ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

A Corporate Tax Cut Would Benefit Coastal Investors, Not the Heartland

November 30, 2017 • By Carl Davis

The centerpiece of the House and Senate tax plans is a major tax cut for profitable corporations that the American public does not want, and that will overwhelmingly benefit a small number of wealthy investors living in traditionally “blue” states. New ITEP research shows that poorer states such as West Virginia, Oklahoma, Alabama, and Tennessee would be largely left behind by a corporate tax cut, while the lion’s share of the benefits would remain with a relatively small number of wealthy investors who tend to be concentrated in larger cities near the nation’s coasts.

A recent ITEP study concluded that the tax bill before the Senate would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today, while providing foreign investors with more benefits than American households. This report delves deeper by breaking out impacts of different components of the Senate tax plan on U.S. taxpayers in 2019 and 2027. This approach leads to several conclusions.

Senate Tax Plan Harms Low- and Middle-Income Kentuckians to Pay for Giveaways to Those at the Top

November 21, 2017

Senators will return to Capitol Hill next week after the Thanksgiving recess for a potential vote on their revised plan. According to estimates from the Institute on Taxation and Economic Policy (ITEP), the bottom 60 percent of Kentuckians, who make an average of $37,500 a year, will actually face more taxes from the plan with an average increase of $80 in 2027.

How the Revised Senate Tax Bill Will Affect North Dakota Residents’ Federal Taxes

November 18, 2017 • By ITEP Staff

Updated November 18, 2017 The revised Senate tax plan approved by the Finance Committee on November 16th would raise taxes on many low- and middle-income families while bestowing immense benefits on wealthy Americans and foreign investors. See below for graphs showing these effects in North Dakota in 2027. Download the national and 50-state detailed tables for […]

Arizona Center for Economic Progress: Just Like the House GOP Plan, the Senate GOP Tax Plan Is Another Handout to the Wealthiest Households and Large Corporations

November 14, 2017

Newly published data shows that the new Senate GOP tax plan isn’t much better than the House GOP tax plan for the middle-class, small businesses, and lower-income Americans. The Institute on Taxation and Economic Policy analysis (https://itep.org/senatetaxplan/) shows that on average, the top 5% of Americans will receive around 50% of the tax cuts. Read […]

House Tax Bill Would Put Property Tax Deduction Out of Reach for Most Households

November 13, 2017 • By ITEP Staff

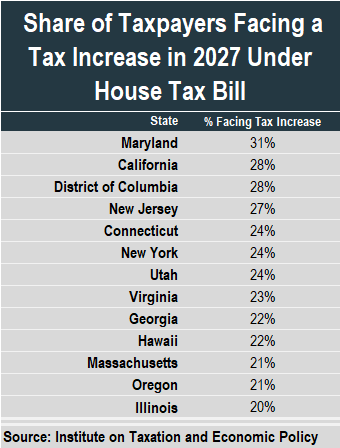

The House of Representatives is expected to vote this week on a bill that would reduce federal revenues by roughly $1.5 trillion over the next decade. Despite the bill’s high price tag, many households would pay more in federal tax if the bill is enacted, in large part because it slashes the deduction for state […]

Flawed Data from House Leadership Attempts to Hide Tax Hikes Under Proposal

November 9, 2017 • By Carl Davis

In a story published yesterday evening, Politico reported that House leaders have been “working to create customized data models” to show lawmakers that their constituents will not face a tax increase under the tax bill being debated in the House. On this point, House leaders have taken on an impossible task.

Arizona Center for Economic Progress: With Further Analysis Completed, It’s Time to Call the GOP Tax Plan What it Is: Welfare for the Wealthy

November 6, 2017

A 50-state analysis of the House tax plan released last week reveals that in Arizona the wealthiest 1% of Arizonans will receive the greatest share of the total tax cut in year one and their share would grow through 2027. And during that 10-year window, the value of the tax cut gets smaller and smaller for every […]

Trump Administration Might Propose a Long-Overdue Gas Tax Increase

October 31, 2017 • By Carl Davis

The Trump Administration is reportedly considering backing a 7-cent increase in the federal gas tax next year to pay for improvements in the nation's infrastructure. While most of the tax policy ideas coming from the administration in recent weeks would undermine the nation's ability to fund core public services, this one is a notable exception.

Trickle-Down Dries Up: States without personal income taxes lag behind states with the highest top tax rates

October 26, 2017 • By Carl Davis, Nick Buffie

Lawmakers who support reducing or eliminating state personal income taxes typically claim that doing so will spur economic growth. Often, this claim is accompanied by the assertion that states without income taxes are booming, and that their success could be replicated by any state that abandons its income tax. To help evaluate these arguments, this study compares the economic performance of the nine states without broad-based personal income taxes to their mirror opposites—the nine states levying the highest top marginal personal income tax rates throughout the last decade.

Michigan League for Public Policy: Immigrant families in Michigan: A state profile

October 18, 2017

Michigan immigrants also contribute millions in tax revenue each year, and in doing so help pay for important public programs and infrastructure in the state. In 2015 for example, undocumented immigrants in Michigan paid approximately $86.6 million in state and local taxes. Young undocumented immigrants also contribute their share in taxes. In 2015, DACA-eligible immigrants […]

Tax Foundation Updates Its Problematic Wishlist for State Tax Policy

October 18, 2017 • By Carl Davis

This week the Tax Foundation published its 2018 State Business Tax Climate Index, or as University of Iowa economist Peter Fisher has nicknamed it, the “Waste of Time Index.”

Poverty is Down, But State Tax Codes Could Bring It Even Lower

September 15, 2017 • By Misha Hill

The U.S. Census Bureau released its annual data on income, poverty and health insurance coverage this week. For the second consecutive year, the national poverty rate declined and the well-being of America’s most economically vulnerable has generally improved. In 2016, the year of the latest available data, 40.6 million (or nearly 1 in 8) Americans were living in poverty.

Astonishingly, tax policies in virtually every state make it harder for those living in poverty to make ends meet. When all the taxes imposed by state and local governments are taken into account, every state imposes higher effective tax rates on poor families than on the richest taxpayers.

New Jersey Policy Perspective: Reforming New Jersey’s Income Tax Would Help Build Shared Prosperity

September 12, 2017

These reforms would also make New Jersey’s tax system more equitable, but it would not undo the tax code’s upside-down nature, in which low-income and middle-class New Jerseyans pay greater shares of their incomes to state and local taxes than wealthy residents. With these changes, this inequity would be slightly evened out. The share paid by the top 1 percent would rise to 7.7 percent from 7.1 percent, but that would still be lower than any other group of New Jersey families.

Reducing the Cost of Child Care Through State Tax Codes in 2017

September 11, 2017 • By ITEP Staff

Low- and middle-income working parents spend a significant portion of their income on child care. As the number of parents working outside of the home continues to rise, child care expenses have become an unavoidable and increasingly unaffordable expense. This policy brief examines state tax policy tools that can be used to make child care more affordable: a dependent care tax credit modeled after the federal program and a deduction for child care expenses.

State lawmakers seeking to make residential property taxes more affordable have two broad options: across-the-board tax cuts for taxpayers at all income levels, such as a homestead exemption or a tax cap, and targeted tax breaks that are given only to particular groups of low- and middle-income taxpayers. One such targeted program to reduce property taxes is called a “circuit breaker” because it protects taxpayers from a property tax “overload” just like an electric circuit breaker: when a property tax bill exceeds a certain percentage of a taxpayer’s income, the circuit breaker reduces property taxes in excess of this “overload”…

Sales taxes are one of the most important revenue sources for state and local governments; however, they are also among the most unfair taxes, falling more heavily on low- and middle-income households. Therefore, it is important that policymakers nationwide find ways to make sales taxes more equitable while preserving this important source of funding for public services. This policy brief discusses two approaches to a less regressive sales tax: broad-based exemptions and targeted sales tax credits.

Rewarding Work Through State Earned Income Tax Credits in 2017

September 11, 2017 • By ITEP Staff

The Earned Income Tax Credit (EITC) is a policy designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, providing the opportunity for struggling families to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits.

Arkansas Advocates for Children and Families: The Trump Tax Plan: What Would It Mean for Arkansas?

September 5, 2017

Who benefits and who loses under the Trump tax plan? An analysis by the Institute on Taxation and Economic Policy (ITEP) estimates that Arkansas would fare worse under the plan compared to other states. Relative to our share of the U.S. population, we would be one of the 12 states receiving the lowest share of the total Trump tax cut.

New Mexico Voices for Children: The Trump Tax Plan Isn’t ‘Reform.’ Here’s Why:

September 1, 2017

In April the Trump administration released a sketchy outline of their half-baked ideas for tax changes. An analysis by the Washington, D.C.-based Institute for Taxation and Economic Policy (ITEP) of that back-of-the-envelope ‘plan’ found that nearly half (48 percent) of Trump’s proposed tax cuts would go to millionaires. Millionaires make up only 0.5 percent of the U.S. population.

New Mexico Voices for Children: Trump Tax Plan Does Little for NM’s Middle Class

August 31, 2017

Average New Mexicans would not benefit much from President Trump’s tax reform proposal, which would give the biggest tax breaks to New Mexico’s millionaires. That’s according to a report released recently by the Institute on Taxation and Economic Policy (ITEP).

Maryland Center on Economic Policy: Trump Tax Framework Would Give Away Trillions in Tax Breaks to Millionaires

August 24, 2017

The Trump administration and congressional leaders are gearing up to overhaul the federal tax code this fall. While many of the details remain fuzzy, one thing is clear: the administration’s top priority is to hand out big tax breaks to millionaires.

Budget and Tax Center: Costly Tax Cuts in New State Budget Continue Precarious Road Ahead for North Carolina

August 21, 2017

The new two-year state budget passed by lawmakers included another package of tax cuts that will further limit the amount of revenue available for public investments. The latest tax cuts will reduce annual available revenue by $900 million and, when combined with tax cuts passed since 2013, result in an estimated $3.5 billion in less annual revenue compared to the tax system that was in place prior to tax changes in 2013.

Maine Center for Economic Policy: Maine Millionaires Primary Recipients of Proposed Trump Tax Breaks

August 17, 2017

New analysis from the Institute on Taxation and Economic Policy (ITEP) shows Maine’s millionaires would get an average tax cut of $135,220 under President Trump’s proposed tax plan. Maine millionaires represent only 0.3 percent of all Maine households, yet would receive more than a quarter of all tax breaks.