ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

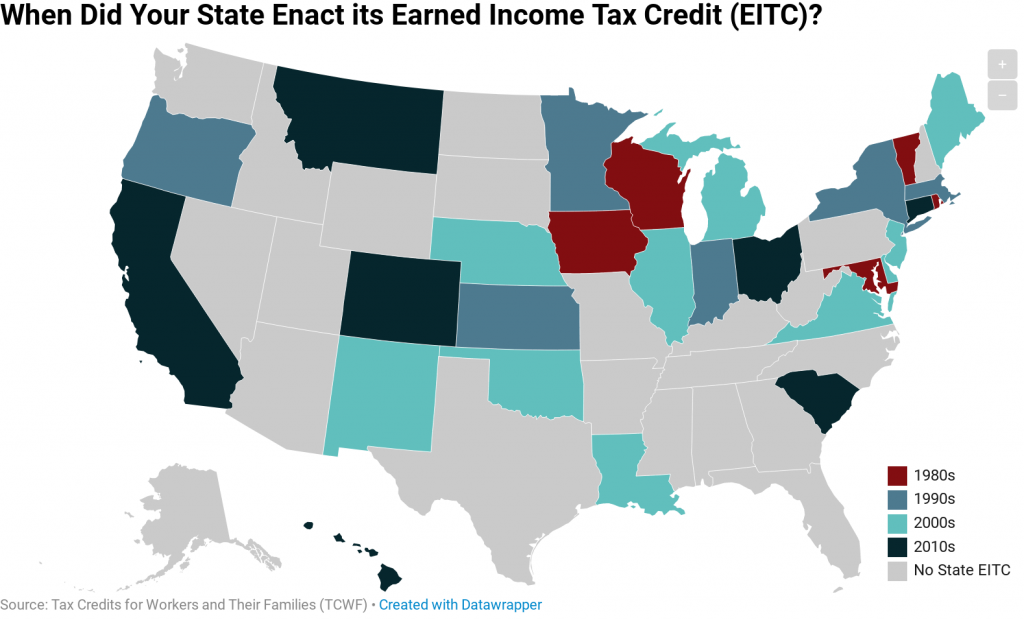

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

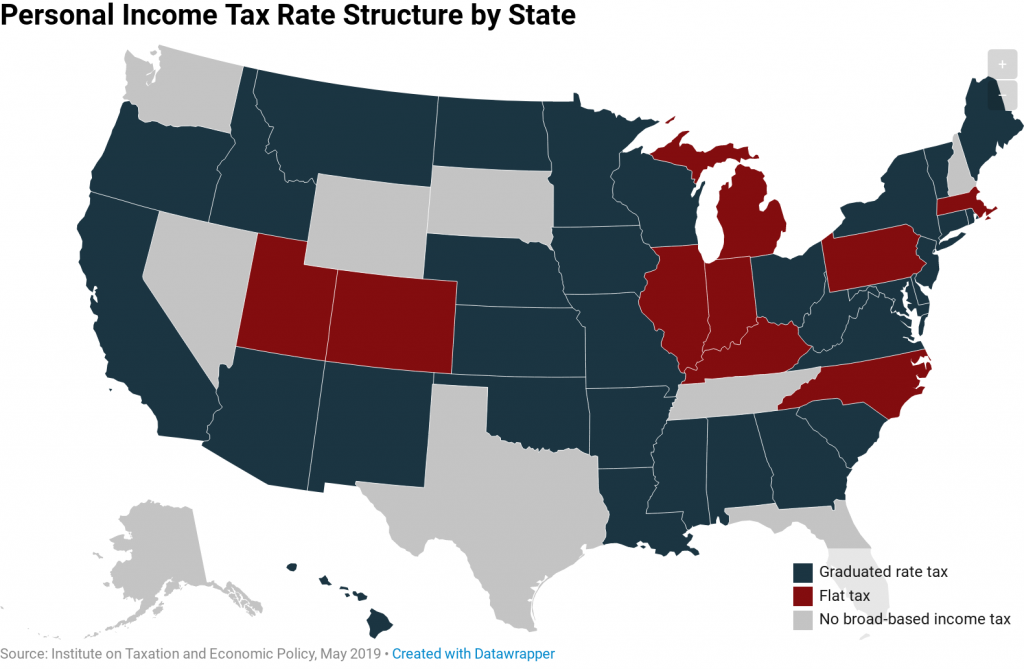

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

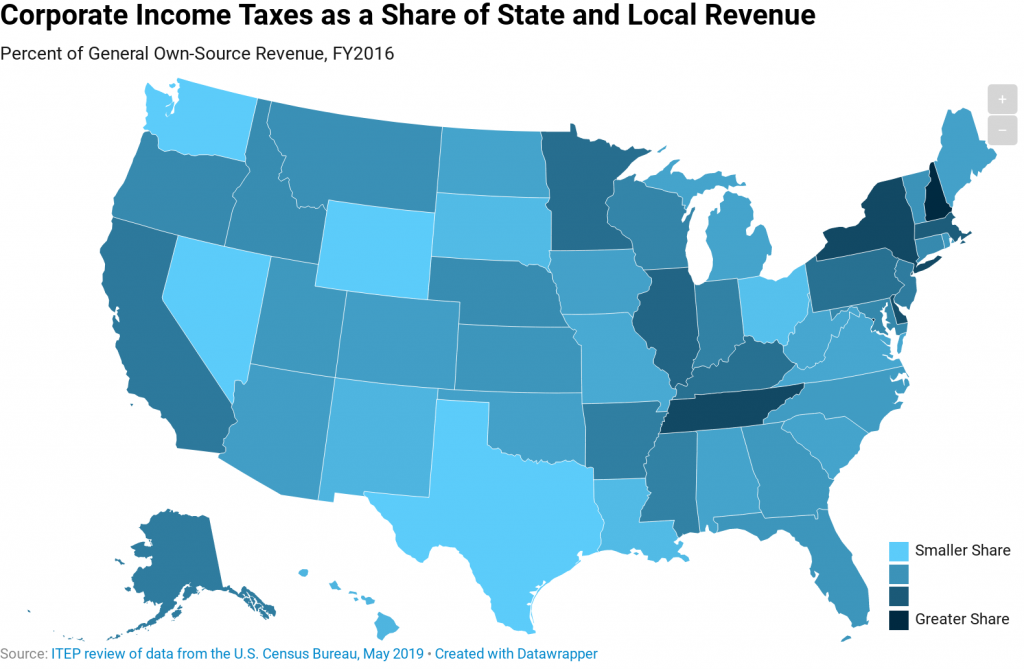

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

After states implemented laws that allow taxpayers to circumvent the new $10,000 cap on deductions for state and local taxes (SALT), the IRS has proposed regulations to address this practice. It’s a safe bet the IRS will try to crack down on the newest policies that provide tax credits for donations to public education and other public services, but it remains to be seen whether new regulations will put an end to a longer-running practice of exploiting tax loopholes in some states that allow public money to be funneled to private schools.

Policy Matters Ohio: Refundability Now

June 4, 2019

The federal credit is so effective that 29 states, including Ohio, have used it as a model for their own EITCs, calculating the state credit’s value as a percentage of the federal one. However, Ohio’s credit leaves out the most important part: refundability.

From a new report comparing five major federal tax credit proposals to resources for continuing gas tax debates and the launch of ITEP's interactive library On the Map, here’s a summary of ITEP news this month.

Congressional Research Service Calls Three Strikes on the Trump Tax Cuts

May 30, 2019 • By Matthew Gardner

This new report is the most comprehensive assessment yet undertaken by the CRS, which has an unimpeachable reputation as an impartial arbiter of policy disputes. So, when it says that the TCJA doesn’t appear to have grown wages or the economy and has made our long-term budget deficits even worse, it’s a judgment that will last.

In 1986, Rhode Island became the first state to enact a tax credit patterned after the federal Earned Income Tax Credit (EITC). Since then, EITCs have become increasingly widespread at the state level with 28 states and the District of Columbia now offering them. These credits are designed to improve family economic security by bolstering […]

Unlike Trump-GOP Tax Law, There Are Tax Plans That Would Actually Deliver on Promise to Help Working People

May 24, 2019 • By Alan Essig

Using the tax code to boost the economic security of low- and moderate-income families is a proven strategy. These bold proposals would go much further than any policy currently on the books, and their approach directly contrasts with longstanding supply-side theories that call for continual tax cuts to those who are already economically faring far better than everyone else.

Connecticut Voices for Children: Impact of the FY 2020-2021 Appropriations and Finance Committee Budget and Revenue Proposals on Children and Families

May 23, 2019

The report recommends that state legislators and the Governor repeal the state’s Bond Lock, revise the volatility cap, and implement additional tax reforms that begin to correct the state’s regressive revenue system by asking more of the state’s wealthiest residents. Read more

One of the most important decisions that must be made when designing a state personal income tax is whether to charge taxpayers a single flat rate on all their taxable income, or whether to levy a series of graduated rates that ask more of high-income taxpayers

Proposals for Refundable Tax Credits Are Light Years from Tax Policies Enacted in Recent Years

May 22, 2019 • By Steve Wamhoff

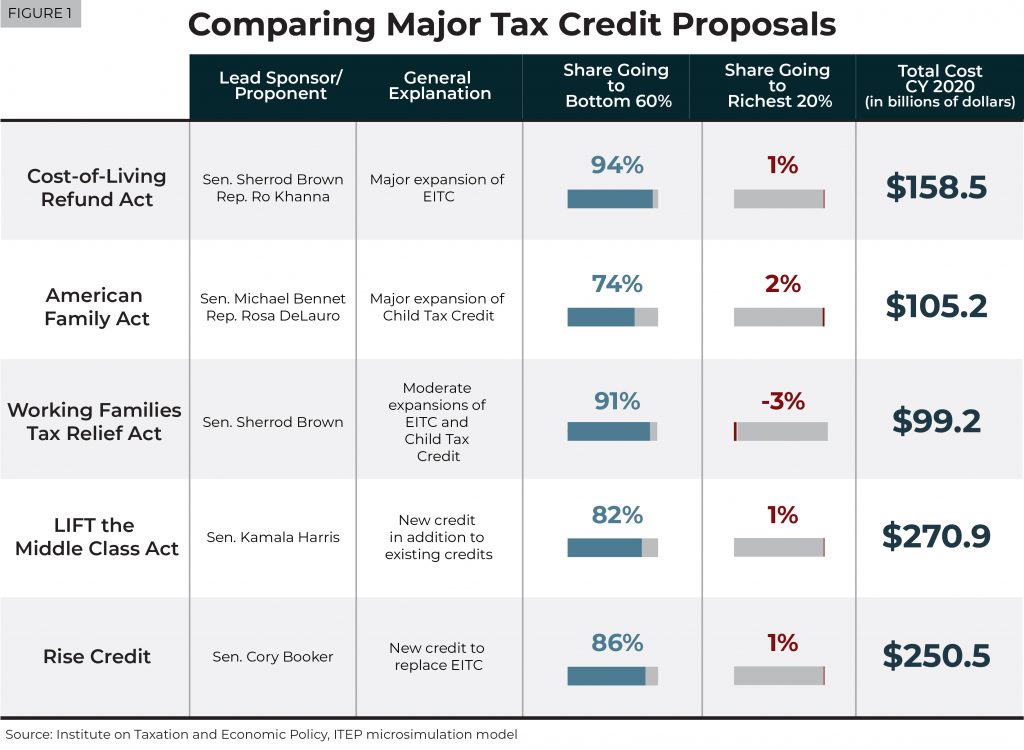

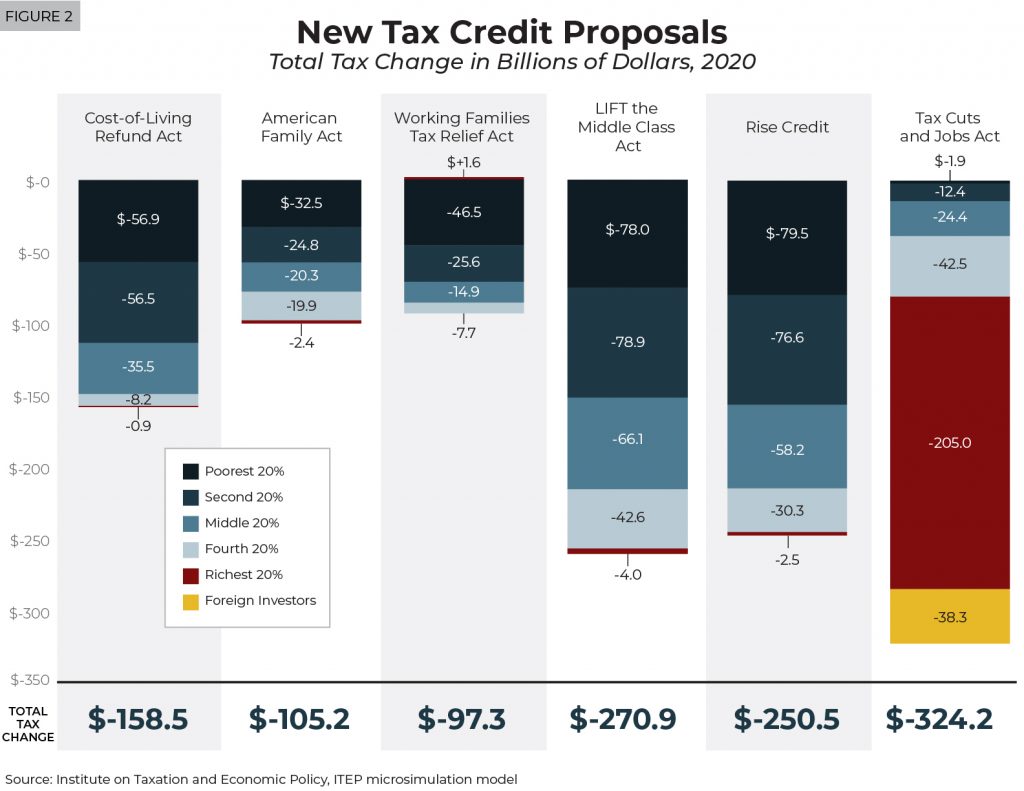

A new ITEP report examines five big proposals that have been announced this year to create or expand tax credits to address inequality and help low- and middle-income households.

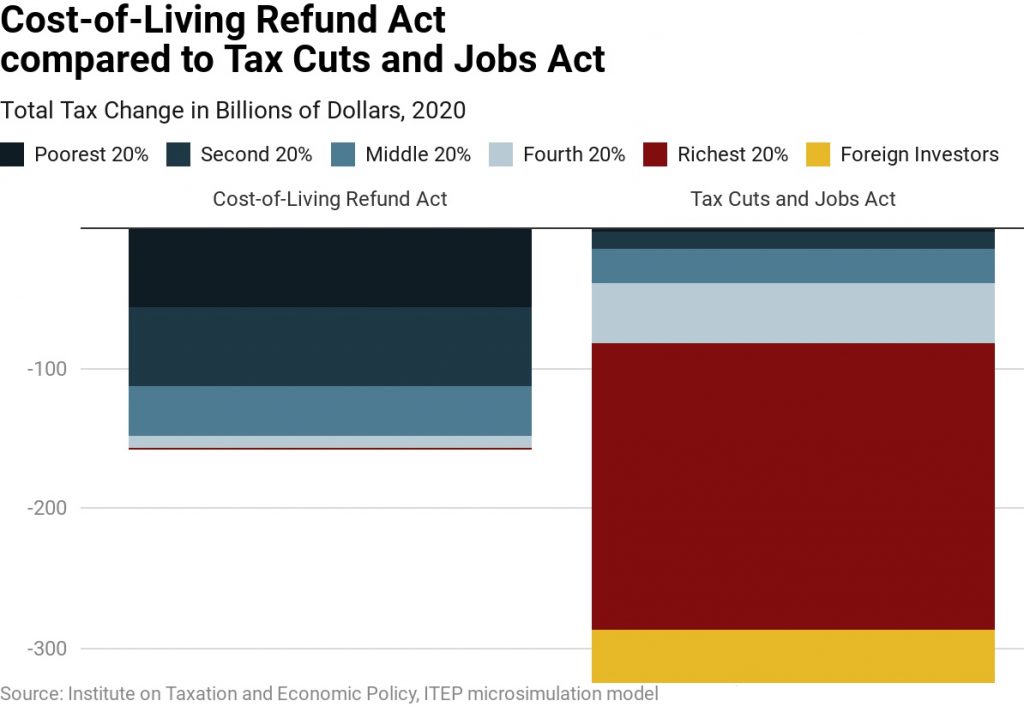

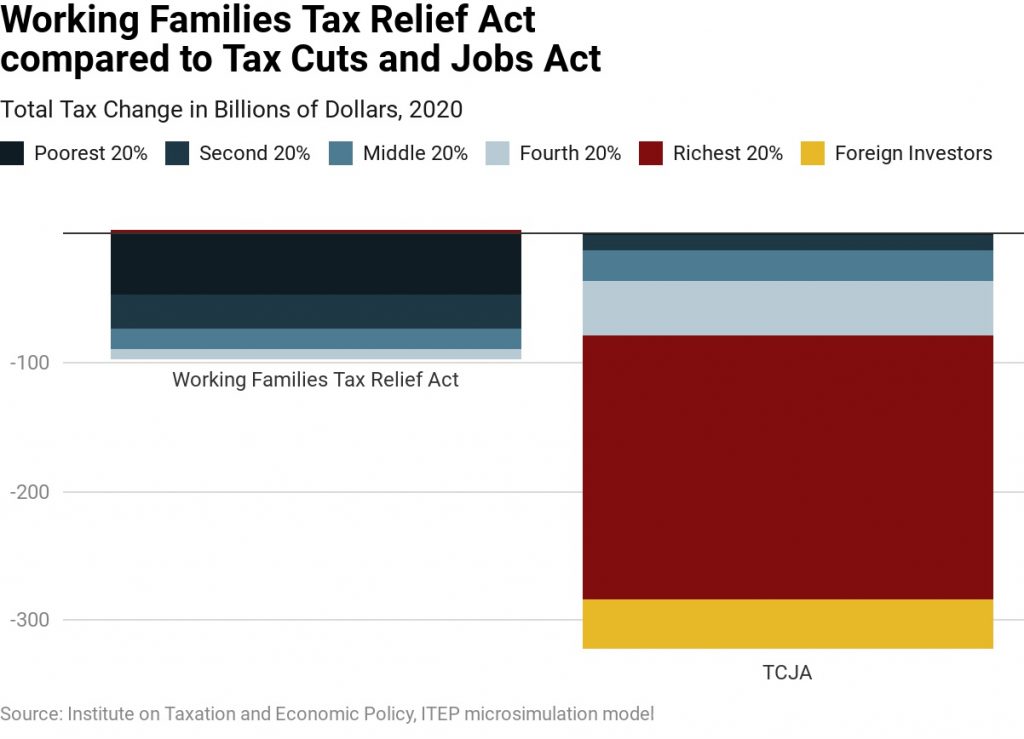

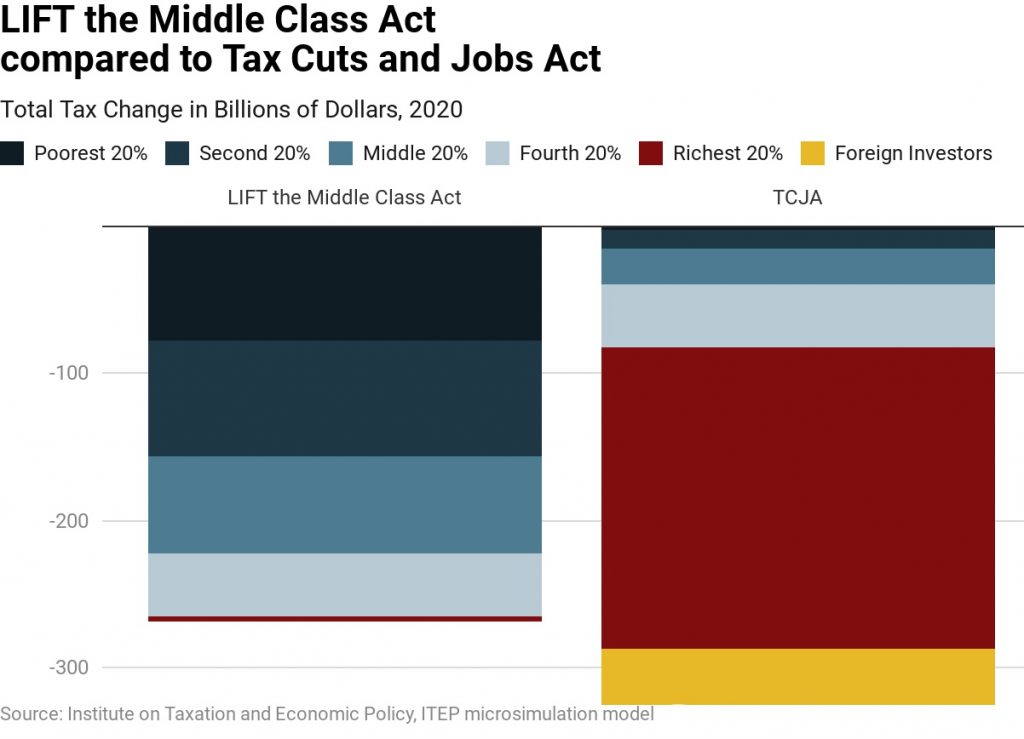

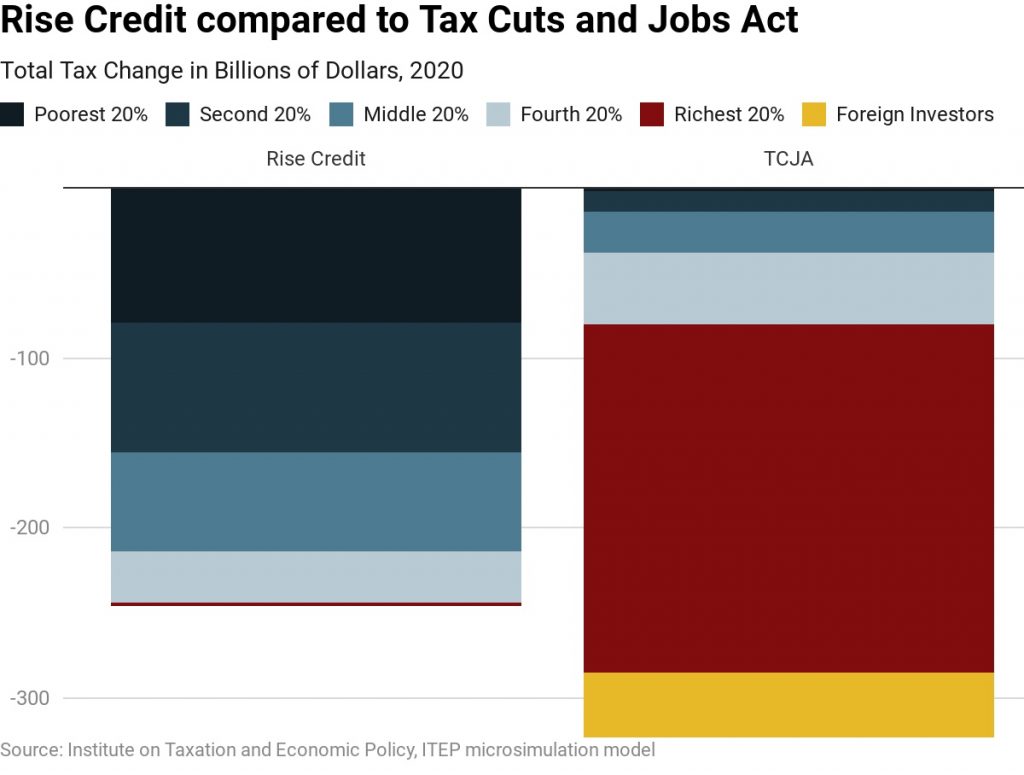

Federal lawmakers have recently announced at least five proposals to significantly expand existing tax credits or create new ones to benefit low- and moderate-income people. While these proposals vary a great deal and take different approaches, all would primarily benefit taxpayers who received only a small share of benefits from the Tax Cuts and Jobs Act.

The Cost-of-Living Refund Act would expand the Earned Income Tax Credit (EITC) for low- and moderate-income working people. The maximum EITC would nearly double for working families with children. Working people without children would receive an EITC that is nearly six times the size of the small EITC that they are allowed under current law.

The American Family Act would expand the Child Tax Credit (CTC) for low- and middle-income families. The CTC would increase from $2,000 under current law to $3,000 for each child age six and older and to $3,600 for each child younger than age six. The proposal removes limits on the refundable part of the credit so that low- and moderate-income families with children could receive the entire credit.

The Working Families Tax Relief Act would expand the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC) for low- and middle-income families.

The LIFT (Livable Incomes for Families Today) the Middle Class Act would create a new tax credit of up to $3,000 for single people and up to $6,000 for married couples, which would be an addition to existing tax credits. Eligible taxpayers would be allowed a credit equal to the maximum amount or their earnings, whichever is less. Income limits would prevent well-off households from receiving the credit.

The Rise Credit would replace the existing EITC. In most cases, the Rise Credit would be $4,000 for single people and $8,000 for married couples. Eligible taxpayers would be allowed a credit equal to the maximum amount or their earnings, whichever is less.

Gas Taxes Have Gone Up in Most States, but Decades-Long Procrastinators Remain

May 21, 2019 • By Carl Davis

The upcoming Memorial Day weekend marks the start of the traditional summer driving season. In most states, summer road-trippers are paying more gas tax than they did a few years ago and are benefiting from smoother and safer roads as a result. In total, 30 states have raised or reformed their gas taxes in the last six years.

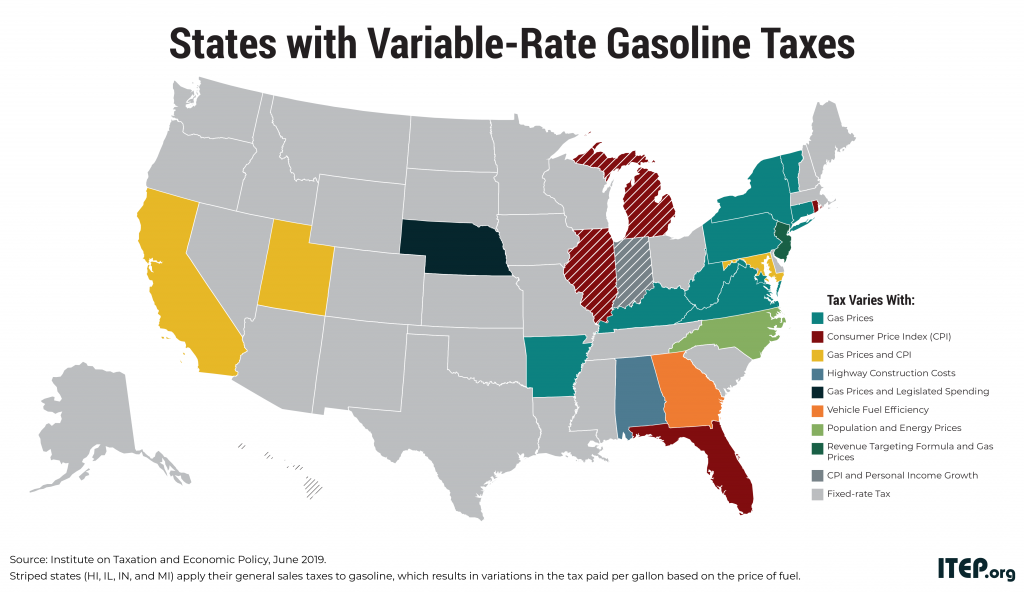

These States Abandoned Old Gas Tax Structures in Favor of More Sustainable Variable-Rate Gas Taxes

May 20, 2019 • By ITEP Staff

Because of these reforms, more than 193 million people (or 59 percent of the U.S. population) now live in places where the state gas tax rate automatically varies over time.

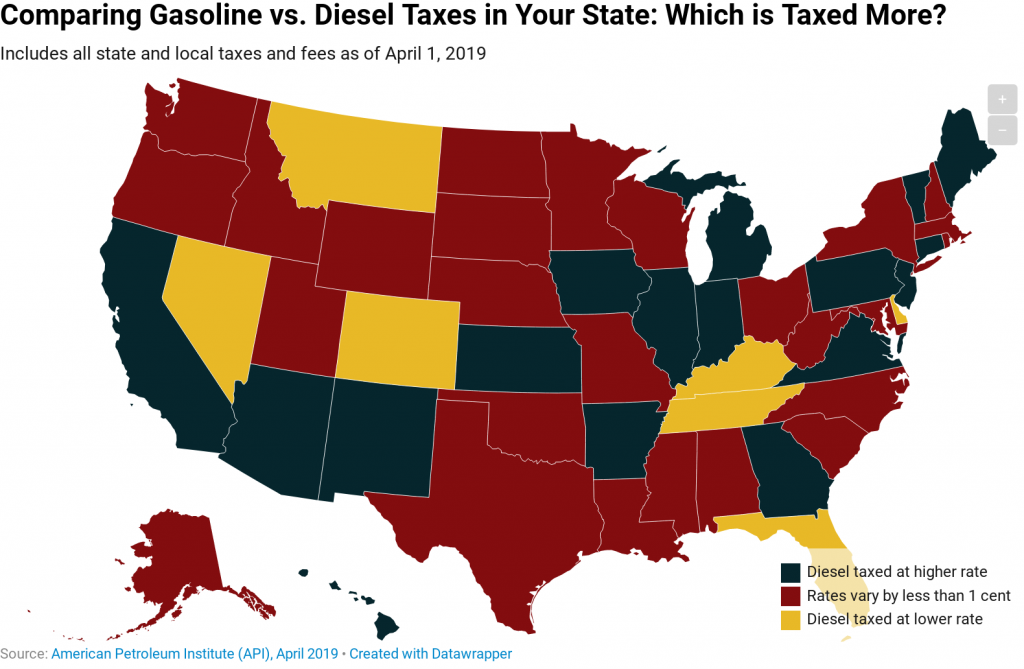

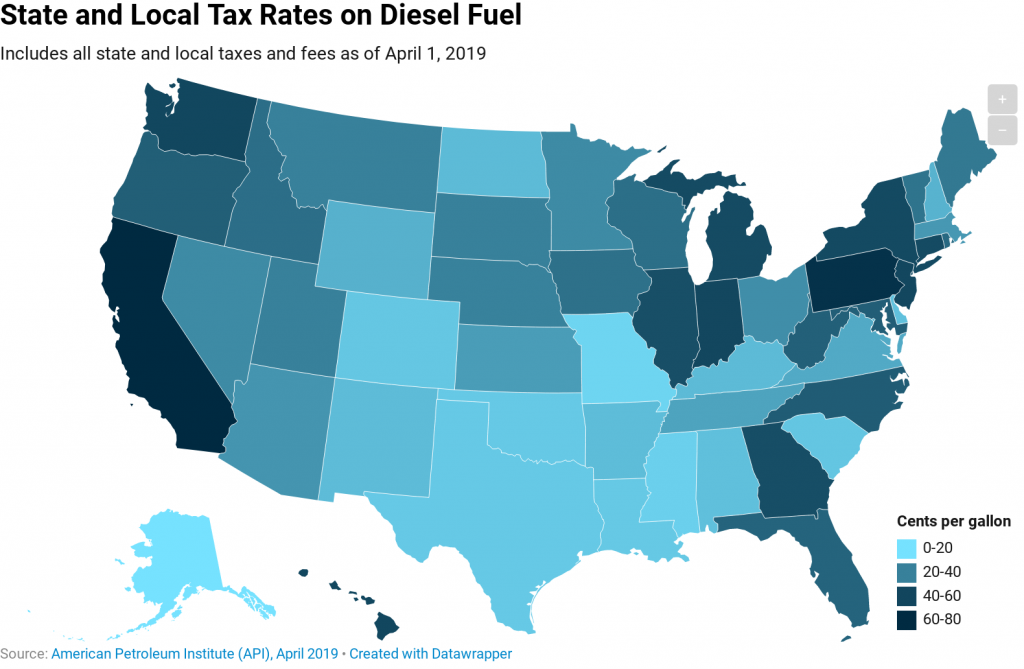

Twenty-six states and the District of Columbia tax these two fuel types at the same rate or very similar rates, as of April 2019, according to data from the American Petroleum Institute.

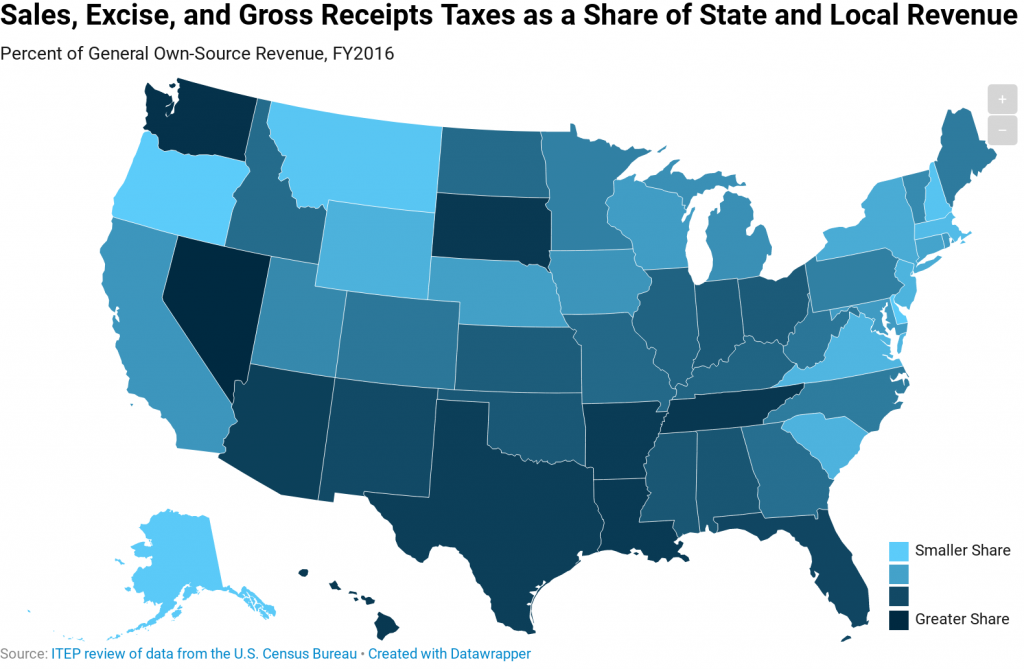

Consumption taxes (including general sales taxes, excise taxes on specific products, and gross receipts taxes) are an important revenue source for state and local governments. While five states lack state-level general sales taxes (Alaska, Delaware, Montana, New Hampshire, and Oregon), every state levies taxes on some types of consumption.

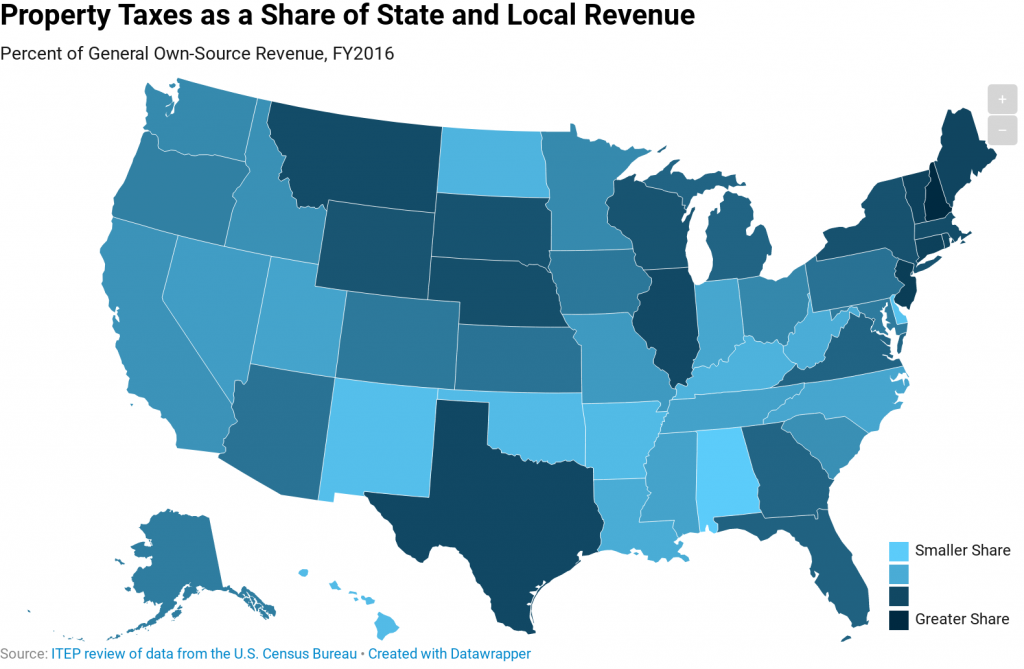

The property tax is the oldest major revenue source for state and local governments and remains an important mechanism for funding education and other local services. This map shows the share of state and local general revenue in each state that is raised through property taxes.

The tax rates identified in this map include state and local excise and sales taxes on diesel fuel, as well as various fees, as calculated by the American Petroleum Institute (API). These taxes are levied in addition to the federal government’s 24.4-cent-per-gallon diesel tax.

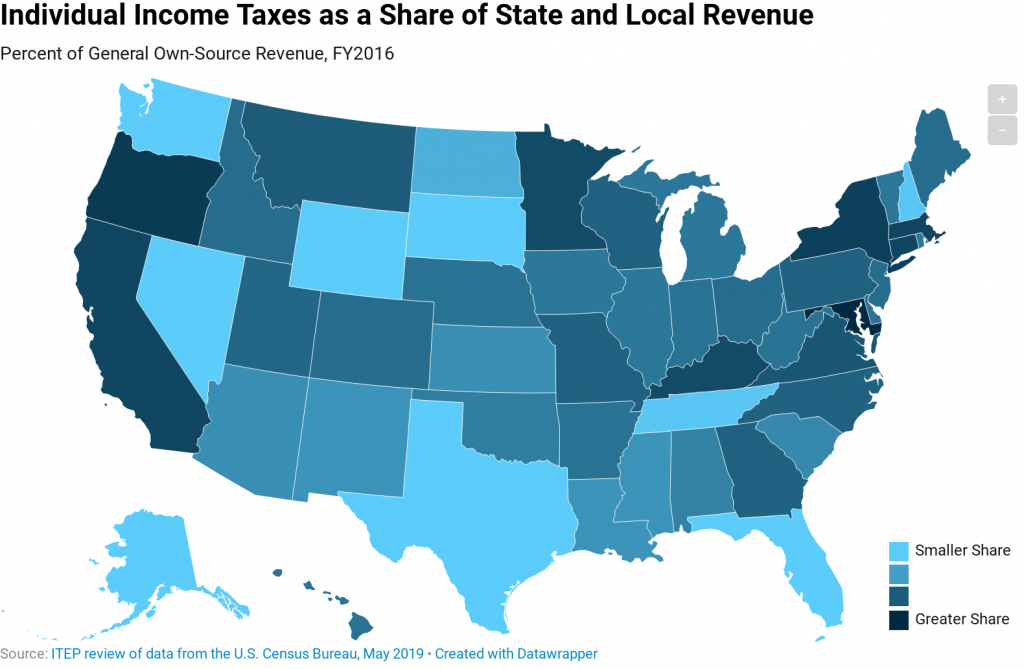

Income taxes vary considerably in their structure across states, though the best taxes are fine-tuned to taxpayers’ ability-to-pay.

Policymakers and the public widely agree that economic inequality is the social policy problem of our age. It threatens the livelihoods of millions of children and adults, and it even threatens our democracy. Although some say Americans could fix it themselves by simply rolling up their sleeves, as a sub-headline in a March U.S. News and World Report column implied, the reality is different.

Policy Matters Ohio: The Good and the Bad in the House Tax Plan

May 15, 2019

The tax plan approved by the Ohio House last week would sharply limit an income-tax break for business owners that costs more than $1 billion a year while providing few benefits to the Ohio economy. At the same time, it would eliminate the bottom two brackets of the income tax and cut rates by 6.6%. […]

Corporate income taxes are an important source of revenue for state governments and ensure that profitable corporations benefiting from public services pay toward the maintenance of those services.