ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

NEW: ITEP Analysis of Senate Tax Bill Shows Windfall for the Wealthy, Not Much for the Rest

June 25, 2025 • By ITEP Staff

Contact: Jon Whiten ([email protected]) With Senate Republicans hoping to hold a vote soon on their version of the tax and spending package passed by the House last month, a new national and state-by-state analysis from the Institute on Taxation and Economic Policy (ITEP) finds that, like the House-passed bill, the Senate proposal favors the richest […]

The idea of exempting overtime pay from income tax has gained traction, but there's little evidence it's an effective policy. Alabama tried it in 2023 but ended the policy after just two years. Their reversal highlights how exempting overtime is an expensive gimmick and a distraction from real worker issues.

This is a recklessly expensive bill that will expand economic inequality in America by making the tax code more tilted to the top, and pay for it in part by stripping health care from millions of Americans and rolling back critical climate investments.

The ‘Big, Beautiful’ Bill Creates a $5 Billion Tax Shelter for Private School Donors

June 9, 2025 • By Amy Hanauer

On May 22, Congress passed the House reconciliation bill or “One Big Beautiful Bill Act” by a one-vote margin. The bill’s dozens of destructive tax provisions would supercharge inequality and force devastating cuts to health and food aid that have been bedrocks of the American safety net since the 1960s.

As the Washington, D.C. region heads toward a likely recession, local policymakers will need to look to new revenue sources to help lessen the pain. In D.C., lawmakers ought to adopt a simple reform that would raise substantial revenue and make the District’s business tax system fairer.

West Virginia Center on Budget & Policy: Big Beautiful Bill’s Tax Cuts Overwhelmingly Favor the Wealthiest in West Virginia Even Before Accounting for Tariffs and Benefit Cuts

May 31, 2025

Earlier this month the U.S. House of Representatives passed a major new tax and spending bill that not only represents the largest cuts to Medicaid and SNAP in history, taking away SNAP and Medicaid benefits from millions of recipients including tens of thousands in West Virginia, but also includes tax provisions that would overwhelmingly favor the richest taxpayers in […]

New York Times: Religious Education Lost at the Supreme Court. But It’s Winning Everywhere Else.

May 24, 2025

The court rejected a religious charter school, but conservatives may get much of what they want in a school voucher program that passed the House this week. Read more.

The Guardian: Trump’s ‘Big, Beautiful Bill’ Benefits the Rich at the Expense of the Poor

May 24, 2025

Republicans in Congress are trying to pass a new tax and spending bill that may end up being a “big, beautiful bill” – but mostly for wealthy Americans. Read more.

Inc.: Trump’s ‘Big Beautiful Bill’ Offers a Big Tax Win for Small Businesses

May 22, 2025

The bill that the House of Representatives passed early Thursday morning in a nail-biting 215-to-214 vote—a wide-ranging domestic policy package called the One Big Beautiful Bill—could have wide-ranging and long-lasting implications for U.S. small businesses. Read more.

ITEP Statement: House-Passed Tax Plan Widens the Gap Between the Rich and the Rest

May 22, 2025 • By ITEP Staff

After a floor session that began in the middle of the night, the House of Representatives has passed its reconciliation bill including massive tax cuts and deep cuts to spending. Statement from Amy Hanauer, Executive Director of the Institute on Taxation and Economic Policy: “It’s not surprising that this bill was written behind closed doors […]

ITEP Statement: House’s Recklessly Expensive Tax Bill Would Expand Inequality

May 13, 2025 • By ITEP Staff

This bill gives enormous additional tax cuts to wealthy people and corporations, spikes the deficit, and strips health care from millions of Americans.

El Pais: The Republican Tax Reform Proposal Makes Remittances More Expensive

May 11, 2025

The fight against immigration reaches the tax bill, which includes a tax on money transfers that will affect undocumented immigrants. Read more.

ITEP Statement: Partial House Tax Bill Doubles Down on Trickle Down

May 10, 2025 • By ITEP Staff

So far this costly bill appears to double down on trickle down, with huge tax cuts that will further enrich the rich and not much for the rest of us. What’s more, many of the modest improvements for lower- and middle-income families are proposed to be temporary, whereas the benefits for the wealthiest are proposed to be permanent.

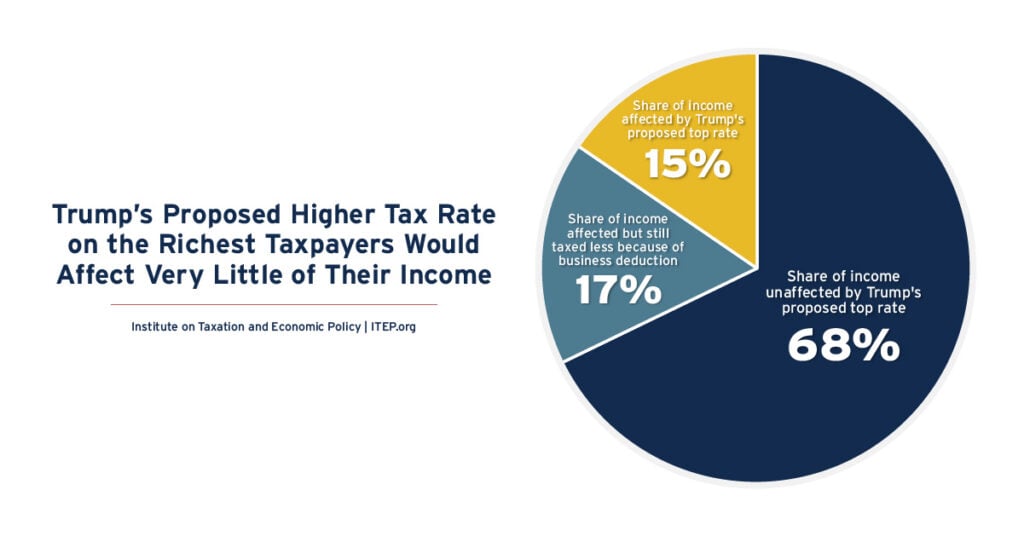

Trump’s Proposed Higher Tax Rate on the Richest Taxpayers Would Affect Very Little of Their Income

May 10, 2025 • By Carl Davis, Steve Wamhoff

President Donald Trump has proposed allowing the top rate to revert from 37 percent to 39.6 percent for taxable income greater than $5 million for married couples and $2.5 million for unmarried taxpayers. But many other special breaks in the tax code would ensure that most income of very well-off people would never be subject to Trump’s 39.6 percent tax rate.

ITEP Testimony: Miles Trinidad on Rhode Island’s High-Earner Income Tax Surcharge

May 6, 2025

This written testimony was submitted to the Rhode Island House Finance Committee on May 6, 2025. Thank you for the opportunity to provide testimony in support of H-5473, a bill to create a 3 percent surcharge on those earning over $625,000 a year. My name is Miles Trinidad. I am an analyst at the Institute […]

Florida Policy Institute: Florida Budget Proposals in Brief (FY 2025-26): Tax and Revenue

May 3, 2025

The Legislature is at a standstill, with two seemingly competing visions for the future of taxes in Florida. On the one hand, the House of Representatives advanced House Bill (HB) 7033 with various changes to the state’s general sales tax, as well as changes to local tourist development taxes. Read more.

Video: ITEP’s Amy Hanauer Discusses Billionaires, Taxes, and More at FP Solutions Summit

April 25, 2025

On April 24, 2025 ITEP Executive Director Amy Hanauer spoke on the panel “The Billionaire Tax Debate: Rethinking Fiscal Responsibility Around the World,” at the FP Solutions Summit. Video is embedded below (the relevant panel begins around the 38:30 mark).

Business Ethics, the Environment & Responsibility: Redefining Purpose: The Effect of the 2019 Business Roundtable Statement on Corporate Tax Strategies

April 23, 2025

Business Roundtable (BRT) firms have faced intense scrutiny from investors, media, and the public following their 2019 “Statement on the Purpose of a Corporation,” which marked a shift from shareholder-centric governance to a stakeholder-focused approach. This shift has sparked debate over whether BRT firms are genuinely committed to social responsibility or merely using it as […]

Thomson Reuters: Pushback Against Trump Plan to End IRS Direct File

April 16, 2025

Lawmakers and tax policy organization officials sounded off against the Trump administration’s reported intention to end the IRS’ free e-filing program after the only tax filing season it was available to taxpayers nationwide and in partnership with two-dozen state revenue agencies. Read more.

It’s Tax Day. You’ve Paid Your Share, but the Billionaires Haven’t.

April 15, 2025 • By Amy Hanauer

You likely had most of your federal taxes deducted from your paychecks throughout the year. This is not true, however, for mega-millionaires and billionaires, some of whom are practically running our government right now.

Rep. Andreas Salinas: There’s a False Choice — and Then There’s the Right Choice — on Trump’s Tax Cuts

April 15, 2025

Rarely has Congress faced such an important decision on tax policy as it does right now: whether and how to extend the massive tax cuts enacted in 2017 during the first Trump administration — tax cuts that have largely benefited the rich at the expense of working families. Read more.

Arizona Daily Star: Trump’s Deportation Net Widens to Migrants with Legal Status, Taxpayers

April 13, 2025

The Trump administration has moved to revoke parole protections issued under President Joe Biden and deport migrants like Doralis, who followed all the rules and used CBP One to enter the U.S. Read more.

IRS Cooperation with ICE Will Damage Public Trust, Putting Tax Revenues in Jeopardy

April 10, 2025 • By Marco Guzman

Attempts by the Department of Homeland Security to secure private information from the IRS on people who file taxes with an Individual Taxpayer Identification Number is a violation of federal privacy laws that protect taxpayers. It is also a change that could seriously damage public trust in the IRS, which could jeopardize billions of dollars in tax payments by hardworking immigrant families.

Newsweek: Florida Wants to Cut Property Taxes—But California Has a Warning

April 10, 2025

As state lawmakers consider cutting and even abolishing property taxes in Florida, California—which passed major reform in the late 1970s protecting homeowners against significant hikes—offers a cautionary tale of how well-intended tax revolts can backfire against those they should benefit. Read more.

Audio: ITEP’s Steve Wamhoff on What Federal Tax Policy Should – and Shouldn’t – Accomplish

April 10, 2025

ITEP Federal Policy Director Steve Wamhoff appeared on the Oregon Center for Public Policy’s “Policy for the People” podcast, discussing his recent report and the 2025 tax debate.