ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Expanded Child Tax Credit is Key to Reducing Child Poverty, New Census Data Illustrate

September 10, 2024 • By Jon Whiten

From 2021-2023, child poverty has more than doubled from 5.2 to 13.7 percent. The latest Census data make clear that lawmakers have the tools to help millions of children and their families – and it’s beyond time they take action.

The IRS has opened its free tax filing service called Direct File to every state for the 2025 tax filing season. Direct File was made possible by President Biden’s Inflation Reduction Act, which provided new resources for the IRS to improve customer service and ensure taxpayers claim the benefits and deductions for which they are […]

Steven Moore Sanchez

August 26, 2024 • By ITEP Staff

As Development Manager, Steven manages ITEP’s fundraising strategy and activities, helping to grow and sustain the organization. Prior to joining ITEP, Steven served as Development Coordinator at the National Low Income Housing Coalition, where he managed relations with donor partners and collaborated closely with senior staff on development activities. He previously worked as a Development […]

The no tax on tips idea isn't a new one, but it's always been abandoned because it's practically impossible to do without creating new avenues for tax avoidance. Despite its embrace by the candidates from both major parties, this policy idea would do little to help the roughly 4 million people who work in tipped occupations while creating a host of problems.

Minnesota stands apart from the rest of the country with a moderately progressive tax system that asks slightly more of the rich than of low- and middle-income families. Recent reforms signed by Gov. Tim Walz have contributed to this reality.

Sales Tax Holidays Miss the Mark When it Comes to Effective Sales Tax Reform

August 6, 2024 • By Marco Guzman

Nineteen states have sales tax holidays on the books in 2024. These suspensions combined will cost states and localities over $1.3 billion in lost revenue this year. Sales tax holidays are poorly targeted and too temporary to meaningfully change the regressive nature of a state’s tax system.

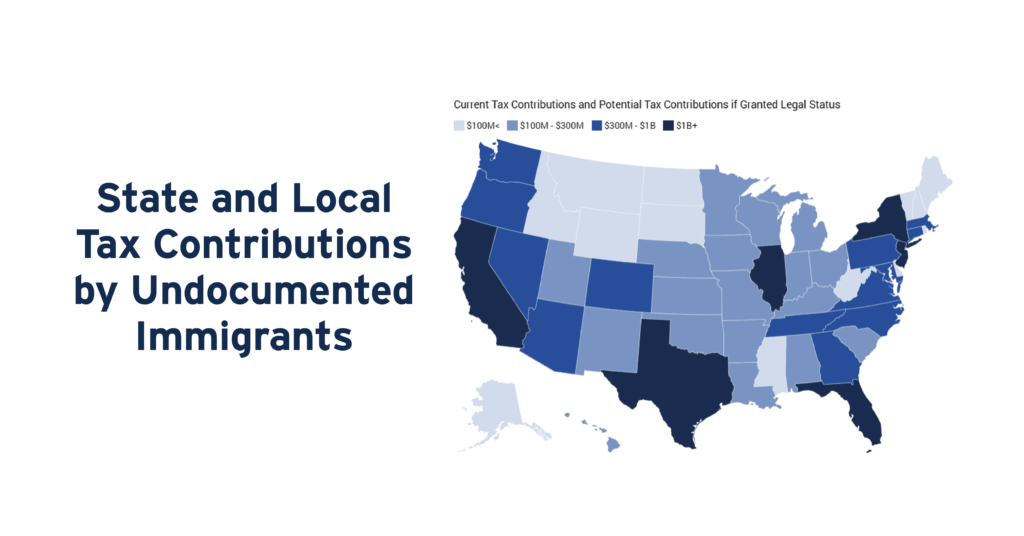

Undocumented immigrants pay taxes that help fund public infrastructure, institutions, and services in every U.S. state. Nearly 39 percent of the total tax dollars paid by undocumented immigrants in 2022 ($37.3 billion) went to state and local governments.

Undocumented immigrants paid $96.7 billion in federal, state, and local taxes in 2022. Providing access to work authorization for undocumented immigrants would increase their tax contributions both because their wages would rise and because their rates of tax compliance would increase.

Four states expanded or boosted refundable tax credits for children and families, and the District of Columbia is poised to create a new Child Tax Credit. These actions — in Colorado, Illinois, New York, Utah, and D.C. — continue the recent trend of improving the well-being of children and families with refundable tax credits.

Major tax cuts were largely rejected this year, but states continue to chip away at income taxes. And while property tax cuts were a hot topic across the country, many states failed to deliver effective solutions to affordability issues.

Corporate Tax Breaks Contribute to Income and Racial Inequality and Shift Resources to Foreign Investors

July 16, 2024 • By Emma Sifre, Steve Wamhoff

Corporate tax cuts and corporate tax avoidance worsen income and racial inequality in our country. Most of the benefits flow to foreign investors and the richest 20% of Americans.

While Massachusetts legislators recently dropped a real estate transfer tax from their major housing bill, the District of Columbia council sent a budget to the mayor that includes a mansion tax that would increase the tax rate on properties valued over $2.5 million. Meanwhile, lawmakers in New Jersey and South Carolina continue to, respectively, raise and reduce needed revenues.

Reality Interrupts the Fever Dream of Income Tax Elimination in Kentucky

June 27, 2024 • By Eli Byerly-Duke

Keeping the Kentucky income tax on a march to zero would mean tax hikes for working families or widespread cuts to education, health care, and other public services. Reversing course is certainly the wiser course of action.

States Should Enact, Expand Mansion Taxes to Advance Fairness and Shared Prosperity

June 26, 2024 • By Carl Davis, Erika Frankel

The report was produced in partnership with the Center on Budget and Policy Priorities and co-authored by CBPP’s Deputy Director of State Policy Research Samantha Waxman.[1] Click here to use our State Mansion Tax Estimator A historically large share of the nation’s wealth is concentrated in the hands of a few, a reality glaring in […]

Rita Jefferson

June 25, 2024 • By ITEP Staff

Rita is a Local Analyst who focuses on equity and fairness. Prior to joining ITEP, Rita worked for the Cook County Treasurer’s Office on research related to property taxation, tax collection, and municipal debt. She has also worked on issues including fines and fees, state block grants, and homelessness prevention. She has a Master of […]

Property Tax Circuit Breakers Can Help States Create More Equitable Tax Codes

June 24, 2024 • By Brakeyshia Samms

Well-designed property tax circuit breaker programs allow states to reduce the impact that property taxes have on the upside-down tilt of their tax codes.

Marcus Rojas

June 24, 2024 • By ITEP Staff

As a Communications Associate, Marcus helps prepare various digital content and translate complex tax policies into effective messaging for a wide range of audiences. He joined the communications team as an intern during his senior year at the University of Florida until his role became a permanent position. During his college tenure, Marcus published news […]

SCOTUS Rejects Expansion of Trump’s Corporate Tax Cuts, Leaves Broader Tax Questions for Another Day

June 20, 2024 • By Steve Wamhoff

The Supreme Court matters, for tax fairness as for every other part of our lives. Whether or not we ever have a government that taxes billionaires as much as it taxes the rest of us will depend on how the Supreme Court rules in the future and who appoints justices to the Court.

SCOTUS Ruling on Moore Prevents Big Retroactive Corporate Tax Break, Leaves Door Open to Federal Wealth Taxes

June 20, 2024 • By ITEP Staff

The Supreme Court upheld the 2017 Trump tax law’s mandatory repatriation tax, one of the few revenue-raising measures in the law. The Court’s ruling is an important victory for fair taxation, as invalidating the tax would have given about 400 multinational corporations a collective $271 billion tax break.

Juneteenth is a reminder of the hard-fought victories that helped Black Americans secure their delayed freedom, justice, and suffrage. And in the chapters about tax policy, the tales are no less fraught. From America’s prologue to the last paragraph of the Civil War, governments raised more tax revenue from the taxation of Black bodies than […]

States Should Opt Into IRS Direct File as the Program is Made Permanent

May 30, 2024 • By Jon Whiten

While there is plenty of room to expand Direct File at the federal level, states can take matters into their own hands and bring this benefit to their residents by opting into the program.

There are a variety of factors that affect teacher pay. But one often overlooked factor is progressive tax policies that allow states to raise and provide the funding educators and their students deserve.

Iowa Flat Tax Shows Why Such Policies Are a Problem Everywhere

May 9, 2024 • By Eli Byerly-Duke

As Iowa lawmakers change the state’s graduated personal income tax to a single flat rate, they are designing a state tax code where the rich will pay a lower rate overall than families with modest means.

Corporate Taxes Before and After the Trump Tax Law

May 2, 2024 • By Matthew Gardner, Michael Ettlinger, Spandan Marasini, Steve Wamhoff

The Trump tax law slashed taxes for America’s largest, consistently profitable corporations. These companies saw their effective tax rates fall from an average of 22.0 percent to an average of 12.8 percent after the Trump tax law went into effect in 2018.

Matt Resseger

April 24, 2024 • By ITEP Staff

Matt Resseger is a Senior Economist at ITEP, where he began working in April 2024. Prior to joining ITEP, Matt served as Senior Economist at the Boston Planning and Development Agency, bringing economic analysis and modeling to planning and policy questions throughout the city. Matt’s work in Boston spanned research on the city’s housing and […]