ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

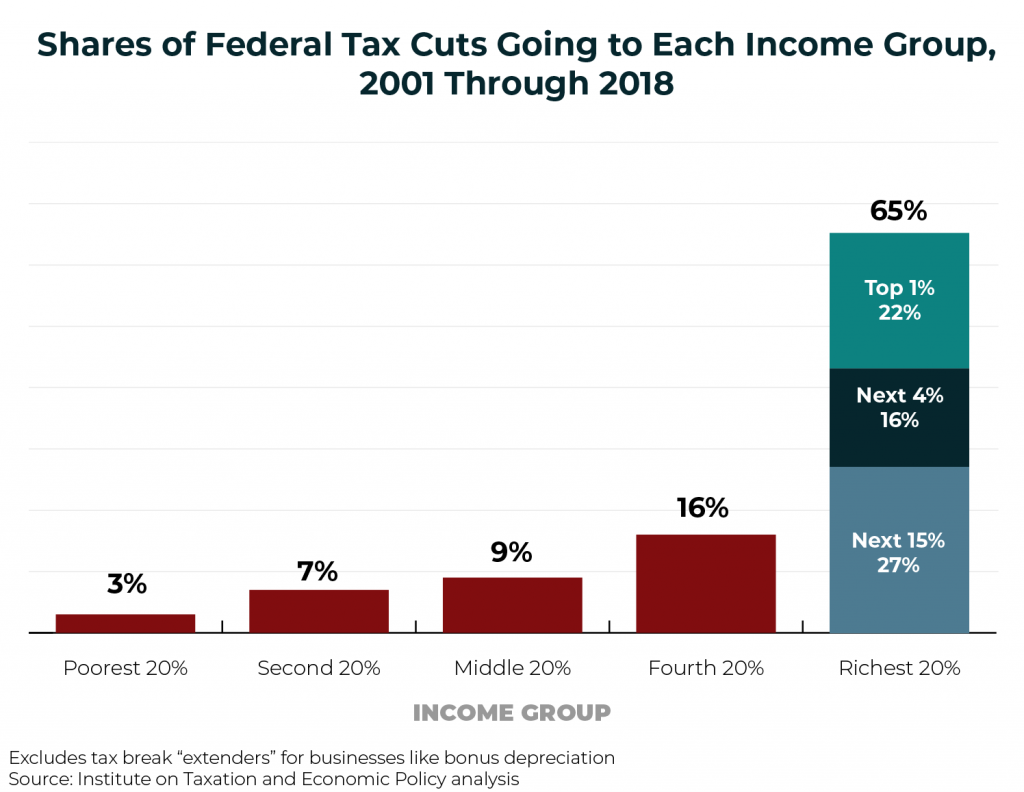

Income inequality is a national challenge. And inadequate federal revenue is a challenge that the nation will eventually have to reckon with. This chart book makes a strong case for why federal lawmakers should seriously consider progressive revenue-raising options.

The IRS Could Calculate Taxes for the Vast Majority of Taxpayers—But a Bipartisan Measure Would Ban It

April 12, 2019 • By Jessica Schieder

A proposal re-introduced this week by Sen. Elizabeth Warren (D-MA), Sen. Jeanne Shaheen (D-NH), and Rep. Brad Sherman (D-CA), The Tax Filing Simplification Act of 2019, goes a long way toward making tax filing a much more straight-forward process by broadening the IRS’s mandate.

The Montana Senate this week stopped a bill to restructure the state's temporary tribal tax exemption program, making tribal governments the only sovereignties on which Montana levies a tax and making it more difficult for leaders to buy back illegally seized land. Still, the success of the bill in the House is troubling.

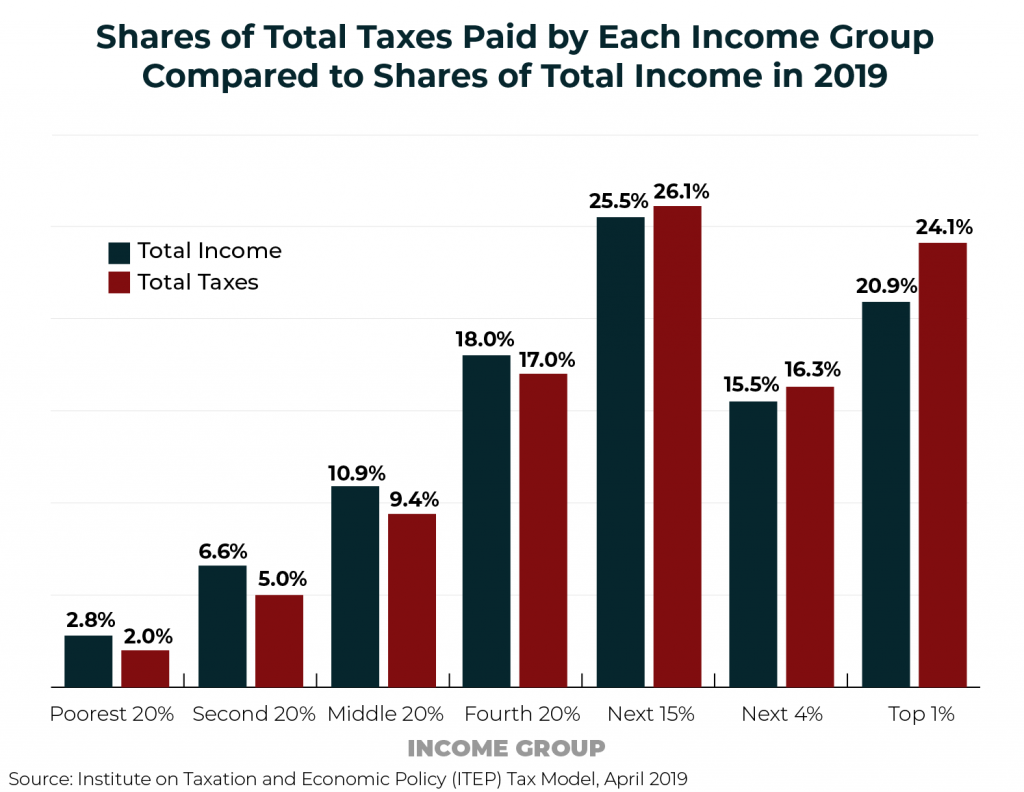

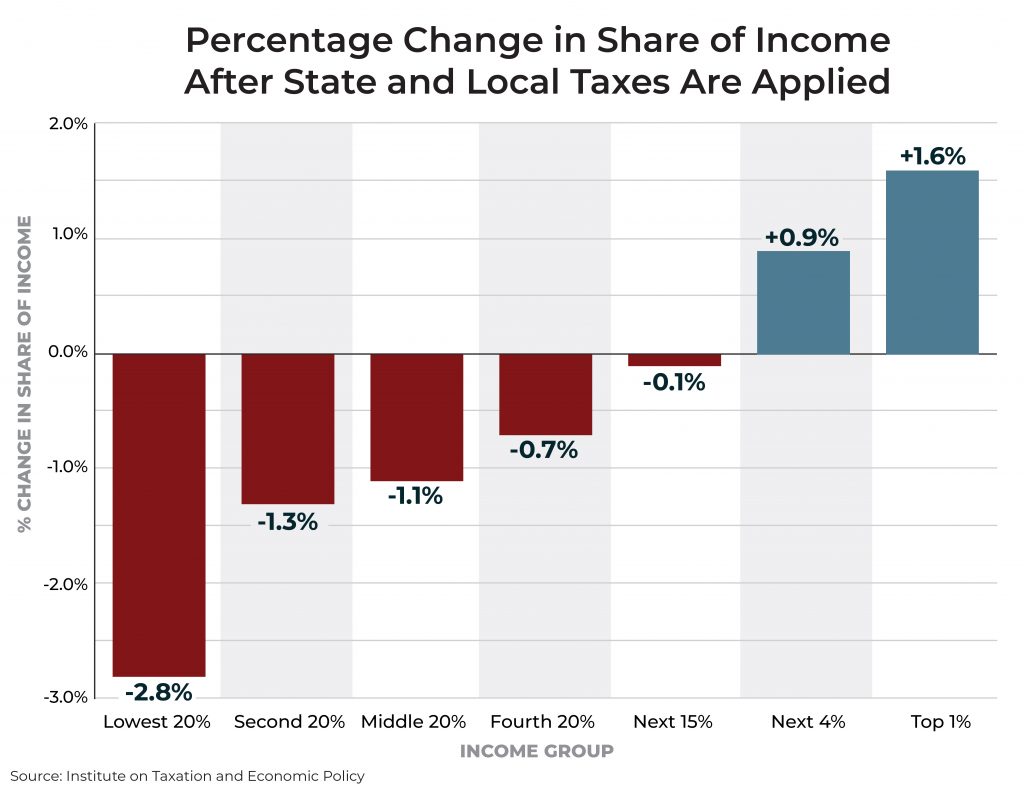

For years, Americans have been told that the rich are paying a highly disproportionate share of the nation’s taxes. Claims to that effect often focus on just one tax, the federal personal income tax, which is indeed progressive overall. But when the nation’s tax system is viewed in its entirety, it becomes clear that the reality is very different. Despite their enormous incomes and wealth, the nation’s richest taxpayers are paying a share of overall taxes that slightly exceeds their share of income.

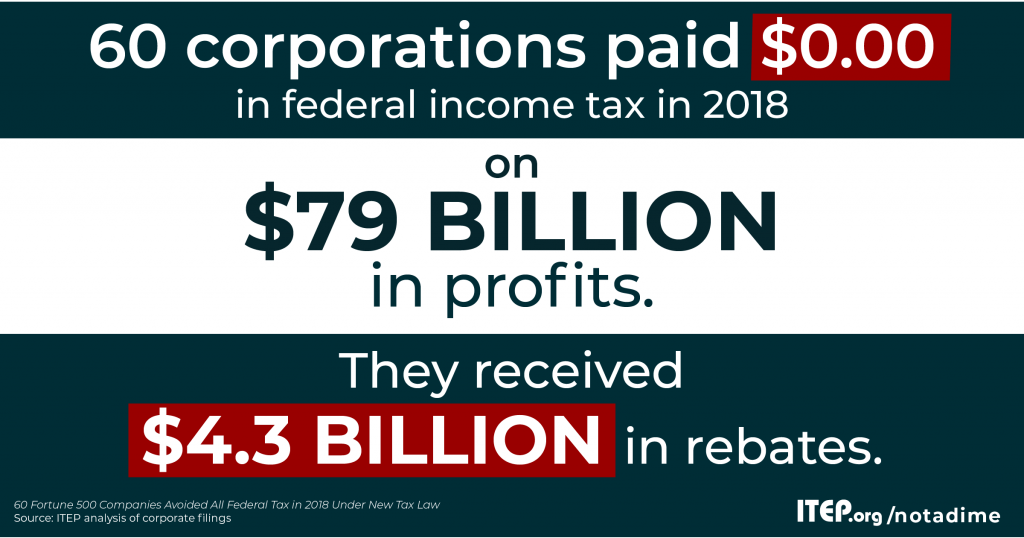

60 Fortune 500 Companies Avoided All Federal Income Tax in 2018 Under New Tax Law

April 11, 2019 • By Matthew Gardner

91 corporations did not pay federal income taxes on their 2018 U.S. income. Read the follow-up report released in December 2019, Corporate Tax Avoidance in the First Year of the Trump Tax Law. Media Contact An in-depth analysis of Fortune 500 companies’ financial filings finds that at least 60 of the nation’s biggest corporations didn’t […]

Corporate Tax Avoidance Remains Rampant Under New Tax Law

April 11, 2019 • By Lorena Roque, Matthew Gardner, Steve Wamhoff

For decades, profitable Fortune 500 companies have been able to manipulate the tax system to avoid paying even a dime in tax on billions of dollars in U.S. profits. This ITEP report provides the first comprehensive look at how the new corporate tax laws that took effect after the passage of the 2017 Tax Cuts and Jobs Act affects the scale of corporate tax avoidance.

The DC Line: – David Schwartzman: By Offsetting Federal Tax Cuts Locally, We Can Improve the Quality of Life for All DC Residents

April 10, 2019

Misha Hill of the Institute on Taxation and Economic Policy (ITEP) has estimated that the top 20 percent income bracket of DC residents will receive almost $700 million in federal tax cuts this year, with most ($541 million) going to the top 5 percent (with incomes above $319,000 per year). The same study finds that […]

Connecticut Voices for Children: Even with Modest Capital Gains Tax, Wealthiest Would Pay Average of $36,000 Less in Taxes After Trump Tax Cuts

April 10, 2019

Connecticut faces a $4 billion deficit over the Fiscal Years 2020-21 biennial budget. Without adequate revenues, painful budget cuts that could fall heavily on children and families are inevitable. Read more

Connecticut Voices for Children: A Balanced Approach to Revenues: Ensuring Fairness and Adequacy

April 10, 2019

As the General Assembly develops its biennial budget facing a $4 billion deficit, Connecticut Voices for Children urges legislators and the Governor to adopt a balanced approach by adopting revenue streams that enhance the fairness of our tax system while providing the adequate funds to sustain us today and to invest for tomorrow. Budget cuts […]

A chorus is building and calling on our elected officials to tax the rich. And pundits and policymakers are seriously debating proposals calling for higher income taxes and a wealth tax instead of attempting to shut down the conversation by labeling such proposals as class warfare.

Sen. Ron Wyden of Oregon, the ranking Democrat on the Senate Finance Committee, announced that he would soon release a proposal to eliminate massive tax breaks enjoyed by the wealthy on their capital gains income. If successful, the proposal would ensure that income from wealth is taxed just like income from work.

What to Watch for When the IRS Releases Its SALT Workaround Regulations

April 1, 2019 • By Carl Davis

The Treasury Department and IRS last summer proposed regulations that would make it more difficult for taxpayers to avoid the $10,000 cap on deductions for state and local taxes (SALT). Now, likely days away from the unveiling of the final version of IRS regulations on SALT cap workarounds, Carl Davis recaps the finer points ITEP will be watching for when the regulations become public.

Connecticut Voices for Children: Impact of the Governor’s FY 2020-2021 Budget on Children and Families

March 31, 2019

Connecticut’s long-term fiscal health and economic growth depend on policies that improve equity and support our most vulnerable families and children. Governor Lamont’s proposed state budget avoids additional major cuts to essential programs and services, though it is based on revenue proposals that fall most heavily on our lowest income taxpayers. It asks little of […]

Connecticut Voices for Children: Connecticut’s Radical New Budget Rules: Locking in Decreased Investment in our State for the Next Decade

March 31, 2019

Faced with increasingly difficult decisions in crafting the Fiscal Year (FY) 2018-19 biennial budget, the Connecticut General Assembly found itself at an impasse. In order to break the log jam, the legislature included drastic measures in the final budget deal. It is increasingly clear that the long-term effects of these measures will be damaging to […]

This month in tax policy news: Corporate profits soar while corporate tax collections plummet. Also inside: A look at regressive state tax policies and progressive remedies and the continued unpackaging of the Tax Cuts and Jobs Act. It's ITEP's March 2019 Monthly Digest.

The Trump Tax Law Further Tilted an Already Uneven Playing Field

March 27, 2019 • By Jessica Schieder

Proponents sold the Tax Cuts and Jobs Act (TCJA) as a way to spur new investment, increase workers’ paychecks, and reverse the off-shoring of jobs. Testimony presented during a House Ways and Means hearing held today reflected on how—more than a year after the law’s passage—each of those pitches ring hollow.

Policy Matters Ohio: Senate Transportation Budget Zeroes Out Public Transit, Slightly Improves EITC

March 25, 2019

Last week, the Ohio Senate took a leap backwards by removing $100 million for public transit from the Transportation Budget allocated by the Ohio House of Representatives. They also took small steps to otherwise improve equity by expanding Ohio’s Earned Income Tax Credit. Read more

Data released Friday by the U.S. Treasury Department should give great pause to all who care about the federal government’s ability to raise revenue in a fair, sustainable way. In the wake of the 2017 corporate tax overhaul, corporate tax collections have fallen at a rate never seen during a period of economic growth.

A 2019 ITEP analysis found that Black and Latinx households are overrepresented in the lowest-income quintiles; while they represent about 22 percent of overall tax returns, they account for 30 percent of the poorest quintile of taxpayers.

North Carolina Justice Center: Higher Rates on Higher Income: Why a Graduated Income Tax is Good Policy for North Carolina

March 20, 2019

At the same time, a graduated rate structure — in contrast with the state’s current flat tax rate on income — can make more revenue available for key public investments, generating broad-based benefits to many people and communities. It is also better able to keep up with the needs of a growing state. That is […]

Rep. Doggett and Sen. Whitehouse Reintroduce Bill to End Offshore Tax Avoidance

March 15, 2019 • By Lorena Roque

On Thursday, Representative Lloyd Doggett and Senator Sheldon Whitehouse announced that they are reintroducing the “No Tax Breaks for Outsourcing Act.” Our international corporate tax rules have been a mess for a long time, and Tax Cuts and Jobs Act (TCJA) failed to resolve the problems. The old rules and the new rules under TCJA both tax offshore corporate profits more lightly than domestic corporate profits, but in different ways. The No Tax Breaks for Outsourcing Act would create rules that tax domestic profits and foreign profits in the same way.

State Millionaires’ Taxes Can Advance Racial Justice

March 15, 2019

Millionaires’ taxes can help address this problem. They can raise substantial revenue for public services by asking more of those at the top, a group that’s disproportionately white. White families are three times likelier than Black and Latinx families to be in the top 1 percent, according to a report by Prosperity Now and the Institute on Taxation and Economic Policy.

Policy Matters Ohio: Loopholes Upon Loopholes

March 12, 2019

As noted, of the three deductions, by far the most taxpayers took advantage of the deduction for self-employment taxes. The Institute on Taxation and Economic Policy, which has a model of the federal and Ohio tax systems, roughly estimates that 330,000 of the Ohio taxpayers who had business income and took the self-employment tax deduction […]

Gov. Pritzker’s Tax Proposal Is a Huge Step Toward Fairer Taxes

March 7, 2019 • By Lisa Christensen Gee

Gov. Pritzker’s Fair Tax proposal reflects a necessary and strong commitment to reforming Illinois’s tax system in a fair way that will help the state raise the revenue it needs to stabilize its finances and improve quality of life for all its residents. The state’s financial crisis spans several years and getting the state back on firm fiscal footing requires bold solutions and—yes—tax increases.

The nation is currently engaging in serious discourse about how to expand economic opportunity and remedy income inequality via the federal tax code. State tax systems are also important and have a dismal effect on the growing economic divide. In a new report, Fairness Matters: A Chart Book on Who Pays State and Local Taxes, we further parse our Who Pays? data.