ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Opportunity Zones Have Nothing to Do with Reparations, Except …

August 2, 2019 • By Jenice Robinson

Among other things, this blog highlights how federal, state and local policies systematically work to reinforce the racial wealth gap by, for example, using the tax code to redistribute the nation’s wealth to billionaire developers and keeping low-income people of color in a perpetual cycle of debt through fines and fees to fund local governments. Opportunity zones and the top-heavy 2017 tax law are emblematic of a long history of policymaking that advantages wealthy white families.

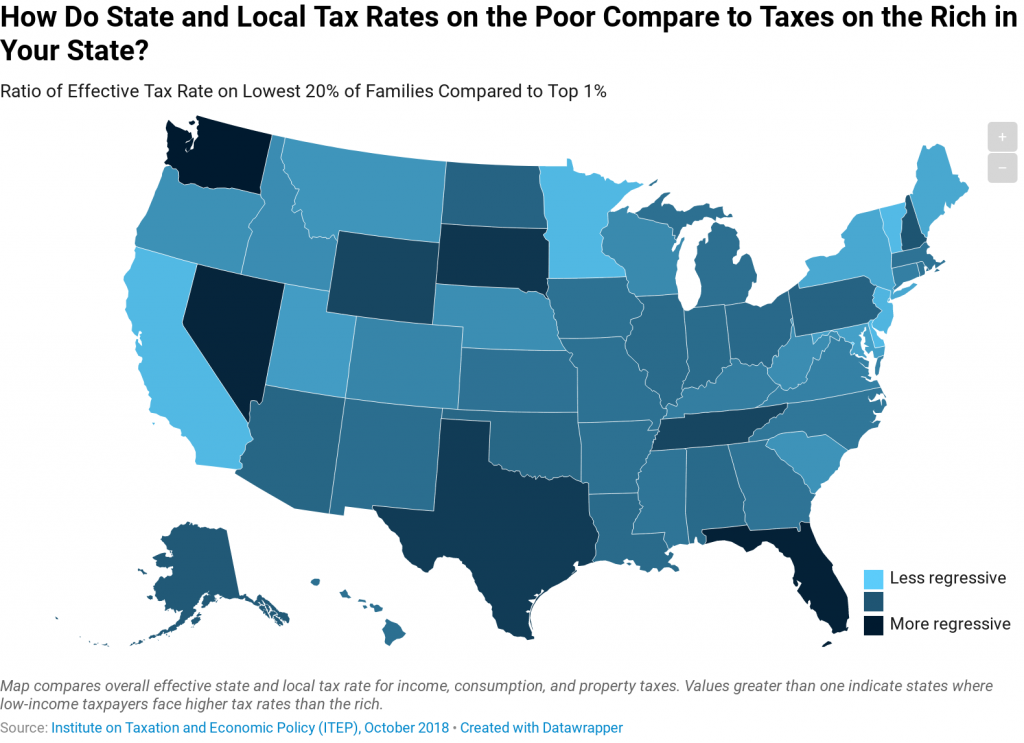

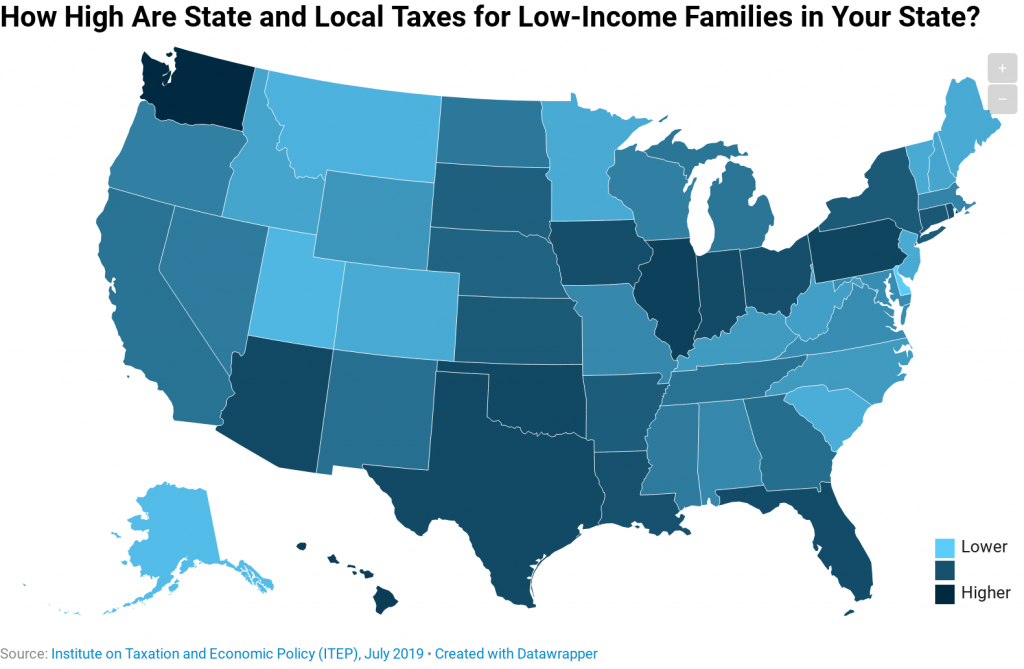

How Do Tax Rates on the Poor Compare to Taxes on the Rich in Your State?

August 1, 2019 • By ITEP Staff

No two state tax systems are the same, but 45 states have one thing in common: Low-income residents are taxed at a higher rate than the top 1 percent. Effective tax rates for the lowest 20 percent of families range from a high of 17.8 percent in Washington State to a low of 5.5 percent in Delaware.

A direct federal tax on wealth, as described in a January report from ITEP and proposed by Sen. Elizabeth Warren, could raise substantial revenue to make public investments, curb rising inequality, and is supported by a large majority of Americans. But would it work? Recent research highlighted in a new academic paper outlines approaches that would make it easier than you might think.

OHIO legislators passed a budget with unfortunate income tax cuts for high-income households. Other states turned their attention to unconventional ideas during their legislative off-seasons, for better and for worse. And there are many gems to be found in our “What We’re Reading” section below, including new research on the racial inequities that continue to pervade our communities and schools.

We shouldn’t wait for Washington to tax the rich. We can begin at the state level. Examining the federal policy landscape is a logical place to start, but state policymakers are missing a key opportunity if they don’t join this national conversation and take a hard look at how their tax codes are affecting individuals […]

The nation’s tax policies and their role in economic inequality are front and center during this election cycle. For those interested in how the nation can move toward a fairer tax system and or more detailed information about progressive tax policy ideas, ITEP created this quick guide.

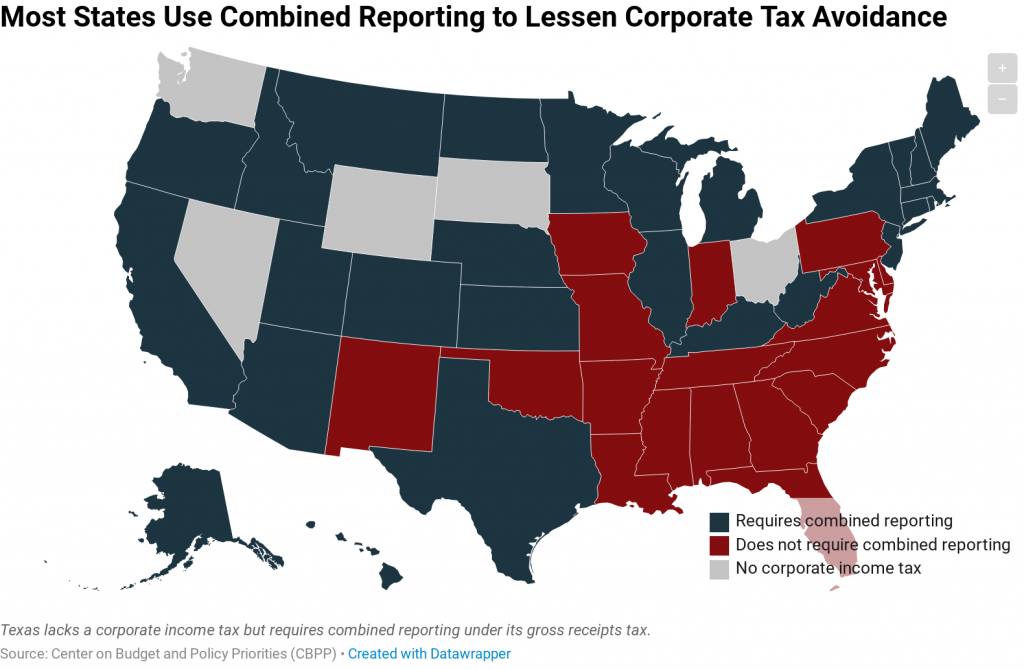

"Combined reporting" lessens the effectiveness of a tax avoidance scheme known as income shifting, in which large multi-state corporations dubiously claim that their income was earned in states with little or no corporate income tax.

If a future Congress and president enact a real tax reform, one that requires corporations to pay their fair share and ends TCJA’s various corporate breaks for offshore profits, then companies will use inversions and other tactics to dodge taxes once again—if lawmakers let them. That’s why any real tax reform will include something like the Stop Corporate Inversions Act, introduced last week by Sens. Dick Durbin and Jack Reed to block inversions.

Many States Move Toward Higher Taxes on the Rich; Lower Taxes on Poor People

July 18, 2019 • By Meg Wiehe

Several states this year proposed or enacted tax policies that would require high-income households and/or businesses to pay more in taxes. After years of policymaking that slashed taxes for wealthy households and deprived states of revenue to adequately fund public services, this is a necessary and welcome reversal.

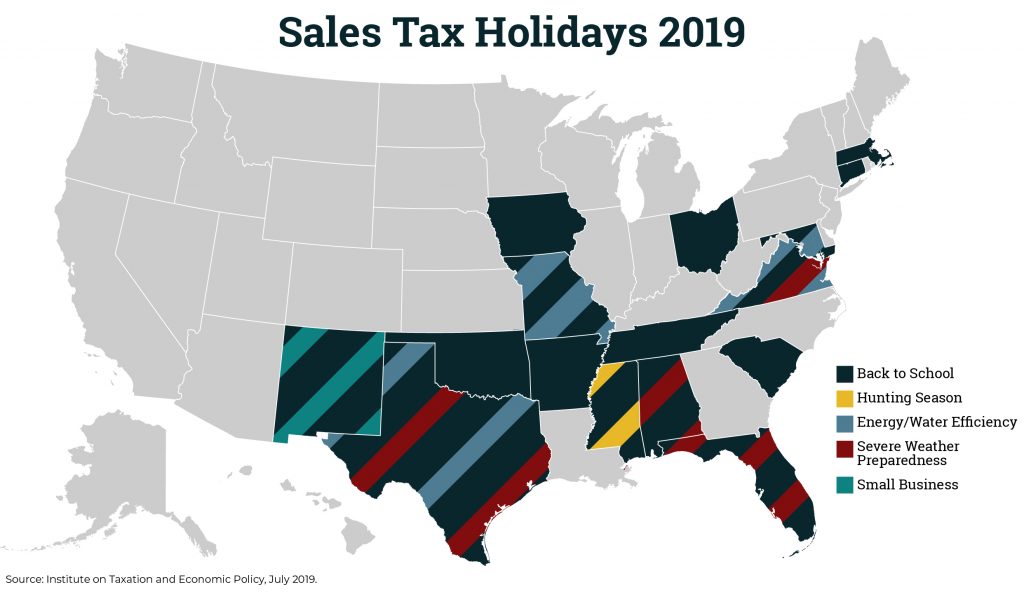

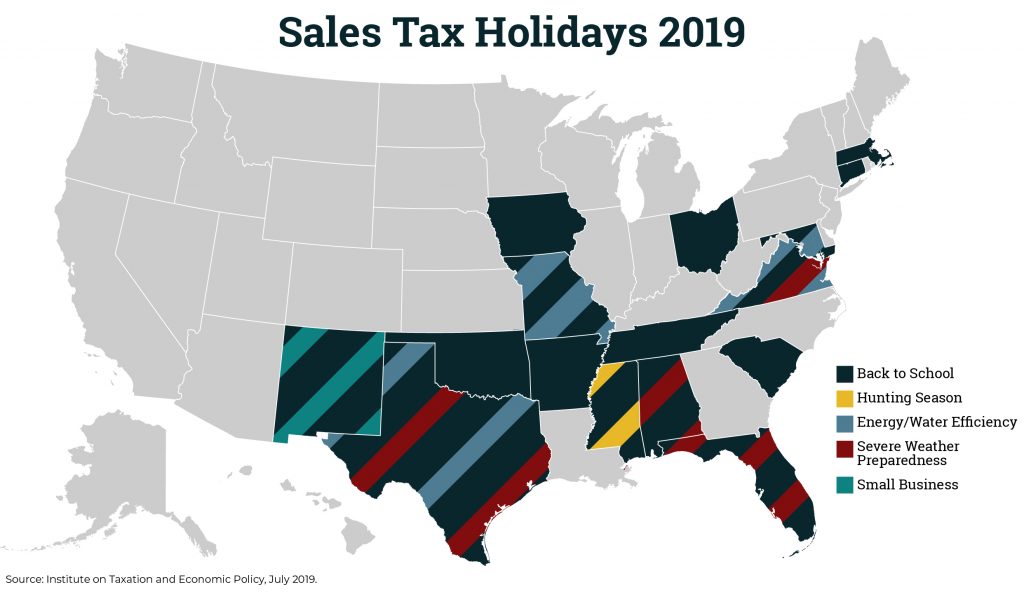

Lawmakers in many states have enacted “sales tax holidays” (16 states will hold them in 2019), to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. While these holidays may seem to lessen the regressive impacts of the sales tax, their benefits are minimal. ITEP’s policy brief […]

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 17, 2019 • By Dylan Grundman O'Neill

Lawmakers in many states have enacted “sales tax holidays” (16 states will hold them in 2019), to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. While these holidays may seem to lessen the regressive impacts of the sales tax, their benefits are minimal. This policy brief looks at sales tax holidays as a tax reduction device.

Sales Tax Holidays Are Outdated Gimmicks That Have Run Their Course

July 17, 2019 • By ITEP Staff

Just as the very first sales tax holiday for car sales did not fix the auto industry’s challenges, providing consumers a temporary reprieve on sales tax will not address families’ pocketbook concerns.

CommonWealth: Before the T Derailed, its Funding Got on the Wrong Track

July 16, 2019

Overall, funding for the Commonwealth during the last two decades has relied increasingly on sales taxes and regressive user fees, while cutting income tax rates. As a result, we have an upside-down tax system. Effectively, these taxes and fees make lower-income Massachusetts residents pay a higher percentage (10 percent) of their income in state and […]

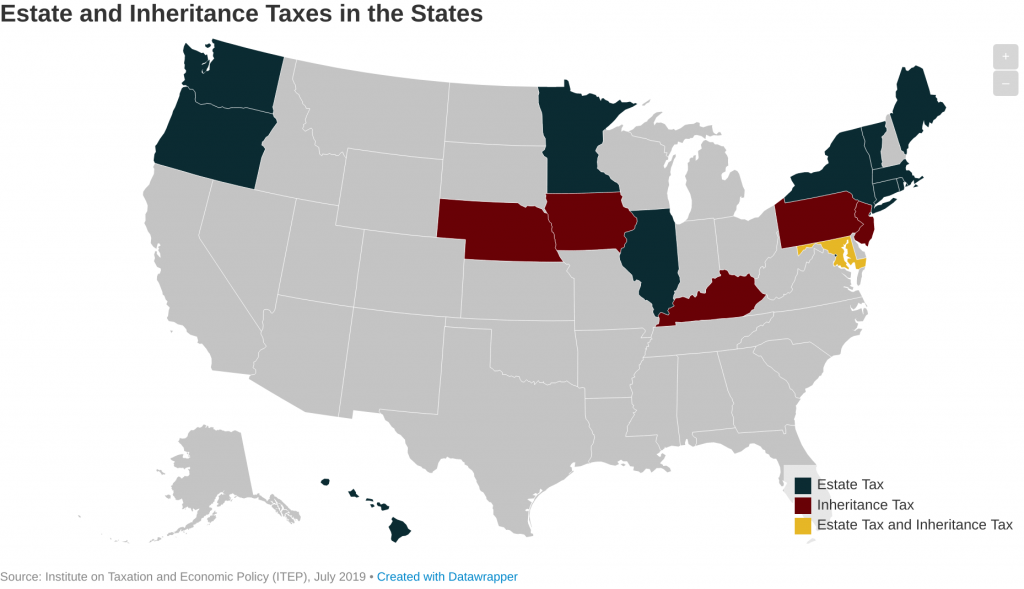

States have been repealing estate taxes since the early 2000s. Now, just 17 states and the District of Columbia (D.C.) levy estate and/or inheritance taxes. Twelve states and D.C. levy estate taxes while six states levy inheritance taxes (Maryland levies both). These taxes have long been used not just to raise revenue for vital public services, but to promote equality of opportunity and reduce the transfer of concentrated wealth from one generation to the next.

Arizona Center for Economic Progress: Using Increased Revenues from Conformity on More Tax Cuts is Fiscally Irresponsible

July 11, 2019

Arizona Should Use Increased Revenues to Prepare for Next Recession Instead of Giving Tax Cuts While a recession does not appear imminent, the current economic expansion began in June 2009 and in July will become the longest economic expansion in American history at 121 months. Given this and the impossibility of predicting when the next […]

MarketWatch: Here’s What 2020 Democratic Candidates Have Said About Universal Basic Income

July 11, 2019

Harris’s proposal would cost more than $270 billion in 2020, according to an estimate by the Washington, D.C.-based Institute on Taxation and Economic Policy. Read more

Missouri’s Creative Approach to Ending the “Race to the Bottom” in State Business Taxes

July 10, 2019 • By Matthew Gardner

Each year, state and local governments spend billions of dollars on targeted tax incentives—special tax breaks ostensibly designed to encourage businesses to relocate, expand or simply stay where they are. A law enacted by the Missouri legislature creates a template for states to work bilaterally to put the brakes on the “race to the bottom” in state business taxes.

Daily Progress: Opinion/Commentary: New IRS Rule Narrows Tax Loophole in Virginia

July 7, 2019

First, people and businesses making stock contributions, rather than cash, may still be able to profit from their donations through avoidance of capital gains taxes. A fix suggested by the Institute on Taxation and Economic Policy is to require taxpayers to pay capital gains tax if they receive a large state tax credit as compensation […]

The Washington Post: States Are Doing It. So Why Hasn’t Congress Increased the Federal Gas Tax?

July 6, 2019

All told, 31 of the 50 states have raised or reformed their motor fuel taxes during the past decade, according to the Institute on Taxation and Economic Policy. What’s more, 22 states now have variable-rate policies in place to make sure that inflation does not erode this crucial revenue stream. In so doing, they are […]

Public News Service: Deadline Today for WA Initiative Requiring Voter Approval for Tax Increases

July 5, 2019

Taxes took center stage because of a finding that Washington has the most regressive tax code in the country. According to the Institute on Taxation and Economic Policy, people in the top 1% pay 3% or less of their income in taxes, while those in the bottom 20% pay nearly 18%. Read more

CT Mirror: Gasoline Taxes Are on the Rise — Just not in CT

July 5, 2019

Twelve states ordered gasoline tax hikes that took effect this week, according to the nonprofit Institute on Taxation and Economic Policy (ITEP). While many policymakers say fuel levies are on the way out, the latest increases mean 31 out of 50 states have raised gasoline taxes at least once this decade, according to ITEP. Read […]

The American Prospect: Without Congressional Input, Trump May Further Widen the Gap Between Rich and Poor

July 3, 2019

“This is just another tax break for rich people,” says Steve Wamhoff, director of federal tax policy at the Institute on Taxation and Economy Policy, who authored a blog post on the policy implications of such a proposal. But even addressing whether the proposal makes economic sense raises serious red flags. Read more

Business Insider: Gas and Diesel Prices Rose at the Worst Possible Time for Drivers in the US and These States Are Being Affected Most

July 3, 2019

For some states, the gas tax increase has been long delayed. Some states have postponed this increase for several years due to the political challenges, Carl Davis, a research director at the Institute of Taxation and Economic Policy, told Business Insider. Davis is an expert in transportation infrastructure funding. “Lawmakers don’t want to take a […]

No two state tax systems are the same, but 45 states have one thing in common: Low-income residents are taxed at a higher rate than the top 1 percent. This map shows the effective tax rates for the lowest-income 20 percent in each state--ranging from a high of 17.8 percent in Washington to a low of 5.5 percent in Delaware.

Pacific Standard: Developers Aren’t Reporting How They’re Using Tax Incentives Meant for Low-Income Areas

July 2, 2019

Even for those who have tracked the bill closely, the reporting process remains opaque. “This bill was thrown together so incredibly quickly—there weren’t hearings on it, these types of questions weren’t fleshed out in the way they should have been, so a lot of how this was put together remains a mystery,” says Carl Davis, […]