ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

The Bond Buyer: Where SALT Workarounds Are Being Promoted

July 5, 2018

he $10,000 federal cap on the deductibility of state and local taxes has led to a flurry of activity in red states to promote tax credits for taxpayers’ efforts to make charitable donations to get around that cap. That’s the finding of a survey by the Institute for Taxation and Economic Policy that highlights the […]

Fox Business: Higher State Taxes, Not OPEC, Boosting Gas Prices

July 5, 2018

In July, Oklahoma, South Carolina and Tennessee were among seven states that raised their gas taxes Opens a New Window. . At least 27 states have raised or updated their gas taxes since 2013, according to a report from the Institute on Taxation and Economic Policy Opens a New Window. . California – where drivers pay some […]

24/7 Wall Street: 10 States With the Lowest Gas Prices Get Government Help

July 5, 2018

While oil prices are the major component of gas prices, state taxes are often overlooked. And they are unlikely to change very much. According to the Institute on Taxation and Economic Policy, most increases have been a few pennies, even as the number of states that have bumped them has grown. The organization reports: In […]

The Nation: Will Red-State Protests Spark Electoral Change?

July 5, 2018

State lawmakers came “out of the gate in 2011 with a pretty regressive, large-scale tax-cut plan,” said Meg Wiehe, deputy director of the Institute on Taxation and Economic Policy (ITEP), a nonprofit, tax-focused research group. Led by Governor Fallin, the Oklahoma GOP wanted to scrap the income tax entirely—a plan that was the brainchild of […]

USA Today: Gas Taxes Rise Sunday in Seven States as AAA Projects Record Travel for July 4th

July 2, 2018

Massive teacher protests this spring in Oklahoma, West Virginia, Kentucky and other states prompted the Oklahoma Legislature to raise taxes on cigarettes, fuel and oil and gas production to pay for raises averaging $6,100 per year and to boost funding for schools, support personnel and state workers. “The last time the Sooner State raised its gas tax […]

Augusta Free Press: Rising Gas Prices, Health Costs Mitigate Impact of Tax Cuts

July 2, 2018

Meanwhile, six months after passage of the tax cut law, Virginia’s wealthiest one percent will be watching fireworks at the country club in great comfort knowing that their tax cuts will provide them with a $60,000 average tax cut a year, according to the Institute on Taxation and Economic Policy. According to figures from GasBuddy.com, the price […]

Seattle Times: Fight Heats up over Washington State Carbon ‘Fee’ Likely to Make Fall Ballot

July 2, 2018

Opponents criticize the measure as a regressive tax on Washingtonians. They note that the state — with a sales tax but no income tax — already is considered to have the most regressive tax system in the nation, according to a study by the Institute on Taxation and Economic Policy. Read more

American Prospect: The Two Biggest Lies in Donald Trump’s Tax Plan

June 29, 2018

Following is an excerpt from an essay in the American Prospect by ITEP Senior Fellow Matt Gardner: Despite a full-court charm offensive by the White House, its media surrogates, and big corporations that benefit most from the 2017 Republican Tax Act, the public stubbornly sees the truth: that President Trump’s tax bill was designed for […]

San Antonio Express News: Why Immigrants Come

June 29, 2018

What’s needed is a change of policy and a change of focus. The objective should not be to decrease the supply of labor needed in the farm fields and hospitality industries but rather to create a program and a process whereby employers can legally hire these undocumented workers to do the jobs they can’t find […]

Fast Company: AT&T’s Long Partnership with NSA Is Just Another Swamp Romance

June 28, 2018

The Institute on Taxation and Economic Policy said AT&T enjoyed an effective tax rate of just 8 percent between 2008 and 2015, despite the fact that the company enjoyed record profits, and took full advantage of tax breaks and loopholes. AT&T objected, saying it pays an effective tax of 32.7%. Read more

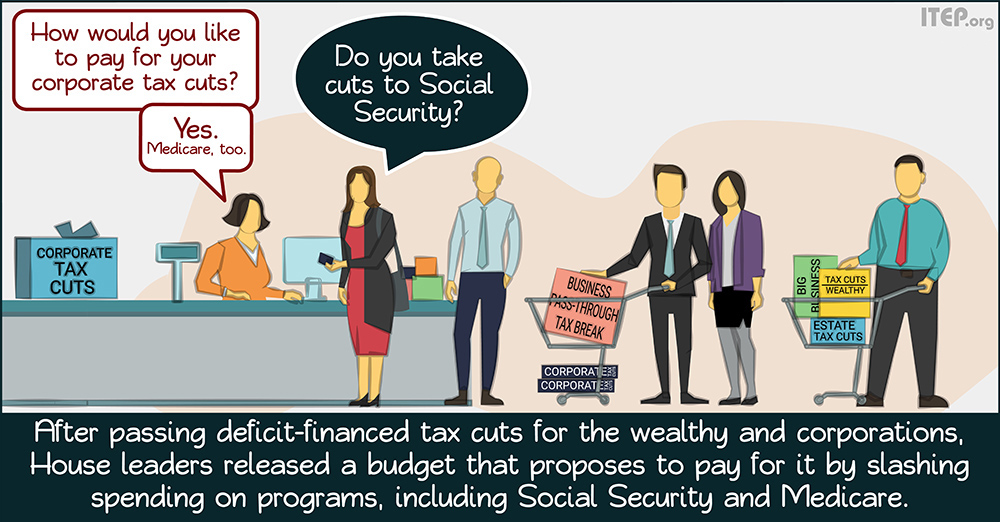

American Prospect: Massive Spending Cuts, the Tax Act’s Hidden Costs

June 28, 2018

According to an analysis released last year by the Institute on Taxation and Economic Policy, those in the bottom fifth of the income distribution paid just under 7 percent of their income in federal taxes, and just over 12 percent in state and local taxes. That contrasts with the top 1 percent of tax filers, […]

Rigging the System and Poor Shaming (Rightly) Are Incompatible Political Strategies

June 27, 2018 • By Jenice Robinson

The absurdity of blaming poor and moderate-income people for their circumstances is close to running its course as an effective political tool, particularly as some elected officials more boldly assert their intent to cater to the whims of the wealthy. Take last year’s GOP-led drive to eliminate the Affordable Care Act (ACA), for example. House […]

Bloomberg BNA: Fix’ for Federal Cap on State Tax Deduction? K-12 Tax Credits

June 27, 2018

But the very same charge can be made against the tax credit programs for private K-12 schools, the Institute on Taxation and Economic Policy said in its report. These programs are now being openly promoted by tax advisers and accountants as a way to sidestep or circumvent the SALT deduction cap, according to ITEP. “In […]

Wall Street Journal: As Treasury Targets Workarounds to Tax Law, Impact May Extend Beyond High-Tax States

June 27, 2018

Tax experts say the federal government will find it difficult if not impossible to write rules to stop the workarounds in New York, New Jersey and Connecticut without also limiting existing tax credits in Georgia, Alabama, South Carolina and elsewhere. According to a recent paper from law professors, 33 states currently have more than 100 […]

Consumer Reports: Sales Tax Ruling May Have Limited Impact

June 27, 2018

Most states currently have some kind of sales tax, though the amount—and what items or services are taxed—varies widely from state to state. Some experts think states will need to pass additional legislation to collect more tax on online purchases, which could take some time. “The Court’s decision provides no hard-and-fast rules for states to […]

The American Prospect: Raises and Bonuses, The PR Fraud

June 27, 2018

It’s hard to imagine a greater encouragement for companies to shift as much profit overseas as possible, mostly to low- or no-tax havens. By the time the tax debate began, the corporate offshore profits pile had grown to $2.6 trillion, on which the companies owed more than $750 billion in unpaid U.S. taxes, according to […]

Governing: Why New Jersey Is Headed for Another Shutdown

June 26, 2018

But Meg Wiehe, deputy director of the left-leaning Institute on Taxation and Economic Policy, notes that the federal corporate income tax cut also has an effect on high-income earners. Historically, shareholders have been the biggest beneficiaries of corporate tax cuts. According to her organization’s research, that means New Jersey’s wealthiest 1 percent will still see […]

NPR: Supreme Court Ruling Means Some Online Purchases Will Cost More

June 22, 2018

While the court made clear that the states do not have unlimited power to require sales tax collection, “The court blessed South Dakota’s law,” said Carl Davis, research director for the Institute of Taxation and Economic policy. The law specifically protects small businesses from collecting sales taxes if they have less than $100,000 in sales […]

New York Times: Supreme Court Widens Reach of Sales Tax for Online Retailers

June 22, 2018

The decision, in South Dakota v. Wayfair Inc., was a victory for brick-and-mortar businesses that have long complained they are put at a disadvantage by having to charge sales taxes while many online competitors do not. And it was also a victory for states that have said that they are missing out on tens of […]

CNBC: Here’s What That Supreme Court Sales Tax Decision Means for You

June 22, 2018

If you haven’t been doing this, you might get a nasty surprise at checkout if your state successfully pushes online merchants to collect those taxes. “This is about improved enforcement of a tax that’s already on the books,” said Carl Davis, research director at the Institute on Taxation and Economic Policy. “For years, shoppers have […]

CNBC: Trump Celebrates Supreme Court Decision that Could Force His Online Store to Collect More Taxes

June 22, 2018

The store, which brands itself as “the official retail website of The Trump Organization,” currently names just four states in which it collects sales taxes. Before April, only two were listed. “The end game here is that internet stores like Trump store should begin collecting sales tax” in more states, said Carl Davis, research director […]

Buffalo News: Sales Tax Ruling Will Help Stores Compete Against Online Retailers

June 22, 2018

Carl Davis, research director at the Institute on Taxation and Economic Policy, a Washington think tank, was quoted in The New York Times saying, “State and local governments have really been dealing with the nightmare scenario for several years now.” He added that “this is going to allow state and local governments to improve their […]

Market Insider: Trump Praises Supreme Court Decision on Sales Tax

June 22, 2018

A Trump Organization representative did not respond to a request for comment from Business Insider on how the Supreme Court decision could affect TrumpStore.com. When New York was added to the list of states, a Trump Store spokesperson told Business Insider the online retailer has “always, and will continue to collect, report, and remit sales […]

Supreme Court Decision in Wayfair Is a Leap Forward for Sales Tax Modernization

June 21, 2018 • By Carl Davis

For years, state and local governments have been dealing with a tax enforcement nightmare as out-of-state Internet retailers have refused to collect sales tax. That non-collection was facilitated by a Supreme Court precedent that tax collection can only be required when a retailer has a “physical presence” inside of a state. In today’s ruling in […]

Reuters: How U.S. Tax Reform Rewards Companies that Shift Profit to Tax Havens

June 20, 2018

“If the guardrails in the new territorial system were meant to prevent companies from avoiding all taxes, AbbVie’s (tax rate) is a pretty clear signal that these guardrails may not be effective,” said Matthew Gardner, senior fellow with the Institute of Taxation and Economic Policy. Read more