ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Long-term troubles for this country and this planet now demand our attention. Progressive tax policy would transform our ability to tackle them.

Frequently Asked Questions and Concerns About the President Billionaires’ Minimum Income Tax

April 6, 2022 • By Steve Wamhoff

Find the answers to some frequently asked questions about President Biden's Billionaires’ Minimum Income Tax, which would limit very wealthy individuals’ ability to put off paying income taxes on capital gains until they sell assets.

DC Fiscal Policy Institute: DC’s Earned Income Tax Credit – The Most Generous in the Nation, but not the Most Inclusive

April 6, 2022

The DC Earned Income Tax Credit (EITC) is a powerful tool for advancing racial, gender, and economic equity. Modeled after the federal tax credit by the same name, DC’s EITC goes to families and individuals earning low and moderate incomes to help them keep more of what they earn and meet basic needs. It is claimed […]

Racial Discrimination in Home Appraisals Is a Problem That’s Now Getting Federal Attention

March 31, 2022 • By Brakeyshia Samms

With both assessments and appraisals being unfair, homeowners of color are stuck between a rock and a hard place when it comes to determining the worth of what is, for most homeowners, their most valuable asset.

The Commonwealth Institute for Fiscal Analysis: Gas Tax Proposal Misses the Mark

March 29, 2022

Earlier this month, Virginia Gov. Glenn Youngkin announced a new policy proposal to suspend the state’s 26-cents per gallon gas tax for three months and to cap gas tax rates in future years. If enacted, this policy is likely to miss the mark on helping families in Virginia who are struggling with higher costs, while […]

ITEP Statement on Biden Administration’s Billionaire Minimum Income Tax Plan

March 28, 2022 • By ITEP Staff

The following is a statement from Amy Hanauer, executive director of the Institute on Taxation and Economic Policy, on the Biden administration’s inclusion of a Billionaire Minimum Income Tax in its latest budget proposal: “Creating a Billionaire Minimum Income Tax would ensure for the first time that the very wealthiest people in this country, those […]

What the Biden Administration Can Do on Its Own, Without Congress, to Fix the Tax Code

March 25, 2022 • By Steve Wamhoff

The Biden administration has several options to address tax reform even when Congress is unable or unwilling to help.

Women’s History Month is a Reminder that Sensible Tax Policy is Central to Women’s Economic Security

March 24, 2022 • By Brakeyshia Samms

Women’s History Month is a chance to remember what happens for women when tax policy becomes more progressive, boosts income, and helps make raising a family more affordable.

New Hampshire Fiscal Policy Institute: Expansions of the Earned Income Tax Credit and Child Tax Credit in New Hampshire

March 23, 2022

Prior to the temporary expansions, nearly one in five likely eligible Granite Staters did not claim the EITC, and approximately 7,745 children were estimated to be eligible for the CTC while the credit was not claimed on their household’s tax return. The potential under enrollment in key assistance programs, along with underutilization of the EITC […]

Tax Breaks for Elderly Taxpayers in the States in 2022

March 21, 2022 • By ITEP Staff

Read as PDF

Georgia Budget and Policy Institute: House Proposes Massive Tax Cuts for Wealthiest, Slashing State Revenues

March 14, 2022

Members of the Georgia General Assembly are considering legislation that would fundamentally change the structure of the tax code and result in disproportionately large tax cuts for the wealthiest while hundreds of thousands of families would see tax increases or few benefits. This is due to the package’s proposed flat personal income tax rate and […]

What We Can Learn Today from the American Rescue Plan – and Sen. Rick Scott’s Proposed Tax Increases

March 11, 2022 • By Steve Wamhoff

The success of the American Rescue Plan Act is worth revisiting today. Instead of pursuing Sen. Rick Scott’s agenda of making life more difficult for those already working the hardest, Congress should extend or make permanent some of the beneficial policies in ARPA.

California Budget & Policy Center: California’s Tax & Revenue System Isn’t Fair for All

March 10, 2022

Californians need quality public health and schools, access to affordable housing and clean water, and safe roads and neighborhoods along with many more services to live and thrive – no matter one’s zip code. Accordingly, the state’s tax and revenue system must raise adequate revenue to cover the services provided by state and local governments and make […]

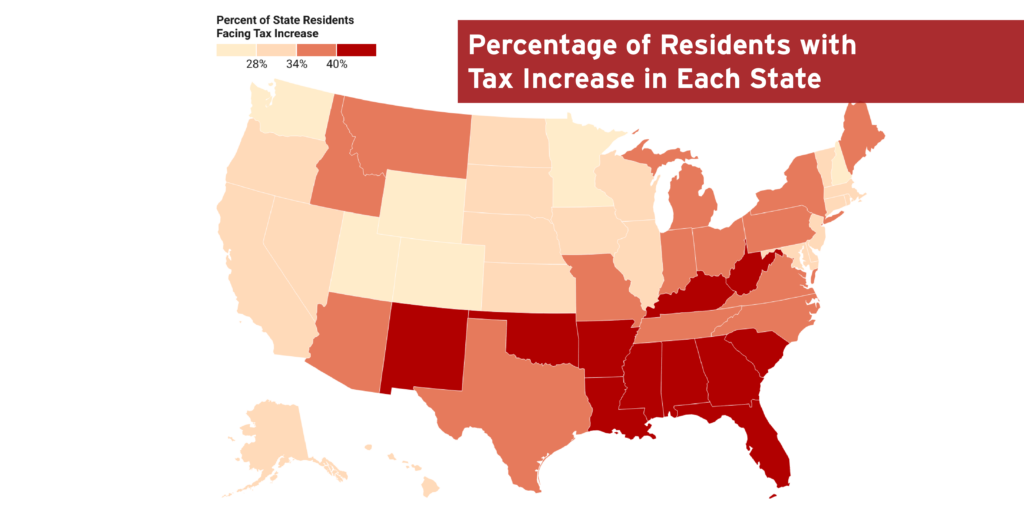

State-by-State Estimates of Sen. Rick Scott’s “Skin in the Game” Proposal

March 7, 2022 • By Steve Wamhoff

A proposal from Sen. Rick Scott would increase taxes for more than 35% of Americans, with the poorest fifth of Americans paying 34% of the tax increase.

President Biden should elevate his tax and revenue proposals which remain essential if we are to pay for environmental restoration, health priorities and peacekeeping, the front-burner items that may dominate the speech.

New Jersey Policy Perspective: Making New Jersey Affordable for Families – The Case for a State-Level Child Tax Credit

February 23, 2022

A state-level child tax credit would recognize the unique costs of raising children and the support that most families need to care for their kids and set them up for success. When families can pay for basic expenses and save for their children’s futures, it improves child well-being immediately by reducing key costs like food […]

Sen. Scott and others who favor shifting taxes away from the rich and down the income distribution often focus solely on the federal personal income tax and ignore all the other taxes that Americans pay.

The Federal Gas Tax Holiday is Not a New Idea, Just a Bad One

February 17, 2022 • By Steve Wamhoff

The argument for suspending the gas tax, which would cost $20 billion, is weaker than ever.

It’s become popular to urge people to imagine a better world. But on tax policy, the last year gives us ample evidence that lets us move far beyond imagining.

West Virginia Center on Budget and Policy: House Personal Income Tax Cut Plan Largely Benefits Wealthy, Not Fiscally Sustainable

February 15, 2022

The West Virginia Legislature has introduced a bill to cut and eventually eliminate the state’s personal income tax. The House Finance Committee voted to advance that bill to the House floor with no discussion or questions asked. Like previous attempts to eliminate the state’s income tax, HB 4007 would lead to major revenue losses for the […]

Oklahoma Policy Institute: Strengthening the Grocery Tax Credit Would Provide Fiscally Smart Tax Relief to Working Oklahomans

February 14, 2022

Oklahoma can effectively eliminate the state and local sales tax on groceries for most low-income families by strengthening the Sales Tax Relief Credit. At a time when many Oklahomans are struggling to put food on the table and are at risk of eviction, a more robust Sales Tax Relief Credit can help put money back into the pockets […]

Common Good Iowa: New Income Tax Cuts – a Recipe for Disaster and Inequity

February 10, 2022

Iowa lawmakers have repeatedly cut taxes over the last three decades in ways that provide the greatest benefits to the highest-income taxpayers while ratcheting down investments that historically made the state attractive to raise a family or do business — including public schools and public health. Now, within months of passing tax cuts that when […]

Federal EITC Enhancements Help More Than One in Three Young Workers

February 8, 2022 • By Aidan Davis

More than one in three young adults would benefit from workers without children being eligible to receive the federal EITC. This policy change would bolster young adults’ economic security.

Amazon Avoids More Than $5 Billion in Corporate Income Taxes, Reports 6 Percent Tax Rate on $35 Billion of US Income

February 7, 2022 • By Matthew Gardner

Amazon avoided about $5.2 billion of federal income tax on its record $36 billion in U.S. pretax income for fiscal year 2021.

Idaho Center for Fiscal Policy: HB 436 Tax Cuts Benefit Wealthy Idahoans

February 7, 2022

The tax cuts proposed in HB 436 would benefit wealthy Idahoans the most. The bill would also collapse the state’s five tax brackets to four, and would lower the income tax rate on the wealthiest tax bracket from 6.5% to 6%. Read more