ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Indiana Institute for Working Families: Trump Tax Plan Would Shortchange Indiana, Middle Class & Working Families (But Would Let Them Eat Cake)

August 15, 2017

A new analysis of the Trump tax plan from the Institute for Taxation and Economic Policy shows that Indiana would only get an 87% share of tax cuts relative to the state’s ratio of the U.S. population. This is the 23rd-smallest share among states. In part because the plan is aimed at high-income households and Indiana is a poorer state, no matter how you slice it, Indiana gets shortchanged compared to the average state by Trump’s plan.

2017 marked a sea change in state tax policy and a stark departure from the current federal tax debate as dubious supply-side economic theories began to lose their grip on statehouses. Compared to the predominant trend in recent years of emphasizing top-heavy income tax cuts and shifting to more regressive consumption taxes in the hopes […]

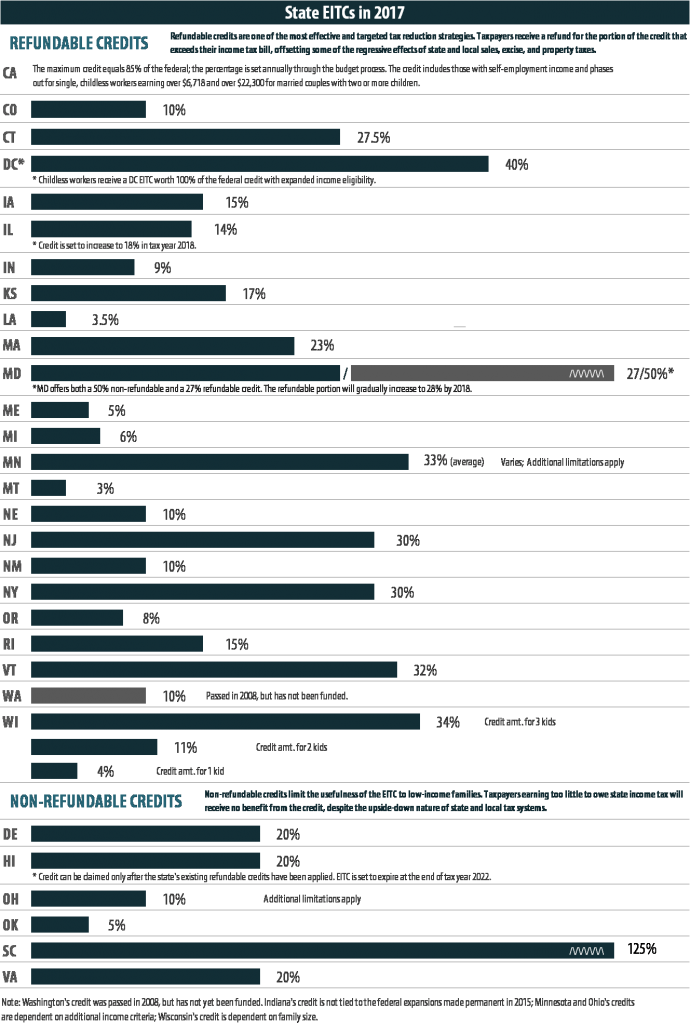

The Earned Income Tax Credit (EITC) is a policy designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, providing the opportunity for struggling families to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits.

Florida Policy Institute: The Growing Divide: Federal Tax Plan Would Give Massive Tax Cuts to Wealthy Floridians as the Poorest Americans Continue to Struggle

July 21, 2017

The federal tax plan broadly outlined by the current administration would do very little to create opportunities for Floridians struggling to make ends meet. Instead, the tax plan would provide massive tax cuts for Florida’s highest income earners, accordingly to a recent report by the Institute on Taxation and Economic Policy (ITEP). Broadly outlined, the plan is likely to make an already unfair tax system that favors the wealthy even worse.

New Jersey Policy Perspectives: Trump Tax Plan: A Boon for the Wealthiest New Jerseyans

July 21, 2017

A federal tax package based on President Trump’s April outline would fail to deliver on its promise of mostly helping the middle class, instead showering most of its help to the richest 1 percent, according to a new 50-state analysis from the Institute on Taxation and Economic Policy released today.

Hope Policy Institute: Mississippi’s Wealthiest Get the Most Benefit under New Federal Tax Cut Proposal

July 21, 2017

New research from the Institute on Taxation and Economic Policy (ITEP) looks at the potential effects of a tax cut proposal from the Trump Administration on families in the 50 states. The tax cut proposal would reduce the tax rate on corporate income from 35 percent to 15 percent, would repeal the estate tax, replace the current income tax brackets with three brackets at 10 percent, 25 percent, and 35 percent, eliminate most itemized deductions, except charitable giving and home mortgage interest, and create a new tax credit for childcare expenses, among other things.

Kentucky Center for Economic Policy: Trump Tax Plan Would Be a Windfall for Only the Wealthiest Kentuckians

July 21, 2017

The wealthiest Kentuckians would be winners from the $4.8 trillion in federal tax cuts President Donald Trump has proposed, as shown by a new report from the Institute on Taxation and Economic Policy (ITEP). But as a poor state the tax cuts — coupled as they are with huge federal budget cuts to programs and […]

West Virginia Center on Budget & Policy: New Report Shows Trump Tax Plan Benefits Wealthy, Fails to Help Middle Class

July 20, 2017

A new analysis from the Institute on Taxation and Economic Policy reveals a federal tax reform plan based on President Trump’s April outline would fail to deliver on its promise of largely helping middle-class taxpayers, showering 61.4 percent of the total tax cut on the richest 1 percent nationwide. In West Virginia, the top 1 percent of the state’s residents would receive an average tax cut of $51,600 compared with an average tax cut of $720 for the bottom 60 percent of taxpayers in the state.

Economic Progress Institute: Trump Tax Plan Would Mostly Benefit Wealthiest Rhode Island Taxpayers

July 20, 2017

A new analysis from the Institute on Taxation and Economic Policy reveals a federal tax reform plan based on President Trump’s April outline would fail to deliver on its promise of largely helping middle-class taxpayers, showering 61.4 percent of the total tax cut on the richest 1 percent nationwide. In Rhode Island, the top 1 percent of the state’s residents would receive an average tax cut of $86,610 compared with an average tax cut of just $430 for the bottom 60 percent of taxpayers in the state.

Maine Center for Economic Policy: Trump Tax Plan Would Give Richest Maine Taxpayers an Average $53,000 Tax Cut and Trigger Deep Cuts to Federal Dollars for Maine

July 20, 2017

A new analysis from the Institute on Taxation and Economic Policy reveals a federal tax reform plan based on President Trump’s April outline would fail to deliver on its promise of helping middle-class taxpayers, showering three out of every five dollars of the total tax cut on the richest 1 percent nationwide. In Maine, the top 1 percent of the state’s residents would receive an average tax cut of $53,000 compared with an average tax cut of $400 for the bottom 60 percent of taxpayers in the state.

Trump Tax Proposals Would Provide Richest One Percent in Nebraska with 52.6 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Nebraska would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,572,200 in 2018. They would receive 52.6 percent of the tax cuts that go to Nebraska’s residents and would enjoy an average cut of $128,300 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in North Carolina with 46.5 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in North Carolina would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,541,500 in 2018. They would receive 46.5 percent of the tax cuts that go to North Carolina’s residents and would enjoy an average cut of $78,880 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Vermont with 39.1 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Vermont would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,192,800 in 2018.

Trump Tax Proposals Would Provide Richest One Percent in New Hampshire with 41.3 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in New Hampshire would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,668,100 in 2018. They would receive 41.3 percent of the tax cuts that go to New Hampshire’s residents and would enjoy an average cut of $98,940 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Missouri with 50.3 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Missouri would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,587,000 in 2018. They would receive 50.3 percent of the tax cuts that go to Missouri’s residents and would enjoy an average cut of $101,580 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Montana with 51 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Montana would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,819,000 in 2018. They would receive 51 percent of the tax cuts that go to Montana’s residents and would enjoy an average cut of $113,270 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in New York with 66.9 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in New York would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $3,234,000 in 2018. They would receive 66.9 percent of the tax cuts that go to New York’s residents and would enjoy an average cut of $176,680 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Pennsylvania with 50.2 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Pennsylvania would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,780,400 in 2018.

Trump Tax Proposals Would Provide Richest One Percent in Utah with 65.5 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Utah would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,573,600 in 2018.

Trump Tax Proposals Would Provide Richest One Percent in Wyoming with 64 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Wyoming would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $3,008,400 in 2018.

Trump Tax Proposals Would Provide Richest One Percent in New Jersey with 54.7 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in New Jersey would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $3,101,200 in 2018. They would receive 54.7 percent of the tax cuts that go to New Jersey’s residents and would enjoy an average cut of $130,440 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Oklahoma with 56.3 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Oklahoma would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,379,600 in 2018.

Trump Tax Proposals Would Provide Richest One Percent in Texas with 59.3 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Texas would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $2,019,900 in 2018.

Trump Tax Proposals Would Provide Richest One Percent in Tennessee with 44.6 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Tennessee would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,793,500 in 2018.

Trump Tax Proposals Would Provide Richest One Percent in Ohio with 47.2 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Ohio would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,485,800 in 2018.