ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Oregon Center for Public Policy: Commercial Activities Tax Fairness Credit Would Strengthen the Tax Reform Package

June 9, 2017

Analysis by the Institute on Taxation and Economic Policy (ITEP) shows that, all else being equal, a tax reform package with a CAT Fairness Credit would be more progressive than a tax reform package with an income tax rate reduction.

A Better Wyoming: Guess Which Sparsely Populated Mineral Rich State is Getting an Income Tax…

June 8, 2017

Alaska stopped collecting income taxes 35 years ago, and Wyoming has never remotely considered implementing one in the 82 years since it decided instead to charge state and local sales taxes. The Institute on Taxation and Economic Policy (ITEP) discovered recently that nearly 82 percent of Alaskans could expect to pay less under a progressive income tax than they would under a sales tax designed to generate an identical level of revenue.

Kentucky Center for Economic Policy: Troubling Hints About Direction for Tax Reform

June 8, 2017

The corporate tax cuts described above mean profitable businesses chip in less for the public services that help them succeed. And the result of less reliance on income and inheritance taxes is clear (see graph below): those at the top in Tennessee and Indiana pay an even smaller share of their income in state and local taxes than the wealthiest Kentuckians do, and their lowest-income residents pay an even higher share than the poorest Kentuckians.

This week, we celebrate a victory in Kansas where lawmakers rolled back Brownback's tax cuts for the richest taxpayers. Governors in West Virginia and Alaska promote compromise tax plans. Texas heads into special session and Vermont faces another budget veto, while Louisiana and New Mexico are on the verge of wrapping up. Voters in Massachusetts may soon be able to weigh in on a millionaire's tax, the California Senate passed single-payer health care, and more!

A Better Wyoming: Everything You Know About Wyoming Taxes is Wrong

June 6, 2017

Wrong. According to the Institute on Taxation and Economic Policy (ITEP), a D.C. think tank that studies state tax policy, Wyoming’s wealthiest residents pay the lowest tax rate in the country. Meanwhile, people at the bottom 20 percent of Wyoming’s shaky economic ladder pay taxes at seven-times the rate that the top one percent of earners do. That’s the largest tax rate discrepancy between rich and poor in the United States.

Oklahoma’s Budget Signed by Governor, but Long-Run Challenges Remain

June 2, 2017 • By Aidan Davis

On the last day of their legislative session, Oklahoma lawmakers finalized a $6.8 billion budget bill that was later signed by Gov. Mary Fallin. In the governor's statement on the bill, she noted that state agencies will be hard hit by the agreement--"it leaves many agencies facing cuts for the sixth year in a row"--and that while it does include some recurring revenue, it does not address the state's long-run structural budget challenges.

The Cost Of Trickle-Down Economics For North Carolina

May 26, 2017

Since 2013, state lawmakers have passed significant income tax cuts that largely benefit the state’s highest income earners and profitable corporations. These costly tax cuts have made the state’s tax system more upside-down by delivering the greatest income tax cuts to the state’s highest income taxpayers, while maintaining a heavier tax load on low- and […]

Evidence Counts: Senate Tax Plan Punches More Holes Into Budget (Updated)

May 24, 2017

Similar to previous tax plans from the Senate, this plan increase taxes on most West Virginians while lowering them for higher-income residents. According to the Institute on Taxation and Economic Policy, the Senate tax plan increases taxes on 60 percent of West Virginia households while lowering taxes on the top 40 percent of households. This is because lower income West Virginians pay more in sales taxes than income taxes, while the opposite is true for higher income people.

New Hampshire Fiscal Policy Institute: Revenue in Review: An Overview of New Hampshire’s Tax System and Major Revenue Sources

May 24, 2017

New Hampshire’s revenue system is relatively unique in the United States, as it lacks broad-based income and sales taxes and instead relies on a diversity of more narrowly-based taxes, fees, and other revenue sources to fund public services. This system presents both advantages and disadvantages to stable, adequate, and sustainable revenue generation.

Kentucky Center for Economic Policy: Any Way You Slice It, A Shift To Consumption Taxes Will Hurt Kentucky

May 22, 2017

According to ITEP, replacing all of Kentucky’s income tax revenue with sales tax revenue would require an increase in our sales tax rate to 13.3 percent – more than double the current 6 percent rate and by far the highest state sales tax rate in the country (next highest is California at 7.5 percent). But […]

Florida Policy Institute: New Report Finds Shortcomings in Florida’s Scholarship Tax Credit Program

May 19, 2017

State tax policies are undermining high-quality public education by redirecting public dollars for K-12 education toward private schools via tuition tax credits, according to a new report published by the Institute of Taxation and Economic Policy (ITEP) and the School Superintendents Association (AASA). In the case of Florida, the scholarship tax credit program failed to […]

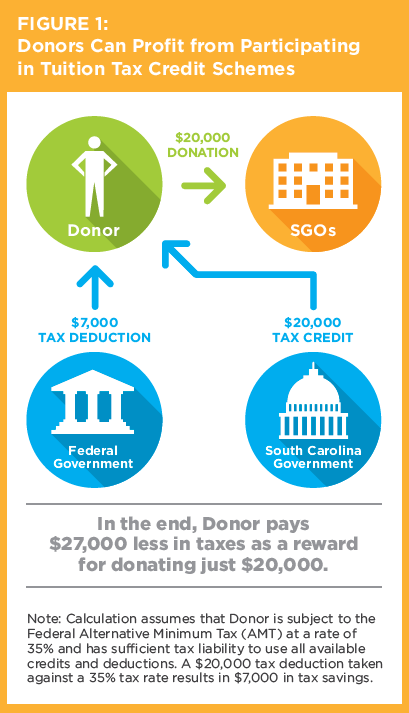

Investors and Corporations Would Profit from a Federal Private School Voucher Tax Credit

May 17, 2017 • By Carl Davis

A new report by the Institute on Taxation and Economic Policy (ITEP) and AASA, the School Superintendents Association, details how tax subsidies that funnel money toward private schools are being used as profitable tax shelters by high-income taxpayers. By exploiting interactions between federal and state tax law, high-income taxpayers in nine states are currently able […]

Public Loss Private Gain: How School Voucher Tax Shelters Undermine Public Education

May 17, 2017 • By Carl Davis, Sasha Pudelski

One of the most important functions of government is to maintain a high-quality public education system. In many states, however, this objective is being undermined by tax policies that redirect public dollars for K-12 education toward private schools.

West Virginia Metro News: West Virginia Has Miserable Company When It Comes to Budget Troubles

May 14, 2017

If there’s a bright side to West Virginia’s state budget troubles — in a misery-loves-company kind of way — it’s that plenty of other states have been having trouble too. “West Virginia is not unique this year or even in recent years in taking a little longer than usual to agree on a budget, largely […]

Evidence Counts: Latest Compromise Tax Plan Still a Bad Deal for West Virginia

May 10, 2017

Last week, the governor called the legislature back into special session to continue work on the state budget. The actual budget bill, however, was not part of the call, instead the intention was for the legislature to vote on a compromise tax plan that would influence how the budget was finalized. The version of the plan ( […]

Maryland’s Money Matters: ‘Dreamers’ Make Important Contributions to Maryland

May 5, 2017

It is unclear, as of now, whether the Trump administration will choose to end protections for young adults who came to the U.S. as children and have legal status through the Deferred Action for Childhood Arrivals (DACA) program. If the administration elects to end the program, thousands of Marylanders could lose their jobs and ability to attend college, many business could lose valued workers, and Maryland could lose nearly $14 million annually in state and local tax revenue.

The Progressive Pulse: Young Undocumented Immigrants’ Tax Contributions Would Drop by Nearly Half Without the Protection of the DACA Program

May 3, 2017

Young immigrants eligible for DACA (Deferred Action for Childhood Arrivals) annually contribute $2 billion in state and local taxes, according to new analysis from the Institute on Taxation and Economic Policy. The ITEP report finds that this number would drop by nearly half without DACA protection at a time when the Trump Administration has sent mixed signals on whether it intends to honor the DACA executive order in the long term.

State Rundown 5/3: Lawmakers See Value in State EITCs, Danger in Tax Cut Triggers

May 3, 2017 • By ITEP Staff

This week, Kansas lawmakers found that they’ll have to roll back Gov. Brownback’s tax cuts and then some to adequately fund state needs. Nebraska legislators took notice of their southern neighbors’ predicament and rejected a major tax cut. Both Hawaii and Montana‘s legislatures sent new state EITCs to their governors, and West Virginia began an […]

Oklahoma Policy Institute: Itemized Deduction Reform is a Promising State Budget Solution

May 2, 2017

When Oklahomans filed their state income taxes in 2016, more than 70 percent of households used the standard deduction, which was $6,300 for individuals and $12,600 for married couples filing jointly. The remaining households itemized their deductions, adding up deductions for mortgage interest, charitable contributions, business expenses, and several other deductions allowed under federal and state tax laws. […]

Massachusetts Budget and Policy Center: The Evidence on Millionaire Migration and Taxes

April 27, 2017

Economists consistently find that a well-educated workforce and a high-quality transportation system are among the bedrock elements upon which a prosperous state economy is built. Providing everyone with access to the education and training they need to reach their full potential boosts the productivity of individual workers and strengthens the overall economy.

Oregon Center for Public Policy: State corporate income taxes continue to shrink

April 27, 2017

As Oregon lawmakers consider raising corporate taxes to prevent cuts to schools and other public services, a new report finds that many of the nation’s largest corporations are paying little or nothing in state income taxes across the country. Despite reporting large profits to shareholders, these corporations are paying less to states in income taxes […]

State Rundown 4/27: States Finally Reaching Resolution on Gas Taxes

April 27, 2017 • By ITEP Staff

This week, transportation funding debates finally concluded with gas tax updates in Indiana, Montana, and Tennessee, and appear to be nearing an end in South Carolina. Meanwhile, Louisiana and Oregon lawmakers debated new Gross Receipts Taxes, and Texas legislators considered eliminating the state’s franchise tax. — Meg Wiehe, ITEP Deputy Director, @megwiehe Louisiana Gov. Bel Edward’s Commercial Activities Tax (CAT) was pulled from committee early this week without a vote due to opposition, […]

Fiscal Policy Institute: Immigrant Youth Add $140 Million to New York Tax Revenues

April 25, 2017

The report, conducted by the Institute on Taxation and Economic Policy and co-released in New York by the Fiscal Policy Institute, focuses on the executive order known as Deferred Action for Childhood Arrivals, or DACA. The executive order first went into effect in 2012, and in New York State, of the estimated 820,000 undocumented immigrants, about 76,000 are eligible for DACA.

New Jersey Policy Perspectives: DACA-Eligible New Jerseyans Pay $66 Million a Year in Taxes

April 25, 2017

New Jersey’s young immigrants eligible for DACA (Deferred Action for Childhood Arrivals) contribute $66 million in state and local taxes each year, the seventh highest level of all the states. And those annual contributions would increase by $27 million – the sixth most of all states – under comprehensive immigration reform.

A few weeks ago, a young undocumented immigrant posted a photo on Facebook after filing her taxes that went viral. The young woman, Belen Sisa, is one of 1.3 million young people who are currently eligible for temporary work authorizations and deferred deportation action through DACA (Deferred Action for Childhood Arrivals). President Obama signed the […]