ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

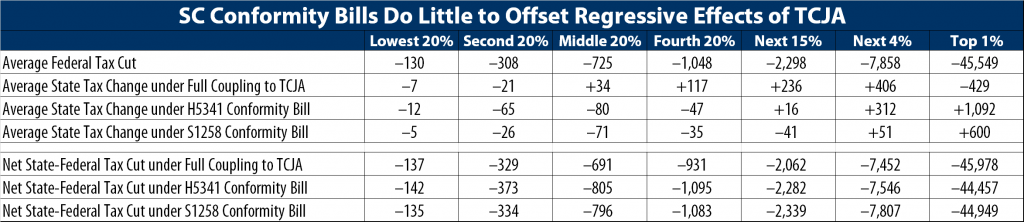

What’s at Stake in South Carolina’s Upcoming Tax Conformity Debate

June 22, 2018 • By Dylan Grundman O'Neill

South Carolina legislators will return next week to try to finalize a few issues before the end of their session and fiscal year on June 30th, including the question of how to respond to the federal Tax Cuts and Jobs Act (TCJA). That's a short timeframe with some important questions at stake, and some misinformation has been spread, so here's a quick guide to the facts, issues, and options.

The U.S. Supreme Court made big news this morning by allowing states to collect taxes due on internet purchases, which will help put main-street and online retailers on an even playing field while also improving state and local revenues and the long-term viability of the sales tax as a revenue source. Many states remain focused on more local issues, however, as Louisiana's third special session of the year kicked off, Massachusetts won a living wage battle while losing an opportunity to put a popular millionaires tax proposal before voters, and major fiscal debates continue in Maine, New Jersey, and Vermont.

State Rundown 6/13: Budget Crunch Time Sets in as State Fiscal Years Come to Close

June 13, 2018 • By ITEP Staff

With many state fiscal years ending June 30th, budget negotiations were completed recently in California, Illinois, Michigan, and North Carolina. New Jersey remains a state to watch as a government shutdown looms but leaders continue to disagree about a proposed millionaires tax, corporate taxes, and school funding. In other states looking to wealthy individuals and large corporations for needed revenues, Arizona's teacher pay crisis could be solved with a tax on its highest-income residents and a similar proposal in Massachusetts is polling well, but Seattle's new "head tax" could be on the chopping block.

State Rundown 6/1: Time Is Ripe for Closer Look at Intergovernmental Relations

June 1, 2018 • By ITEP Staff

This week, Virginia lawmakers overcame their budget impasse and approved an expansion of Medicaid, North Carolina's behind closed doors budget debate appears to be wrapping up, and Vermont's special session continues in the wake of the governor's vetoes of the state budget and accompanying tax bills. New research highlighted in our What We're Reading section shows that both corporate income tax cuts and business tax subsidies contribute to wider economic inequality. And the possible reconstitution of a federal commission on intergovernmental relations could not come soon enough, as other headlines this week include a state-to-local shift in school funding, governments…

As IRS Prepares to Act, Red-State Taxpayers Profit from Use of SALT “Workaround Credits”

May 24, 2018 • By Carl Davis

A new ITEP report explains the close parallels between the new workaround credits and existing state tax credits, including those benefiting private schools. The report comes the same day that the IRS and Treasury Department announced they would seek new regulations related to these tax credits. It notes that the SALT workarounds are emblematic of a broader weakness with the federal charitable deduction. And it cautions regulators to avoid a “narrow fix” that will only address the newest SALT workarounds (which, so far, have only been enacted in blue states) without also addressing other abuses of the deduction, which have…

State Rundown 5/23: Special Sessions Abound Amid Budget Vetoes, Stalemates, Federal Tax Bill

May 23, 2018 • By ITEP Staff

This week the governors of Louisiana and Minnesota both vetoed budget bills, leading to another special session in Louisiana and unanswered questions in Minnesota, and Missouri legislators managed to push through a tax shift bill just before adjourning their regular session and heading right into a special session to impeach their governor. Wisconsin and Wyoming localities are both looking at ways to raise revenues as state funding drops. And our What We're Reading section contains helpful pieces on changing demographics, the effects of wealth inequality on families with children, and the impacts of the Supreme Court sports gambling and online…

State Rundown 5/17: Don’t Bet on Legal Sports Betting Solving State Budget Woes

May 17, 2018 • By ITEP Staff

This week the U.S. Supreme Court opened the door to legal sports gambling in the states (see our What We're Reading section), which will surely be a hot topic in state legislative chambers, but most states currently have more pressing matters before them. The teacher pay crisis made news in North Carolina, Alabama, and nationally. Louisiana, Oregon, and Vermont lawmakers are headed for special sessions over tax and budget issues. And several other states have recently reached or are very near the end of their legislative sessions.

State Rundown 5/9: Iowa Digs a New Hole as Other States Try to Avoid or Climb Out of Theirs

May 9, 2018 • By ITEP Staff

This week we have news of a destructive tax cut plan finally approved in Iowa just as one was narrowly avoided in Kansas. Tax debates in Minnesota and Missouri will go down to the wire. And residents of Arizona and Colorado are considering progressive revenue solutions to their states' education funding crises.

State Rundown 5/3: Progressive Revenue Solutions to Fiscal Woes Gaining Traction

May 3, 2018 • By ITEP Staff

This week, Arizona teachers continued to strike over pay issues and advocates unveiled a progressive revenue solution they hope to put before voters, while a progressive income tax also gained support as part of a resolution to Illinois's budget troubles. Iowa and Missouri legislators continued to try to push through unsustainable tax cuts before their sessions end. And Minnesota and South Carolina focused on responding to the federal tax-cut bill.

State Rundown 4/27: Arbor Day Brings Some Fruitful Tax Developments, Some Shady Proposals

April 27, 2018 • By ITEP Staff

This Arbor Day week, the seeds of discontent with underfunded school systems and underpaid teachers continued to spread, with walkouts occurring in both Arizona and Colorado. And recognizing the need to see the forest as well as the trees, the Arizona teachers have presented revenue solutions to get to the true root of the problem. In the plains states, tax cut proposals continue to pop up like weeds in Kansas and threaten to spread to Iowa and Missouri, where lawmakers are running out of time but are still hoping their efforts to pass destructive tax cuts will bear fruit.

State Rundown 12/31/9999: IRS Glitch and Legislative Impasses Extend Tax Season

April 20, 2018 • By ITEP Staff

This week the IRS website asked some would-be tax filers to return after December 31, 9999. State legislators don't have quite that much time, but are struggling to wrap up their tax debates on schedule as well. Iowa legislators, for example, are ironically still debating tax cuts despite having run out of money to cover their daily expenses for the year. Nebraska's session wrapped up, but its tax debate continues in the form of a call for a special session and the threat of an unfunded tax cut going before voters in November. Mississippi's tax debate has been revived by…

State Rundown 4/13: Teacher Strikes, Special Sessions, Federal Cuts Haunting States

April 13, 2018 • By ITEP Staff

This Friday the 13th is a spooky one for many state lawmakers, as past bad fiscal decisions have been coming back to haunt them in the form of teacher strikes and walk-outs in Arizona, Kentucky, and Oklahoma. Meanwhile, policymakers in Maryland, Nebraska, New Jersey, Oregon, and Utah all attempted to exorcise negative consequences of the federal tax-cut bill from their tax codes. And our What We're Reading section includes yet another stake to the heart of the millionaire tax-flight myth and other good reads.

This week, Kentucky legislators passed a bill shifting taxes onto low- and middle-income families, Oklahoma legislators reached a deal on education funding, and their counterparts in Kansas proffered multiple proposals for their education funding needs. Meanwhile, tax debates are coming down to the wire in Iowa, Missouri, and Nebraska, and responses to the federal tax-cut bill were settled on in Maryland, New York, and Wisconsin.

Trends We’re Watching in 2018, Part 4: Tax Cuts & Tax Shifts

April 4, 2018 • By Lisa Christensen Gee

While a lot of tax activities in the states this year have focused on figuring out the impact of federal tax changes on states' bottom lines and residents, there also have been unrelated efforts to cut state taxes or shift from personal income taxes to more regressive sales taxes.

State Rundown 3/30: Several Major Tax Debates Will March on into April

March 30, 2018 • By ITEP Staff

This week, after the recent teacher strike in West Virginia, teacher pay crises brought on by years of irresponsible tax cuts also made headlines in Arizona and Oklahoma. Maine and New York lawmakers continue to hash out how they will respond to the federal tax bill. And their counterparts in Missouri and Nebraska attempt to push forward their tax cutting agendas.

Trends We’re Watching in 2018, Part 3: Improvements to Tax Credits for Workers and Families

March 26, 2018 • By Aidan Davis

This has been a big year for state action on tax credits that support low-and moderate-income workers and families. And this makes sense given the bad hand low- and middle-income families were dealt under the recent Trump-GOP tax law, which provides most of its benefits to high-income households and wealthy investors. Many proposed changes are part of states’ broader reaction to the impact of the new federal law on state tax systems. Unfortunately, some of those proposals left much to be desired.

State Rundown 3/22: Some Spring State Tax Debates in Full Bloom, Others Just Now Surfacing

March 22, 2018 • By ITEP Staff

The onset of spring this week proved to be fertile ground for state fiscal policy debates. A teacher strike came to an end in West Virginia as another seems ready to begin in Oklahoma. Budgets were finalized in Florida, West Virginia, and Wyoming, are set to awaken from hibernation in Missouri and Virginia, and are being hotly debated in several other states. Meanwhile Idaho, Iowa, Maryland, and Minnesota continued to grapple with implications of the federal tax-cut bill. And our What We're Reading section includes coverage of how states are attempting to further public priorities by taxing carbon, online gambling,…

With many state legislative sessions about halfway through, the ripple effects of the federal tax-cut bill took a back seat this week as states focused their energies on their own tax and budget issues. Major proposals were released in Nebraska and New Jersey, one advanced in Missouri, and debates wrapped up in Florida, Utah, and Washington. Oklahoma and Vermont are considering ways to improve education funding, while California, New York, and Vermont look to require more of their most fortunate residents. And check in on "what we're reading" for resources on the online sales tax debate, the role of property…

Trends We’re Watching in 2018, Part 2: State Revenue Shortfalls and the Impact on Education and Other Services

March 12, 2018 • By Aidan Davis

Many states struggle with a need for revenue, yet their lawmakers show little will to raise taxes to fund public services. Revenue shortfalls can prove to be a moving target. Some states with expected shortfalls are now seeing rosier forecasts. But as estimates come in above or below projections, states continue to grapple with how and whether to raise the revenue necessary to adequately fund key programs. Here are a few trends that are leading to less than cushy state coffers this year.

This week was very active for state tax debates. Georgia, Idaho, and Oregon passed bills reacting to the federal tax cut, as Maryland and other states made headway on their own responses. Florida lawmakers sent a harmful "supermajority" constitutional amendment to voters. New Jersey now has two progressive revenue raising proposals on the table (and a need for both). Louisiana ended one special session with talks of yet another. And online sales taxes continued to make news nationally and in Kansas, Nebraska, and Pennsylvania.

Trends We’re Watching in 2018, Part 1: State Responses to Federal Tax Cut Bill

March 5, 2018 • By Dylan Grundman O'Neill

Over the next few weeks we will be blogging about what we’re watching in state tax policy during 2018 legislative sessions. And there is no trend more pervasive in states this year than the need to sort through and react to the state-level impact of federal tax changes enacted late last year.

State Rundown 2/28: February a Long Month for State Tax Debates

February 28, 2018 • By ITEP Staff

February may be the shortest month but it has been a long one for state lawmakers. This week saw Arizona, Idaho, Oregon, and Utah seemingly approaching final decisions on how to respond to the federal tax-cut bill, while a bill that appeared cleared for take-off in Georgia hit some unexpected turbulence. Other states are still studying what the federal bill means for them, and many more continue to debate tax and budget proposals independently of the federal changes. And be sure to check our "What We're Reading" section for news on corporate tax credits from multiple states.

This week, major tax packages relating to the federal tax-cut bill made news in Georgia, Iowa, and Louisiana, as Minnesota and Oregon lawmakers also continue to work out how their states will be affected. New Mexico's legislative session has finished without significant tax changes, while Idaho and Illinois's sessions are beginning to heat up, and Vermont's school funding system is under the microscope.

This Valentine's week finds California, Georgia, Missouri, New York, Oregon, and other states flirting with the idea of coupling to various components of the federal tax-cut bill. Meanwhile, lawmakers seeking revenue solutions to budget shortfalls in Alaska, Oklahoma, and Wyoming saw their advances spurned, and anti-tax advocates in many states have been getting mixed responses to their tax-cut proposals. And be sure to check out our "what we're reading" section to see how states are getting no love in recent federal budget developments.

State Rundown 2/8: State Responses to Federal Bill Gaining Steam

February 8, 2018 • By ITEP Staff

Several states this week are looking at ways to revamp their tax codes in response to the federal tax cut bill, with Georgia, Idaho, Maryland, Nebraska, and Vermont all actively considering proposals. Meanwhile, Connecticut, Louisiana, and Pennsylvania are working on resolving their budget shortfalls. And transportation funding is getting needed attention in Mississippi, Utah, and Wisconsin.