Tax Reform Options and Challenges

Senate “Pass-Through” Deduction Threatens to Undermine State Tax Systems

December 1, 2017 • By Carl Davis

The U.S. Senate will soon be voting on a bill that would, among other things, allow so-called “pass-through” businesses to pay significantly lower taxes than their employees...If the Senate “pass-through” deduction is enacted into law, dozens of states will be forced to confront the possibility of reduced revenue collections, more regressive tax codes, and increased tax avoidance.

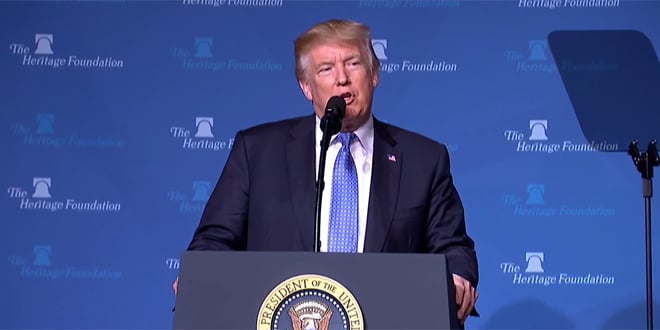

New ITEP Report Explains How Tax Reform Should Eliminate Breaks for Real Estate Investors Like Trump

December 1, 2017 • By Steve Wamhoff

A new report from ITEP provides more details on the many breaks and loopholes for wealthy real estate investors like Trump and what a true tax reform would do to close them.

How True Tax Reform Would Eliminate Breaks for Real Estate Investors Like Donald Trump

December 1, 2017 • By ITEP Staff

The federal tax code includes several loopholes and special breaks that advantage wealthy real estate investors like President Donald Trump. Under current law, real estate investors can claim losses much more quickly and easily than other taxpayers, but they also have several methods to delay or avoid reporting any profits to the IRS.

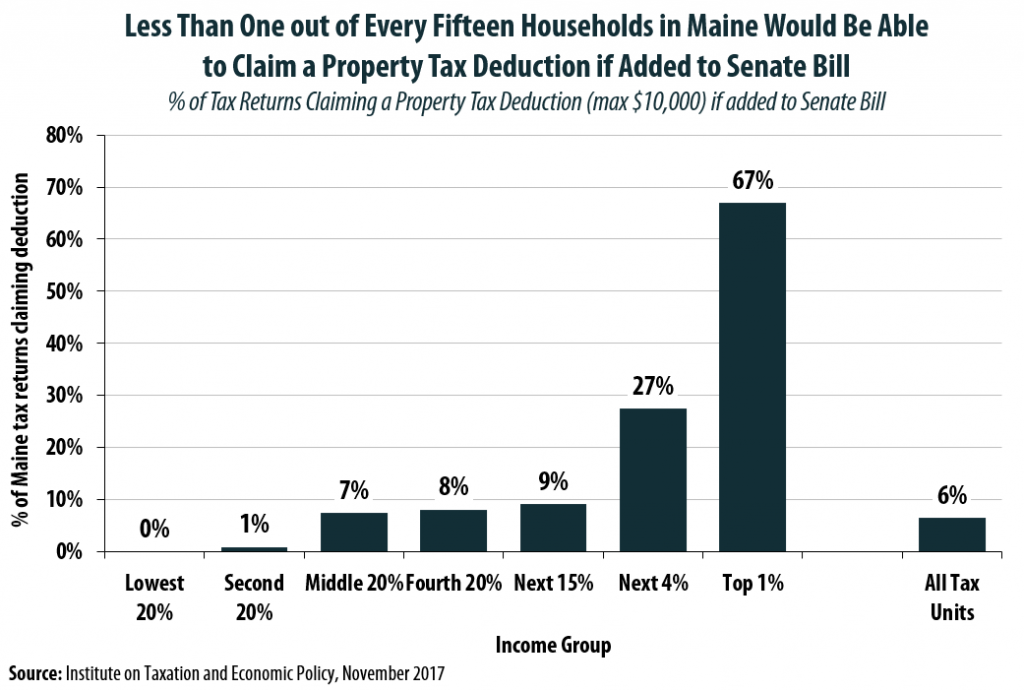

Senator Collins Pushes Hard for a Property Tax Deduction that Very Few of Her Constituents Will Be Able to Claim

December 1, 2017 • By Carl Davis

Adding a property tax deduction back into the Senate bill may sound like a compromise, but a new analysis performed using the ITEP Microsimulation Tax Model reveals that the amount of state and local taxes deducted by Maine residents would plummet by 90 percent under this change, from $2.58 billion to just $262 million in 2019. In short, this change is much more symbolic than substantive.

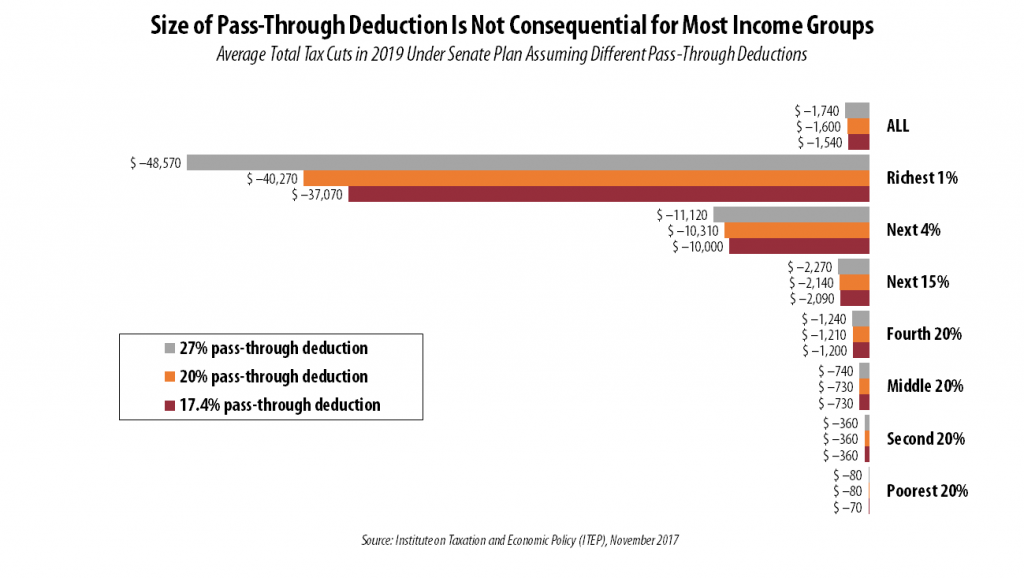

Republican Senators Debate Size of “Pass-Through” Break, But Proposed Compromises Will Make No Difference to Anyone Who Is Not Well-Off

November 30, 2017 • By Steve Wamhoff

Senators Ron Johnson of Wisconsin and Steve Daines of Montana want the tax bill on the Senate floor to be amended to offer a more generous tax break for “pass-through” businesses. We have estimated how all the provisions in the tax bill would impact each income group under three possible scenarios. The only thing different in each scenario is the size of the deduction for pass-through income: 17.4 percent (the deduction in the bill as this is written), 20 percent and 27 percent. We find that the size of the pass-through break makes no difference for anyone who is not…

A Corporate Tax Cut Would Benefit Coastal Investors, Not the Heartland

November 30, 2017 • By Carl Davis

The centerpiece of the House and Senate tax plans is a major tax cut for profitable corporations that the American public does not want, and that will overwhelmingly benefit a small number of wealthy investors living in traditionally “blue” states. New ITEP research shows that poorer states such as West Virginia, Oklahoma, Alabama, and Tennessee would be largely left behind by a corporate tax cut, while the lion’s share of the benefits would remain with a relatively small number of wealthy investors who tend to be concentrated in larger cities near the nation’s coasts.

Lawmakers Are Allowing Monied Interests to Trump the Voices of Their Constituents

November 30, 2017 • By Alan Essig

George Washington is said to have described the U.S. Senate as the body that cools the passions of an impulsive House of Representatives just as a saucer cools tea. But current Senate leaders appear to think of themselves as more of a Bunsen burner.

Chained CPI Would Raise Everyone’s Personal Income Taxes in the Future, Would Hurt the Poor Right Away

November 30, 2017 • By Steve Wamhoff

One of the findings is that every income group would face higher personal income taxes in years after 2025 (including 2027). Chained CPI would gradually push taxpayers into higher income tax brackets and make the standard deduction, the Earned Income Tax Credit, and several other breaks less generous over time. The switch to chained CPI would cause some low-income people to face a tax hike starting in 2019, the second year the plan would be in effect.

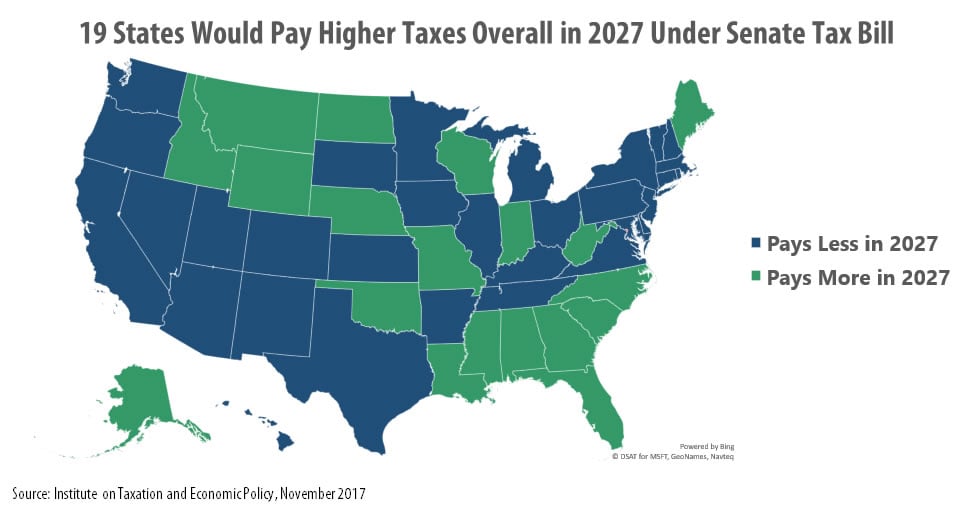

A recent ITEP study concluded that the tax bill before the Senate would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today, while providing foreign investors with more benefits than American households. This report delves deeper by breaking out impacts of different components of the Senate tax plan on U.S. taxpayers in 2019 and 2027. This approach leads to several conclusions.

Mick Mulvaney and the 19 States Paying Higher Taxes Under the Senate Tax Bill

November 22, 2017 • By Steve Wamhoff

One of the more surprising findings of ITEP’s recent estimates on the Senate tax bill is that 19 states would pay more overall in federal taxes if the bill becomes law. This is not just an increase in the personal income taxes paid (which would happen in some states under the House bill). This is an increase in their net federal taxes overall, even including the assumed benefits of corporate tax cuts and estate tax cuts.

Revised Senate Plan Would Raise Taxes on at Least 29% of Americans and Cause 19 States to Pay More Overall

November 18, 2017 • By ITEP Staff

The tax bill reported out of the Senate Finance Committee on Nov. 16 would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today.

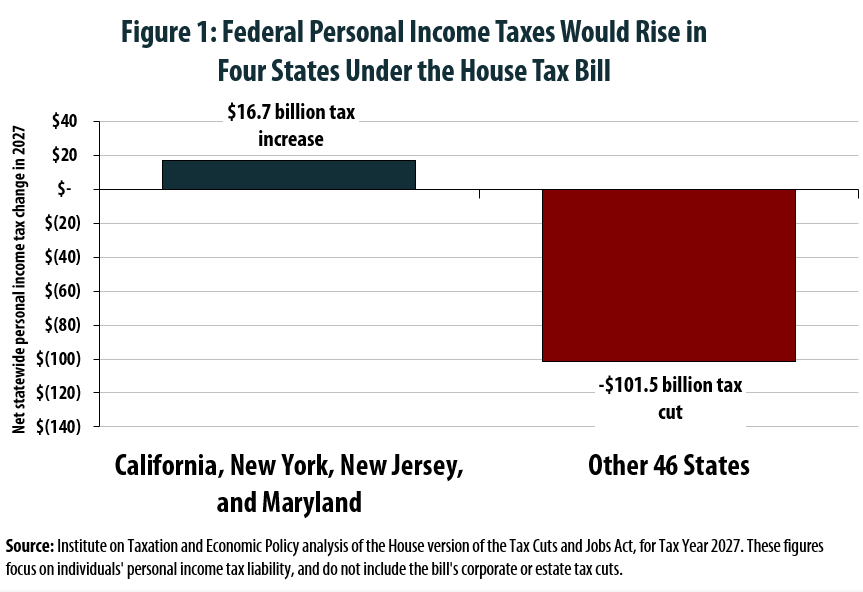

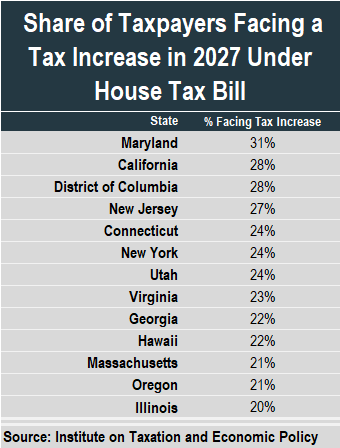

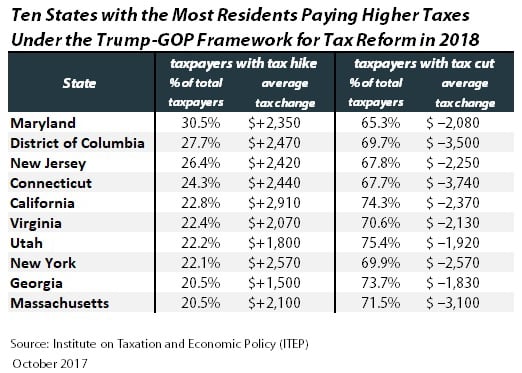

House Tax Plan Offers an Exceptionally Bad Deal for California, New York, New Jersey, and Maryland

November 14, 2017 • By Carl Davis

An ITEP analysis reveals that four states would see their residents pay more in aggregate federal personal income taxes under the House’s Tax Cuts and Jobs Act. While some individual taxpayers in every state would face a tax increase, only California, New York, Maryland, and New Jersey would see such large increases that their residents’ overall personal income tax payments rise when compared to current law.

House Tax Bill Would Put Property Tax Deduction Out of Reach for Most Households

November 13, 2017 • By ITEP Staff

The House of Representatives is expected to vote this week on a bill that would reduce federal revenues by roughly $1.5 trillion over the next decade. Despite the bill’s high price tag, many households would pay more in federal tax if the bill is enacted, in large part because it slashes the deduction for state […]

Flawed Data from House Leadership Attempts to Hide Tax Hikes Under Proposal

November 9, 2017 • By Carl Davis

In a story published yesterday evening, Politico reported that House leaders have been “working to create customized data models” to show lawmakers that their constituents will not face a tax increase under the tax bill being debated in the House. On this point, House leaders have taken on an impossible task.

House Tax Plan Would Make Offshore Tax Avoidance Substantially Worse

November 8, 2017 • By Richard Phillips

The Sunday release of the Paradise Papers has once again brought the issue of offshore tax avoidance to the forefront of public discussion. The papers expose the complex structures that companies such as Apple and Nike have pursued in recent years to pay little to nothing in taxes on their offshore earnings. Yet even as these revelations make headlines, House Republicans are moving forward with major tax legislation, the Tax Cuts and Jobs Act, that would reward the worst tax avoiders and make it even easier for multinational companies to avoid taxes.

Analysis of the House Tax Cuts and Jobs Act

November 6, 2017 • By Matthew Gardner, Meg Wiehe, Steve Wamhoff

The Tax Cuts and Jobs Act, which was introduced on Nov. 2 in the House of Representatives, would raise taxes on some Americans and cut taxes on others while also providing significant savings to foreign investors.

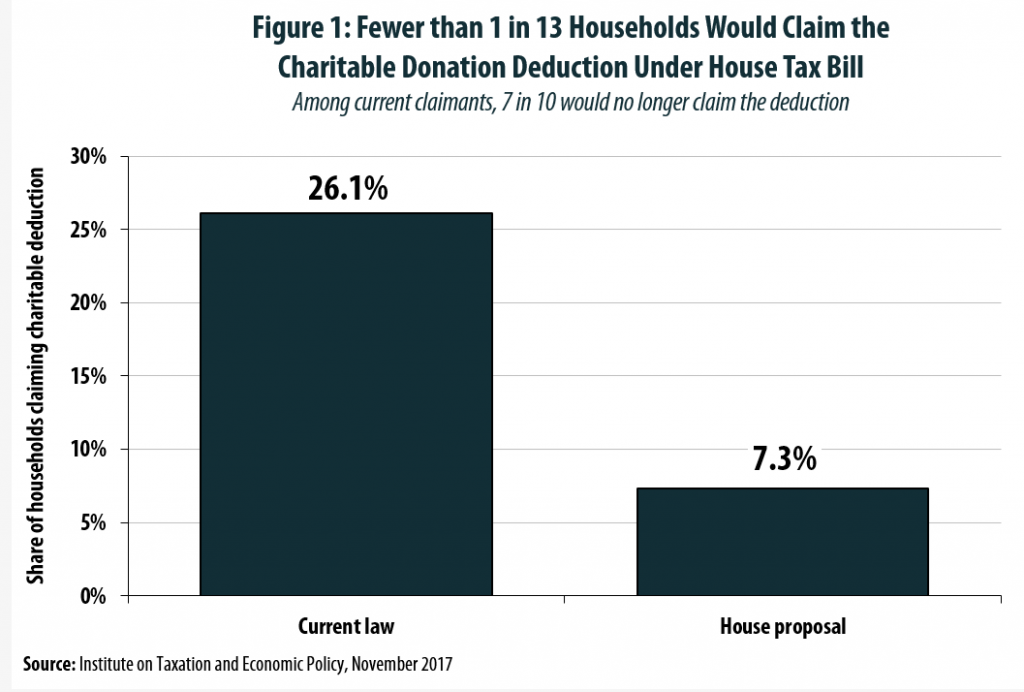

House Tax Bill Would Reserve Charitable Giving Subsidies for a Small Subset of Wealthier Households

November 6, 2017 • By Carl Davis, Steve Wamhoff

In the tax policy framework released in September, President Trump and Congressional leadership insisted that their proposal would retain the tax incentive for donating to charity because doing so helps “accomplish important goals that strengthen civil society, as opposed to dependence on government.” Now that the House has released a more detailed proposal, it is finally possible to evaluate exactly how their plans would impact the incentive to donate to charity.

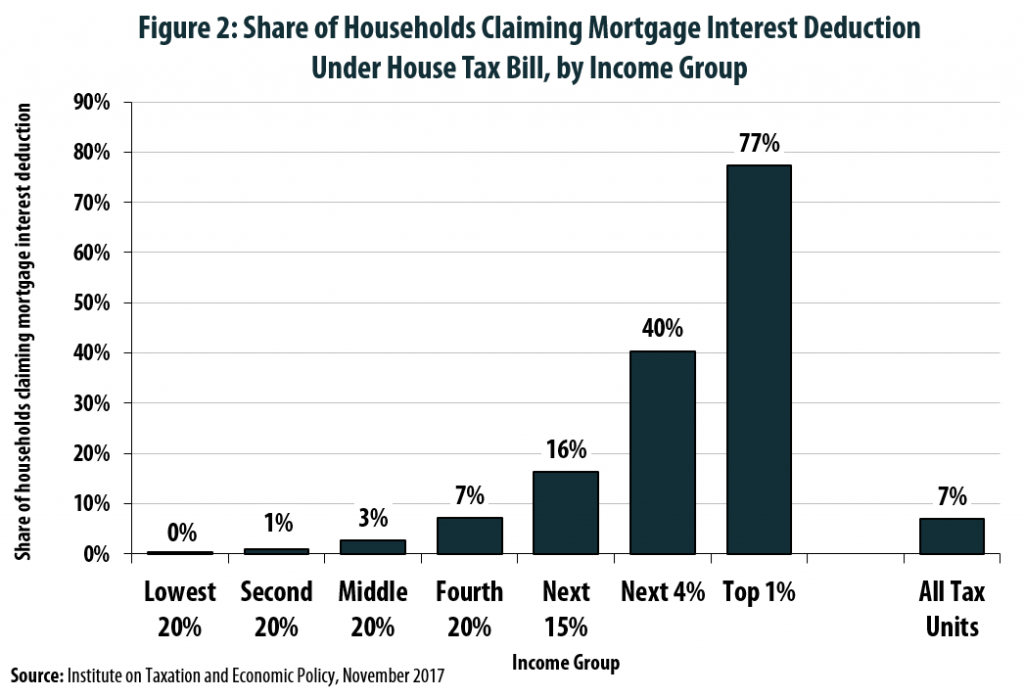

Mortgage Interest Deduction Wiped Out for 7 in 10 Current Claimants Under House Tax Plan

November 5, 2017 • By Carl Davis, Steve Wamhoff

Throughout the ongoing federal tax debate, President Trump and Congressional leadership have insisted that while many tax deductions and credits would be wiped out, the mortgage interest deduction would be spared from the chopping block. But while the proposal recently unveiled by House leaders retains the mortgage interest deduction on paper, the actual substance of this policy would be nearly unrecognizable to today’s homeowners.

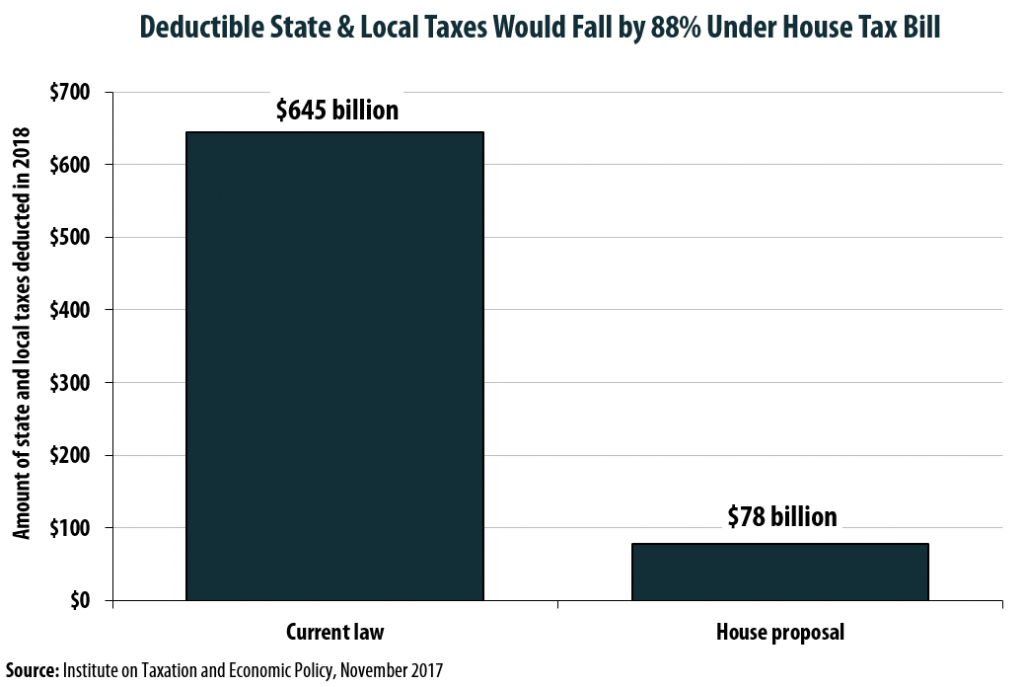

House Plan Slashes SALT Deductions by 88%, Even with $10,000 Property Tax Deduction

November 3, 2017 • By Carl Davis, Steve Wamhoff

One of the most contentious issues in the current federal tax debate is over what to do with the deduction for state and local taxes paid (the SALT deduction). Since the deduction’s benefits vary by state, the House proposal to drastically scale it back has led to an outcry among lawmakers from states such as New York, New Jersey, and California whose constituents would be impacted most dramatically by the change. In an attempt to address those concerns, House leadership agreed to partially retain the deduction for real estate property taxes paid (up to $10,000 per year) while still repealing…

A Chart Book on the U.S. Tax System

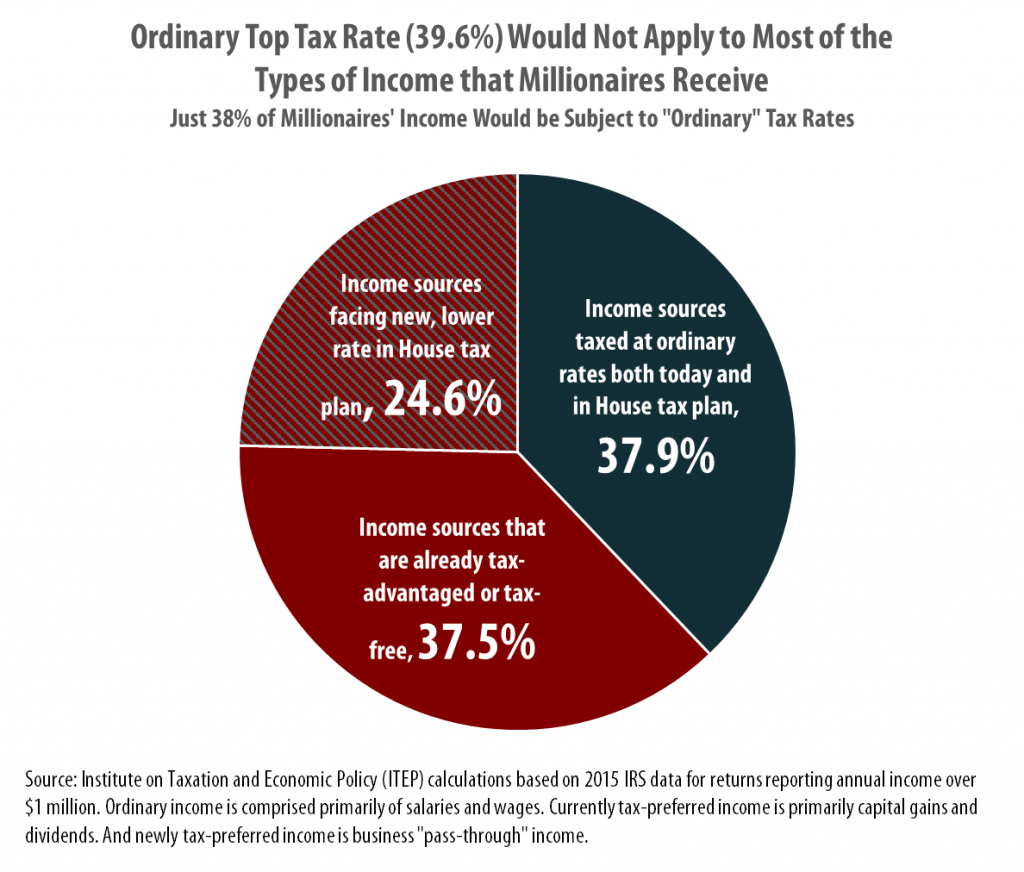

House Tax Plan Will Keep 39.6% Top Rate, But That Won’t Matter for Most Types of Income Going to the Rich

November 1, 2017 • By Carl Davis

In recent days, news that House tax writers will not seek to cut the top personal income tax rate below 39.6 percent on taxable income above $1 million has led some to question whether the newest iteration of the Trump-GOP tax plan will provide a major windfall to the wealthy—a fact that has so far been widely understood. Unfortunately, this second-guessing is unnecessary.

As our report on the Trump-GOP tax framework explained, in nine states plus the District of Columbia, more than a fifth of households would pay higher taxes under the framework.

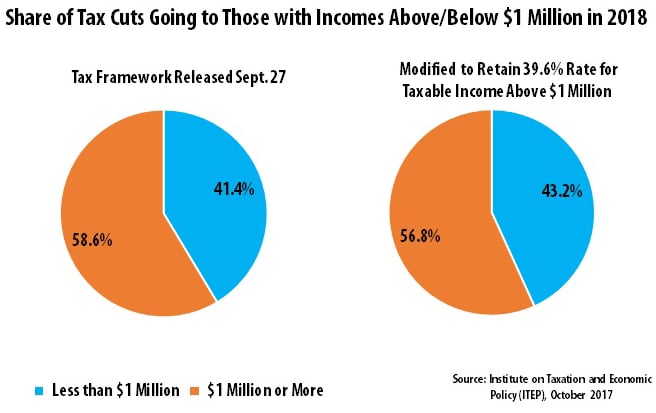

GOP Tax Plan Will Mainly Benefit Millionaires Even If Top Rate Remains 39.6 Percent

October 24, 2017 • By Steve Wamhoff

The Trump-GOP taxframework would reduce the top personal income tax rate from 39.6 percent to 35 percent, but now lawmakers are discussing keeping the top personal income tax rate at 39.6 percent for those with taxable income of more than $1 million. This modification would barely change the proposal’s overall impact.

The Jig Is Up: Republican Budget Resolution Finally Admits That Deficit Will Soar Under GOP Tax Plan

October 20, 2017 • By Alan Essig

For some lawmakers, annual deficits matter a lot—unless the nation is paying for tax cuts for the wealthy via deficit spending. Last night, Republican lawmakers demonstrated that previous grandstanding about the nation’s debt is much ado about nothing. The Senate approved a budget resolution on a party-line vote that would 1. fast-track legislation adding $1.5 trillion to the deficit over 10 years by cutting taxes, and 2. make it easy to enact this measure without a single Democratic vote.

Real tax reform would mean raising more revenue to make public investments and increasing the progressivity of the tax code. Many conservatives strongly disagree with this and insist that a substantial tax cut for the wealthiest Americans will grow the economy. Rather than engage in this policy debate based on policy ideals and principles, President Trump, other White House officials and GOP leaders have peppered their sales pitch for tax cuts with false claims about the amount of taxes that Americans pay and the effect the current GOP tax proposal would have on the tax system.

In addition to distributional analyses of existing and proposed tax law, ITEP provides policy recommendations for lawmakers to build a more equitable tax code, from progressive revenue-raising options to corporate tax reform to establishing a model for a wealth tax.