ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Bloomberg BNA: Taxes Lost to Offshore Profits Rise to $752B in 2016

October 17, 2017

The report, released Oct. 17 by the left-leaning U.S. Public Interest Research Group Education Fund and the Institute on Taxation and Economic Policy, “undermines the case for any tax proposal that would allow companies to repatriate their U.S. profits at a special low tax rate,” according to a news release. In addition to a lower […]

New York Times: U.S. and Europe May Collide on Taxing Apple and Amazon

October 13, 2017

The rulings on Amazon and Apple — which those companies are disputing — are byproducts of a race among governments to lure corporate giants to their shores in the hunt for new sources of revenue. That cutthroat competition is the reason that 73 percent of Fortune 500 companies have a subsidiary in a low-tax haven, […]

FiveThirtyEight: The GOP Had One Big Divide On Health Care. It Has Three On Taxes.

October 11, 2017

Here’s the problem: The draft Republican plan would raise a lot of people’s taxes. Estimates from the Tax Policy Center suggest that limiting tax deductions and going from seven tax brackets to three would cause tax increases for about 12 percent of taxpayers,1 including a third with incomes between $150,000 and $300,000, who would pay […]

Middle-Income More Likely Than the Rich to Pay More Under Trump-GOP Tax Plan

October 11, 2017 • By Jenice Robinson

The Trump Administration and GOP leaders continue to wrap their multi-trillion tax cut gift to the wealthy in easily refutable rhetoric about boosting the nation’s middle class. Later today, trucks and truck drivers will serve as a backdrop for a Pennsylvania speech in which Trump is anticipated to talk about how proposed tax changes that […]

Bloomberg BNA: N.Y., N.J., Connecticut Hurt Most If State Deduction Ditched

October 10, 2017 • By ITEP Staff

The White House has said the tax reform framework was crafted with the middle class in mind. However, a report released Oct. 4 by the Institute on Taxation and Economic Policy, said the richest 1 percent of residents in all but a handful of states would receive at least half of the tax cuts being […]

Select State News Coverage of ITEP’s 50-State Analysis of the GOP Tax Proposal

October 10, 2017

The Sentinel: Trump Tax Even in Harrisburg Will Feature Truckers The Columbus Dispatch: 15% of Ohioans Could See Tax Increase Under GOP Plan KGW Portland: Richest Oregonians Benefit Most from Proposed Tax Cuts Raleigh News & Observer: The Racial Wealth Divide Could Grow with Tax Changes Northwest Indiana Times: Hoosiers Would Lose in Trump Tax […]

Ralph Nader Radio Hour: The Truth About Trump’s Tax Plan

October 7, 2017

Ralph and Alan Essig, Executive Director of Citizens for Tax Justice break down President Trump’s Tax Reform proposal and insurance expert, Robert Hunter, returns to explain what’s going on with hurricane and flood insurance in the wake Harvey, Irma and Maria. Read more

Electablog: Everything You Need to Know About the Trump Tax Plan

October 7, 2017

http://www.eclectablog.com/2017/10/episode-53-everything-you-need-to-know-about-the-trump-tax-scam.html

ITEP Statement on House Budget Resolution: Lawmakers Gear up to Give the Public What It Doesn’t Want

October 5, 2017 • By Alan Essig

Passing a budget is supposed to provide a structure for our elected officials to responsibly manage our nation’s finances and public investments. But that is not the purpose of this budget resolution.

The Trump-GOP tax plan is touted as plan for the middle-class but delivers a boon to the wealthy, throws a comparative pittance to everyone else and even includes a dose of tax increases for some middle- and upper-middle-income taxpayers. The data belie the rhetoric.

Bloomberg: GOP Tax Plan Seen Hurting Middle Class in N.Y., 8 Other States

October 5, 2017 • By ITEP Staff

The ITEP report concludes that many of the most affected people would be middle-income and upper-middle income taxpayers. For example, in Maryland, about one-third of those making from $48,700 to $73,700 would face a tax hike, while 41 percent of those between $73,700 and $126,500, would face an increase, the study says. And almost 65 […]

Washington Post: How Much Will Trump Tax Plan Cost You and Your Wealthiest Neighbors

October 5, 2017 • By ITEP Staff

https://www.washingtonpost.com/news/politics/wp/2017/10/05/how-the-trump-tax-plan-could-affect-someone-in-your-state-with-your-income/?utm_term=.819c02760361

Mother Jones: Republicans Are Already Giving Up on a Key Part of Trump’s Tax Plan

October 5, 2017

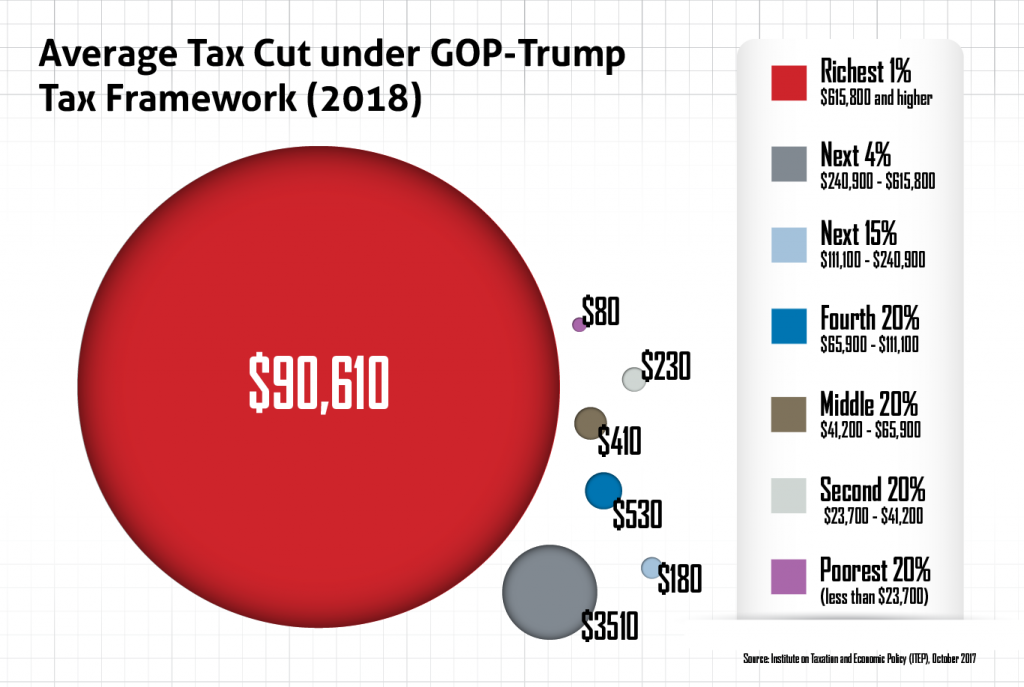

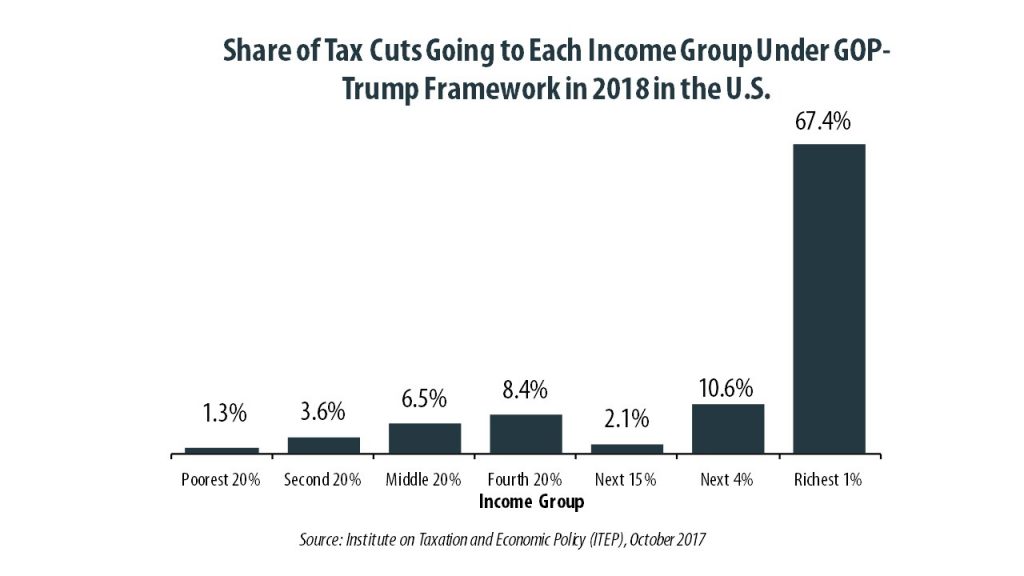

For the third time in eight days, a new study has found that President Donald Trump’s tax plan is a major handout to the richest Americans. On Wednesday, the left-leaning Institute on Taxation and Economic Policy estimated that the top 1 percent of Americans would get 67 percent of the benefits from the Republican tax plan released last […]

The Washington Monthly: The Republican Tax Cut Framework Is Already in Trouble

October 4, 2017

The tax cut framework suggests that Republicans will eventually define some corporate tax loopholes to close. They haven’t done so yet because that will unleash a host of corporate lobbyists to fight against them, which is all the proof we should need that the statutory tax rate, as it exists today, is meaningless. The real […]

50-State Analysis: GOP-Trump Tax Proposal Would Give the Store Away to the Wealthy, Exacerbate the Income Divide

October 4, 2017 • By Alan Essig

A 50-state analysis of the GOP tax framework reveals the top 1 percent of taxpayers would receive a substantial tax cut while middle- and upper-middle-income taxpayers in many states would pay more, the Institute on Taxation and Economic Policy said today. The GOP continues to tout its tax plan as “beneficial to the middle class.” […]

Bloomberg: Trump Plan Aims New Foreign Tax at Apple, Other Multinationals

October 2, 2017

Currently the U.S. taxes corporate profits worldwide, no matter where they’re earned. That approach — which makes America unique among developed nations — comes with a large asterisk: Companies can defer paying tax on their overseas earnings until they return that income to the U.S., a process known as repatriation. The repatriation quirk has prompted […]

Raleigh News & Observer: The Racial Wealth Divide Could Grow with Tax Changes

September 30, 2017

But that’s assuming nothing changes. If Trump moves forward with the policies he campaigned on, especially his tax “reform” plan, the gap surely grows. Trump’s tax plan is heavily skewed toward providing massive tax breaks for the ultra-wealthy. Half of the proposed cuts will go to millionaires, according to the Institute on Taxation and Economic […]

On Point with Tom Ashbrook: Totaling Up President Trump’s Tax Overhaul Plan

September 28, 2017

And now, it’s time for the Trump tax plan. A miracle for the middle class, the president said in Indianapolis yesterday. He’s selling hard. But there are knowns and unknowns here. Known: upper-income households would get large tax cuts. Known: lower-income households would get none. Unknown: how exactly the middle class would make out. Or […]

Salon: Everyone Hates Trump’s Godawful Tax Plan — Except the GOP Donor Class

September 28, 2017

Wealthy businesses and individuals will benefit from the proposal in other ways as well, including a reduction in the corporate tax rate from 35 percent to 20 percent. On the other hand, the outline also proposes eliminating many corporate deductions, which primarily benefit the largest enterprises. According to research by the left-leaning Institute on Taxation and […]

Bloomberg: Stock Traders Celebrate Nonexistent Tax Cuts

September 28, 2017

Although Republicans say the plan is to reduce the corporate tax rate to 20 percent from the current 35 percent, the Institute on Taxation and Economic Policy found that more than 250 of the largest U.S. companies already paid an effective rate of just 21.2 percent from 2008 to 2015. Read more

Think Progress: Trump’s Plan Gives Corporate Tax Lobbyists Nearly Everything They Want

September 28, 2017

Another key corporate giveaway in the proposal would allow multinational corporations to bring accumulated foreign earnings back to the homeland at a low one-time rate, known as a repatriation tax. The administration has still not announced that rate but officials have reportedly indicated it will be somewhere in the 10 percent range. The non-partisan Institute […]

ITEP ED on GOP Tax Plan: “There is Something Terribly Wrong with This Picture”

September 27, 2017 • By Alan Essig

Economically, the rich are doing just fine, yet the GOP is brazenly selling old hat trickle-down economic theories laden with rhetoric about projected economic growth that will benefit working people. Worse, they are doing so even though opinion polling shows the majority of Americans do not want Congress to pass tax cuts for the wealthy and corporations.

Fox News: Trump, Republicans reveal tax plan: What to know

September 27, 2017

The Institute on Taxation and Economic Policy last week slammed Trump’s plan as it said it wouldn’t alleviate financial burdens of the middle class. “Vague promises can’t conceal the hard facts: if anything resembling President Trump’s current proposal becomes law, the outcome would be a redistribution of wealth to the already wealthy on a scale […]

New York Times: Will a Corporate Tax Holiday Give Workers Anything to Cheer?

September 26, 2017

Apple alone is sitting on an overseas stash of almost $260 billion, according to Bloomberg, while Microsoft has more than $120 billion parked abroad. The pharmaceutical giant Pfizer does not regularly disclose how much of its offshore profits are stored in foreign tax havens, but the Institute on Taxation and Economic Policy estimates that at […]

New York Times: Nothing Is Too Strange for Cities Wooing Amazon to Build There

September 25, 2017

Tax policy experts are more skeptical of Amazon’s bidding process and how much cities stand to benefit. “Why are they doing this whole dog and pony show? Amazon wants something for nothing,” said Matthew Gardner, a senior fellow at the Institute on Taxation and Economic Policy, a nonpartisan think tank. “They would like a package […]