ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

International Business Times: How Changing Corporate Tax Rates Affects The Economy, Government Revenue

August 7, 2017

As Suarez Serrato pointed out in the IBT interview, the study also highlighted the gulf between statutory and effective corporate tax rates. While the federal corporate rate stands at 35 percent and the average state rate is just over 6 percent, two studies by the Institute on Taxation and Economic Policy found that, taking loopholes into […]

USA Today: In Some States, Sales Tax Holidays Lose Luster

August 4, 2017

For more than a decade after New York started the modern trend in 1997, the number of states with annual sales tax holidays grew steadily. But the count peaked at 19 in 2010, and this year’s tally is one fewer than last year. The Institute on Taxation and Economic Policy estimates that states lost $300 million […]

Politifact: Are There Over $4 Trillion in Earnings Offshore?

August 4, 2017

We also turned to the Institute on Taxation and Economic Policy, which found that Fortune 500 companies — a slightly smaller pool — report $2.6 trillion offshore. ITEP included total untaxed earnings, not just indefinitely reinvested ones, in their studies of Apple and Pfizer, as these companies provide a disclosure allowing for a fuller estimate of […]

Between the Lines: Trump Tax Plan Would Benefit the Wealthiest Americans

August 3, 2017

Between The Lines’ Scott Harris spoke with Matthew Gardner, senior fellow with the Institute on Taxation and Economic Policy, who discusses his group’s analysis of the Trump administration’s tax reform plan, and what a progressive reform plan focused on reversing growing economic inequality would look like. Read more

International Business Times: As Mnuchin Discusses Tax Reform, Business Groups Lobby To Shape Tax Policy

August 1, 2017

Two reports on effective federal and state corporate tax rates by the Institute on Taxation and Economic Policy found that, for dozens of profitable Fortune 500 companies, it has, on occasion, been zero.) Trump’s White House has recently backed off its 15-percent corporate-tax-rate goal, with a plan to implement something closer to 20 percent. Read […]

Houston Chronicle: Sanctuary Cities Law Could Cost Texas Billions

August 1, 2017

An analysis of data from the U.S. Census, the Bureau of Economic Analysis and the Institute on Taxation and Economic Policy found that if 10 percent of undocumented immigrants leave Texas, the state would forfeit about $190.7 million in federal tax revenue and $223.5 million more in state and local taxes. The disappearance of those […]

The Problems with the Multi-Million-Dollar Effort to Secure Millionaire and Corporate Tax Cuts

July 31, 2017 • By Alan Essig

Until GOP leaders put forth a detailed tax proposal, we will not know for certain whether the plan will focus on the middle-class and create jobs. But what we do know is that unless the plan is a radical departure from the principles outlined by President Trump earlier this year or laid out by Paul Ryan last year in his “Better Way,” plan, GOP-led tax “reform” efforts will be a tax break bonanza for the wealthiest Americans while delivering a pittance to working people.

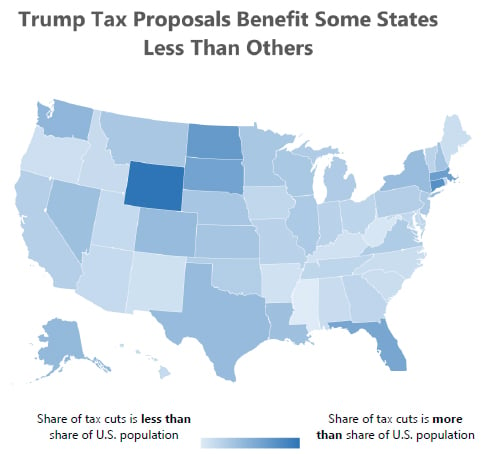

Utah Public News Service: Trump’s Economic Policies to Increase Economic Inequality

July 31, 2017

The Trump administration’s tax proposals would not benefit all taxpayers or states equally, according to new analysis from the Institute on Taxation and Economic Policy. Matt Gardner, a senior fellow with the institute, says the richest 1 percent of taxpayers would receive more than 60 percent of the tax benefits. He adds that poorer states, largely […]

San Francisco Chronicle: Should We Fear Big Tech?

July 29, 2017

Many tech companies have avoided taxes by placing intangibles such as patents and copyrights in subsidiaries in low- or no-tax countries, then attributing income likely generated elsewhere to those subsidiaries. Pharmaceutical companies have also employed this strategy, said Matthew Gardner, a senior fellow with the Institute on Taxation and Economic Policy, a research and education. […]

The New York Times: Wisconsin’s Lavish Lure for Foxconn: $3 Billion in Tax Subsidies

July 28, 2017

Big companies like Foxconn possess leverage to extract concessions from state governments that smaller firms cannot, said Carl Davis, research director at the nonpartisan Institute on Taxation and Economic Policy in Washington. “This is not a comprehensive strategy for economic development,” he said. “If Wisconsin were going to offer this kind of subsidy for every […]

The Atlantic: How Much is Wisconsin Paying for a Taiwanese Manufacturer’s Jobs

July 28, 2017

Plus, states rarely seem to consider whether the money they lavish on corporations might be better spent elsewhere—on public goods like bridges, say, or educational initiatives for their work forces. “If offering more tax incentives requires spending less on public education, congestion-relieving infrastructure projects, workforce development, police and fire protection, or high technology initiatives at […]

The Sacramento Bee: A Jackpot for the 1 Percent, a Pittance for the Rest of Us

July 27, 2017

In California, the bottom line would be even more unfair. The 1 percent with the highest incomes – an average of more than $2.7 million a year – would get nearly two-thirds of the total tax cut, an average of nearly $150,000 each in 2018, the nonpartisan Institute on Taxation and Economic Policy estimated this […]

Trump Touts Tax Cuts for the Wealthy as a Plan for Working People

July 26, 2017 • By Steve Wamhoff

Unless the administration takes a radically different direction on tax reform from what it has already proposed, its tax plan would be a monumental giveaway to the top 1 percent. The wealthiest one percent of households would receive 61 percent of all the Trump tax breaks, and would receive an average of $145,400 in 2018 alone.

Gizmodo: Meet the Shell Company Uber Used to Acquire Otto

July 25, 2017

This kind of patent game has been played best by Pfizer. In its annual report on offshore tax havens used by Fortune 500 companies, the Institute on Taxation and Economic Policy notes that Pfizer hasn’t reported any federal taxable income in eight years, in part because of its effort to offshore its patents. “The company […]

Bloomberg: Americans Say They Back Gas Tax to Fix Crumbling Roads

July 20, 2017

Twenty-six states have raised or updated their gas taxes since 2013, including eight so far this year, according to the Institute on Taxation and Economic Policy, a non-profit research organization in Washington. Read more

Law 360: Wealthy Benefit More Under $5T Trump Tax Plan

July 20, 2017

The Institute on Taxation and Economic Policy on Thursday projected a minimum $4.8 trillion federal revenue reduction over a 10-year period under President Donald Trump’s tax plan that the nonprofit said would give more than three-fifths of all tax cuts to the wealthiest 1 percent of Americans. Based on the broad outlines of the Trump […]

50-State Analysis of Trump’s Tax Outline: Poorer Taxpayers and Poorer States are Disadvantaged

July 20, 2017 • By Alan Essig

Not only would President Trump’s proposed tax plan fail to deliver on its promise of largely helping middle-class taxpayers, it also would shower a disproportionate share of the total tax cut on taxpayers in some of the richest states while southern and a few other states would receive a smaller share of the tax cut […]

Newsday: Rural America Keeps Rejecting Big Wind

July 19, 2017

Since last October, NextEra Energy, the world’s biggest producer of wind energy, has filed lawsuits in federal and state courts against five rural governments, including the town of Hinton, Oklahoma, population: 3,000. NextEra is funding its courthouse mugging of small-town America with your tax dollars. A recent report by the Institute on Taxation and Economic […]

Louisville Courier-Journal: Fix Kentucky’s Upside Down Tax Code

July 19, 2017

And among other things, the legislation would raise Kentucky’s tax on cigarettes and other tobacco products, including e-cigarettes. This would initially generate about $155 million in revenue, but – more importantly – it would discourage tobacco use and reduce associated costs. Kentucky has one of the highest smoking rates and highest rates of lung cancer […]

The Hill: Tech Groups Voice Support for Tax Reform

July 19, 2017

The U.S. currently taxes companies on their income at home and abroad. Corporations, however, don’t have to pay taxes on their income abroad until they repatriate it back home. Supporters of a territorial system argue it could help bring lost tax dollars back into the U.S. The Institute on Taxation and Economic Policy estimates that […]

Bloomberg BNA: Low Tax Revenue Fuels State Deficits, Budget Battles

July 16, 2017

In more than a dozen other states, legislators fought down to the wire. Maine and New Jersey were forced into brief government shutdowns. Much press was given to New Jersey Gov. Chris Christie’s (R) time at the beach over the July 4th weekend when some stretches of state coastline were closed to beach-goers. “In some […]

MarketWatch: Why Back to School Sales Could Actually Cost You Money

July 14, 2017

Currently 16 states have back-to-school sales tax holidays planned for 2017, with most located in the Southeast. Some states also have sales tax holidays for other products, such as guns and hunting supplies, energy-efficient appliances and hurricane preparedness items. “Sales tax holidays may provide some taxpayers savings on necessary purchases, but they’re a distraction from […]

Richmond Times-Dispatch: Legislator Proposes Exempting Poorest Virginia Localities from Some Taxes

July 14, 2017

Carl Davis, research director at the nonpartisan Institute on Taxation and Economic Policy, says state taxes don’t play that large a role in economic development decisions. Companies search for an ideal location and a trained workforce and balance a host of other factors during site selection. “There’s just so much more than state tax policy […]

Regardless of Political Maneuvers, Tax Cuts for the Rich Remain Tied to Cuts in Health Care

July 13, 2017 • By ITEP Staff

The GOP continues its dogged attempt to unravel the Affordable Care Act under the guise of ‘fixing’ our health system despite multiple Congressional Budget Office reports indicating millions stand to lose health care coverage. It’s is not obvious that this version of the bill is much different from the previous fiasco of a bill in which CBO projected 22 million would lose coverage.

The American Prospect: As Trump Gears Up for Big Tax Cuts, Seattle Opts to Tax Wealthy

July 12, 2017

Currently, Washington is one of the few states that don’t levy a personal or corporate income tax. No cities in Washington levy a tax on income, either. That’s partially why the Institute on Taxation and Economic Policy found in 2015 that the state has most regressive taxation system in the entire country, with low- and […]