ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Vox: How Tax Cuts for the Rich Led to the Oklahoma Teachers Strike

April 9, 2018

Before the strike last week, the state legislature tried to avert the work stoppage by passing a $447 million tax increase that effectively gives teachers an average annual pay bump of $6,000. That concession from the state legislature didn’t meet the teachers’ full demands, but it was a huge win considering the state legislature hadn’t approved a tax increase since 1990.

Courier Journal: Kentucky Tax Reform Bill is a Break for the Rich but a Hike for Everybody Else, Study Says

April 6, 2018

The tax bill that zipped through the General Assembly on Monday will amount to a tax break for millionaires but a tax increase for 95 percent of Kentuckians, according to an analysis by the Washington-based Institute for Taxation and Economic Policy.

WUKY: A Tale Of Two Tax Studies

April 6, 2018

"This is a complicated tax plan with a lot of moving pieces, but the net result is clear: that it is middle-class tax hike. Kentucky's poorest families and the middle class will end up paying more while the state wealthiest taxpayers are going to end up paying less," ITEP analyst Aidan Davis says.

Lexington Herald Ledger: Study: GOP Bill Cuts Taxes for the Rich, Raises Taxes for 95 Percent of Kentuckians

April 5, 2018

A new study of the tax bill rushed through the Kentucky General Assembly Monday shows the changes it makes to the tax code are likely to lower taxes for the wealthy while raising taxes for 95 percent of Kentuckians. The analysis, performed by the Institute for Taxation and Economic Policy in Washington D.C., a liberal-leaning think tank, studied the impact of the tax cuts and increases on Kentuckians.

Washington Post: Kentucky Legislators Send Tax Cuts for Wealthy, Tax Hikes for the Other 95 Percent to Governor’s Desk

April 5, 2018

The Kentucky legislature passed a sweeping tax overhaul this week, and now lawmakers are asking Gov. Matt Bevin to sign a bill that would slash taxes for some corporations and wealthy individuals while raising them on 95 percent of state residents, according to a new analysis.

Kentucky Center for Economic Policy: House Bill 366 Represents a Tax Shift Away from the Wealthy to Low- and Middle-Income Kentuckians

April 4, 2018

A new analysis of HB 366 by the Institute on Taxation and Economic Policy (ITEP) shows the dramatically skewed impact of the tax changes on Kentuckians by income group. As can be seen in the graph below, Kentuckians whose income puts them in the top 5 percent will see a tax cut, with those in the top 1 percent, whose average income is $1,042,000, receiving an average tax cut of $7,086.

Kentucky Center for Economic Policy: Tax Plan Is a Tax Shift with Troubling Long-Term Effect on Revenues

April 2, 2018

The General Assembly introduced a tax bill today that is a shift in taxes away from corporations and high-income people and over to low- and middle-income Kentuckians. Although the official estimate is that it would bring $248 million more in net revenue by the second year, the plan relies heavily on a fading source in […]

Hawaii News Now: Nonprofit to State on Tax Savings for Low-Income Families: Check Your Math

March 29, 2018

The state miscalculated the benefits of the federal tax overhaul to low-income families in Hawaii, a new analysis concludes. The source of the confusion: The scope of the tax savings that the child tax credit benefit would offer very low-income families (those earning up to $10,000 a year).

Honolulu Star Advertiser: New Tax Benefits Likely Overstated for Hawaii’s Poorest

March 29, 2018

A nonpartisan Washington, D.C.-based nonprofit, the Institute on Taxation and Economic Policy, has estimated that Hawaii’s richest 1 percent, represented by households earning over $554,230, would save $39,420 on average next year under the new law. The group also figured that Hawaii taxpayers earning less than $26,620 would save $130 on average in taxes.

Colorado Fiscal Institute: Pies & Charts: Mid-Session Briefing

March 29, 2018

Pies and Charts is the annual mid-session briefing hosted by Colorado Fiscal Institute.

Minnesota Budget Project: Families With Children Could Pay Higher Taxes Under Tax Conformity

March 28, 2018

The complex set of tax changes in the recent federal tax bill creates a set of challenging decisions for states like Minnesota. Because Minnesota’s state income and corporate taxes use federal tax law as their starting points, when federal laws change, Minnesota policymakers need to decide whether to incorporate those changes into our tax system. Read more […]

Hawai’i Budget & Policy Center: Effects of Federal Tax Cuts in Hawai‘i: Correcting the Record

March 28, 2018

Although corporate taxes are not reported on individual income tax forms, corporate tax cuts benefit those who own stocks, and the vast majority are owned by upper-income individuals. For that reason, ITEP included corporate tax breaks in its analysis of the federal tax law.

Amazon and Other E-Retailers Get a Free Pass from Some Local-Level Sales Taxes

March 26, 2018 • By Carl Davis

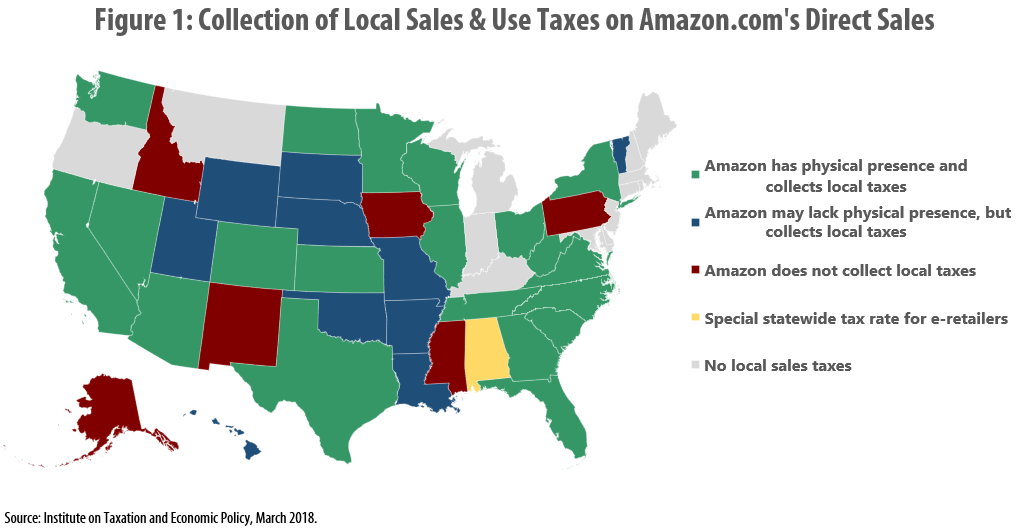

A new ITEP analysis reveals that in seven states (Alabama, Alaska, Idaho, Iowa, Mississippi, New Mexico, and Pennsylvania), the nation’s largest e-retailer, Amazon.com, is either not collecting local-level sales taxes or is charging a lower tax rate than local retailers. In other states, such as Colorado and Illinois, Amazon is collecting local tax because it has an in-state presence, but localities cannot collect taxes from other e-retailers based outside the state.

Many Localities Are Unprepared to Collect Taxes on Online Purchases: Amazon.com and other E-Retailers Receive Tax Advantage Over Local Businesses

March 26, 2018 • By Carl Davis

Online retailer Amazon.com made headlines last year when it began collecting every state-level sales tax on its direct sales. Savvy observers quickly noted that this change did not affect the company’s large and growing “marketplace” business, where it conducts sales in partnership with third-parties and rarely collects tax. But far fewer have noticed that even on its direct sales, Amazon is still not collecting some local-level taxes.

Idaho Center for Fiscal Policy: Considerations on House Bill 675

March 21, 2018

A proposal before the Legislature seeks to amend the child tax credit that was created through recent legislation passed by both chambers and signed by the Governor. This analysis presents the effect of the revised credit amount proposed in House Bill 675 together with the provisions of House Bill 463 on Idaho families, as enacted. […]

Colorado Fiscal Institute: Forecast Five: March 2018 Revenue Estimates

March 20, 2018

As a result of TCJA, Legislative Council estimates the state will see increased revenue of $196.5 million in FY 2018-2019, and $329.8 million in increases in FY 2019-2020. However, new analysis from the Institute on Taxation and Economic Policy suggests the revenue increase next year could be closer to $28 million.

Iowa Fiscal Partnership: Passing Through a Special Break for Wealthiest Filers

March 19, 2018

The tax bill that recently passed the Iowa Senate included a provision from the recent federal tax cut bill that provides preferential tax treatment for certain kinds of business income earned mostly by the highest income taxpayers. The “Qualified Business Income Deduction” (QBID) provides a 20 percent exemption of that income from the personal income tax.

Iowa Fiscal Partnership: Passing through a special break

March 19, 2018

The tax bill that recently passed the Iowa Senate included a provision from the recent federal tax cut bill that provides preferential tax treatment for certain kinds of business income earned mostly by the highest income taxpayers. The “Qualified Business Income Deduction” (QBID) provides a 20 percent exemption of that income from the personal income […]

Iowa Fiscal Partnership: Governor’s Plan Sets Stage For Service Cuts

March 16, 2018

Iowa’s General Assembly opened with promises from legislative leadership and the Governor for tax reform. We noted key opportunities to assure a fairer and sustainable system in a brief report last fall, “Introduction to 2018: What should be part of tax reform? And what should not?”[i] These options remain; some are gaining attention — such as the elimination of federal deductibility and the closing of sales tax loopholes — and some are not.

E.I.T.C. Spells LOVE for Kids and Families in Arkansas

March 16, 2018

Many people in our state work at low-paying jobs. Arkansans who work hard for little money pay a much higher share of their income to state and local taxes compared to the wealthiest. That’s not the way it should be. Fortunately, there is a great option for Arkansas (just ask the 29 other states that are already using it!) that can help turn things around for working families. That option is a state-level Earned Income Tax Credit (or EITC). At Arkansas Advocates for Children and families, we are so in love with the Earned Income Tax Credit that we decided to sing about it.

Georgia Budget & Policy Institute: Lawmakers Approve Major Tax Plan, Still Reviewing Several Tax Breaks

March 15, 2018

A range of tax bills are still in the pipeline at the General Assembly after lawmakers already approved a sweeping package of income tax cuts. Georgia’s 2018 General Assembly advanced 11 pieces of tax legislation by the Feb. 28 Crossover Day milestone that affect state revenues if approved by the House, Senate and the governor. […]

New Jersey Policy Perspective: Op-Ed: Tax Law Requires More Than ‘SALT Cap’ Workarounds

March 14, 2018

If you live in a high-wealth and high-tax state like New Jersey, the news gets worse. For the first time in 100 years, taxpayers may no longer deduct their full state and local taxes (“SALT” for short) from the income on which federal taxes are owed. The deductible ceiling is set at $10,000, so if you pay more than that with property and income taxes combined, your taxable income will increase by a bit.

Georgia Budget and Policy Institute: All Georgians Stand to Lose from Immigrant Crackdown Measure

March 9, 2018

And Georgia immigrants contribute significant state and local tax revenue, including $352 million a year by undocumented immigrants as a whole and $66 million by Dreamers in particular. Read more here

Maine Center for Economic Policy Policy Brief: The LePage Tax Bill

March 9, 2018

On March 1, Gov. Paul LePage’s Administration presented a tax bill to the Legislature designed to mirror at the state level some of the reforms enacted by passage of the Tax Cuts and Jobs Act at the federal level. The proposal is framed as simple conformity with federal law but goes much further than routine […]

Iowa Fiscal Partnership: Governor’s Tax Cut Plan Sets Stage For Service Cuts

March 7, 2018

Governor Kim Reynolds’ tax proposal trades massive cuts in public services for small savings for lower-income taxpayers, larger savings for high-income taxpayers and few meaningful strides toward fairness in a system that already treats the poor poorly and raises too little revenue to avoid mid-year cuts.