ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

USA Today: After Losing Fight to Levy ‘Amazon tax,’ Seattle Is Back to Square One on Helping Homeless

June 20, 2018

The construction pause “was a concrete action as opposed to just a threat,” said Matthew Gardner, a senior fellow at the Institute on Taxation and Economic Policy, a nonpartisan, nonprofit in Washington, D.C., focused on federal, state and local tax reform issues. “It seems pretty clear now that whoever ‘wins’ the HQ2 battle is very likely going to be […]

Cleveland Plain Dealer: Our Immigrant Neighbors Are Not Violent Criminals to Be Uprooted and Separated from Their Children

June 20, 2018

According to a 2017 study carried out for the Institute on Taxation and Economic Policy, a Washington, D.C. research organization, undocumented immigrants collectively pay almost $12 billion a year in state and local taxes, approximately 8 percent of their income. To put this in perspective, the institute observes that “the top 1 percent of taxpayers pay […]

NorthJersey.com: NJ Lottery Operator Northstar Wants $97 Million Raise and Less Money for New Jersey

June 15, 2018

In neighboring Pennsylvania, the Legislature in 2014 approved decreasing the minimum profit margin from 27 percent to 25 percent and projected net revenue would increase by $40 million over the following three to four years. Since the change, Pennsylvania’s net revenues decreased cumulatively by $35 million, according to research by the Institute on Taxation and […]

Washington Post: Seattle Council Votes to Repeal Tax to Help Homeless Amid Opposition from Amazon, other Businesses

June 12, 2018

“There’s a bargaining power problem here, and cities are on the wrong side of it,” said Matthew Gardner, a tax policy analyst at the Institute on Taxation and Economic Policy, a left-leaning think tank. “When Amazon decides to be bullies and make this kind of threat, it’s really hard for officials to know how seriously […]

Springfield (Mass) Republican: Tax Breaks That Help Students Attend Private School Could Be Repealed

June 9, 2018

“This is a brand new tax break that was created automatically by an obscure linkage to federal law, and whether lawmakers want to offer it or not is worth discussing,” said Carl Davis, research director at the Institute on Taxation and Economic Policy, a Washington-based tax think tank that tends to favor liberal policies. “It’s […]

Politico Morning Tax: More on the Way Out

June 8, 2018

GUILTY OF WANTING TO CHANGE GILTI: House Democrats, led by Rep. Peter DeFazio of Oregon, have rolled out a bill that would revamp the international system Republicans crafted in the Tax Cuts and Jobs Act. One of the big changes in the proposal: Forcing companies paying the minimum tax on Global Intangible Low Taxed Income […]

The (Maine) Free Press: Where the Democratic Gubernatorial Candidates Should Stand on the Issues

June 7, 2018

In the past several years, the LePage administration and now the Trump administration have been very kind to higher-income earners. In 2011, the governor signed a $400 million tax cut, largely skewed to benefit the wealthiest income earners, which he paid for by cutting tax revenue sharing to municipalities, causing property taxes to rise. Since […]

Reno News and Review: Tax Hike?

May 31, 2018

According to the Institute on Taxation and Economic Policy, the poorest 20 percent of Nevada families pay 6.1 percent of their income in sales tax. The wealthiest one percent of Nevada families pays six-tenths of one percent. That fund has generated from nine to six million dollars annually. With 20 years of sales tax payments […]

Urban Milwaukee: What’s Wrong with Illinois?

May 30, 2018

Although Illinois is widely viewed as a blue state because of its recent record of supporting Democratic presidential candidates, from a “who pays” angle it looks much more like a red state, collecting a much higher proportion of taxes from low earners than high earners. The next chart, based on data developed by the Institute […]

Politifact: Scott Dawson distorts Alabama Gov. Kay Ivey’s Grant Funding

May 25, 2018

But Matt Gardner, senior fellow at the Institute on Taxation and Economic Policy, said there is a distinction between tax dollars and taxpayer dollars. “User fees are, technically, not ‘tax dollars’ in that they are not the product of our tax system,” Gardner said. “But the broader claim that these are not ‘taxpayer dollars’ doesn’t […]

Reuters: U.S. Treasury Readies Crackdown on SALT Workarounds

May 24, 2018

But the nonpartisan Institute on Taxation and Economic Policy, or ITEP, warned that narrow action could have unintended consequences for federal charitable donations if the government imposes arbitrary distinctions between different types of organizations. The group said Congress is better positioned to act fairly. “The gifts being made under these schemes are not truly ‘charitable’ […]

New York Times: I.R.S. Warns States Not to Circumvent State and Local Tax Cap

May 24, 2018

Carl Davis, the research director for the Institute on Taxation and Economic Policy in Washington, said that Alabama provides a 100 percent state tax credit for taxpayers who donate money to organizations that give children vouchers to attend private school. Under its new law, New York gives an 85 percent state tax credit to residents […]

Washington Post: NJ Democrats Loved the Idea of Taxing the Rich Until They Could Actually Do It

May 24, 2018

A spokesman for Sweeney, the state Senate president, said families earning over $1.1 million in New Jersey already face an average $738 tax hike under the GOP law, citing data from the Institute on Taxation and Economic Policy (ITEP), a left-leaning think tank. That number accounts only for the GOP tax law’s changes for households […]

Politico Morning Tax: Is the End Near

May 24, 2018

Along those same lines, some liberals are clearly a bit queasy about the idea of the state SALT maneuvers, given that most of the benefits flow to top earners. But the liberal Institute on Taxation and Economic Policy also said it would be “unfair, arbitrary and ineffective” for the federal government to target the blue […]

Washington Times: Treasury Department Warns States over SALT Workarounds

May 24, 2018

The Institute on Taxation and Economic Policy, a left-leaning think tank, issued a new report Wednesday warning the Treasury not to single out the blue states, saying if they’re going to tackle charitable donations they could also target private school voucher programs. “Long before the tax law passed, some states abused the idea of charitable […]

State Efforts to Shield Taxpayers From SALT Cap Expose Deeper Flaws with Tax Incentives for Charitable Contributions

May 23, 2018 • By Carl Davis

Long before the tax law passed, some states abused the idea of charitable giving to funnel public money to various activities, such as private K-12 education, by reimbursing up to 100 percent of their taxpayers’ donations with tax credits. The flimsy, hastily-written SALT deduction cap enacted last year made this type of gaming even easier than before, and it was entirely predictable that states would respond by enacting more tax credits of this type.

San Francisco Chronicle: How Amazon and Entrepreneurs Can Pay Zero Federal Income Tax, and Do So Legally

May 16, 2018

With the recent news that Amazon paid zero federal taxes for 2017, every entrepreneur should be asking, :”How can my company pay no taxes, and legally, too?” According to the Institute on Taxation and Economic Policy, Amazon “paid no U.S. income taxes on $5.6 billion in domestic profits last year.” But companies in a position […]

Bloomberg: The Kochs Helped Slash State Taxes. Now Teachers Are in the Streets

May 16, 2018

“There’s this promise,” says Meg Wiehe of the Institute on Taxation and Economic Policy. “ ‘We’re going to put more money in your pockets. We’re going to let your family decide how to use this money.’ But the trade-off is: Your school is unfunded, your teachers’ pay is frozen, your classrooms are crowded, your textbooks are […]

USA Today: Amazon Tax over Head Tax Foreshadows Battles to Come in other Cities

May 16, 2018

In Washington state, neither state or local government are allowed to tax income. In addition, state law caps real estate tax increases to no more than 1% a year. “It’s a very challenging environment in which to raise revenues. So from that unique perspective, the proposed tax on workers seems like the best available to […]

The Hill: We Need Real Tax Reform

May 15, 2018 • By Steve Wamhoff

Following is an excerpt from an op-ed by Steve Wamhoff, ITEP director of federal policy, published in The Hill on May 15, 2018. By now, it’s crystal clear that the Trump-GOP tax law (the Tax Cuts and Jobs Act, or TCJA) benefits corporations and the rich more than anyone else. But Republican leaders are pushing […]

Seattle Times: Coalition Abandons Initiative Requiring Legislature to ‘Balance’ Washington’s Tax Code

May 15, 2018

It’s no great secret that Washington state has a regressive tax system, meaning people with modest incomes pay a comparatively high share of it in state and local taxes. The poorest fifth pay about 17 percent of their income in state and local taxes, while the wealthiest 1 percent pay 2.4 percent, according to the […]

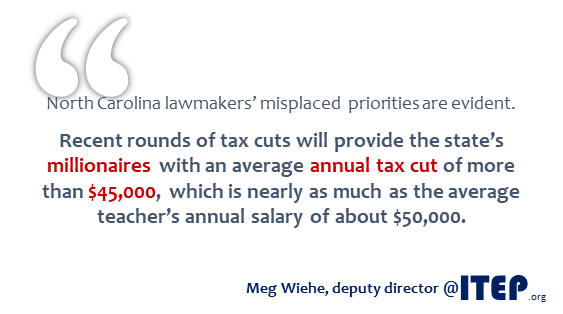

Millionaires Average Annual Tax Cut in North Carolina Is Comparable to Average Teacher’s Salary

May 11, 2018 • By Meg Wiehe

North Carolina lawmakers' misplaced priorities are evident: The recent rounds of tax cuts will provide the state’s millionaires with an average annual tax break of more than $45,000, which is nearly as much as the average teacher’s annual salary of about $50,000.

Associated Press: Arizona Voters May Be Asked Whether They Want to Tax High Earners to Fund Education

May 11, 2018

Ballot initiatives to hike taxes on the rich are rare but not unheard of. A measure in Washington state in 2010 to adopt an income tax for individuals who make more than $200,000 was overwhelmingly voted down. Meg Wiehe, deputy director of the Institute on Taxation and Economic Policy, said the public could be more […]

Politico: Trump Store Collecting Online Sales Tax after Criticism

May 4, 2018

The research director of the liberal-leaning Institute on Taxation and Economic Policy, Carl Davis, said in a blog post Thursday that “the Trump Organization quietly updated TrumpStore.com’s sales tax information page this week to indicate that the company will now collect sales tax in New York.” Read more

Business Insider: The Trump Org Just Quietly Announced It Is Collecting Sales Tax in a New State

May 4, 2018

New York’s addition to the list of states where TrumpStore.com collects sales tax, which previously included Louisiana, Florida, and Virginia, was first spotted Thursday by the Institute on Taxation and Economic Policy, a nonpartisan think tank. “Refusing to collect sales tax in New York was a risky move, and it’s not surprising that they’ve reversed course,” […]