ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

NC Budget and Tax Center: Corporations over Carolinians?

May 31, 2018

Big corporations and wealthy executive have been on quite a run. Corporate profits are at historic levels,[1] stock prices are through the roof, and plush executive pay has become the norm. At the same time, corporate taxes have been slashed both here in North Carolina starting in 2013 and last December at the federal level. […]

Center on Budget and Policy Priorities: Arizona Proposal Would Finance School Funding Boost, Make Tax Code Less Regressive

May 30, 2018

The measure would also make Arizona’s tax code somewhat less regressive. Currently, the poorest 20 percent of households pay 12.5 percent of their annual income to state and local taxes — more than twice as much as the wealthiest 1 percent of Arizonans, who pay just 5.7 percent, according to the Institute on Taxation and […]

NC Budget and Tax Center: Revenue Options to Support Children’s Educational Success

May 30, 2018

The General Assembly legislative session begins on May 16, the same day teachers plan a day of action to highlight the unmet needs their students face in the classroom and their communities. While the evidence is quite clear that supporting children’s educational success can generate lifelong benefits for families and the broader economy[1], the NC […]

New Jersey Policy Perspective: Fast Facts: Proposed Tax Changes Would Bring More Balance to New Jersey’s Tax Code

May 24, 2018

The tax changes proposed in Gov. Murphy’s first budget would bring more balance to New Jersey’s tax code by raising taxes on the wealthiest one percent while reducing them for the lowest-income New Jerseyans.[1] Updating the tax code would also raise nearly $2 billion in new revenue for targeted investments in early education, public transit, health care and other essential public services.

SALT/Charitable Workaround Credits Require a Broad Fix, Not a Narrow One

May 23, 2018 • By Carl Davis

The federal Tax Cuts and Jobs Act (TCJA) enacted last year temporarily capped deductions for state and local tax (SALT) payments at $10,000 per year. The cap, which expires at the end of 2025, disproportionately impacts taxpayers in higher-income states and in states and localities more reliant on income or property taxes, as opposed to sales taxes. Increasingly, lawmakers in those states who feel their residents were unfairly targeted by the federal law are debating and enacting tax credits that can help some of their residents circumvent this cap.

NC Policy Watch: Governor Cooper recognizes North Carolina is in a hole, stops digging

May 22, 2018

Holding off on another round of tax cuts for the richest taxpayers and profitable corporations and keeping the increased standard deduction and lower rate for the majority of taxpayers will reduce the tax cuts given to the top 5 percent of taxpayers since 2013. Read more here

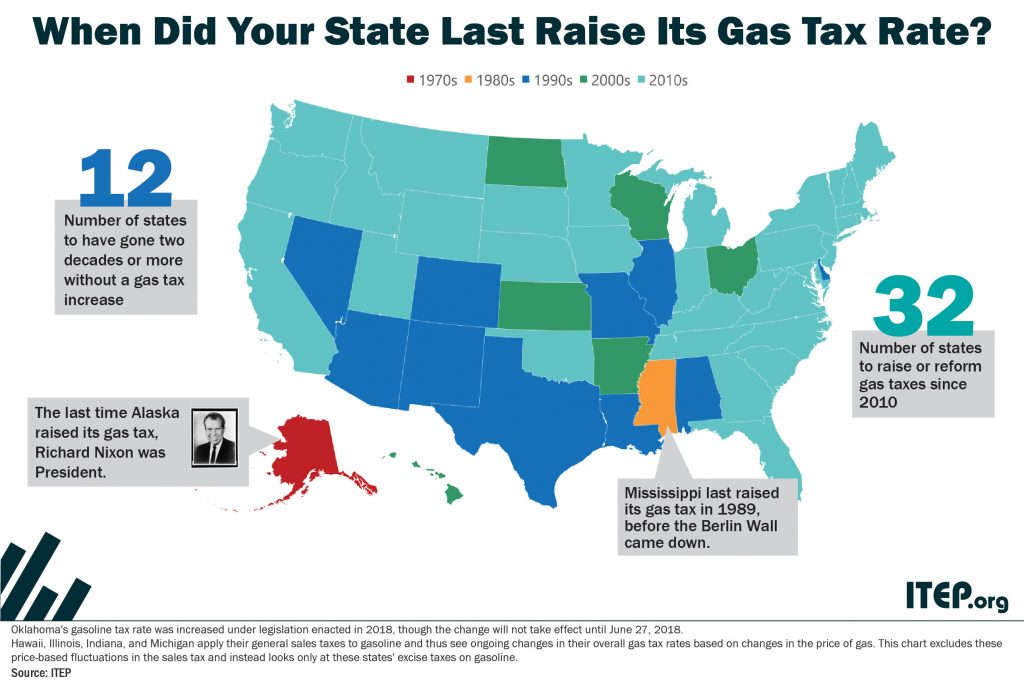

An updated version of this blog was published in April 2019. State tax policy can be a contentious topic, but in recent years there has been a remarkable level of agreement on one tax in particular: the gasoline tax. Increasingly, state lawmakers are deciding that outdated gas taxes need to be raised and reformed to fund infrastructure projects that are vital to their economies.

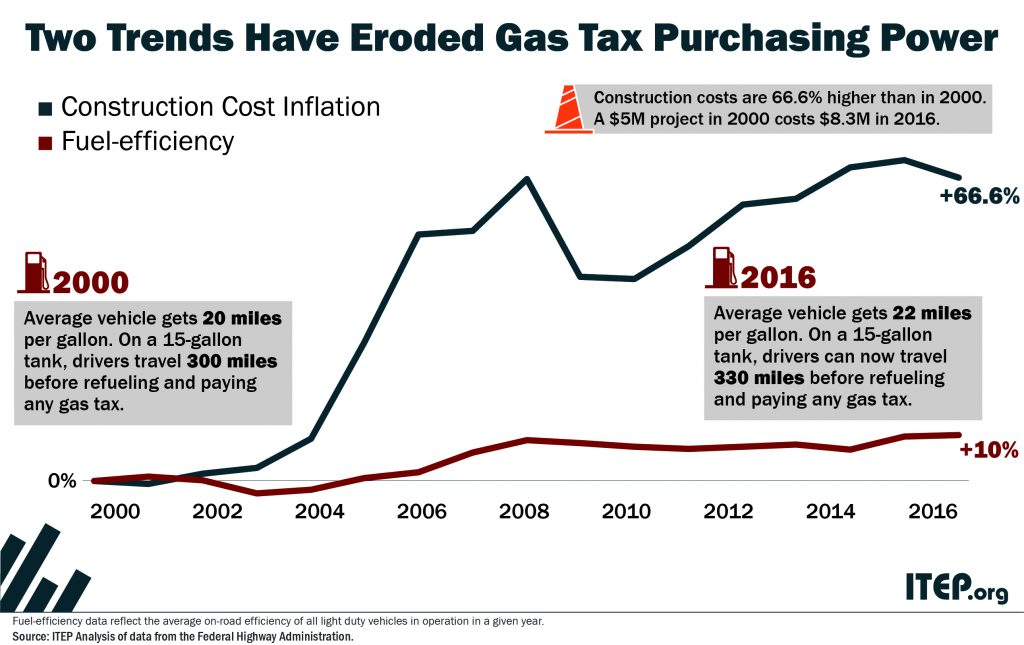

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

North Carolina Justice Center: New Report Looks at How Corporate Tax Cuts Have Hurt North Carolina

May 21, 2018

A new report on corporate income taxes looks at how corporate taxes have been slashed at the state and federal levels, provides evidence that wealthy shareholders are the prime beneficiaries of corporate tax cuts, and shows that corporate tax cuts have not solved North Carolina’s most pressing economic problems. Unless leaders in Raleigh change course, corporations could be in line for yet another tax cut next year if a rate cut to the corporate income tax moves ahead as currently scheduled.

Louisiana Budget Project: Black households would bear disproportionate burden of sales tax renewal

May 18, 2018

Lawmakers can address this imbalance by expanding Louisiana’s EITC. An increase of the state EITC from 3.5 percent to 7 percent of the federal EITC would offset a half-cent cent sales tax renewal for families in the bottom 40 percent of income earners. An EITC increase from 3.5 percent to 10 percent would offset a […]

NBC: What Trump’s disclosure of his 500 LLCs can and can’t tell us

May 16, 2018

A 2015 report by the Institute on Taxation and Economic Policy, a non-profit, non-partisan, tax policy think tank, said Delaware’s tax code made it “a magnet for people looking to create anonymous shell companies, which individuals and corporations can use to evade an inestimable amount in federal and foreign taxes.” Read more

CNN: North Carolina teachers want better pay and they’re marching to fight for it

May 16, 2018

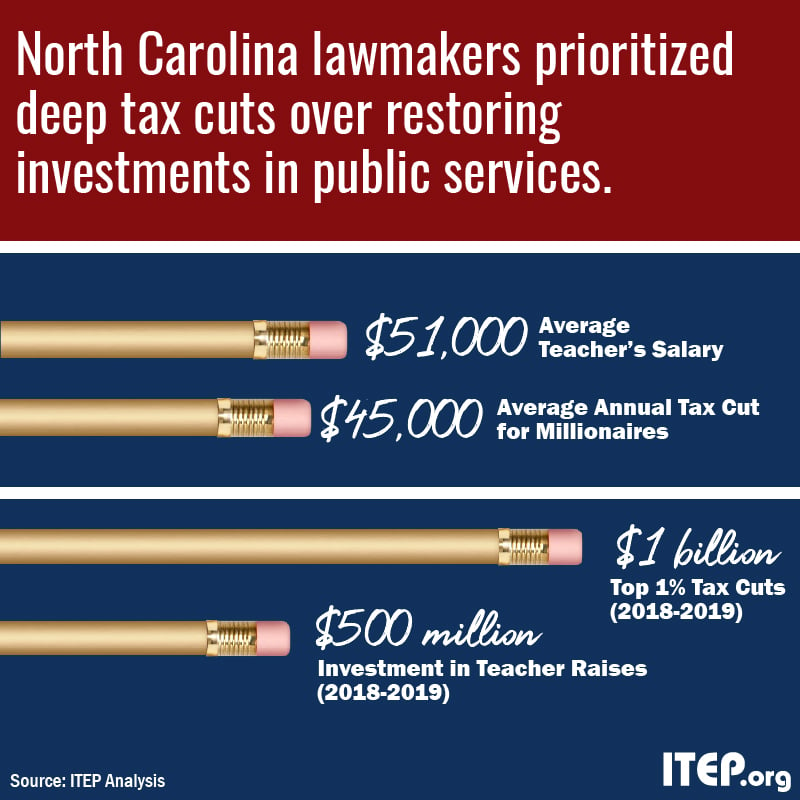

Mark Jewell, president of the North Carolina Association of Educators, has said the state could be spending a lot more on schools if it hadn’t shrunk revenues by lowering corporate and personal income tax rates in the past few years. He points to a 2017 report by the nonpartisan Institute on Taxation and Economic Policy, […]

Minnesota Budget Project: Governor Dayton’s Proposed Supplemental Budget Makes Investments In Education, Health And Human Services, Economic Development, Saves For The Future

May 16, 2018

Governor Mark Dayton released his FY 2018-19 supplemental budget proposal today, focused on making strategic investments to support Minnesota’s economic success, prioritizing working Minnesotans in responding to the federal tax bill, and leaving some of the state’s projected surplus unspent “to cushion against risk.”

NC Teachers’ March on Raleigh and the Tax Cuts that Led Them There

May 15, 2018 • By Aidan Davis

Once again, public school teachers are taking a stand for education and against irresponsible, top-heavy tax cuts that deprive states of the revenue they need to sufficiently fund public services, including education.

Michigan League for Public Policy: The Looming Danger of Tax Cut Triggers in Michigan

May 15, 2018

New analysis by the Institute on Taxation and Economic Policy (ITEP) uses current year and two-year forecasts to calculate the impact that a 0.1 or 0.25 rate reduction in the Personal Income Tax (PIT) could have on taxpayers and state revenue. The data shows that any reduction in the PIT actually shifts the tax load further to low-income Michiganders.

New Jersey Policy Perspectives: DACA Recipients Contribute $59 Million Per Year in Taxes

May 15, 2018

The ITEP study found that New Jersey’s young immigrants eligible for DACA contribute $59 million in state and local taxes each year, the seventh highest level of all fifty states. These contributions would increase by $38 million per year – the sixth most of all states – if all of those eligible for DACA enrolled […]

Seattle Weekly: Seattle City Council Passes Reduced Head Tax

May 14, 2018

This comes on the heels of a 2015 Institute on Taxation and Economic Policy report that showed Washington has the most regressive tax system in the country because of its high reliance on sales taxes. Read more

News & Observer: Arizona Income Tax story

May 12, 2018

Meg Wiehe, deputy director of the Institute on Taxation and Economic Policy, said the public could be more likely to support income tax hikes since federal tax debate in the fall. “People understand the consequences,” she said. “They’re starting to connect the dots of what does it mean when there’s less revenue to spend.” The […]

Valdosta Daily Times: T-SPLOST: Good for our community

May 12, 2018

According to the Institute on Taxation and Economic Policy, the fuel tax in Georgia actually increased .3 cents on gasoline and .4 cents on diesel in 2017. The fuel tax is indexed to the consumer price index and is adjusted annually. So basically there was no real increase in revenue to fund additional projects with […]

Idaho Center for Fiscal Policy: Idaho Primary Election Fiscal Policy Guide

May 11, 2018

This guide provides a brief summary of proposed tax changes put forth by the candidates. Estimates of the distributional impact on Idaho taxpayers and state revenue and provided by the Idaho Center for Fiscal Policy.

Marketplace: Tax cuts: Have they benefited Indiana’s economy?

May 11, 2018

As for the potential long-term consequences, the richest Indiana taxpayers will receive the largest average tax cuts in 2027 (with an average cut of $4,840), while taxes would go up slightly for the poorest 20 percent (with an average increase of $160), according to an analysis from the Institute on Taxation and Economic Policy. Read more

New Tax Subsidy for Private K-12 Tuition in Massachusetts Creates a Host of Problems

May 9, 2018 • By Carl Davis

Last year’s federal tax cut bill changed 529 college savings accounts in a major way, expanding them so that they can be used as tax shelters by higher-income families who choose to send their children to private K-12 schools. This controversial change was added in the Senate by the slimmest of margins—requiring a tie-breaking vote […]

Working Life Podcast: A shift in the air on tax cuts?; Arizona uprising update; Inequality is worse than you think

May 9, 2018

The teachers’ uprisings around the nation have challenged the bankrupt ideology of supply-side tax cutting—and maybe marks a shift in the public’s view of taxes and public spending. Jonathan Tasini talks about that with Meg Wiehe, deputy director of the Institute for Taxation and Economic Policy. Read more

CNN: North Carolina teachers will be the next to walk out. Here’s what they want

May 8, 2018

An analysis by the Institute on Taxation and Economic Policy finds North Carolina would have $3.5 billion more in annual revenue if lawmakers had not changed the tax system that was in place in 2013. Read more

Seattle Post-Intelligencer: How Seattle’s Amazon avoids paying taxes

May 8, 2018

Amazon effectively paid no U.S. income taxes in 2017, according to an analysis by the Institute on Taxation and Economic Policy. Meanwhile, the company reported a staggering $1.9 billion in profits in the fourth quarter of 2017. “At a time when states all want to see HQ2 coming to them, but they don’t necessarily have the cash […]