ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Albany Times Union: Ending Poverty Will Take a New Look at Wealth, Too

January 2, 2023

We would do well to remember the millions of families in New York that were already experiencing the storms of poverty, inequality and policy violence, not to mention those who have nowhere safe to celebrate the holidays. Read more.

Seattle Times: Proliferation of GoFundMes Reveals a Dirty Little Open Secret

January 2, 2023

This time of year, we find ourselves touched by the generosity, grace and kindness of people helping people. Extending ourselves to others reveals the best of who we are as humans, and that emerges so clearly during the holiday season. Yet as moved as I often am by the ways people show up for each […]

Yahoo Finance: These 23 Companies Got $50 Billion in Tax Breaks Due to a Trump Tax Law

December 24, 2022

The government spending bill that was just passed through the Senate and awaits approval from Congress is estimated to total nearly $1.7 trillion. While it will fund a variety of initiatives like aid to Ukraine and enhanced retirement savings, it will not extend “accelerated depreciation” tax breaks, which were initiated during the Trump administration and seen by […]

The Tax Deal That Wasn’t: Congress Decides Corporate Tax Cuts Are Too Expensive if it Means Also Helping Children

December 20, 2022 • By Joe Hughes

Congressional leaders announced their long-awaited omnibus spending package which will fund the government through September 2023. The good news: the bill does not include needless corporate tax giveaways. The bad news: it also leaves out any expansion of the child tax credit.

Hawaii Public Radio: Report: State could slash child poverty in half with new tax credit

December 20, 2022

The child tax credit has been available at the federal level since 1997. Before 2021, families were able to take advantage of a $2,000 credit per child. Under the American Rescue Plan, the credit was expanded to $3,000 per child between the ages of 6 and 17, and $3,600 for every child under 6 years […]

Pluribus News: States Advance Child Tax Credits as Congress Deliberates

December 15, 2022

Lawmakers in Connecticut, New York and several other states want to expand tax breaks for families with children next year, inspired by a 2021 federal tax credit that dramatically reduced child poverty. Read more.

Reversing the Stricter Limit on Interest Deductions: Another Huge Tax Break for Private Equity

December 6, 2022 • By Steve Wamhoff

Private equity is doing fine on its own and does not need another tax break. Congress should keep the stricter limit on deductions for interest payments —one of the few provisions in the 2017 tax law that asked large businesses to pay a little bit more.

Bipartisan Retirement Proposals Are Mostly Just More Tax Cuts for the Wealthy

December 5, 2022 • By Steve Wamhoff

The EARN Act and SECURE Act 2.0, two bipartisan retirement bills working their way through Congress, are major disappointments. They would mainly provide more tax breaks for the well-off who will most likely retire comfortably regardless of what policies Congress enacts. The bills would provide modest assistance for those who really need help to save.

Montana Budget & Policy Center: Tax Credits for Workers and Families

November 23, 2022

Montana has an opportunity to invest high state revenues to support families and individuals and improve our tax system. State tax credits targeted to those in most need of assistance help Montanans struggling to afford necessities. By expanding the state Earned Income Tax Credit (EITC), establishing a refundable state Child Tax Credit (CTC), and passing […]

The Lever: Will Biden End An Illegal $50 Billion Tax Giveaway?

November 23, 2022

The IRS is sanctioning state laws allowing rich Americans to bypass the SALT cap and avoid billions in taxes, but a new Biden nominee could end the scheme. Read more.

Route 50: How Tax Credits Could Help States Reduce Child Poverty by 25%

November 23, 2022

Child poverty in the U.S. hit a record low last year, according to the U.S. Census Bureau, in part due to the American Rescue Plan Act’s expansion of the federal child tax credit. While the initiative expires at the end of 2021, states could continue the trend with their own child tax credit policies, a new […]

Jacobin: In Massachusetts, Unions Beat Billionaires to Pass a Tax on the Rich

November 23, 2022

Voters in Massachusetts just ratified the Fair Share Amendment, which taxes income above $1 million to fund public services. A broad coalition of labor and community groups took on billionaire money and won. Read more.

CNBC: As a Key Deadline Looms to Claim 2021 Tax Credits, Republicans Complain of ‘Suspicious Timing’ of IRS Letters

November 23, 2022

Certain tax credits were made temporarily more generous in 2021. For certain people, there still may be time to claim the money, which may add up to thousands of dollars — but some politicians aren’t happy the IRS just reminded Americans about the cash. Read more.

Child Tax Credit Expansion Would Shrink the Racial Wealth Gap

November 21, 2022 • By ITEP Staff

Extending the expanded Child Tax Credit would benefit nearly every child in low- and middle-income families. Under current rules, 24% of white children, 45% of Black children, and 42% of Hispanic children will not receive the full credit in 2023 because their families make too little. These figures would drop to zero if the provisions were extended, helping families of all races and disproportionately helping families of color.

The Economic Progress Institute: Rhode Island Standard of Need

November 18, 2022

With scenic beaches, culinary and arts communities, higher education institutions, and a vibrant celebration of culture, Rhode Island can be a wonderful place to live and to raise a family. Yet many Rhode Islanders work at jobs with wages that pay too little to meet even the most basic living costs. They experience multiple barriers […]

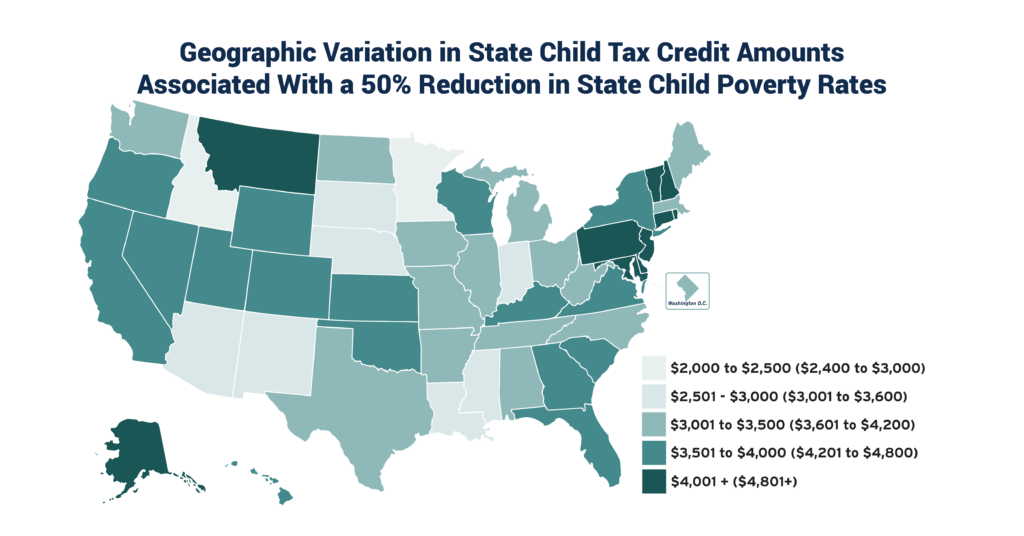

State policymakers have the tools they need to drastically reduce child poverty within their borders. A new ITEP report, coauthored with Columbia University’s Center on Poverty and Social Policy, explores state Child Tax Credit (CTC) options that would reduce child poverty by up to 50 percent. Temporary expansion of the federal CTC in 2021 reduced […]

State Child Tax Credits Have Enormous Potential to Cut Child Poverty

November 16, 2022 • By ITEP Staff

CONTACT: Jon Whiten New state-by-state data charts a course for how states can make headway for the next generation As the dust settles on this year’s elections and state lawmakers look toward 2023’s legislative sessions, they should consider creating or improving their state Child Tax Credits. A new report released today by the Institute on […]

Policy Matters Ohio: Increase Family Security and Expand Opportunity in Ohio

November 14, 2022

The expanded federal child tax credit (CTC) improved the lives of millions of children and families. We outline how a simple solution — direct payments to families with children — helped families pay for basic household expenses, relieved parents of stress, and made families more stable and secure. But now, because Congress failed to act, […]

Policy for the People Podcast: Our Labor, Their Fortunes: Billionaires Capture Oregon’s Wealth

November 11, 2022

Wealth inequality is at mind-boggling levels in Oregon and elsewhere. Listen to Research Director Carl Davis talk about the trends here.

Fiscal Policy Institute: Inequality in New York & Options for Progressive Tax Reform

November 11, 2022

Income statistics have long shown that the top earners in New York State earn relatively more than their counterparts elsewhere in the U.S. Income inequality alone, however, provides an incomplete picture of the wealthiest households’ economic resources. In order to understand real economic power, we have to look at households’ wealth (their total net assets). […]

Massachusetts Voters Score Win for Tax Fairness with ‘Fair Share Amendment’

November 9, 2022 • By Marco Guzman

In a significant victory for tax fairness, Massachusetts voters approved Question 1—commonly known as the Fair Share Amendment—Tuesday night with 52 percent of the vote. The new constitutional amendment creates a 4 percent surcharge on income over $1 million, and the revenue will specifically fund education and transportation projects in the Bay State.

Oregon Center for Public Policy: Wealth Inequality in Oregon Is Extreme

November 3, 2022

How extreme is wealth inequality in Oregon? So extreme that, together, three billionaires residing in the state have about twice the wealth as that of the entire bottom half of Oregonians. Read more.

Washington Post: Tax-cut Guru Still Says He’s Right About Trump, Truss and Trickle-down

November 2, 2022

The mess in England doesn’t mean he’s wrong. Arthur Laffer, the chief cheerleader for supply-side economics since the days of Ronald Reagan, wants to make that clear. Read more.

Route Fifty: In One State, a Fight Over How Tax Hikes are Passed at the Ballot Box

November 1, 2022

In Arizona, Republican legislators are asking residents to make it tougher for voters to pass ballot measures that would raise taxes. Supporters say the proposal, which will be decided in next week’s election, is intended to rein in ballot initiatives that threaten the state’s economy and that are often backed by groups from outside of […]