how fairly the tax burden is spread among […]

Beacon: New Ad Highlights Collins’ Vote to Pass Tax Break for Wealthy Corporations

December 4, 2019

Marking two years since Senator Susan Collins cast a key vote in support of the 2017 Republican tax overhaul, the progressive 16 Counties Coalition launched a new ad on Monday highlighting corporations like Amazon and Prudential Financial that paid no corporate income taxes following the bill’s passage. In comparison, the ad notes, “one in four Mainers will eventually see their taxes […]

Fox Business: Biden to Unveil Tax Proposal Targeting Corporations, Wealthy

December 4, 2019

Under Biden’s plan, companies like Amazon, Netflix, General Motors, JetBlue and IBM, which reported net income of more than $100 million in the U.S. but paid zero or negative federal income taxes, would be hit with a 10 percent minimum levy on book income. The minimum tax, which Biden’s campaign expects to impact 300 companies, […]

Worker Relief and Credit Reform Act

December 2, 2019 • By ITEP Staff

Data available for download The Worker Relief and Credit Reform (WRCR) Act would replace the existing EITC. In most cases, the WRCR credit would be $4,000 for single people and $8,000 for married couples. Eligible taxpayers would be allowed a credit equal to the maximum amount or their earnings, whichever is less. People caring for […]

The News Tribune: How Did Tacoma Do Under Trump Tax Cuts? You Can Calculate it for Yourself

November 26, 2019

President Donald Trump has said it’s time to consider another tax cut — as evidence mounts that wealthier taxpayers in the Tacoma area and around the nation benefited a lot more than others from his first one. … Steve Wamhoff, director of federal tax policy at the Institute on Taxation and Economic Policy, pointed out that the […]

CNBC: Blue States File Appeal in Legal Battle Over SALT Tax Deductions

November 26, 2019

Whether the final rule will ultimately deter people from donating to these funds remains to be seen. “If you’re really passionate about private school vouchers in Georgia, you donate and you still get 100% of your donation back,” Carl Davis, research director at the Institute on Taxation and Economic Policy, told CNBC earlier. “You just […]

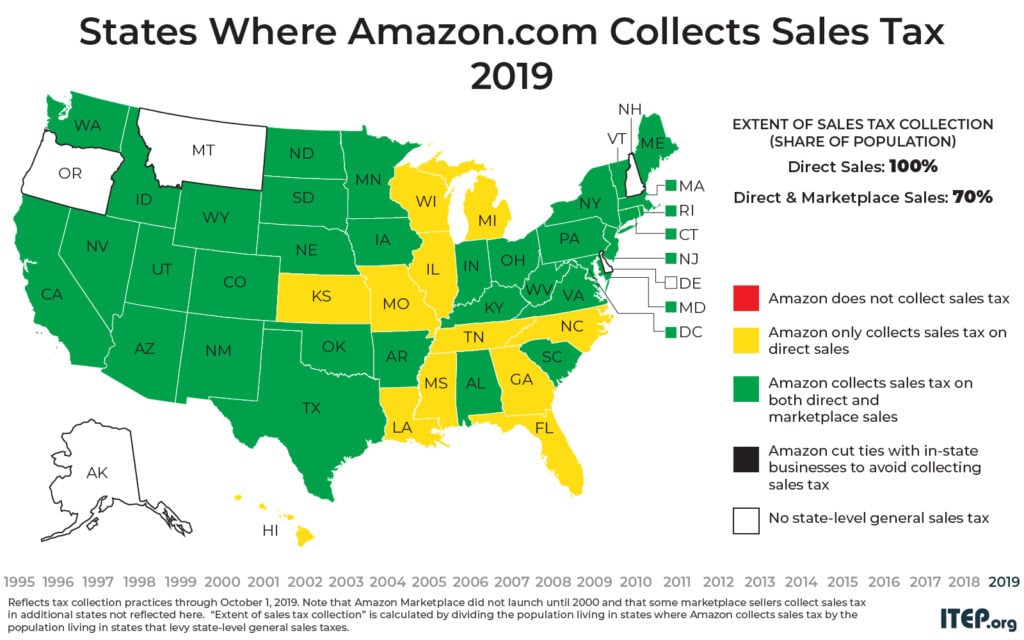

A Lump of Coal for 12 States Not Collecting Marketplace Sales Taxes this Holiday Season

November 25, 2019 • By Carl Davis

The last few years have brought major improvements in how states enforce their sales tax laws on purchases made over the Internet. Less than a decade ago, e-retailers almost never collected the sales taxes owed by their customers. The result was a multi-billion dollar drain on state coffers and a competitive disadvantage for local businesses. But this holiday season looks a bit different.

The Oracle: Big Corporate Tax Loopholes Strain Florida Budget

November 25, 2019

A 2019 report from the Institute on Taxation and Economic Policy, for instance, examined data from the IRS and Congressional Budget Office, estimating that Florida loses $1.1 billion annually from state corporate tax loopholes. $1.1 billion might seem small compared to the state’s $90 billion budget, but even small funding changes can have big impacts. The […]

Vanity Fair: “My Reserve Of F–Ks To Give Is Really Depleted”: How Teflon Tim Cook Gets Away With Enabling Donald Trump

November 25, 2019

Cook runs the biggest company on earth, with a current market cap of $1.16 trillion, and yet, according to the Institute on Taxation and Economic Policy, a nonprofit, nonpartisan tax-policy think tank, Apple has been playing America for billions in taxes for years. Read more

Business Insider: From Amazon To GM, Here Are all the Major Tech and Transportation Companies who Avoided Federal Income Tax Expenses Last Year

November 24, 2019

The Institute on Taxation and Economic Policy, a nonprofit think tank, analyzed SEC filings of Fortune 500 companies and identified 60 major corporations that didn’t report any federal income tax expenses in 2018. Of those, 11 do business in the tech or transportation industries. Read more

The New York Times: How FedEx Cut Its Tax Bill to $0

November 17, 2019

“Something like $1.5 billion in future taxes that they had promised to pay, just vanished,” said Matthew Gardner, an analyst at the liberal Institute on Taxation and Economic Policy in Washington. “The obvious question is whether you can draw any line, any connection between the tax breaks they’re getting, ostensibly designed to encourage capital expenditures, and what […]

Orlando Sentinel: As Florida Cuts Corporate Taxes, Your Tax Burden Rises … and Schools, Mental Health, Roads Suffer

November 15, 2019

Families that make less than $50,000 a year pay between 8.1% and 12.7% of their income in local and state taxes, according to the Institute on Taxation and Economic Policy, while families that make $200,000 or more pay between 2.3% and 4.5%. Read more

PolitiFact: Viral Post Says Democrats Spent $40 Million on Impeachment. That’s False

November 15, 2019

Tax policy experts told us they aren’t sure how much the impeachment inquiry has cost since Speaker Nancy Pelosi announced it Sept. 24. “I can’t think of anyone who’s tried to calculate this cost,” said Matt Gardner, a senior fellow at the Institute on Taxation and Economic Policy, in an email. Read more

USA Today: Trump Is Floating Another Tax Cut. But the Last Thing We Need Is More Breaks for the Rich.

November 14, 2019

Why is it so important that the rich pay more? Those at the top benefit much more from all the public investments we finance with our tax dollars. President Donald Trump has again hinted that another tax cut may be on the way. It does not appear he has any actual plan to provide one, which is […]

Orlando Sentinel: In Florida, 99% of Companies Pay No Corporate Income Tax — with Lawmakers’ Blessing

November 13, 2019

A leaky corporate income tax ultimately shifts more of the cost of Florida government from corporations onto others, including low- and middle-income families, said Matt Gardner, a senior fellow at ITEP. “Every million dollars you’re not collecting that way is a million dollars that local governments are trying to collect through speed traps or dog-catcher […]

Washington Post: Pete Buttigieg Proposes Free College for Americans Earning Under $100,000 in his New Economic Plan

November 8, 2019

Democratic candidate Julián Castro, the former secretary of housing and urban development in the Obama administration, has also proposed expanding the EITC. Castro would go further and also make the child tax credit fully refundable, another benefit to lower-income families that Buttigieg did not include in his plan. Sens. Kamala D. Harris (D-Calif.) and Cory […]

The Washington Post: Pete Buttigieg Proposes Free College for Americans Earning Under $100,000 in His New Economic Plan

November 8, 2019

Democratic candidate Julián Castro, the former secretary for housing and urban development in the Obama administration, has also proposed expanding the EITC. Castro would go even further and also make the child tax credit fully refundable, another benefit to lower-income families that Buttigieg did not include in his plan. Sens. Kamala D. Harris (D-Calif.) and […]

Capitol and Main: Trump Boasts of Economic Growth as Inequality Deepens

November 7, 2019

A second term for Trump would likely mean a doubling down on his inequality exacerbating tax and regulatory agenda. “There will be more tax cuts and further inequality,” said Steven Wamhoff, the director of Federal Tax Policy at the Institute on Taxation and Economic Policy. Republicans have already proposed legislation to make Trump’s 2017 tax […]

Fast Company: While Trump Boasts of Economic Growth, Inequality Deepens

November 7, 2019

“There will be more tax cuts and further inequality,” said Steven Wamhoff, the director of federal tax policy at the Institute on Taxation and Economic Policy. Republicans have already proposed legislation to make Trump’s 2017 tax cuts permanent, because many provisions will otherwise expire at the end of 2025. While the bill would protect cuts […]

Amy Hanauer Appointed as Executive Director of ITEP-CTJ

November 5, 2019 • By ITEP Staff

Institute on Taxation and Economic Policy (ITEP) and Citizens for Tax Justice (CTJ) Boards of Directors announced today the appointment of Amy Hanauer as Executive Director to lead the organizations’ tax justice work. Hanauer, founder of Policy Matters Ohio, will assume responsibilities mid-January 2020, joined by long-time ITEP-CTJ team member Meg Wiehe in her expanded role as Deputy Executive Director. Together the pair will lead the organizations in transforming tax policies to better meet the country’s needs.

Arizona Center for Economic Progress: More Money for Public Education Will Benefit Arizona Small Businesses

November 5, 2019

Most small business owners will continue to be taxed at some of the lowest personal income tax rates in the nation. Small business owners whose profits and wages from their businesses are high enough to be in the top 1% of income earners will still have the first $250,000 they earn as individual filers or […]