ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

New York Times: Republican Plan Would Raise Taxes on Millions

November 7, 2017

Few independent economists find evidence to support that claim. Analyses published since the plan was introduced last week have consistently found that some middle-class families would see their taxes go up immediately, compared with existing law. One such analysis, from the Institute on Taxation and Economic Policy, found that 8 percent of middle-income earners would […]

New York Times: Republican Tax Rewrite Helps Some Millionaires but Hurts Other

November 7, 2017

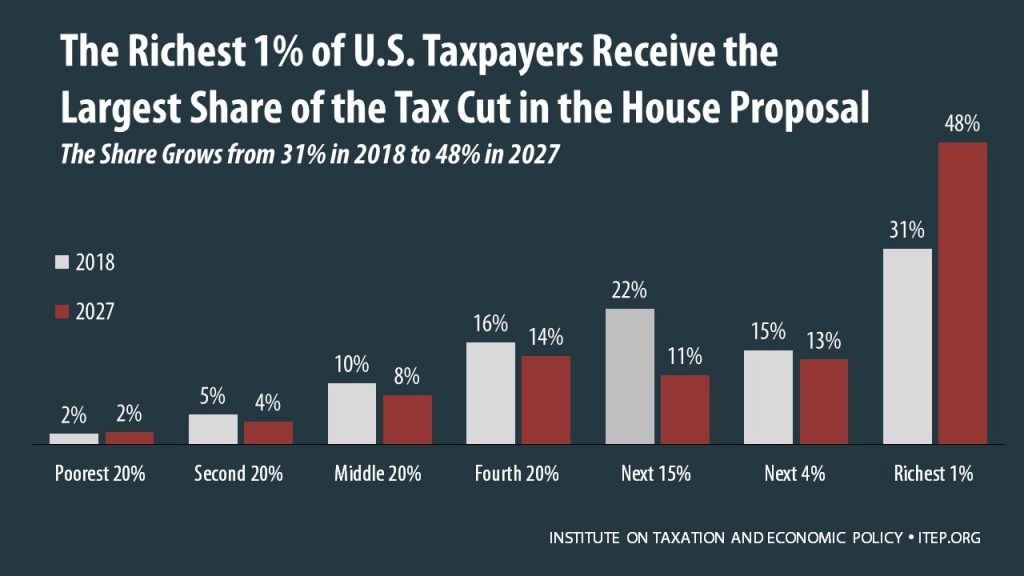

The independent Institute on Taxation and Economic Policy said on Monday that the top 1 percent of income earners, those who make just under $500,000 a year or more, would receive nearly half of the bill’s tax benefits a decade from now. That group of taxpayers would consistently see income gains from the bill, and […]

Washington Post: Welcome to the New Gilded Age

November 7, 2017

As the corporate welfare is doled out, the same bill widens the gap between the rich and everybody else. The liberal Institute on Taxation and Economic Policy concluded that the middle fifth of Americans would get a modest tax cut of $460 (1.4 percent of their income) in 2018, while the richest 1 percent would […]

Washington Post: No Doubt About Who Wins Under GOP Tax Proposal

November 7, 2017

In another study, the Institute on Taxation and Economic Policy finds: The middle 20 percent of income-earners in America, the group that is quite literally the “middle-class,” would receive 10 percent of the benefits in the U.S. in 2018 and just 8 percent of the benefits in 2027. In other words, in 2027 the middle […]

Mother Jones: New Estimate Confirms That Republican Tax Plan Favors the Very, Very Rich

November 6, 2017

Here’s another estimate of who gets what from the Republican tax plan. This one is from the Institute on Taxation and Public Policy: This is fairly close to the estimate from the Joint Committee on Taxation with the exception of the far-right bar in 2027. ITEP estimates that millionaires will retain a pretty fat 2.5 […]

Australian Broadcasting Corp: The Surprising Journey Your Money Takes after Buying a Pair of Nikes

November 6, 2017

Tax activists ask why it is that Australia makes $2 in profit from that $100 but Nike in America makes about $14 in profit. “That’s a pretty good indication that there’s some income shifting going on,” says Matt Gardner, a senior fellow at the Washington-based Institute on Taxation and Economic Policy. Read more

New York Magazine: The Richest One Percent of America Gets Half the Trump Tax Cuts

November 6, 2017

Well, now the House GOP has filled in all the missing details, and the result … would overwhelmingly benefit the rich. An analysis by the Institute on Taxation and Economic Policy, a left-leaning think tank whose calculations are broadly respected, finds that the highest-earning one percent of households would receive nearly half the direct benefit […]

New Analysis: Wealthy Will Receive a Growing Share of Tax Cuts in House Tax Plan Over Time

November 6, 2017 • By Alan Essig

A national and 50-state distributional analysis of the House tax plan released late last week reveals that not only would the wealthiest 1 percent receive the greatest share of the total tax cut in year one, but their share would grow over time due to phase-ins of tax cuts that mostly benefit the rich and the eventual elimination or erosion in value of provisions that benefit low- and middle-income taxpayers.

Salon: The Election Is All About Casting Aside Trumpism

November 5, 2017

In New Jersey, undocumented immigrants paid close to $600 million in state and local taxes, according to the Institute on Taxation and Economic Policy. In 2013, analysts at the Social Security Administration calculated that undocumented immigrants had paid $13 billion into the system in the year 2010, and earned $34,000 a year, on average, at the time. […]

Huffington Post: Trump’s Exit From Anti-Corruption Pact Helps Big Oil Hide How Much It Pays In US Taxes

November 4, 2017

The secrecy underscores the generous subsidies and tax credits afforded to the oil and gas industry. Nearly half of all untapped oil reserves in the U.S. would be unprofitable without subsidies, a study published last month in the journal Nature found. Exxon Mobil alone received $12.8 billion in subsidies and paid a tax rate of […]

Roll Call: Tax ID Used by Immigrants Targeted in GOP Tax Bill

November 3, 2017

Meg Wiehe, deputy director at the Institute on Taxation and Economic Policy, said the provision would harm more than 5.1 million children — the majority of whom are U.S. citizens or young “Dreamers” brought to the country illegally when they were children. “Their undocumented parents are hard-working taxpayers, paying not only state and local taxes […]

CNNMoney: Broadcom Moving Legal Headquarters Back to U.S.

November 3, 2017

Matthew Gardner, a fellow at the Institute on Taxation and Economic Policy, pointed to several additional reasons Broadcom might want change its address. Broadcom is in the middle of a $5.5 billion merger with Brocade, a networking company. That deal has been held up because of a review by the Committee on Foreign Investment in […]

Marketplace: Key Question on The GOP Tax Plan: What’s Your ZIP code?

November 3, 2017

ITEP Research Director Carl Davis talks to Marketplace about the state and local tax deduction. Read more or listen

Fortune: Did You Catch the Huge Loophole in the GOP Tax Plan? The Rich Sure Did.

November 3, 2017

Following in an excerpt from an op-ed by Alan Essig published in Fortune. In September, shortly after the GOP released the initial framework for its so-called middle-class tax plan, multiple independent analyses revealed that millionaires would reap the greatest benefit, both as a share of the entire tax cut and as a percentage of their […]

Mother Jones: Republicans Unveil Huge Corporate Tax Cuts Paid For by Deficit-Spending

November 3, 2017

Completely repealing the state and local deduction would lead to taxes going up for 1 in six Americans, according to the left-leaning Institute on Taxation and Economic Policy. In a high-tax state like Maryland, nearly 1 in 3 households would see their taxes increase. Read more

Las Vegas Review Journal: GOP Unveils Tax-Reform Bill That Faces Political Hurdles

November 3, 2017

Alan Essig, executive director of the left-leaning Institute on Taxation and Economic Policy, rejected GOP claims that the bill would help the middle class. “The starting point for tax reform has always been to drastically cut corporate taxes with the promise that benefits would trickle down to the working poor. … The core of this […]

Newsweek: Tax Reform Plan Is More Radical Than You Think

November 3, 2017

Critics note that there are plenty of other ways wealthier earners would do well. “Keeping the top tax rate at 39.6 percent for millionaires is a cosmetic change meant to make this tax plan more palatable. Unless tax writers take out other provisions that almost exclusively benefit the highest-income households, millionaires will still benefit most,” […]

Associated Press: Why Tax Plan Might Not Put US Firms’ Overseas Cash to Work

November 3, 2017

Apple has more than $230 billion overseas, Microsoft $124 billion, according to the Institute on Taxation and Economic Policy. Returning those overseas profits to America, the Republicans say, would give the economy a healthy jolt as companies put their newly available cash to work. But critics note that a similar one-time “tax holiday” on overseas […]

Vox: 2 Winners and 3 Losers from the Republican Tax Bill

November 3, 2017

The Center on Budget and Policy Priorities, pulling together assessments from the Congressional Budget Office, the Joint Committee on Taxation, the Tax Policy Center, the Treasury’s Office of Tax Analysis, and the Institute on Taxation and Economic Policy, found that workers would only receive a quarter or less of the benefits from tax cuts — […]

Washington Post: Answers to Major Questions about the Republican Tax Plan

November 3, 2017

Boosting corporate income tax rates and squeezing loopholes would hurt other companies, such as capital intensive industries. Oil and gas companies, for example, take advantage of special depreciation rates, two of which are about a century old. International companies – such as pharmaceutical or technology firms – shelter income abroad to avoid taxes in the […]

Dallas Morning News: Was Exxon Mobil’s Tax Rate Last Year Really -5.1%?

November 3, 2017

So, who’s right? “They are both correct,” said Matt Gardner, senior fellow at the Institute on Taxation and Economic Policy. “They’re just measuring different things.” Tax breaks, financial reporting rules and differing tax rates around the world make looking at these numbers a tricky business. In fact, both experts interviewed by The Dallas Morning News on […]

Bottom-Line Conclusion about GOP Tax Plan Is the Same After Reviewing More Details

November 2, 2017 • By Alan Essig

Instead of engaging in thorough, public process that may have yielded real tax reform for middle-class families, lawmakers covertly put together a plan that reserves its biggest benefits for corporations and the wealthy while throwing in a few gimmicks for political cover.

Even if Top Marginal Tax Rate Remains 39.6%, GOP Tax Plan Will Still Largely Benefit the Wealthy

November 1, 2017 • By ITEP Staff

Keeping the top tax rate at 39.6 percent for millionaires is a cosmetic change meant to make this tax plan more palatable. Unless tax writers take out other provisions that almost exclusively benefit the highest-income households, millionaires will still benefit most.

Between the Lines: Trickle Down Hoax Central to GOP Tax Reform Plan

November 1, 2017

Between The Lines’ Scott Harris spoke with Matthew Gardner, senior fellow with the Institute on Taxation and Economic Policy, who assesses the winners and losers in the Republican tax reform plan, and the real world track record which proves that trickle-down economics is a lie. MATTHEW GARDNER: The plan we’re looking at right now, as […]

NPR’s On Point: Who Benefits from GOP Tax Plan

October 30, 2017

We go to the biggest legislative push yet by the president and Republican Congress: to overhaul American taxes. Details slated to be released this week, with a lightning-fast push through Congress as the GOP dream. Who wins, who loses. This hour, On Point: We ask what to look for in the coming GOP tax plan. —Tom […]