ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Taxes and Racial Equity: An Overview of State and Local Policy Impacts

March 31, 2021 • By ITEP Staff

Historic and current injustices, both in public policy and in broader society, have resulted in vast disparities in income and wealth across race and ethnicity. Employment discrimination has denied good job opportunities to people of color. An uneven system of public education funding advantages wealthier white people and produces unequal educational outcomes. Racist policies such as redlining and discrimination in lending practices have denied countless Black families the opportunity to become homeowners or business owners, creating extraordinary differences in intergenerational wealth. These inequities have long-lasting effects that compound over time.

New Research: Tax Policy Choices Can Narrow or Worsen the Racial Income Gap

March 31, 2021 • By ITEP Staff

Media contact A new report released today by the Institute on Taxation and Economic Policy spotlights a stark challenge confronting state and local lawmakers. Tax policy has the potential to narrow the racial income and wealth gaps, but an overreliance on inequitable revenue sources in some states indefensibly makes those gaps worse. The research builds […]

California Budget & Policy Center: American Rescue Plan Provides Assistance to Millions of Californians

March 30, 2021

This latest round of federal fiscal relief will help reduce hardship as a result of the pandemic, particularly for Californians with low incomes and people of color, and begins to set the stage for a more equitable economic recovery. This report outlines key provisions of the plan and what it means for Californians. Read more

WTTW: Proposals Could Expand Eligibility for Earned Income Tax Credit

March 29, 2021

“[Illinois] just piggybacks off of that by saying if you got the federal credit you get 18% of that for state purposes,” said Lisa Christensen Gee, the director of special initiatives at the Institute of Taxation and Economic Policy. The credit offsets state income tax liability, and if an individual has more credit than the […]

We all need the things that the public sector provides. When corporate taxes go unpaid, the American people have less for the things that would help our communities. That means less repair of our failing infrastructure, less investment in greening our economy, less funding to help young people attend college.

Testimony to Senate Budget Committee on Ending a Rigged Tax Code: The Need To Make the Wealthiest People and Largest Corporations Pay their Fair Share of Taxes

March 25, 2021 • By Amy Hanauer

Following is testimony of ITEP Executive Director Amy Hanauer before the Senate Budget Committee to consider “Ending a Rigged Tax Code: The Need To Make the Wealthiest People and Largest Corporations Pay their Fair Share of Taxes” “Chairman Sanders and Ranking Member Graham, thank you for the opportunity to speak to this committee. My name […]

Indy Week: Anti-Poverty Advocates Rejoice Over New Child Tax Credit

March 24, 2021

It’s hard to overstate the significance of the expanded tax credit for low-income families. Information released by the Institute on Taxation and Economic Policy found that more than 2.6 million children in North Carolina stand to benefit from the credit, and the Center on Budget and Policy has calculated that the legislation will move 137,000 […]

Connecticut Post: State Rep. Sean Scanlon (opinion): State child tax credit would ease burden on families

March 24, 2021

The good news for families is that President Biden’s recently passed stimulus bill features a provision long championed by my Congresswoman Rosa DeLauro that not only makes the tax credit fully refundable but also expands the credit from $2,000 to $3,000 for children 6 to 17 and to $3,600 per child under the age of […]

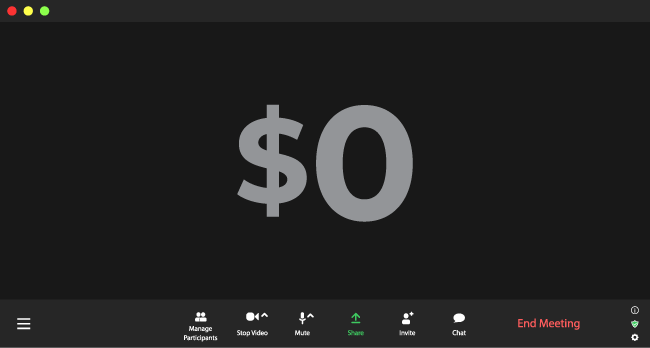

CBS News: Zoom’s pandemic profits exceeded $670 million. Its federal tax payment? Zilch

March 24, 2021

“We are only taxing about half of all corporate profits,” observed Matt Gardner, a senior fellow at the Institute on Taxation and Economic Policy, which put out a report on Monday highlighting Zoom’s likely $0 federal tax bill for 2020. … “There is nothing exceptional or illegal in what Zoom is doing here,” said Gardner, […]

The Street: New York Inches Closer to Legalizing Recreational Cannabis

March 24, 2021

Last November, voters in New Jersey and Arizona voted to legalize marijuana. And in December, New Jersey placed a social equity excise tax on cannabis sales in order to address the disparate effect of anti-marijuana laws on communities of color. About one in three Americans live in a state with legal sales of recreational cannabis, […]

Arkansas Times: Can’t Forget the Millionaires: Income Tax Cut on Agenda Today

March 23, 2021

Arkansas Advocates for Children and Families has run the numbers by the Institute on Taxation and Economic Policy. It says 72 percent of the tax cut will go to people making more than $192,000 a year. The tax cut would take effect in 2022. When fully implemented, it would cut revenue by $27.4 million a […]

Salon: Zoom Increased Profit by 4,000% during the Pandemic — but the Company Paid $0 in Federal Income Tax

March 23, 2021

The U.S.-based online video chat platform Zoom has seen its profits skyrocket by 4000% during the Covid-19 pandemic thanks to the growing reliance on remote work and schooling, but an analysis by the Institute on Taxation and Economic Policy finds that the company didn’t pay a dime in federal corporate income taxes on its 2020 […]

Business Insider: Zoom Paid $0 in Federal Taxes on $664 Million in Pandemic Profits, Mostly by Paying Executives Stock Options

March 23, 2021

“Companies that compensate their leadership with stock options can write off, for tax purposes, huge expenses that far exceed their actual cost,” Matthew Gardner, a senior fellow at the Institute for Taxation and Economic Policy, wrote in a post breaking down Zoom’s tax strategy. Read more

New York Post: Zoom Paid No Federal Income Tax Last Year amid Pandemic Profit Surge

March 23, 2021

The Silicon Valley firm appears to have achieved that feat largely thanks to its use of stock-based compensation for employees, which helped reduce its worldwide tax bill by more than $302 million for the year ending Jan. 31. Corporations that pay their executives in stock often benefit from a provision in the federal tax code […]

Common Dreams: Zoom Paid $0 in Federal Income Taxes on 4,000% Profit Increase During Pandemic: Report

March 22, 2021

The U.S.-based online video chat platform Zoom has seen its profits skyrocket by 4000% during the Covid-19 pandemic thanks to the growing reliance on remote work and schooling, but an analysis by the Institute on Taxation and Economic Policy finds that the company didn’t pay a dime in federal corporate income taxes on its 2020 […]

The Independent: Zoom Increase Profits by 4000 Per Cent During Pandemic but Paid No Income Tax, Report Says

March 21, 2021

Zoom Video Communications reported that it made a $660m (£476m) pre-tax profit in 2020, up from $16m (£11.5m) in 2019, according to the non-profit Institute on Taxation and Economic Policy. Zoom’s video conferencing platform was widely used by remote workers and school children across the US due to Covid social distancing and quarantine measures. “The […]

Chicago Sun-Times: A New Push to Expand the State’s Earned Income Credit Could Include Immigrants

March 21, 2021

Economic Security for Illinois, working with the Institute in Taxation and Economic Policy, estimates that as many as 500,000 households would benefit from the expansion, including 110,000 immigrant households. Read more

Zoom Video Communications, the company providing a platform used by remote workers and school children across the country during the pandemic, saw its profits increase by more than 4,000 percent last year but paid no federal corporate income tax on those profits.

The Hill: A Straightforward Way to Pay for Biden’s Recovery Plan (Opinion)

March 18, 2021

Now that President Biden and Congress have enacted a $1.9 trillion COVID-19 relief measure, the president will soon provide details for the second item on his agenda, a major recovery plan. The package could include some of the tax increases on which he campaigned to pay for new spending.

Idaho Center for Fiscal Policy: Analysis and Considerations Related to House Bill 332

March 18, 2021

The Idaho Legislature is considering a proposal that would cut income and corporate tax rates and provide a one-time tax rebate. Under the proposal, the tax benefits from this proposed legislation are heavily lopsided. Taking all provisions into account, households with very modest earnings would receive a $78 average tax cut, and the top 1 […]

Marijuana Moment: Cannabis Banking Bill Comes Back to Congress

March 18, 2021

An Institute on Taxation and Economic Policy analysis concluded that “cannabis taxes are a small part of state and local budgets, clocking in at less than 2 percent of tax revenue in the states with legal adult-use sales” but are also “one of states’ fastest-growing revenue sources.” Read more

The Hill: Ohio AG Sues Biden Administration Over Pandemic Bill

March 17, 2021

Carl Davis, the research director for the left-leaning Institute on Taxation and Economic Policy, said that the rhetoric from the conservative attorneys general has been overblown. “There’s a lot of potential very positive uses for this money that states and localities could find in this moment,” Davis told The Hill. “It’s not intended to be […]

Newsweek: This Last-Minute Provision Blocks GOP Govs from Using Stimulus Money to Subsidize Tax Cuts

March 17, 2021

“Basically any tax cut done at the state level has doubled in cost,” said Carl Davis, research director at the Institute on Taxation and Economic Policy. For example, if a state enacts a $50 million tax cut, it will lose $50 million in the revenue it won’t collect and another $50 million in federal aid. […]

CNN: Historic Benefits in Stimulus Bill May Answer a Big Question for Democrats

March 16, 2021

In figures provided exclusively to CNN, the Institute on Taxation and Economic Policy, which generally advocates for a more progressive tax code, similarly calculated that households headed by Whites will make up 67% of those receiving the bill’s direct cash payments, 64% of those benefiting from its expanded child tax credit and 62% benefiting from […]

One Voice Mississippi: Bill Analysis: House Bill 1439: Tax Proposal Moves State Away from a Better, More Equitable Mississippi

March 16, 2021

Mississippi’s House of Representatives recently passed House Bill 1439 (“the Mississippi Tax Freedom Act of 2021”). The House passed the 300-page bill less than 24 hours after they introduced it with little debate and no fiscal note. The plan revives the recurring attempts of some lawmakers to cut state income taxes, but does much more. […]