Inequality

JPMorgan Chase CEO Jamie Dimon, in a May 19 memo to employees, outlines steps the company is taking to help its customers, small businesses and communities stay afloat. The part of the public relations memo that has received the most attention, however, is Dimon’s call for “rebuilding a more inclusive economy.” “It is my fervent […]

Which Workers Wouldn’t Be Helped by a Payroll Tax Cut?

May 8, 2020 • By Jessica Schieder, Lorena Roque

New data released today estimates 20.5 million jobs were lost in the month of April alone. Workers not currently receiving paychecks would be left out of any benefits provided by a payroll tax cut.

COVID-19 has revealed a policy apparatus that reflexively prioritizes those who need it least, a wholly inadequate safety net, an underfunded public health infrastructure, and an inefficient national health stockpile. If the nation stays this course, it will make only cosmetic restorations to a shoddily built house.

Our elected officials have to listen to we the people and change their approach. Going forward, corporate voices cannot continue to steer. Instead, families, communities and working individuals have to lead our policymaking so it better helps people struggling now.

ITEP: Tax Cuts for Millionaires in the CARES Act Violate Public Trust

April 14, 2020 • By Amy Hanauer

“Public trust and the broad agreement that families and communities needed immediate relief from the economic crisis allowed the $2.2 trillion economic relief package to move quickly through Congress. Yet during a crisis in which thousands have lost their lives and millions are losing their jobs, their health care and their retirement security, some of our lawmakers snuck in tax benefits for the nation’s richest families."

Returning to the Economic Status Quo After COVID-19 Crisis Should Not Be an Option

April 6, 2020 • By Jenice Robinson

It will take immense imagination, unyielding political will and a fundamental reordering of our policy priorities to adequately address the problems of this moment and unrig our economy.

COVID-19 and the Case for Race-Forward Economic Policy Prescriptions

March 24, 2020 • By Jenice Robinson

Unconscious bias runs deep. Legislative proposals to assuage the exploding economic crisis are advancing and changing quickly, but initial GOP proposals are consistent with the nation’s long history of ostensibly race-neutral policies that are discriminatory in their outcomes.

Administration Once Again Touts Misleading Information on 2017 Tax Law

March 3, 2020 • By Matthew Gardner

The Trump administration has remained consistently on message about its 2017 Tax Cuts and Jobs Act. More than two years after the passage of the law, Treasury Secretary Steve Mnuchin is still forlornly attempting to portray it as a boon for working families, despite mounds of evidence to the contrary. Earlier this week the Treasury […]

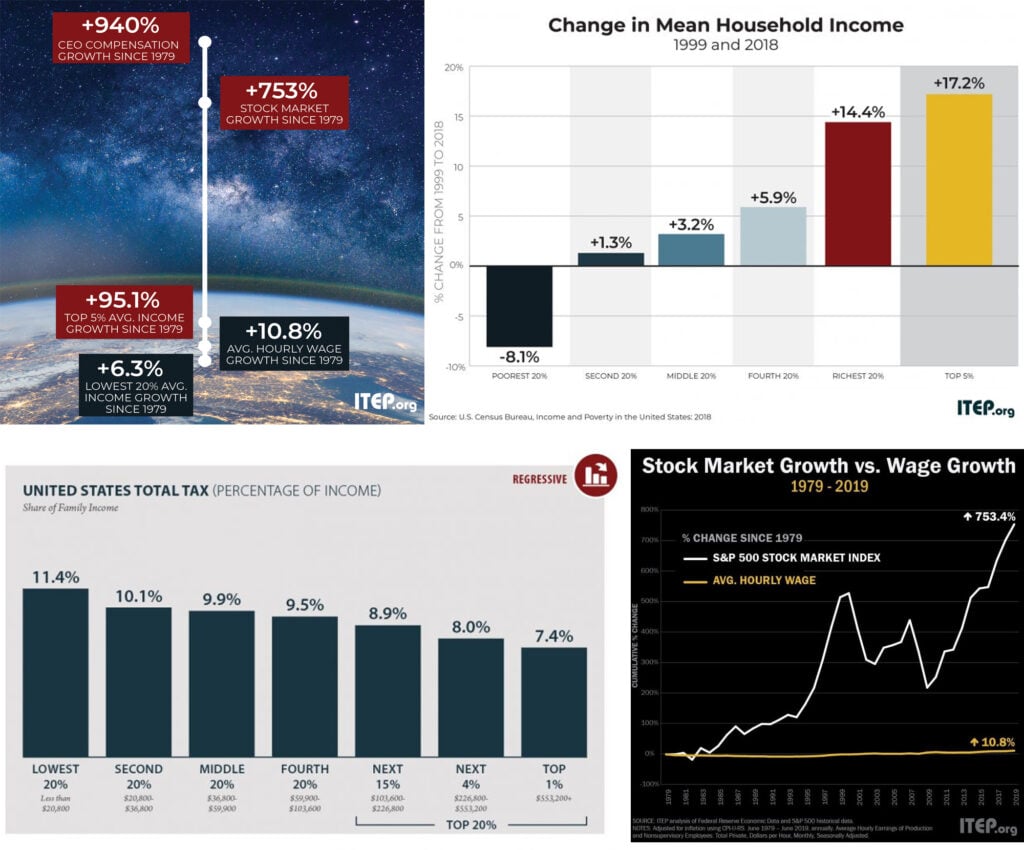

Anti-tax activists’ convoluted claims that the rich pay too much in taxes broke new ground with an op-ed published last week in the Wall Street Journal. Penned by former Texas Sen. Phil Gramm and John Early, a former official of the Bureau of Labor Statistics, the piece is particularly misleading. The so-called evidence in support of their argument against raising taxes on the rich fails to correctly calculate effective tax rates.

Tax Cuts Floated by White House Advisors Are an Attempt to Deflect from TCJA’s Failings

February 21, 2020 • By ITEP Staff, Jenice Robinson, Steve Wamhoff

Now that multiple data points reveal the current administration, which promised to look out for the common man, is, in fact, presiding over an upward redistribution of wealth, the public is being treated to pasta policymaking in which advisors are conducting informal public opinion polling by throwing tax-cut ideas against the wall to see if any stick. But the intent behind these ideas is as transparent as a glass noodle.

2021 Trump Budget Continues 40-Year Trickle-Down Economic Agenda

February 12, 2020 • By Jenice Robinson

The 2017 Tax Cuts and Jobs Act may as well have been called the Promise for Austerity Later Act.

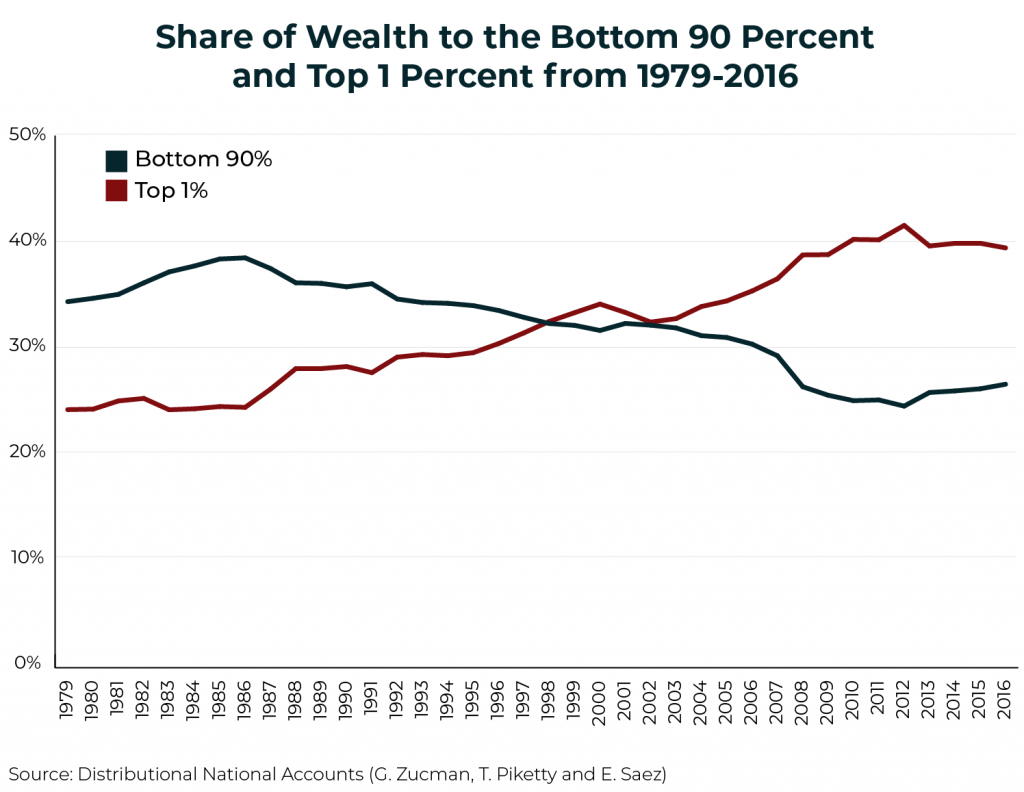

White House Council of Economic Advisers Crows about Lowest-Income Americans Being Infinitesimally “Wealthier”

January 14, 2020 • By Matthew Gardner

When the White House Council of Economic Advisors last week tweeted that the poorest 50 percent of Americans’ wealth is growing 3 times faster than the wealth of the top 1 percent, we were skeptical. As it turns out, the CEA’s tweet is a reminder that the poorest 50 percent wealth grew twice as fast during Barack Obama’s second term than it has under Trump, but to this day remains far below its pre-recession share and significantly less than what it was 30 years ago.

A basic understanding and idea of fairness is a trait we share with intelligent primates, which is precisely why more than two years ago as Congress was debating the Tax Cuts and Jobs Act, the American public disapproved of the tax bill.

Real Change: Fishing for Equity in a Regressive Tax System

October 16, 2019

“It’s always about race, and it’s always about taxes,” said Misha Hill, a policy analyst with the Institute on Taxation and Economic Policy (ITEP). ITEP is the source of the frequently cited statistic that Washington has the most regressive tax system in the country. In fact, Hill said, there are no states in the union […]

Emmanuel Saez and Gabriel Zucman’s New Book Reminds Us that Tax Injustice Is a Choice

October 15, 2019 • By Steve Wamhoff

Cue Emmanuel Saez and Gabriel Zucman. In their new book, The Triumph of Injustice, the economists, who already jolted the world with their shocking data on exploding income inequality and wealth inequality, tell us to stop acting like we are paralyzed when it comes to tax policy. There are answers and solutions. And in about 200 surprisingly readable pages, they provide them.

A New York Times article explained that proponents of a federal wealth tax hope to address exploding inequality but then went on to list the fears of billionaires and economic policymakers, finding that “the idea of redistributing wealth by targeting billionaires is stirring fierce debates at the highest ranks of academia and business, with opponents arguing it would cripple economic growth, sap the motivation of entrepreneurs who aspire to be multimillionaires and set off a search for loopholes.” A wealth tax will not damage our economy and instead would likely improve it. Here’s why.

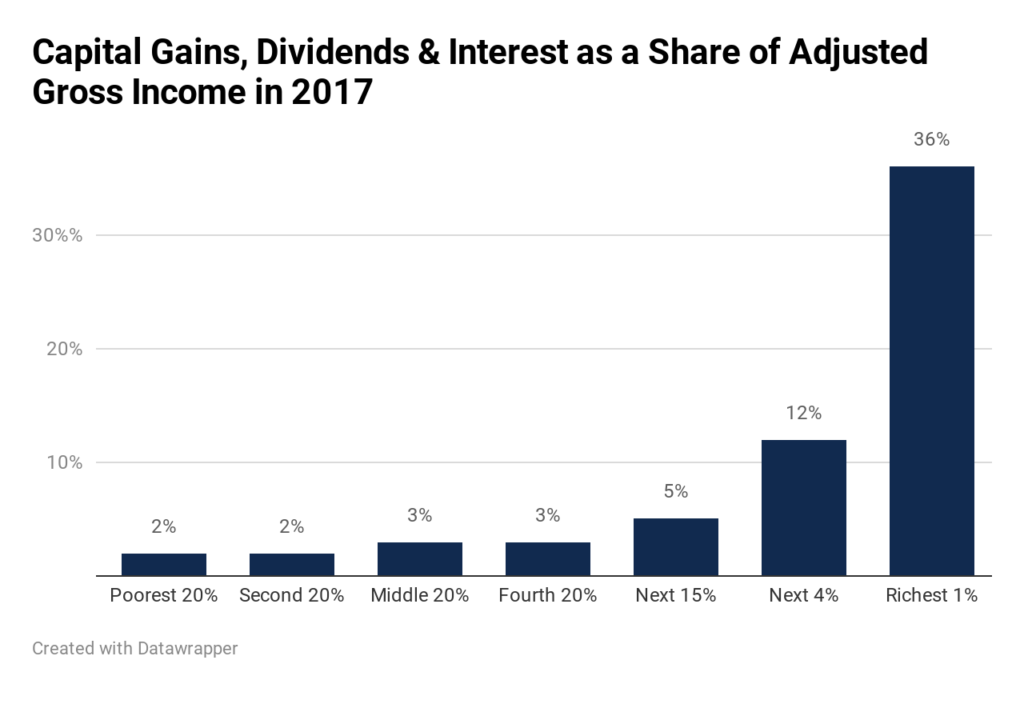

The Nation’s Income Inequality Challenge Explained in Charts

September 27, 2019 • By Stephanie Clegg

Income inequality has reached its highest level since the U.S. Census Bureau began tracking the measure more than 50 years ago, according to recent data. While recent Census data show modest increases in median household income and average hourly wages—numbers anti-tax politicians and pundits have used to deny rising inequality—a deeper look at some of the latest numbers reveals a decades-long trend of widening economic inequality.

Why Are Ideologues Trying to Downplay Poverty and Economic Inequality?

September 12, 2019 • By Jenice Robinson

Our elected officials should pause and check the pulse of the nation. The public is aware of the great income divide and likely isn’t keen on an agenda that would use sleight of hand to “reduce” poverty and spend less on domestic programs—particularly when that agenda is in tandem with using the tax code to further boost income for the wealthy.

How Tax Policy Can Help Mitigate Poverty, Address Income Inequality

September 10, 2019 • By ITEP Staff

Analysts at the Institute on Taxation and Economic Policy have produced multiple recent briefs and reports that provide insight on how current and proposed tax policies affect family economic security and income inequality.

Why Local Jurisdictions’ Heavy Reliance on Fines and Fees Is a Tax Policy Issue

September 4, 2019 • By Meg Wiehe

The exposé (Addicted to Fines: Small Towns Are Dangerously Dependent) raises two important issues that policymakers have the power to address. One, lack of revenue at the local level is linked to a broader challenge with state tax systems. Two, fines and fees often entrap lower-income people in a cycle of debt and, in some jurisdictions, ultimately criminalize poverty by casting unpaid fines as misdemeanor crimes.

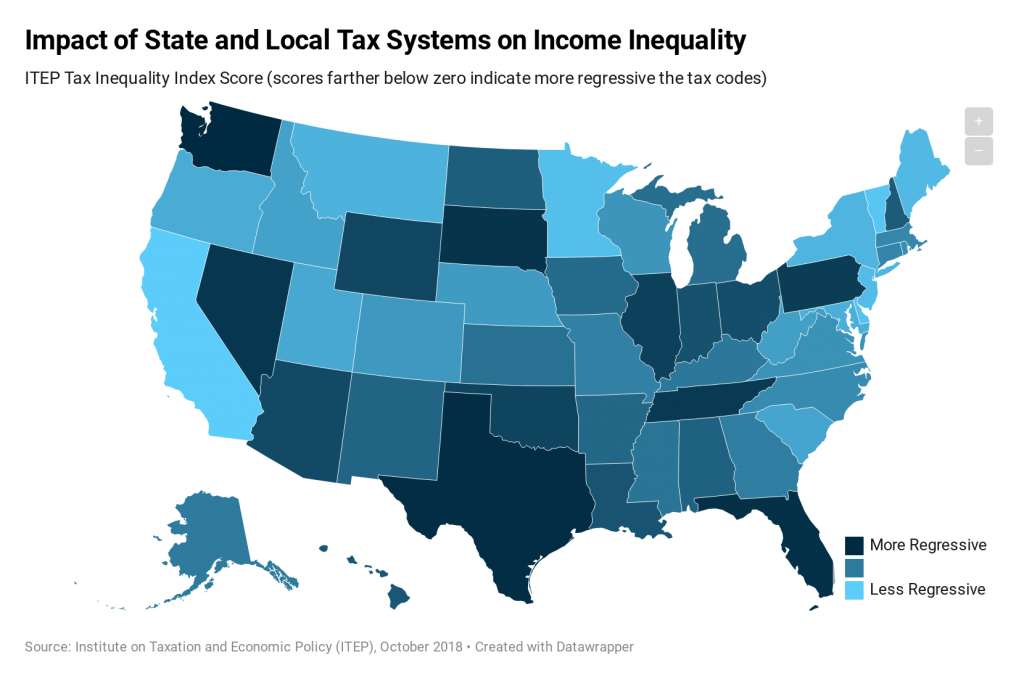

The vast majority of state and local tax systems exacerbate the economic divide by taxing low- and middle-income families at higher rates than the wealthy. This map distills an exhaustive analysis of state and local tax codes into one key number, the ITEP Tax Inequality Index, to show the degree to which each state’s tax […]

Opportunity Zones Have Nothing to Do with Reparations, Except …

August 2, 2019 • By Jenice Robinson

Among other things, this blog highlights how federal, state and local policies systematically work to reinforce the racial wealth gap by, for example, using the tax code to redistribute the nation’s wealth to billionaire developers and keeping low-income people of color in a perpetual cycle of debt through fines and fees to fund local governments. Opportunity zones and the top-heavy 2017 tax law are emblematic of a long history of policymaking that advantages wealthy white families.

File Under “No Surprise”: Wealthiest Taxpayers Use Offshore Tax Shelters More Than the Rest of Us, New Research Finds

June 4, 2019 • By Matthew Gardner

Tax evasion matters. It drains needed revenues from the public treasury, and saps public confidence in rules of the game. A recent Pew Research poll finds that 60 percent of Americans are bothered “a lot” by the feeling that the best-off don’t pay their fair share of taxes. And now, thanks to a new report, […]

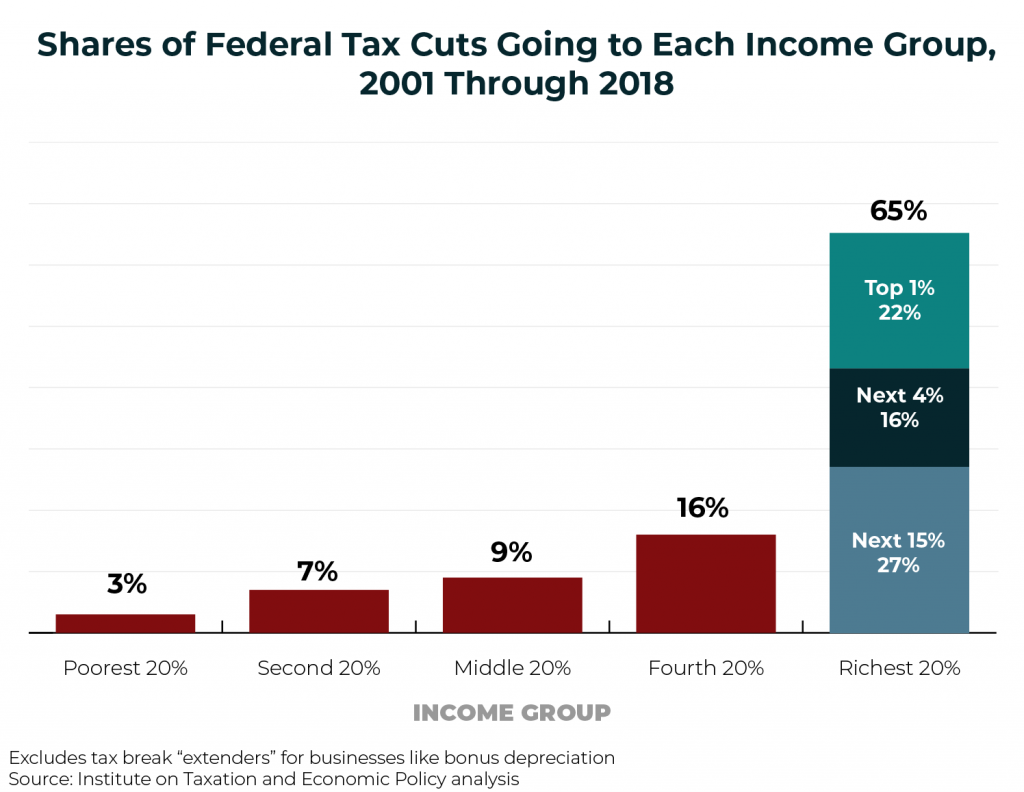

Policymakers and the public widely agree that economic inequality is the social policy problem of our age. It threatens the livelihoods of millions of children and adults, and it even threatens our democracy. Although some say Americans could fix it themselves by simply rolling up their sleeves, as a sub-headline in a March U.S. News and World Report column implied, the reality is different.

Income inequality is a national challenge. And inadequate federal revenue is a challenge that the nation will eventually have to reckon with. This chart book makes a strong case for why federal lawmakers should seriously consider progressive revenue-raising options.