ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Law360: 3 Questions State Tax Pros Have About The Pandemic Relief Law

March 16, 2021

Policymakers and state tax specialists noticed almost immediately that if states want to take full advantage of the $350 billion cash infusion the ARPA gives state and local governments, it appears they are going to have to give up some autonomy. While those who spoke to Law360 said only explicit guidance from the U.S. Treasury, […]

GeekWire: Capital Gains Tax in Washington State: Is it about Fairness and Funding, or Will it Drive Away Startups?

March 16, 2021

Dylan Grundman O’Neill, a senior state tax policy analyst with the Institute on Taxation and Economic Policy, said that research shows that in Washington, more so than in any other state, “the higher your income, the lower your tax rate.” “The top 1% pay an effective rate of only about 3%,” O’Neill said. “While middle-income […]

Fortune: Biden Plots Tax Hikes on Corporations and High-earners to Fund Ambitious Infrastructure Plan

March 16, 2021

Should the President get the rest of the Democratic caucus on board with his vision of a massive infrastructure bill funded by higher taxes on corporations and wealthy individuals, Biden could have yet another legislative victory on his hands—one even bigger and more significant than his coronavirus stimulus bill, with further-reaching economic consequences that could […]

Business Insider: H&R Block Customers Will Get 3rd Stimulus Check, No Delay

March 16, 2021

H&R Block also gives taxpayers the option to receive their refund on a debit card called the Emerald Card. Anyone who qualifies for the third stimulus check and had their most recent refund sent to an Emerald Card will get their money deposited directly onto the card. The nonpartisan Institute on Taxation and Economic Policy estimated […]

Yahoo News: ‘Helping the Country Prosper’: Undocumented Immigrants Pay Billions in US Taxes Each Year — and Have Been for Decades

March 16, 2021

A report from the office shows that 50% to 75% of undocumented immigrants pay billions in taxes each year — and have been since the Internal Revenue Service created a program 25 years ago allowing people without a Social Security number to file taxes. When it comes to state and local taxes, undocumented immigrants pay […]

The Columbus Dispatch: Undocumented Immigrants Pay Billions in Taxes Each Year — and Have Been for 25 Years

March 15, 2021

When it comes to state and local taxes, undocumented immigrants pay more than $11 billion a year, according to a 2017 report from the Institute on Taxation and Economic Policy, a nonpartisan nonprofit based in Washington, D.C. In Ohio, they paid $83.2 million in state and local taxes in 2017, according to the institute. Read more

Bloomberg: Biden’s Rescue Hasn’t Stopped States’ Tax-the-Rich Rally Call

March 15, 2021

“No amount of federal aid can change the fact that nearly all state tax codes worsen the economic and racial inequalities that this pandemic has laid bare,” said Dylan Grundman O’Neill, senior state policy analyst at the left-leaning Institute on Taxation and Economic Policy. Read more

CNBC: Expecting a $1,400 Stimulus Check by Mail? Here’s What to Watch for

March 15, 2021

Instead, the checks will be signed by a career official at the Bureau of Fiscal Service, which is working with the IRS to deliver the money. This has been the precedent prior to the previous presidential administration, according to a Treasury official. “It’s really unusual to have an individual president’s name on a check,” said […]

Trickle-Down Myths Swamp Tax Policy Debates in Mississippi and West Virginia

March 15, 2021 • By Aidan Davis

Recent proposals in both Mississippi and West Virginia seek to pare back, and ultimately eliminate, each state’s income tax while shifting the responsibility of funding services even more onto low- and middle-income taxpayers through increased consumption taxes. The states are moving forward with this tax experiment even though a similar experiment notoriously and immediately sent Kansas into a financial tailspin.

MinnPost: Is Minnesota’s Tax System Unfair?

March 15, 2021

The Institute on Taxation and Economic Policy’s regular assessment of state taxes concludes that just five states and the District of Columbia have positive scores on progressivity: California, Delaware, New Jersey, Vermont and Minnesota. The progressive systems rely less on consumption taxes and more on income taxes, with rates that increase with wealth. They also […]

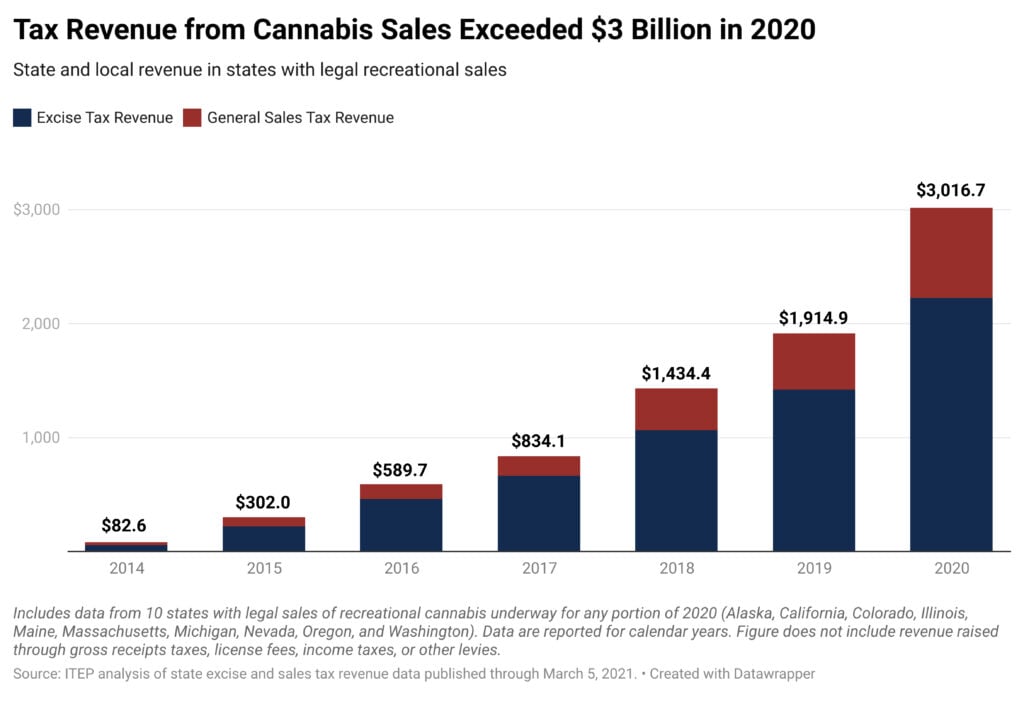

State and Local Cannabis Tax Revenue Jumps 58%, Surpassing $3 Billion in 2020

March 15, 2021 • By Carl Davis

Cannabis taxes are a small part of state and local budgets, clocking in at less than 2 percent of tax revenue in the states with legal adult-use sales. But they’re also one of states’ fastest-growing revenue sources. Powered by an expanding legal market and a pandemic-driven boost in cannabis use, excise and sales taxes on […]

Washington Post: Joe Biden’s COVID-19 Relief Bill Is an Extraordinary Achievement (Opinion)

March 14, 2021

The American Rescue Plan assumes that almost everyone can use a helping hand. According to the Institute on Taxation and Economic Policy, roughly 85 percent of adults and children will receive a stimulus payment — meaning, as Biden said in his Thursday night speech, that “a typical family of four earning about $110,000 will get […]

Independent Record: GOP Lawmaker Doubles Tax Cut Rate in Montana Senate Bill

March 12, 2021

Under the un-amended bill, a person earning from $40,000-$63,000 would see a reduction of about $14, according to an analysis of the proposal by the Institute on Taxation and Economic Policy. The House Taxation Committee delayed action on another bill that also aims to lower the state’s top income tax rate after hitting snags in […]

Fortune: The COVID Relief Bill Doesn’t Raise Taxes on Gig Workers

March 12, 2021

The new tax revenue is money that should’ve been collected all along, but many workers didn’t have the documentation that serves as a reminder and guide to reporting the incomes they make on these platforms. “You are paying what you owe,” said Steve Wamhoff, director of federal tax policy at think tank the Institute on […]

CNBC: New $1,400 Stimulus Checks Are on the Way. Here’s Who Qualifies for the Money

March 12, 2021

“If you got a full payment last time, you will get the full payment this time,” provided your income has not substantially changed, said Steve Wamhoff, director of federal tax policy at the Institute on Taxation and Economic Policy. The $1,400 checks will generally be based on either 2020 or 2019 tax returns, depending on […]

Associated Press: COVID Relief Bill Could Permanently Alter Social Safety Net

March 12, 2021

“The question will be, do they want child poverty to go back up again" by letting that credit expire, said Steve Wamhoff, director of federal tax policy for the liberal Institute on Taxation and Economic Policy.

Forbes: The Historic Child Tax Credit Expansion Could Provide Monthly Payments To Millions Of Households. Here’s How it Would Work

March 11, 2021

The amount of the credit is being increased, but that’s not the whole story. For the first time in history, families will qualify to receive the child tax credit as a monthly stipend. These monthly payments will provide up to $300 per child starting this July through the end of the year (the remaining credit […]

Epoch Times: Biden Administration Eyes Raising Corporate Tax Rate to Pay for Stimulus

March 11, 2021

The tax cuts of 2017, which was signed into law by President Donald Trump, reduced the corporate income tax rate to 21 percent from 35 percent beginning in 2018. It also reduced the tax rates for pass-through businesses and individuals. Progressives criticized the cuts, calling it a giveaway to the rich and corporations. The Institute […]

The Balance: $1.9 Trillion Rescue Bill Hinged On Just 9 Votes

March 11, 2021

The relief package will send stimulus checks of up to $1,400 per taxpayer and $1,400 per dependent, benefiting an estimated 280 million adults and children, according to estimates from the Institute on Taxation and Economic Policy, a nonpartisan nonprofit. Together with the ramped-up rollout of COVID-19 vaccines, the relief package is set to provide the […]

Jacobin: The New COVID-19 Relief Bill Is Good, But Not Good Enough

March 11, 2021

As a spending bill, the ARP’s impact cannot be overstated. It is the mirror opposite of the Trump tax cuts, targeting most of its benefits to the bottom end of the income ladder, rather than the top. It will send stimulus checks up to $1,400 to an estimated 280 million Americans, continue additional $300 weekly […]

The Center Square: Biden Signs $1.9 Trillion Stimulus Bill into Law

March 11, 2021

The $1,400 stimulus checks included in the legislation are expected to reach an estimated 85% of Americans and cost $410 billion, according to the Institute on Taxation and Economic Policy. Read more

Rep. Doggett and Sen. Whitehouse Introduce Bill to Crack Down on Offshore Corporate Tax-Dodging

March 11, 2021 • By Steve Wamhoff

The 2017 tax law simply replaced one set of loophole-ridden rules that favored offshore profits over domestic profits with a new set of loophole-ridden rules doing the same thing. A bill introduced today by Rep. Lloyd Doggett and Sen. Sheldon Whitehouse would finally fix this to follow a simple principle: we should tax the offshore profits and domestic profits of our corporations the same way.

Fort Worth Star-Telegram: Texas Parents Get Big Tax Breaks from COVID Relief Bill

March 11, 2021

Nearly 6.8 million Texans with children could receive monthly checks starting in July, under the new economic relief plan President Joe Biden signed into law Thursday. Nearly one of three adult Texans would qualify for the aid, which would help 7.8 million Texas children, according to an analysis from the Institute on Taxation and Economic […]

Bloomberg: Millions of Americans Miss Out on Stimulus ‘Survival’ Checks

March 11, 2021

The think tank Institute on Taxation and Economic Policy estimates that 280 million people would receive a full or partial payment under the new criteria, compared with 288 million who received all or some of the second $600 direct payment approved in December. Steve Wamhoff, the institute’s director of federal tax policy, said that the […]

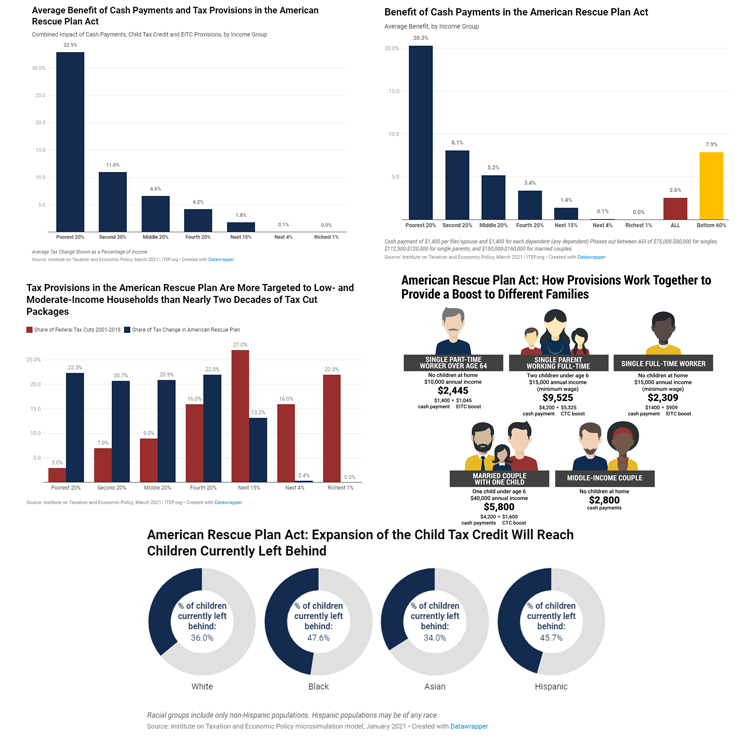

Targeted Relief and the American Rescue Plan in Five Charts

March 10, 2021 • By Stephanie Clegg

The American Rescue Plan Act is unique in that it employs the tax code to deliver relief to those struggling most. These five charts provide a glimpse of how the plan helps families across the income spectrum and also targets economic relief to low- and moderate-income families in the form of cash payments and expansions to the Child Tax Credit and Earned Income Tax Credit.