ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Politico Morning Tax: Yeah, That’s a Nexus

May 4, 2018

The Trump Store has started collecting sales tax on online purchases from customers in New York, a state where it most certainly seemed to have the physical presence required for collection — a Manhattan flagship store. The liberal Institute on Taxation and Economic Policy noted that update on the store’s website. In all, the store […]

Politifact: Bernie Sanders Says Amazon Paid no Federal Income Tax in 2017. He’s Right

May 3, 2018

The trick for companies? They get to write off the value at which the stock was later traded, not the original price for which they sold their stock to employees. “Even if the grant was pennies on the dollar, the companies get to write off the full market value,” said Matt Gardner, senior fellow at […]

Washington Post: Wisconsin Gov. Scott Walker is sending 671,000 families an election-year check

May 3, 2018

Tax experts said the only similar recent tax break that came to mind was in 2014, when New York Gov. Andrew M. Cuomo (D) pushed through a more targeted, three-year tax package aimed at middle-class families ahead of his reelection bid, according to Meg Wiehe, a tax expert at the Institute on Taxation and Economic […]

Bloomberg BNA: Higher Gas Prices May Mean Paying States More in Taxes

May 1, 2018

As a result, a few states will see revenue gains from higher prices because their tax rates are tied to the price of fuel, rather than its volume, Carl Davis, research director for the left-leaning Institute on Taxation and Economic Policy, told Bloomberg Tax. Those states include California, Connecticut, Kentucky, Maryland, Nebraska, New Jersey, New […]

Education Week: Want to Support Schools? Stop Cutting Taxes

April 30, 2018

In fact, a 2013 Institute on Taxation and Economic Policy study found that states with high tax rates are outperforming no-tax states, particularly in per capita gross state product: 8.2 percent per capita growth in gross state product compared with 5.2 percent in no-tax states. Read more

The Arizona Republic: Will #RedforEd teachers support soaking the rich to better fund Arizona schools?

April 30, 2018

Lujan says it’s is all about balancing an out-of-whack tax structure that is too dependent on sales taxes – one that has left low-income Arizonans paying far more in taxes as a percentage of their income than the wealthy. Indeed, 40 percent of Arizona taxpayers – those who earn an average of $28,300 a year […]

Detroit Free Press: Trump’s Tax Law Saves These Companies Millions

April 29, 2018

For example, embattled Wells Fargo saved $662 million off its tax bill during the first three months of 2018. Those tax savings promise to quickly wipe out the $1-billion fine the bank agreed this month to pay to settle mortgage and auto loan violations against its customers. And Google’s parent company saved as much as $1 billion […]

Washington Post: Democrats’ Tax Plan Looks an Awful Lot Like a Big Giveaway to the Wealthy

April 26, 2018

Some Democratic-led states are also moving forward with plans that would offset the tax benefits for the rich, with New Jersey Gov. Phil Murphy (D) acting swiftly to enact a millionaire’s tax, according to Meg Wiehe, deputy director of ITEP, who noted Murphy has acknowledged the workaround may help the rich. Cuomo has rebuffed similar […]

CNN: Where Dissatisfied Teachers Are Taking Action Next

April 25, 2018

The nonpartisan Institute on Taxation and Economic Policy said the state would have $2.8 billion more in annual revenue if legislators had not changed the tax system that existed in 2013. Gov. Roy Cooper had said improving education funding is a priority. Read more

Arizona and Other Teachers’ Strikes are Directly Connected to Tax-Cutting Fervor

April 24, 2018 • By ITEP Staff

Following is a statement by Meg Wiehe, deputy director of the Institute on Taxation and Economic Policy, regarding the pending teachers’ strike in Arizona. “The Arizona teachers’ strike, like other recent strikes and walkouts before it, is as much a state fiscal policy story as it is an education story. Year after year, lawmakers in […]

American Prospect: Even the CBO Says the GOP Tax Reform Will Incentivize Corporate Offshoring

April 23, 2018

In December, House Speaker Paul Ryan published on his website that the Tax Cuts and Jobs Act benefits “job creators of all sizes” as it “Prevents American jobs, headquarters, and research from moving overseas by eliminating incentives that now reward companies for shifting jobs, profits, and manufacturing plants abroad.” Observers like the Institute on Taxation […]

Public Radio East: NC Continues To Fall Behind In Education Funding

April 23, 2018

The non-partisan Institute on Taxation and Economic Policy finds the state would have about $3 billion more in yearly revenue if the tax system from 2013 was still in place. Read more

Associated Press: The Inherent Limits of Tax Cuts

April 23, 2018

The tax overhaul that took effect Jan. 1 provides generous breaks for corporations and wealthy Americans and more modest relief for middle- and low-income households. In addition, the tax cuts for corporations are permanent; those for individuals and families are only temporary. Richard Phillips is a senior policy analyst at the nonpartisan, liberal-leaning Institute on […]

New York Times: Amazon’s Critics Get New Life with Trump’s Attacks on the Company

April 22, 2018

When Mr. Trump bashes Amazon for not collecting taxes, he is echoing long-running criticism of the company by the Institute on Taxation and Economic Policy, a nonpartisan research organization. Amazon collects sales tax in states that have one for items it sells directly to shoppers, but in most states it does not when shoppers buy […]

Providence Journal: Hike Taxes to Invest in Rhode Island

April 20, 2018

The wealthiest Rhode Islanders have benefited enormously from recently enacted federal tax changes. The Institute on Taxation and Economic Policy reported this month that the wealthiest 5 percent of Rhode Island families would receive 45 percent of the total tax cuts in 2018. The Rhode Island tax code as currently structured is upside down — […]

The Courier-Journal: What the Recent Tax Bill Means for the Average Kentuckian

April 18, 2018

Estimates are that the couple will pay about $200 more a year. “That’s a week’s worth of groceries, and it’s gas in the car,” she said. “The majority of the state is in my situation.” An analysis of the changes by the left-leaning Institute on Taxation and Economic Policy says 95 percent of Kentuckians will pay more. […]

The American Prospect: The Big Tax Lie

April 17, 2018

Following in an excerpt from an op-ed by Matthew Gardner that appeared in the American Prospect: A new report from my organization, the Institute on Taxation and Economic Policy, digs into these disclosures and finds that 15 profitable Fortune 500 companies collectively earned $24 billion in U.S. profits during 2017—and each paid zero, or less, […]

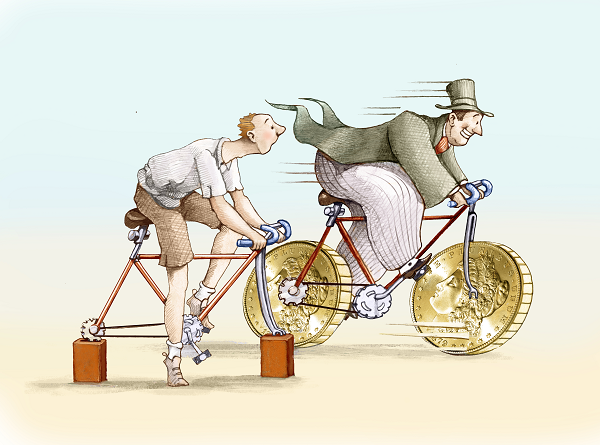

The Week: Americans Don’t Pay Enough in Taxes

April 17, 2018

But here’s the truth: If you add up all the taxes Americans pay, the system is only slightly progressive. As this new report from the Institute on Taxation and Economic Policy shows, those in the poorest quintile pay a total of about 16 percent of their income in taxes, those in the middle pay 25 […]

Associated Press: How Will Taxes Change

April 17, 2018

This chart shows how the current version of the new tax laws will impact Americans at different income levels. The colors represent the average change one can expect as a percentage of 2018 pre-tax income according to the Institute on Taxation and Economic Policy. The darker the color the greater the cuts as a share […]

Think Progress: CBO Confirms Tax Law Will Worsen Offshore Tax Dodging

April 16, 2018

The CBO findings echo analysis from non-partisan think tanks like the Institute on Taxation and Economic Policy, which found that the Republican Tax Cuts and Jobs Act would make offshore tax dodging even worse than it was before. The Center on Budget and Policy Priorities similarly found that the plan is “likely to lead to more […]

Dallas Morning News: NJ Gov. Murphy to Texas Gov. Abbott: Back off from our people and companies Filed under Commentary at 4 days ago

April 16, 2018

We are also not fixated on cutting taxes for the wealthy at the expense of the middle class. According to the Institute on Taxation and Economic Policy, Texas is home to the third-most unfair state and local tax system in the country, with middle-class and working families paying disproportionately higher rates than the wealthiest Texans. […]

The Street: Is President Trump’s Beef with Amazon Justified

April 15, 2018

Matthew Gardner, a senior fellow with the Institute on Taxation and Economic Policy, added that Amazon aggressively fought off calls for years that it start collecting such taxes. Avoiding collection of this money for that long gave the company a huge advantage with shoppers and greatly disadvantaged bricks-and-mortar retailers, he said. Read more

Newark Star-Ledger: The 15 Mostly Red States That Mooch off NJ the Most

April 15, 2018

Under the Republican tax bill, New Jersey and five other states, four of which now pay more to Washington than they receive in services, will contribute a greater share of federal income taxes than they do now, according to the Institute on Taxation and Economic Policy, a progressive research group. Read more

Last Week Tonight with John Oliver: Corporate Taxes

April 15, 2018

ITEP’s corporate data was featured on Last Week Tonight with John Oliver

Two recent Congressional Budget Office reports underscore why the nation needs progressive tax policies. The first, published in March, demonstrates that tax and other public policies have a measurable effect on income disparity. According to CBO data, tax policies (think Earned Income Tax Credit and Child Tax Credit) and means-tested programs (Children’s Health Insurance Program, Medicaid, food assistance, etc.) have helped alleviate growing income inequality. The second CBO report, released this week, reveals that the national debt will soar to untenable levels in the coming years due in part to the recent Trump-GOP tax cuts.