ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

ITEP Comments and Recommendations on REG-107431-19

January 29, 2020 • By Carl Davis

Comments regarding the possibility that owners of passthrough businesses may be able to circumvent the $10,000 SALT deduction cap of section 164(b)(6) by recharacterizing the nondeductible portion of their state and local income tax payments as deductible expenses associated with carrying on a trade or business.

West Virginia Center on Budget & Policy: Who Pays? Rethinking West Virginia’s Tax System

January 28, 2020

To get a sense of a state’s values, one often need look no further than its tax system. What a state spends its tax dollars on and how it acquires those tax dollars typically reveals a lot about the priorities of its people—what they care about and what they stand for. In theory, it’s a […]

New Mexico Voices for Children: Expanding New Mexico’s Best Anti-Poverty Program

January 28, 2020

The Working Families Tax Credit (WFTC) is New Mexico’s equivalent of the federal Earned Income Tax Credit (EITC). The WFTC’s eligibility levels and credit amounts are based directly on the EITC, and like most states, the amount is a set percentage of the federal EITC. These tax credits reduce poverty, improve outcomes for children, and […]

Arizona Center for Economic Progress: In Search of a State Budget That Creates Opportunity for All

January 28, 2020

While all families in Arizona help pay for health, education and public safety through state and local taxes, low-income and middle-income families pay a larger portion of their income in taxes than do wealthier families. When all types of state and local taxes are combined—income, sales, and property—families with income in the lowest 20 percent […]

The Arizona Center for Economic Progress: In Search 2020

January 26, 2020

In Search of State Budget That Creates Opportunity for All When all types of state and local taxes are combined—income, sales, and property—families with income in the lowest 20 percent pay twice what families in the top 1 percent do—$12.95 for every $100 of income and $8.49 for middle income families compared to $5.91 for […]

GOP Legacy on IRS Administration: Auditing Mississippi, not Microsoft

January 24, 2020 • By Matthew Gardner

Money doesn’t buy happiness—but it can buy immunity from the reach of Uncle Sam. The IRS is outgunned in cases against corporate giants because that’s how Republican leaders want it to be. They have systematically assaulted the agency’s enforcement capacity through decades of funding cuts. Instead of saving money, these cuts have cost billions: each dollar spent on the IRS results in several dollars of tax revenue collected.

On the COVID-19 health and economic crisis “The current disaster threatens our health and our economy. Ongoing crises stem from fast-accelerating climate change, skyrocketing inequality, and inadequate federal response to both. We as a country have the resources to address collective problems. But solving them requires that we pull together, raise taxes on those most […]

After years of watching tax policy increasingly leave communities behind, at ITEP I’ll have the chance to work with local, state and national partners on policy solutions. I’m prepared to push for a tax system that can better deliver economic, climate and racial justice; for a public sector that can prepare our kids and our grid for 2020 and beyond; and for an America that works for all of us, whether we were born in Nebraska or Hawaii, Detroit or Miami.

Reforming Connecticut’s Tax System: A Program to Strengthen Working- and Middle-Class Families

January 15, 2020

Connecticut Voices for Children released a report that examined the state’s income and wealth inequality and the state’s regressive tax system that exacerbates these inequalities.

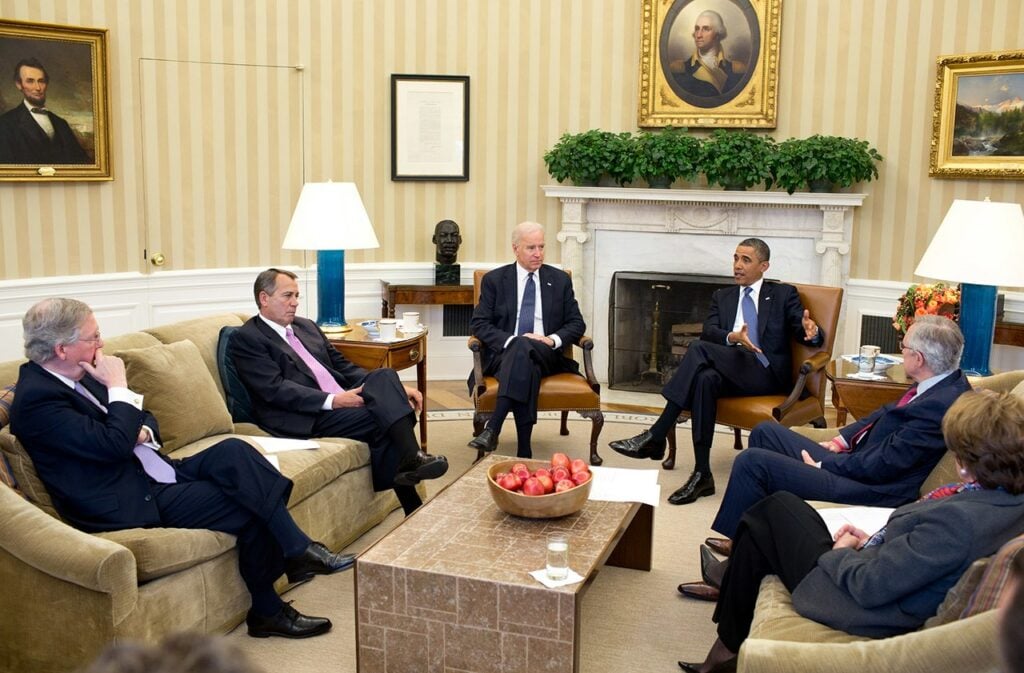

The 2013 Biden-McConnell “Fiscal Cliff” Deal Shows Why the Next President Needs a New Approach to Taxes

January 15, 2020 • By Steve Wamhoff

Americans have long wanted more progressive tax policies and have told pollsters for years that they want wealthy individuals and big corporations to pay more, not less, in taxes. The only way forward is for lawmakers and the next president to take a dramatically different approach to tax policy.

White House Council of Economic Advisers Crows about Lowest-Income Americans Being Infinitesimally “Wealthier”

January 14, 2020 • By Matthew Gardner

When the White House Council of Economic Advisors last week tweeted that the poorest 50 percent of Americans’ wealth is growing 3 times faster than the wealth of the top 1 percent, we were skeptical. As it turns out, the CEA’s tweet is a reminder that the poorest 50 percent wealth grew twice as fast during Barack Obama’s second term than it has under Trump, but to this day remains far below its pre-recession share and significantly less than what it was 30 years ago.

A basic understanding and idea of fairness is a trait we share with intelligent primates, which is precisely why more than two years ago as Congress was debating the Tax Cuts and Jobs Act, the American public disapproved of the tax bill.

Guilty, Not GILTI: Unclear Whether Corps Continue to Lower Their Tax Bills Via Tax Haven Abuse

January 7, 2020 • By Matthew Gardner

President Trump and GOP lawmakers often cited corporations’ abuse of tax havens, e.g. shifting profits offshore to avoid taxes, as justification for dramatically lowering the federal corporate tax rate under the 2017 Tax Cuts and Jobs Act. By 2016, corporations’ offshore cash haul had grown to $2.6 trillion, representing hundreds of billions in lost federal tax […]

Amy Hanauer

January 7, 2020 • By ITEP Staff

Amy Hanauer provides vision and leadership to bring accurate research and data to tax policy conversations. As Director, Amy raises resources, guides strategy, and works with the board and staff to make ITEP a critical part of the policy discussion around a stronger tax code. She brings nearly 30 years of experience working to create economic policy that advances social justice.

Capital and Main: Two Years Later: What Has Trump’s Tax Law Delivered?

January 6, 2020

Promise: “We’re also going to eliminate tax breaks and complex loopholes taken advantage [of] by the wealthy.” – President Trump, November 29, 2017. Reality: The law kept tax loopholes in place and added new ones, including for the commercial real estate industry and wealthy heirs. In 2018, a group of the most profitable corporations paid an effective tax rate […]

Public News Service: Report: Many Big Companies Pay Nothing Under New Tax Law

January 3, 2020

HELENA, Mont. – During the first year of the Trump administration’s new tax law, 91 Fortune 500 companies didn’t pay a dime in federal income tax. That’s according to a new study by the Institute on Taxation and Economic Policy. Report co-author and Policy Analyst at the Institute Lorena Roque says by using legal loopholes, corporations […]

Public News Service: Will WA Lawmakers Tackle Tax Fairness in 2020?

January 3, 2020

How can Washington state create a more just society in 2020? Two experts say the state should tax its way toward that goal. The Institute on Taxation and Economic Policy ranks Washington last in the nation in terms of tax-system fairness, with low-income residents shouldering the biggest tax burden as a portion of their income. Katie Baird, […]

Common Dreams: Eight Ways the Trump-GOP Tax Cuts Have Made the Rich Richer While Failing Working Families

January 3, 2020

Within the Fortune 500, 91 profitable corporations—such as Amazon, FedEx, Netflix and General Motors—paid no U.S. corporate income taxes in 2018, according to the Institute on Taxation and Economic Policy. And 379 profitable Fortune 500 corporations paid just an 11.3 percent tax rate last year. That’s about half the rate established under Trump’s tax law, which […]

Mother Jones: Chevron Made $4.5 Billion in 2018. So Why Did the IRS Give Them a Refund?

January 3, 2020

The largest chunk of Chevron’s $1.1 billion in tax breaks came in the form of tax deferral, a longstanding tax instrument that enables businesses to postpone paying taxes until a later fiscal year—sometimes indefinitely. Tax deferral is not new, but by lowering the corporate tax rate from 35 to 21 percent, Trump’s tax law made […]

Modern Healthcare: Healthcare Industry Had Highest Federal Income Tax Rates in 2018

January 3, 2020

A big driver of the higher taxes in healthcare is a doomed Affordable Care Act fee on health insurers. The amount each insurer pays is based on premium revenue. President Donald Trump in late December signed a spending bill repealing that tax in 2021 and beyond. “It’s just one weird example that there is an industry-specific tax […]

Salon: Under Trump’s Tax Bill, Employees Pay Higher Rates Than Biggest Corporations in the World: Study

January 3, 2020

Workers at some of the biggest corporations in the world are paying higher tax rates than their employers, according to a new study by the Institute on Taxation and Economic Policy. The Republican-passed tax cuts signed by President Trump in 2017 permanently lowered the corporate tax rate from 35 percent to 21 percent but many […]

Workday Minnesota: Dozens of Big Businesses Avoided Corporate Taxes in 2018

January 2, 2020

Roque said corporate tax cuts and loopholes have been enacted by Congresses and presidents of both major parties for the past two decades. Champions of the new tax code argued that lowering corporate rates would lead to increased investments and higher wages, and would increase federal revenues by removing tax shelters. Outside of a few […]

Los Angeles Times: Opinion: The Trump Tax Cut Has Amounted to Nothing but Broken Promises for the Middle Class

January 1, 2020

Thanks to loopholes and the cut itself, tax collections from corporations in the first year of the new law collapsed. ITEP found that the effective corporate tax rate for 379 profitable Fortune 500 corporations was just 11.3% last year. That’s about half the rate Trump’s new law established, which slashed the previous rate by 40%. […]

VTDigger: Report: Vermont Economic Divide Is Growing Larger

December 31, 2019

Vermont taxes are relatively progressive, the report said, noting that the state was one of five singled out by the Institute on Taxation and Economic Policy in 2018 for systems that “do not worsen income inequality.” But federal tax policy — including policy set well before the Trump administration — has been more regressive, disproportionately […]

Counter Point: Trump-GOP Tax Law Ushers in Lowest Corporate Tax Rates in 30 Years

December 30, 2019

Matthew Gardner reveals that “Fortune 500 companies Avoided $73.9 Billion in Tax Under First Year of Trump Tax Law.” Listen