ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Trump Tax Proposals Would Provide Richest One Percent in North Dakota with 51.3 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in North Dakota would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,714,800 in 2018.

Trump Tax Proposals Would Provide Richest One Percent in Washington with 53.6 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Washington would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,983,800 in 2018.

Trump Tax Proposals Would Provide Richest One Percent in Oregon with 45.6 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Oregon would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,676,800 in 2018.

Trump Tax Proposals Would Provide Richest One Percent in Wisconsin with 50.6 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Wisconsin would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,786,500 in 2018.

Trump Tax Proposals Would Provide Richest One Percent in West Virginia with 37.4 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in West Virginia would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $791,400 in 2018.

Trump Tax Proposals Would Provide Richest One Percent in Mississippi with 47.8 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Mississippi would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,108,300 in 2018. They would receive 47.8 percent of the tax cuts that go to Mississippi’s residents and would enjoy an average cut of $62,390 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Virginia with 60 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Virginia would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,718,600 in 2018.

Trump Tax Proposals Would Provide Richest One Percent in Louisiana with 55.6 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Louisiana would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,521,500 in 2018. They would receive 55.6 percent of the tax cuts that go to Louisiana’s residents and would enjoy an average cut of $155,290 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Maine with 33.9 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Maine would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,212,000 in 2018. They would receive 33.9 percent of the tax cuts that go to Maine’s residents and would enjoy an average cut of $53,220 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Rhode Island with 47.4 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Rhode Island would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,795,500 in 2018.

Trump Tax Proposals Would Provide Richest One Percent in South Carolina with 49.5 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in South Carolina would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,134,000 in 2018.

Trump Tax Proposals Would Provide Richest One Percent in South Dakota with 58.6 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in South Dakota would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,770,700 in 2018.

Trump Tax Proposals Would Provide Richest One Percent in Michigan with 53.2 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Michigan would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,621,600 in 2018. They would receive 53.2 percent of the tax cuts that go to Michigan’s residents and would enjoy an average cut of $120,010 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Nevada with 62.7 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Nevada would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $2,498,000 in 2018. They would receive 62.7 percent of the tax cuts that go to Nevada’s residents and would enjoy an average cut of $170,150 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Minnesota with 50.8 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Minnesota would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $2,589,800 in 2018. They would receive 50.8 percent of the tax cuts that go to Minnesota’s residents and would enjoy an average cut of $120,420 in 2018 alone.

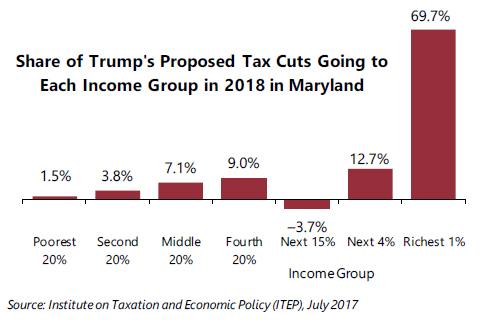

Trump Tax Proposals Would Provide Richest One Percent in Maryland with 69.7 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Maryland would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,802,700 in 2018. They would receive 69.7 percent of the tax cuts that go to Maryland’s residents and would enjoy an average cut of $123,720 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Massachusetts with 63.2 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Massachusetts would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $3,010,300 in 2018. They would receive 63.2 percent of the tax cuts that go to Massachusetts’s residents and would enjoy an average cut of $215,670 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in New Mexico with 42 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in New Mexico would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,264,600 in 2018. They would receive 42 percent of the tax cuts that go to New Mexico’s residents and would enjoy an average cut of $73,070 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Kentucky with 42.8 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Kentucky would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,313,400 in 2018. They would receive 42.8 percent of the tax cuts that go to Kentucky’s residents and would enjoy an average cut of $68,550 in 2018 alone.

Maine Center for Economic Policy: What Happens When Those with the Most Pay the Least Taxes?

July 7, 2017

With the 3 percent surcharge repealed, the state’s tax code is out of balance. Those with the most are asked to pay the least. This means a middle-class family keeps 91 cents on average after state and local taxes for each dollar earned, versus 93 cents kept by the wealthiest in the state. This preferential tax treatment of wealthy Maine household also comes at a cost to roads, public health, and quality education that low and middle income Mainers rely on the most to succeed.

Wisconsin Budget Project: Missing Out: Recent Tax Cuts Slanted in Favor of those with Highest Incomes

June 27, 2017

Since 2011, Wisconsin state lawmakers have made it a high priority to cut taxes, particularly personal income and property taxes. The tax cuts they have passed have disproportionately gone to Wisconsin residents with the highest incomes. Middle-class residents received less than the wealthy, and residents with low incomes received the smallest tax cut. Read more […]

Minnesota Budget Project: DACA recipients make important tax contributions to Minnesota

June 22, 2017

Minnesota’s Deferred Action for Childhood Arrival (DACA) recipients pay an estimated $15 million in state and local taxes, according to a report from the Institute on Taxation and Economic Policy (ITEP). They are contributing to our communities and our economy, and the report shows they would contribute even more if given the opportunity to apply […]

Failed Tax-Cut Experiment (in North Carolina) Will Continue Under Final Budget Agreement, Pushes Fiscal Reckoning Down the Line

June 21, 2017

The final budget agreement from leaders of the House and Senate puts North Carolina on precarious fiscal footing, The tax changes that leaders agreed to—which were less a compromise and more of a decision to combine the tax cuts in both chambers’ proposals—make the cost of these tax cuts bigger than what either chamber proposed. Including the new tax cuts,approximately 80 percent of the net tax cut since 2013 will have gone to the top 20 percent. More than half of the net tax cut will go to the top 1 percent.

Oregon Center for Public Policy: Reason to Hope for a Commercial Activities Tax (CAT) Accompanied by a CAT Fairness Credit

June 21, 2017

The CAT Fairness Credit would be a credit on personal income taxes based on family size and income. It would cost about the same as the combined impact of the personal income tax changes and EITC increase, and would target relief to low- and middle-income taxpayers.

Maine Center for Economic Policy: Senate Republican Vote Defies Will of Voters, Compromises Current and Future School Funding to Give Tax Cuts to Wealthy

June 13, 2017

According to the Institute on Taxation and Economic Policy, repealing the citizen approved surcharge would give a $16,300 tax break on average to the top 1% of Maine households and cost the state over $300 million in school funding over current and future biennia.