ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Alabama: Who Pays? 7th Edition

January 8, 2024 • By ITEP Staff

Alabama Download PDF All figures and charts show 2024 tax law in Alabama, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99 percent) state and local tax revenue collected in Alabama. These figures depict Alabama’s grocery sales tax rate at its 2024 level […]

Colorado: Who Pays? 7th Edition

January 8, 2024 • By ITEP Staff

Colorado Download PDF All figures and charts show 2024 tax law in Colorado, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.2 percent) state and local tax revenue collected in Colorado. These figures depict Colorado’s EITC at its 2024 level of 38 percent […]

California: Who Pays? 7th Edition

January 8, 2024 • By ITEP Staff

California Download PDF All figures and charts show 2024 tax law in California, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.2 percent) state and local tax revenue collected in California. State and local tax shares of family income Top 20% Income Group […]

Arkansas: Who Pays? 7th Edition

January 8, 2024 • By ITEP Staff

Arkansas Download PDF All figures and charts show 2024 tax law in Arkansas, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.5 percent) state and local tax revenue collected in Arkansas. As seen in Appendix D, recent legislative changes have significantly increased the […]

Three states allow an unusual income tax deduction for federal income taxes paid. Missouri and Oregon limit these deductions by capping and/or phasing out the deduction, while Alabama, offers what amounts to an unlimited deduction. These deductions are detrimental to state income tax systems on many fronts, as they offer large benefits to high-income earners […]

Even as revenue collections slow in many states, some are starting the push for 2024 tax cuts early. For instance, policymakers in Georgia and Utah are already making the case for deeper income tax cuts. Meanwhile, Arizona lawmakers are now facing a significant deficit, the consequence of their recent top-heavy tax cuts. There is another […]

The Estate Tax is Irrelevant to More Than 99 Percent of Americans

December 7, 2023 • By Steve Wamhoff

The federal estate tax has reached historic lows. In 2019, only 8 of every 10,000 people who died left an estate large enough to trigger the tax. Legislative changes under presidents of both parties have increased the basic exemption from the estate tax over the past 20 years. This has cut the share of adults leaving behind taxable estates down from more than 2 percent to well under 1 percent.

The Latest Convoluted Arguments in Favor of Rich People Not Paying Taxes

November 13, 2023 • By Steve Wamhoff

Two Senate hearings last week focused on how the richest Americans are avoiding and evading taxes in ways that ordinary Americans could hardly imagine. All the experts brought in to testify seemed to agree that the House GOP’s recent tactic of “paying for” a spending proposal by cutting IRS funding makes no sense because it […]

States differ dramatically in how much they allow families to make choices about whether and when to have children and how much support they provide when families do. But there is a clear pattern: the states that compel childbirth spend less to help children once they are born.

Year-End Tax Package Must Prioritize Children and Families Over Corporations and Private Equity

November 8, 2023 • By Joe Hughes

While Congress considers extending expired tax provisions, it should first and foremost focus on expanding the Child Tax Credit, a policy with a proven track record of helping families and children.

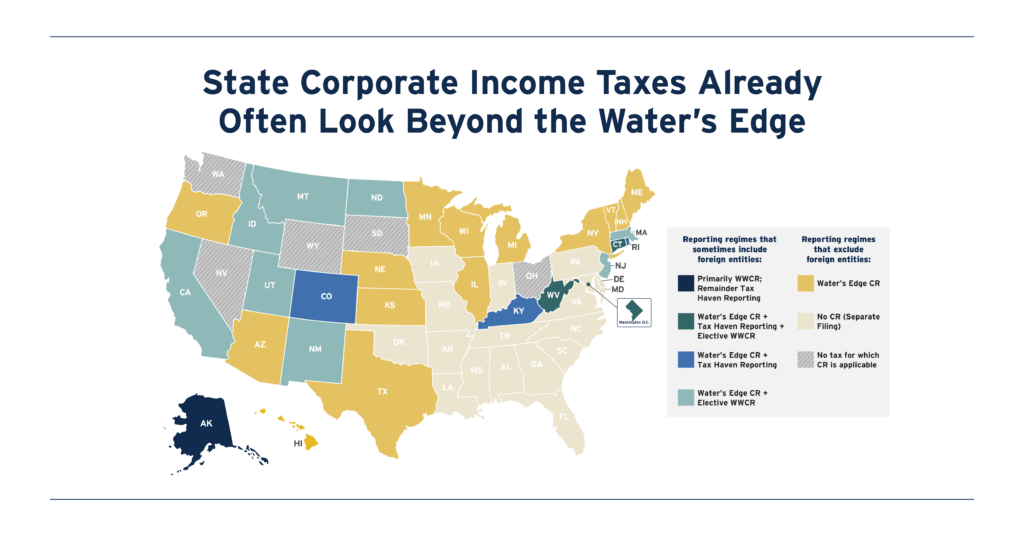

Far From Radical: State Corporate Income Taxes Already Often Look Beyond the Water’s Edge

November 7, 2023 • By Carl Davis, Matthew Gardner

State lawmakers are increasingly interested in reforming their corporate tax bases to start from a comprehensive measure of worldwide profit. This provides a more accurate, and less gameable, starting point for calculating profits subject to state corporate tax. Mandating this kind of filing system, known as worldwide combined reporting (WWCR), would be transformative, as it would all but eliminate state corporate tax avoidance done through the artificial shifting of profits into low-tax countries.

Local Earned Income Tax Credits: How Localities Are Boosting Economic Security and Advancing Equity with EITCs

October 30, 2023 • By Andrew Boardman, Galen Hendricks, Kamolika Das

Leading localities are using refundable EITCs to boost incomes and reduce taxes for workers and families with low and moderate incomes. These local credits build on the success of EITCs at the federal and state levels, reduce economic hardship and improve the fairness of the tax code.

Intuit Receives Millions in Federal Subsidies While Arguing IRS Direct File Would Be Too Costly

October 24, 2023 • By Joe Hughes, Spandan Marasini

The tax preparation industry has for years lobbied to prevent the IRS from providing a tool that would allow Americans to file their taxes online for free. Recent public disclosures from Intuit, the maker of TurboTax and the leader of the pack, show that tax breaks the company claims for doing “research” might be larger […]

State Rundown 10/12: Tax Policy Debates Don’t Just Happen in the Statehouse

October 12, 2023 • By ITEP Staff

It may be the off-season for state legislatures, but tax policy changes could soon emerge from the ballot box or the courts. Advocates in Arkansas want voters to decide the future of taxing diapers and feminine hygiene products, and supporters of public education in Nebraska are working to make sure voters have a say on the state’s school choice tax credit. Meanwhile, cannabis firms in Missouri are suing the state over cities and counties stacking sales tax on marijuana.

The Campaign by Democratic Former Officials to Stop Taxes on the Wealthy

October 6, 2023 • By Steve Wamhoff

One of the most attention-grabbing anti-tax campaigns at work today is called SAFE, which stands for Saving America’s Family Enterprises. But it might as well mean Saving Aristocrats From Everything given the outfit’s knack for opposing any national proposal to limit special tax advantages that only the wealthy enjoy. The basic approach of SAFE is […]

Last year, Congress reversed decades of funding cuts to the IRS to help the agency improve taxpayer services and crack down on wealthy tax cheats through the Inflation Reduction Act. The IRS adopted their assignment, and this past tax filing season was a marked improvement from the year before – both for the agency and […]

State Tax Credits Have Transformative Power to Improve Economic Security

September 12, 2023 • By Aidan Davis

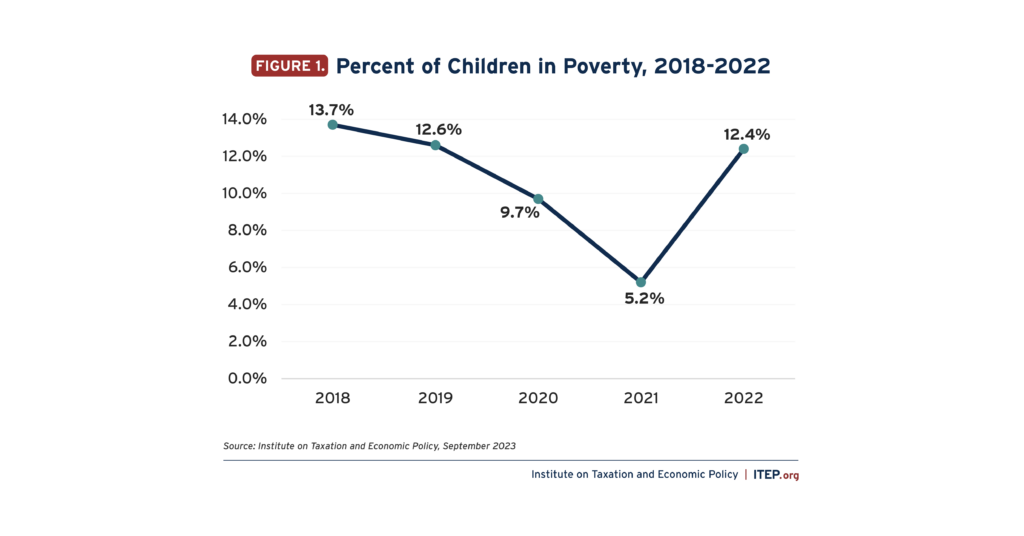

The latest analysis from the U.S. Census Bureau provides an important reminder of the compelling link between public investments and families’ economic well-being. Policy decisions can drastically reduce poverty and improve family economic stability for low- and middle-income families alike, as today’s data release shows.

States are Boosting Economic Security with Child Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Fourteen states now provide Child Tax Credits to reduce poverty, boost economic security, and invest in children. This year alone, lawmakers in three states created new Child Tax Credits while lawmakers in seven states expanded existing credits. To maximize impact, lawmakers should consider making their credits fully refundable, not including an earnings requirement, setting a maximum amount per child instead of per household, setting state-specific phase-out ranges that target low- and middle-income families, indexing to inflation, and offering the option of advanced payments.

Lapse of Expanded Child Tax Credit Led to Unprecedented Rise in Child Poverty

September 12, 2023 • By Joe Hughes

The new Census data should provide both concern and optimism for lawmakers. The steep rise in child poverty is an inexcusable tragedy. But it shows that child poverty is avoidable when Congress makes the decision to make tax policy for those who need the hand up rather than for the rich and powerful.

Boosting Incomes, Improving Equity: State Earned Income Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Nearly two-thirds of states (31 plus the District of Columbia and Puerto Rico) have an Earned Income Tax Credit, an effective tool that boosts low-paid workers’ incomes and helps lower-income families achieve greater economic security. This year, 12 states expanded and improved EITCs.

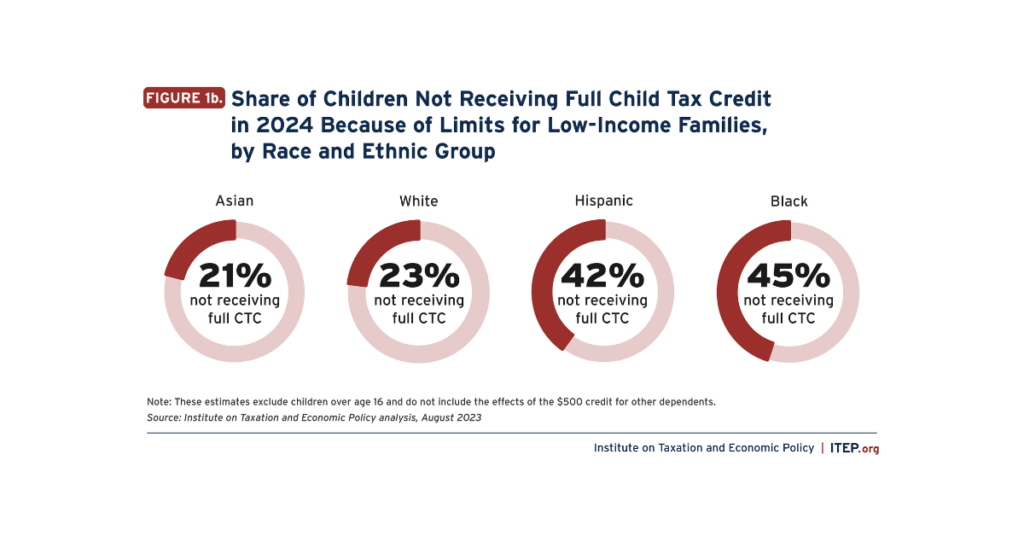

Expanding the Child Tax Credit Would Advance Racial Equity in the Tax Code

August 29, 2023 • By Emma Sifre, Joe Hughes

Expanding the federal Child Tax Credit to 2021 levels would help nearly 60 million children next year. It would help the lowest-income children the most and would particularly help children and families of color.

The Innovative Non-Tax Tax Parts of the Inflation Reduction Act

August 23, 2023 • By Michael Ettlinger

In the year since Congress enacted the Inflation Reduction Act (IRA), ITEP has written extensively on the law’s provisions to increase tax fairness and raise revenue for public investments. The IRA, however, also includes tax provisions that serve purposes other than ensuring that we raise adequate revenue and that we do so in a fair […]

Weakening the SALT Cap Would Make House Tax Package More Expensive and More Tilted in Favor of the Wealthiest

August 7, 2023 • By Steve Wamhoff

The three tax bills that cleared the House Ways and Means Committee in June are reportedly stalled due to some House Republicans’ demands that the package include provisions weakening the $10,000 cap on deductions for state and local taxes (SALT). Modifying the House tax package in this way would make it much more expensive while benefiting the richest fifth of taxpayers almost exclusively.

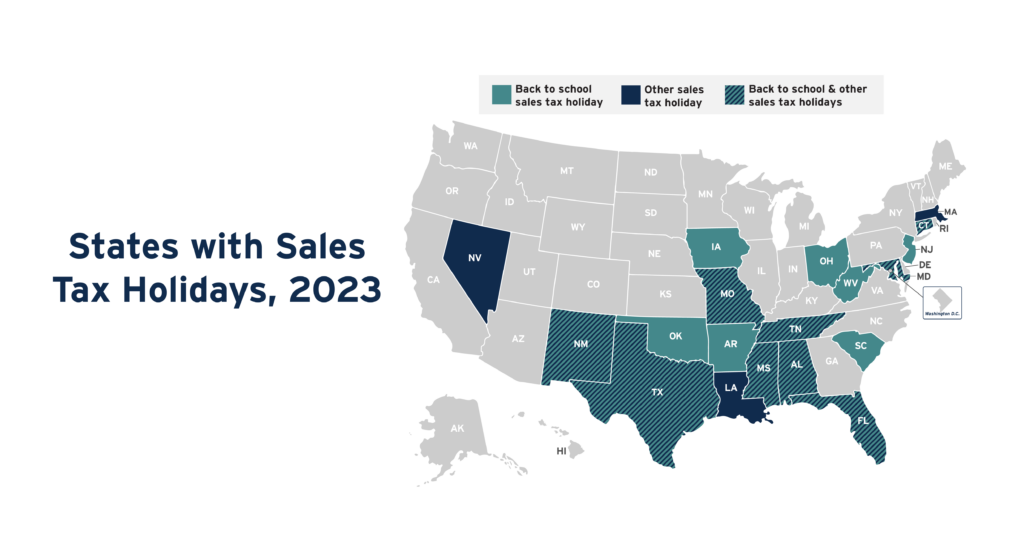

The number of states with sales tax holidays on the books fell to 19 in 2023 from 20 in 2022. Yet even as slightly fewer states have them, they are estimated to cost much more. In 2023, sales tax holidays will cost states and localities nearly $1.6 billion in lost revenue, up from an estimated $1 billion just a year ago.

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 2, 2023 • By Marco Guzman

Nineteen states have sales tax holidays on the books in 2023, and these suspensions will cost nearly $1.6 billion in lost revenue this year. Sales tax holidays are poorly targeted and too temporary to meaningfully change the regressive nature of a state’s tax system. Overall, the benefits of sales tax holidays are minimal while their downsides are significant.