ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Connecticut Voices for Children: Voices from the Capitol: Countdown to the End of the Session

May 10, 2019

Staff experts from our national partners – Elizabeth McNichol of the Center on Budget and Policy Priorities and Aidan Davis of the Institute on Taxation and Economic Policy – joined Jamie Mills of Connecticut Voices for Children in submitting powerful testimony before the Finance Committee in support of a modest surcharge on capital gains earned […]

Presentation: NCSL Task Force on State and Local Taxation, Taxing Cannabis

May 10, 2019 • By Carl Davis

ITEP Research Director Carl Davis presented to the National Conference of State Legislatures (NCSL) Task Force on State and Local Taxation on approaches to cannabis taxation and the recent report Taxing Cannabis.

Maryland Center on Economic Policy: Improving the Child Tax Credit Would Benefit More than 700,000 Marylanders

May 7, 2019

Refundable tax credits like the Earned Income Tax Credit and the Child Tax Credit make an important difference for working families, together bringing more than 100,000 Marylanders’ family incomes above the federal poverty line each year. Maryland has built on these successful policies by supplementing the federal Earned Income Tax Credit with a state credit and extending […]

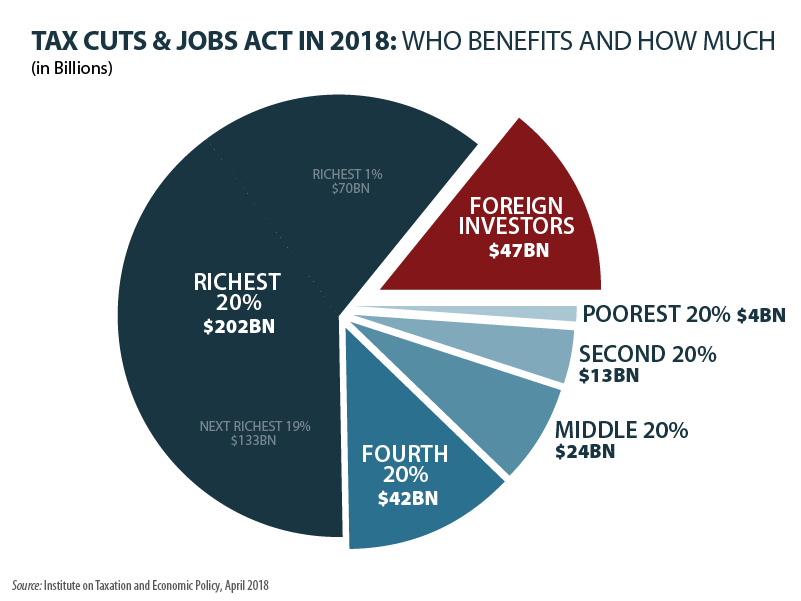

Proponents of Trump Tax Law Cite ITEP with Obvious Lack of Context

May 6, 2019 • By Steve Wamhoff

Sen. Chuck Grassley, the chairman of the Senate Finance Committee, today has an op-ed defending Trump-GOP tax law. “One of the most-covered falsehoods being spread about tax reform,” as he calls the law, “is that it’s a middle-class tax hike.” He cites ITEP’s estimates to back up his point that most people in every income group have lower taxes because of the law. As Sen. Grassley and his staff know full well, this leaves out the important point of our findings.

Vox: Apple Is Spending Even More of Its Huge Tax Cut on Wall Street Stock Buybacks

May 1, 2019

Apple, like a lot of corporations, wasn’t paying the full 35 percent corporate tax rate even before the tax cut bill was passed, but the new legislation has been very good to it. According to the liberal-leaning Institute on Taxation and Economic Policy, dozens of profitable Fortune 500 companies paid no federal income taxes at all […]

Teachers in North Carolina and South Carolina are walking out and rallying this week for increased education funding, teacher and staff pay, and other improvements to benefit students—if you’re unsure why be sure to check out research on the teacher shortage and pay gap under “What We’re Reading” below. Meanwhile, budget debates have recently wrapped up in Indiana, Iowa, Massachusetts, New Hampshire, and Washington. And major tax debates are kicking into high gear in both Louisiana and Nebraska.

Houston Chronicle: Under New Tax Code, Oil Companies Get Rebates, Not Bills

May 1, 2019

Despite earning billions of dollars in profits, companies such as the California oil major Chevron, the Houston independent oil companies Occidental Petroleum and EOG Resources, and the Houston oil field services company Halliburton were able to claim tens of millions in tax rebates, according to a study earlier this month by the Institute on Taxation and Economic Policy.

Bloomberg: Gas Tax for Infrastructure Sparks Fears of Political Backlash

May 1, 2019

Some 30 states have raised their fuel taxes since 2003 -- including Republican-led Ohio, Arkansas and Alabama this year -- according to the Institute on Taxation and Economic Policy. States tack on an average tax of nearly 29 cents per gallon, according to the U.S. Energy Information Administration.

Pacific Standard: Can Ending Fossil Fuel Subsidies Pay for Beto O’Rourke’s Climate Plan?

April 30, 2019

"The 2017 tax act, through its omission of true tax reform, really does leave a lot of opportunities available to Congress, starting in 2020, to broaden the tax base in a way that could raise a substantial amount of money," says Matthew Gardner, a senior fellow at the Institute on Taxation and Economic Policy. The Trump administration's tax legislation, known as the Tax Cuts and Jobs Act, did little to close corporate tax breaks enjoyed by oil and gas and other industries, according to Gardner, "and in fact made some of the biggest tax breaks even bigger."

Houston Chronicle: Oil Companies Dodge Tax Bills Under Trump Reforms, Study Says

April 30, 2019

Despite earning billions of dollars in profits, companies like Halliburton, Chevron, Occidental Petroleum and EOG Resources were able to claim tens of millions in tax rebates, according to a study earlier this month by the Institute on Taxation and Economic Policy.

MinnPost: Legislative Tax Plans: Equitable, Inspirational or Destructive?

April 30, 2019

Minnesota’s current tax system is considered one of the nation’s most progressive. The Institute on Taxation and Economic Policy, a nonpartisan think tank that assesses state and federal tax policies, ranks the state the fourth most-equitable in the way it taxes lower-income residents. It’s the provider tax and that proposed gas tax hike — two inherently regressive taxes — that drag down the overall progressivity of the plans.

New York Times: Apple Plans to Buy $75 Billion More of Its Own Stock

April 30, 2019

When it repatriated its cash under the new tax law, Apple paid $43 billion less than it would have under previous rates, bigger savings than any other American company, according to the Institute on Taxation and Economic Policy, a research group in Washington. Apple has also saved billions of dollars under the lower corporate tax rate. Apple says it is spending billions in the United States, hiring new workers, building data centers, expanding offices in Texas and investing in some outside manufacturers.

Washington Post: Democrats Said a GOP Tax Law Provision Would Devastate Blue States. That’s Not Happening.

April 30, 2019

“A lot of these claims were knee-jerk, political reactions,” said Carl Davis, a tax analyst for the Institute on Taxation and Economic Policy, a left-leaning think tank. “Some perspective is needed on some of the wild claims about how it would damage blue states’ economies.”

New York Times: Profitable Giants Like Amazon Pay $0 in Corporate Taxes. Some Voters Are Sick of It.

April 29, 2019

The list of profitable companies that pay no corporate taxes, compiled by the Institute on Taxation and Economic Policy, a left-leaning think tank, also includes Goodyear and three other Ohio companies, including the Akron-based electric utility FirstEnergy. The company, which has the naming rights to the Cleveland Browns’ stadium, paid no taxes last year on $1.5 billion in income, according to the analysis, and will receive additional tax credits that can be used in the future. In a win for consumers, some of that will be returned to the utility’s customers.

Connecticut Voices for Children: Testimony Supporting H.B. No. 7415

April 26, 2019

Smart state fiscal policies can play a critical role in building strong, equitable state economies. It is time we fix our tax laws to give working people and children a fair shot to get ahead by pursuing twin goals of assuring adequate revenues to support the programs and services vital to the well-being of our […]

ITEP Testimony Supporting H.B. No. 7415, An Act Concerning a Surcharge on Capital Gains

April 26, 2019 • By Aidan Davis

Comments are intended to offer some perspective on the broader tax policy context in which this proposal is being considered. We find that this proposal would help to lessen long-running inequities in Connecticut’s state and local tax law that have allowed high-income taxpayers to pay lower overall effective tax rates than most low- and middle-income families.

State Rundown 4/26: Capital Gains Taxes Make Gains and Regressive Proposals Regress

April 26, 2019 • By ITEP Staff

Progressive capital gains tax proposals made news this week in Connecticut and Massachusetts, while Nebraskans came out in force to oppose a regressive tax shift, and North Carolina teachers prepare to rally over their legislature’s proclivity to cut taxes on wealthy households while underfunding schools.

From the first comprehensive look at corporate filings under the 2017 tax law to bold policy options from analysts and researchers to dramatically reduce poverty, here’s a summary of reports that ITEP released this month.

In early April, a diverse but mostly black crowd took to the streets in the Shaw neighborhood of Washington D.C. to protest T-Mobile’s decision to order Metro PCS to cease playing gogo music. This tale is a shining example of why economic investment—especially taxpayer-incentivized investment—in underserved communities is fraught with controversy. Who ultimately benefits after developers pour millions of dollars into these communities? And, as this controversy reveals, are the usually black and brown denizens of these neighborhoods and businesses that may have catered to them no longer welcome once economic development reaches a critical mass?

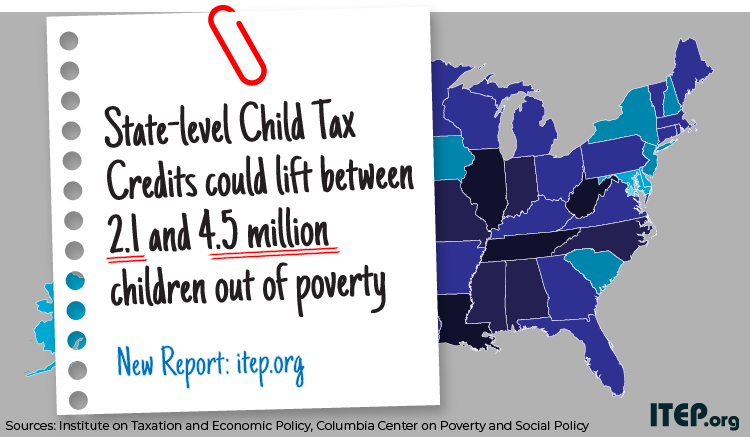

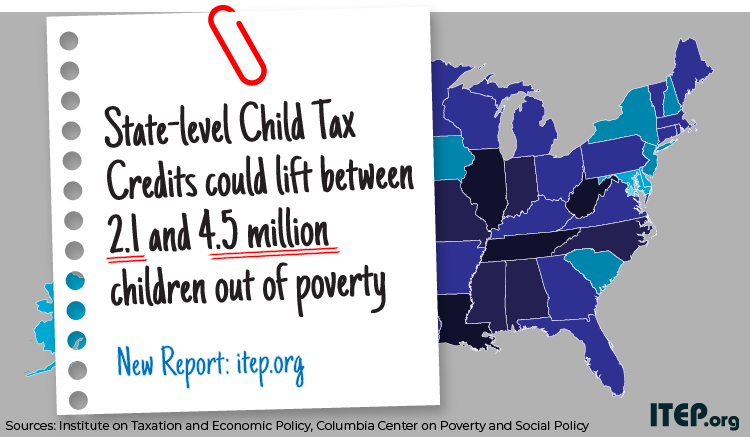

States Could Lift Millions of Children Out of Poverty by Enacting State-Level Child Tax Credits

April 17, 2019 • By Aidan Davis

In a new 50-state analysis, ITEP and the Center on Poverty & Social Policy at Columbia University teamed up to explain how state-level Child Tax Credits (CTCs) could lift between 2.1 and 4.5 million children out of poverty. The report outlines options that would help families who received little to no benefit from the expansion of the federal CTC included in the 2017 Tax Cuts and Jobs Act.

The Case for Extending State-Level Child Tax Credits to Those Left Out: A 50-State Analysis

April 17, 2019 • By Aidan Davis, Meg Wiehe

As of 2017, 11.5 million children in the United States were living in poverty. A national, fully-refundable Child Tax Credit (CTC) would effectively address persistently high child poverty rates at the national and state levels. The federal CTC in its current form falls short of achieving this goal due to its earnings requirement and lack of full refundability. Fortunately, states have options to make state-level improvements in the absence of federal policy change. A state-level CTC is a tool that states can employ to remedy inequalities created by the current structure of the federal CTC. State-level CTCs would significantly reduce…

New 50-State Analysis: State Child Tax Credits Would Lift 2.1 to 4.5 Million Children out of Poverty

April 17, 2019 • By ITEP Staff

Expanding the Child Tax Credit (CTC) at the state level could lift millions of children out of poverty and help families who benefited little or not at all from the 2017 federal expansion of the CTC, according to a 50-state report released today by the Institute on Taxation and Economic Policy and the Center on Poverty and Social Policy at Columbia University.

Pennsylvania Budget and Policy Center: A Fair Share Tax Plan for Pennsylvania — 2019 Update

April 15, 2019

This paper puts forward the Fair Share Tax plan, a major step toward fixing Pennsylvania’s broken tax system and raising the revenues we need to invest in the public goods that are critical to creating thriving communities and individual opportunity in our state: education, infrastructure, protection for our air and water, and human services. The […]

Michigan League for Public Policy: The Cost-of-Living Refund

April 15, 2019

The Cost-of-Living Refund is an enhanced and modernized version of our state Earned Income Tax Credit (EITC). Michigan’s current EITC—at just 6% of the federal credit—provides a huge help to working families struggling to make ends meet by boosting after-tax incomes, pulling Michigan families above the poverty line, and delivering long-lasting benefits to children in […]

$4.3 Billion in Rebates, Zero-Tax Bill for 60 Profitable Corps Directly Related to Loopholes

April 12, 2019 • By Matthew Gardner

Meet the new corporate tax system, same as the old corporate tax system. That’s the inescapable conclusion of a new ITEP report assessing the taxpaying behavior of America’s most profitable corporations. The report, Corporate Tax Avoidance Remains Rampant Under New Law, released earlier this week, finds that 60 Fortune 500 corporations disclose paying zero in federal income taxes in 2018 despite enjoying large profits.