Blog - Federal Policy

525 posts

To Avoid the CARES Act’s Flaws, Invest in Automatic Relief

April 23, 2020 • By Jessica Schieder

With adequate automatic stabilizers, the United States might not end up with economic relief bills that have provisions tucked in them mostly helping millionaires, as we learned was the case with a CARES Act provision suspending limits on business losses. And regular people could get help more quickly, blunting the economic downturn.

Addressing the COVID-19 Economic Crisis: Advice for the Next Round

April 7, 2020 • By Steve Wamhoff

Americans need many things right now beyond tax cuts or cash payments. But for people whose incomes have declined or evaporated, money is the obvious, immediate need to prevent missed rent or mortgage payments, skipped hospital visits and other cascading catastrophes. So, what should Congress do next to get money to those who need it?

Last week, President Trump destroyed everyone’s coronavirus press conference bingo card by announcing that a conversation he had with celebrity chef Wolfgang Puck inspired him to propose restoring a corporate tax deduction for business entertainment expenses. Trump’s own signature tax plan repealed this break two years ago.

Federal Relief Bill Doesn’t Go Far Enough: Q&A with Meg Wiehe

April 2, 2020 • By ITEP Staff, Meg Wiehe, Stephanie Clegg

The final version of the Coronavirus Aid, Relief and Economic Security (CARES) Act enacted last week included rebate provisions that will reach most low-, moderate- and middle-income adults and children, but not everyone. Meg Wiehe sits down for a Q&A to discuss who benefits from the rebate provision, who is excluded and how states can respond to support communities.

Boeing “CARES” A Lot About its Shareholders—But What about the Rest of Us?

April 1, 2020 • By Matthew Gardner

The gigantic Coronavirus-related tax and spending bill enacted last week, the so-called “CARES Act,” sets aside $17 billion in loans for “businesses critical to maintaining national security.” It’s generally understood that the bill’s authors want much, if not all, of this $17 billion to go to a single company: Boeing. So it behooves us to ask whether Boeing benefits America and its economy in ways that merit this largesse.

Temporarily modifying the structure of the EITC to reflect the realities of our current economy could provide a vital lifeline to low-income workers who have seen their incomes disappear during this crisis. What follows are a few such ideas which could be implemented at either the federal or state levels, or both.

House Democrats’ Suggestion of Retroactively Repealing SALT Cap is a Poor Emergency Relief Measure

March 31, 2020 • By Steve Wamhoff

The House Democrats have plenty of ideas to help workers and families and boost the economy, but Speaker Nancy Pelosi’s recent idea to repeal the cap on deductions for state and local taxes (SALT) is not one of them. The 2017 Trump-GOP tax law includes many provisions that should be repealed. Unfortunately, Congressional Democrats have long made it clear that they want to start by repealing the $10,000 cap on SALT deductions, which is one of the law's few provisions that restrict tax breaks for the rich.

Congress “CARES” for Wealthy with COVID-19 Tax Policy Provisions

March 31, 2020 • By Matthew Gardner

At a time when record numbers of Americans are facing unemployment, state and local governments are facing a perfect storm of growing public investment needs and vanishing tax revenues, and small business owners are struggling to avoid even more layoffs, lavishing tax breaks on the top 1 percent in this way shouldn’t be in anyone’s top 20 list of needed tax changes.

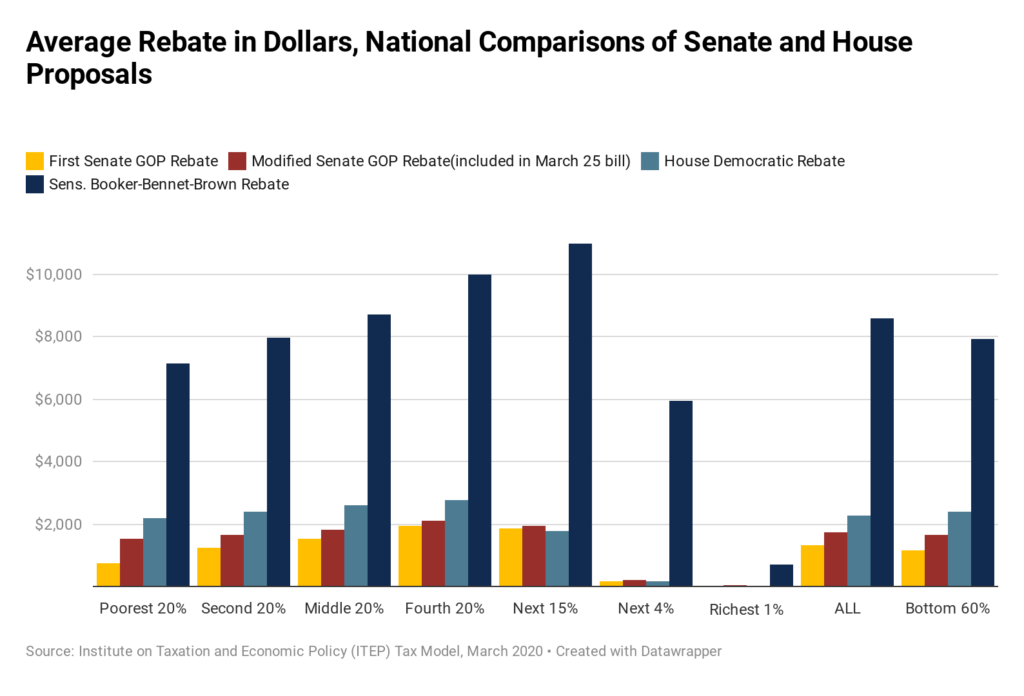

How the Tax Rebate in the Senate’s Bill Compares to Other Proposals

March 25, 2020 • By Steve Wamhoff

Congress is poised to pass a $2 trillion plan that includes $150 billion in fiscal aid to states, $150 billion in health care spending, large expansions of unemployment compensation and more. These measures are clearly needed as the economy teeters on the brink. As the Senate votes on its stimulus/COVID19 bill, one provision ITEP has deeper insights on is the payments to households in the form of tax rebates. ITEP has provided several analyses over the past few days showing that the rebate in the current bill is an improvement over a previous GOP proposal but still falls short of…

COVID-19 and the Case for Race-Forward Economic Policy Prescriptions

March 24, 2020 • By Jenice Robinson

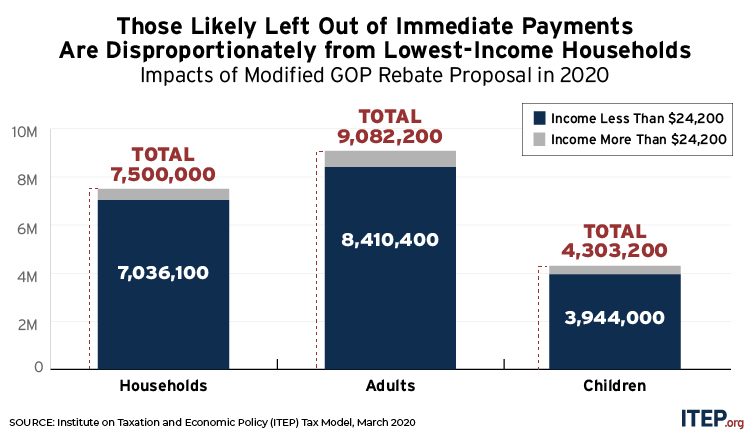

Unconscious bias runs deep. Legislative proposals to assuage the exploding economic crisis are advancing and changing quickly, but initial GOP proposals are consistent with the nation’s long history of ostensibly race-neutral policies that are discriminatory in their outcomes.

NEW ANALYSIS: House Democratic Stimulus Bill Explained

March 24, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

Breaking ITEP analysis explains how a newly-introduced House Democrats' proposal—far more comprehensive and better targeted than the recently failed GOP Senate bill—combines overdue expansion of the Earned Income Tax Credit and Child Tax Credit with direct rebates to reach workers and families across all income groups.

New State-by-State Estimates: Modified Senate GOP Stimulus Bill Still Falls Short

March 23, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

The GOP Senate stimulus bill voted down yesterday is a slight improvement over the first GOP proposal released Thursday, but it still fails to prioritize workers and families or provide fast relief to those who need it most.

Why the GOP Senate Bill Fails to Address the Crisis, and Why a Democratic Bill Looks More Promising

March 20, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

National and state-by-state data available for download By Steve Wamhoff and Meg Wiehe On Thursday night, Senate Majority Leader Mitch McConnell released a bill that reportedly cost more than $1 trillion, most of which would go toward breaks for corporations and other businesses. A provision in the bill to provide payments to families would cost […]

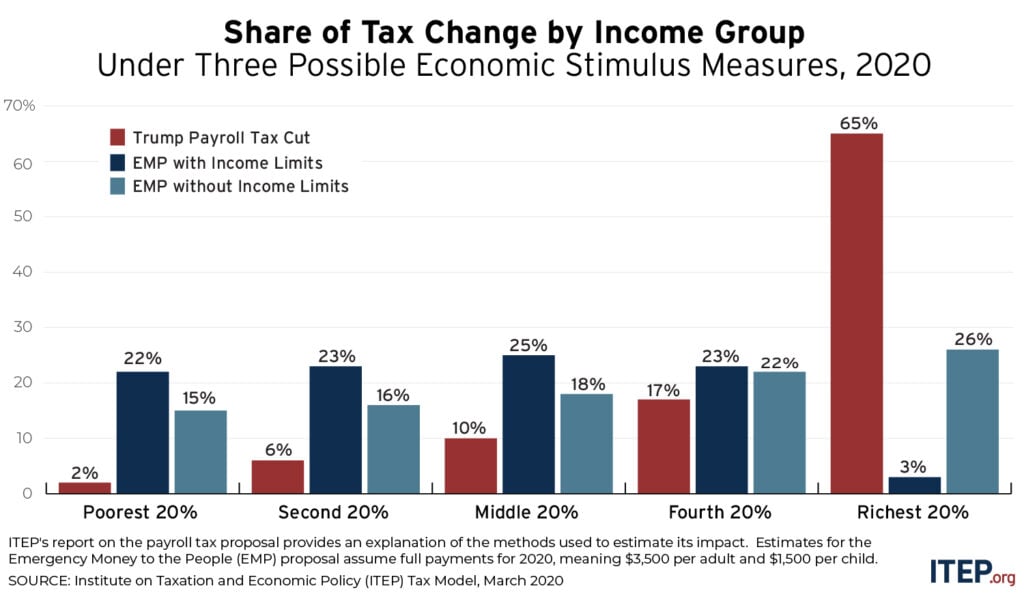

A payroll tax cut would help those lucky enough to keep their job and would provide a bigger break to those with more earnings. Sending checks to every household would be a far more effective economic stimulus because it would immediately put money in the hands of everyone who would likely spend it right away, pumping it back into the economy.

New ITEP Report on President’s Misguided Payroll Tax Proposal

March 13, 2020 • By Steve Wamhoff

Earlier this week, ITEP analyzed what would happen if Congress and the President repeated the 2 percentage-point cut in the Social Security payroll tax that was enacted for two years during the last recession. Little did we know that President Trump was about to propose something far more radical: eliminating all Social Security and Medicare […]

The Trump administration is floating a cut in the Social Security payroll tax as a measure to counteract a potential economic downturn related to the COVID-19 virus. It should go without saying that a public health crisis requires government interventions that have nothing to do with taxes. But even if policymakers want to find ways to stimulate the economy beyond solving the health crisis, the payroll tax cut is not likely to be very effective.

COVID-19 Is No Excuse for Airline Industry or Any Other Corporate Tax Cut

March 10, 2020 • By Matthew Gardner

Trump administration officials have reportedly floated the idea of including tax breaks for the airline industry in its package of COVID-19-related stimulus proposals, which would allow airline companies to defer income taxes into the future. This is an odd policy choice since most of the biggest airlines are already using deferral to zero out most or all of their federal income taxes on billions of dollars in profits.

Some problems can only be solved when public officials have the resources to act. Today’s public health crisis is that kind of problem. Unfortunately, the Trump administration’s deep tax cuts leave our health infrastructure knee-capped, just when we need it most.

Anti-tax activists’ convoluted claims that the rich pay too much in taxes broke new ground with an op-ed published last week in the Wall Street Journal. Penned by former Texas Sen. Phil Gramm and John Early, a former official of the Bureau of Labor Statistics, the piece is particularly misleading. The so-called evidence in support of their argument against raising taxes on the rich fails to correctly calculate effective tax rates.

Lawmakers should keep in mind that transportation funding woes can be traced to the federal government’s extremely outdated gas tax rate, which has not been raised in more than 26 years—not even to keep up with inflation.

Tax Cuts Floated by White House Advisors Are an Attempt to Deflect from TCJA’s Failings

February 21, 2020 • By ITEP Staff, Jenice Robinson, Steve Wamhoff

Now that multiple data points reveal the current administration, which promised to look out for the common man, is, in fact, presiding over an upward redistribution of wealth, the public is being treated to pasta policymaking in which advisors are conducting informal public opinion polling by throwing tax-cut ideas against the wall to see if any stick. But the intent behind these ideas is as transparent as a glass noodle.

How Democratic Presidential Candidates Would Raise Revenue

February 19, 2020 • By Steve Wamhoff

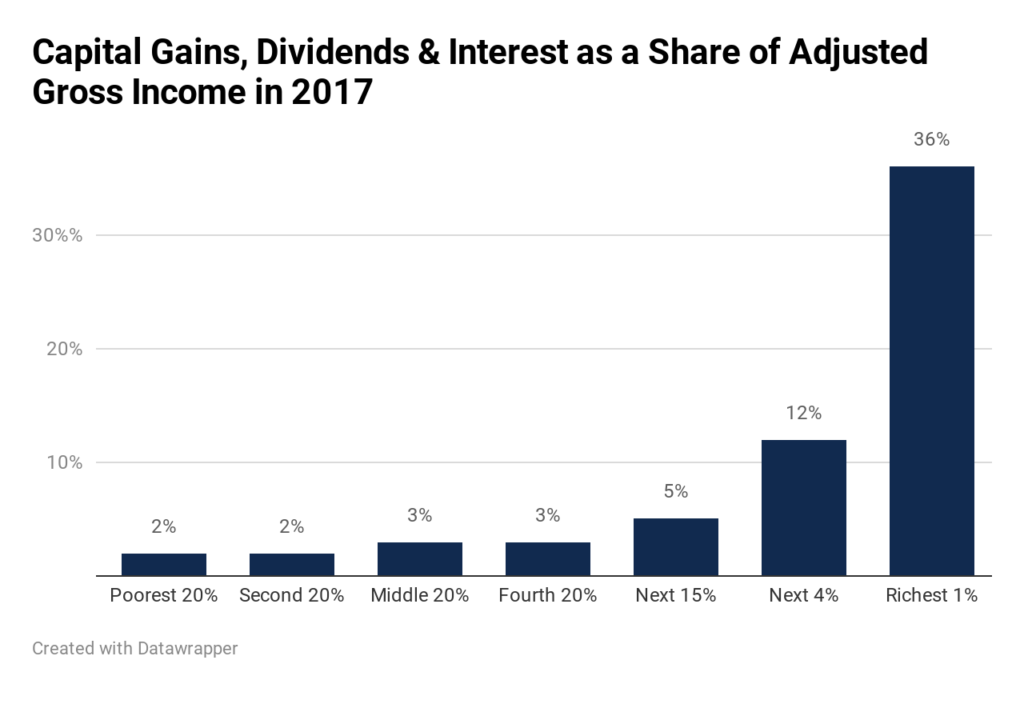

One of the biggest problems with the U.S. tax code in terms of fairness is that investment income, which mostly flows to the rich, is taxed less than the earned income that makes up all or almost all of the income that working people live on.

2021 Trump Budget Continues 40-Year Trickle-Down Economic Agenda

February 12, 2020 • By Jenice Robinson

The 2017 Tax Cuts and Jobs Act may as well have been called the Promise for Austerity Later Act.

Hearing Witness: Trump Administration Giving Tax Breaks Not Allowed by Law

February 12, 2020 • By Steve Wamhoff

The Treasury Department, tasked with issuing regulations to implement the hastily drafted Trump-GOP tax law, is concocting new tax breaks that are not provided in the law. This is the short version of what we learned while watching Tuesday’s House Ways and Means Committee hearing on “The Disappearing Corporate Income Tax.”

Washington Is Finally Having the Right Conversation about Taxes

February 4, 2020 • By Amy Hanauer

Presidential candidates and some elected officials are finally talking about bold tax policy ideas that would increase taxes and raise revenue. This is a dramatic shift from when a radical, right-wing narrative dominated the public debate. Republicans redefined “fiscal responsibility” as fewer taxes and less government, peddled supply-side economic theories, and denied the clear evidence that tax cuts were adding to our nation’s deficits.