ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Sen. Warren Proposes Sweeping Tax Changes to Finance Medicare for All

November 1, 2019 • By Steve Wamhoff

Senator and presidential candidate Elizabeth Warren released a plan today to offset the costs of Medicare for All, a publicly funded single-payer health care program. While ITEP has not crunched the numbers, it seems likely overall that her proposals would raise trillions of dollars and leave costs and taxes either unchanged or lower for most low- and middle-income people.

The News-Tribune: We in Washington Pay Highest Estate Tax in the Nation. There’s a Reason, Officials Say

November 1, 2019

“Low income and middle income (earners) pay much higher proportions of their incomes than the wealthy, mostly because we don’t have the income and the capital gains tax, and we’re really dependent on the sales tax and the (business and occupation) tax,” said state Sen. Christine Rolfes, the Bainbridge Island Democrat who is chairwoman of […]

Albuquerque Journal: Tax Reforms Restore Fairness and Set Up Reliable Revenue

November 1, 2019

Recent analysis by the non-partisan Institute on Taxation and Economic Policy confirms what we expected from income tax changes signed into law this year by Gov. Michelle Lujan Grisham – that we have taken a large step toward improving the fairness of our tax system and helping our working families in New Mexico. Read more

Bloomberg: Treasury Plans to Weaken Rules Meant to Stop Corporate Tax Avoidance

November 1, 2019

The Treasury Department should tread cautiously in weakening these rules now while Democratic lawmakers are eager to repeal large portions of the 2017 tax overhaul, said Matt Gardner, a senior fellow at the left-leaning Institute on Taxation and Economic Policy. If the next Congress makes changes to the overhaul, these rules might be an important […]

WXIA 11Alive: How Much Do Undocumented Immigrants Contribute in Taxes?

November 1, 2019

Let’s take the state of Georgia as an example. Per ITEP, in 2017, undocumented immigrants contributed more than $351 million in local and state taxes – just in Georgia. According to ITEP, undocumented immigrants pay an estimated $11.7 billion in state and local taxes per year. Watch/Read more

Several Democratic candidates have proposed raising the statutory corporate tax rate from its current level of 21 percent to fund their spending proposals. Political reporters and observers may read a great deal into the different corporate rates proposed by candidates, but the truth is that rates mean very little on their own.

The Hill: Left-leaning Group: Taxes on Financial Trades Could Reduce Inequality

October 28, 2019

In its report, the Institute on Taxation and Economic Policy (ITEP) argued it’s possible that the higher costs of financial trades produced by an FTT would be fully borne by investors, and that a portion of the higher costs are borne by the owners and employees of financial institutions. Under either of those options, an FTT would […]

The Sacramento Bee: California Democrat Wants to Make PG&E Pay a Penalty if it Gives Executive Bonuses

October 28, 2019

Harder’s bill would revive a tax called the alternative minimum tax for utilities that offer executive bonuses but have failed to invest in climate-resilient infrastructure. The bill is written to specifically target PG&E, which has not paid federal income taxes in the past decade due to tax loopholes on depreciation, according to the Institute on Taxation […]

A Financial Transaction Tax Could Raise Revenue, Curb Inequality

October 28, 2019 • By Steve Wamhoff

A new report from ITEP explains the potential benefits of a financial transaction tax (FTT), which is supported by several presidential candidates. Few proposals can be said to raise revenue for public investments, make our tax code more progressive, and improve the efficiency of our financial system all at the same time. An FTT can do all of that.

Benefits of a Financial Transaction Tax

October 28, 2019 • By Jessica Schieder, Lorena Roque, Steve Wamhoff

A financial transaction tax (FTT) has the potential to curb inequality, reduce market inefficiencies, and raise hundreds of billions of dollars in revenue over the next decade. Presidential candidates have proposed using an FTT to fund expanding Medicare, education, child care, and investments in children’s health. Any of these public investments would be progressive, narrowing resource gaps between the most vulnerable families and the most fortunate.

Las Cruces Sun News: Income Tax Changes Benefit Most Families in New Mexico

October 27, 2019

Recent analysis by the non-partisan Institute on Taxation and Economic Policy confirms what we expected from income tax changes signed into law this year by Gov. Michelle Lujan Grisham — that we have taken a large step toward improving the fairness of our tax system and helping working families in New Mexico. Read more

Budget & Tax Center: A Costly Cover for More Business Tax Cuts in NC

October 25, 2019

Analysis from the Institute on Taxation and Economic Policy shows that 27 percent of the total net tax cut from the increase in the standard deduction will actually go to the top 20 percent, while just 7 percent will go to the bottom 20 percent whose income leaves them in poverty each year. Read more

House Passes Landmark Bipartisan Bill to Crack Down on Shell Companies Used for Tax Evasion and Other Crimes

October 24, 2019 • By Steve Wamhoff

On Tuesday night, 25 Republicans joined nearly all the chamber’s Democrats to approve the Corporate Transparency Act, a bill that would require those creating a company to report its owners to the federal government. The White House expressed support but called for the House and Senate to work on certain details, creating the possibility that the measure could be enacted.

ProPublica: How a Tax Break to Help the Poor Went to NBA Owner Dan Gilbert

October 24, 2019

The upside for an investor such as Gilbert “could be huge,” said Steve Wamhoff, director of federal tax policy at the Institute on Taxation and Economic Policy, a liberal-leaning think tank. “This seems to be a situation where someone is going to get tax breaks for something they were going to do anyway.” Read more

Wall Street Journal: Rising California Gasoline Prices Highlight Growing Divide in U.S.

October 23, 2019

A dozen states raised gas taxes earlier this year, including Illinois, Ohio, California, Maryland and Michigan, according to the Institute on Taxation and Economic Policy, a state and federal tax-policy think tank. Read more

The Hill: Senate Rejects Dem Measure to Overturn IRS Rules on SALT Deduction Cap

October 23, 2019

Lawmakers will have a major opportunity to revisit the GOP tax law at the end of 2025, when the SALT deduction cap and the law’s other tax changes to the individual code expire. But a future Democratic president and Congress may want to reexamine the cap and the tax law as a whole sooner than […]

The View: 60 Fortune 500 Companies Paid Zero Federal Income Tax

October 18, 2019

In this October 2019 episode of The View, Whoopi Goldberg, Chelsea Clinton and Sunny Hostin call out big business for spending big money to avoid paying taxes in a time when corporate tax rates were slashed by the Trump Administration and Congress. Watch the video

Depreciation Tax Breaks Are a Problem that Deserves More Attention

October 18, 2019 • By Steve Wamhoff

Sen. Bernie Sanders’ recently released corporate tax plan would shut down the major breaks and loopholes that allow corporations to dodge taxes. The reforms in his plan that are most likely to get attention are proposals to shut down offshore tax dodging, as ITEP has long called for.

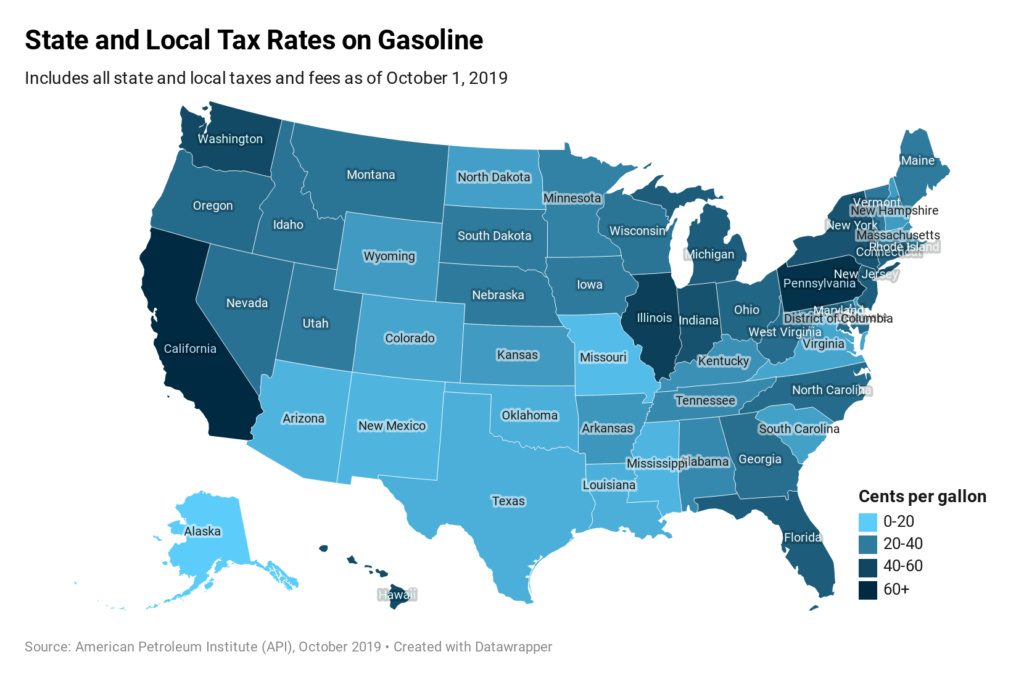

Every state levies excise taxes on motor fuel, including gasoline, to pay for transportation infrastructure. People who drive far distances or heavy vehicles tend to pay more tax, which helps offset the wear-and-tear they inflict on the roads.

KRWG: Analysis: 70% of NM Families With Children Will See State Income Tax Cut

October 16, 2019

Commentary: Most New Mexico families with children – 70% – will get a break on their state personal income taxes when they file their 2019 tax returns, thanks to legislation enacted in April by the state Legislature and Governor Michelle Lujan Grisham. That’s according to an analysis by the Washington, DC-based Institute on Taxation and […]

Real Change: Fishing for Equity in a Regressive Tax System

October 16, 2019

“It’s always about race, and it’s always about taxes,” said Misha Hill, a policy analyst with the Institute on Taxation and Economic Policy (ITEP). ITEP is the source of the frequently cited statistic that Washington has the most regressive tax system in the country. In fact, Hill said, there are no states in the union […]

Emmanuel Saez and Gabriel Zucman’s New Book Reminds Us that Tax Injustice Is a Choice

October 15, 2019 • By Steve Wamhoff

Cue Emmanuel Saez and Gabriel Zucman. In their new book, The Triumph of Injustice, the economists, who already jolted the world with their shocking data on exploding income inequality and wealth inequality, tell us to stop acting like we are paralyzed when it comes to tax policy. There are answers and solutions. And in about 200 surprisingly readable pages, they provide them.

POLITICO: Cannabis was supposed to be a tax windfall for states. The reality has been different.

October 14, 2019

In all, five of the nine states that have set up tax systems for legalized marijuana employ cultivation levies on growers, while all but Alaska charge an excise tax specifically on cannabis sales. Five states also charge the general sales tax, though not the same exact group that has a cultivator tax. The actual effective […]

POLITICO: Cannabis Was Supposed to Be a Tax Windfall for States. The Reality Has Been Different.

October 14, 2019

In all, five of the nine states that have set up tax systems for legalized marijuana employ cultivation levies on growers, while all but Alaska charge an excise tax specifically on cannabis sales. Five states also charge the general sales tax, though not the same exact group that has a cultivator tax. The actual effective […]

The Heartland Institute: Utah Studies New Method for Transportation Funding

October 11, 2019

The Institute on Taxation and Economic Policy has also found that gas taxes are not a sufficient funding source to repair and rebuild the nation’s crumbling infrastructure. This is mainly due to more fuel-efficient vehicles on the road coupled with skyrocketing transportation construction costs. Read more