ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Turning Loopholes into Black Holes: Trump’s Territorial Tax Proposal Would Increase Corporate Tax Avoidance

September 6, 2017 • By Matthew Gardner, Steve Wamhoff

The problem of offshore tax avoidance by American corporations could grow much worse under President Donald Trump’s proposal to adopt a “territorial” tax system, which would exempt the offshore profits of American corporations from U.S. taxes. This change would increase the already substantial benefits American corporations obtain when they use accounting gimmicks to make their profits appear to be earned in a foreign country that has no corporate income tax or has one that is extremely low or easy to avoid.

CBS News Moneywatch: Can Trump’s Corporate Tax Cuts Help the Middle Class?

September 1, 2017

Fortune 500 companies now hold about $2.6 trillion in offshore cash, which leads to billions in lost federal taxes, according to the Institute on Taxation and Economic Policy. A set of earlier tax reform proposals from Mr. Trump would likely most benefit the richest 1 percent of Americans, the group added. “Assuring working people that […]

Fact Check.org: Trump’s Tax Speech

September 1, 2017

U.S. companies with business overseas do keep some profits in offshore accounts, where it isn’t subject to U.S. corporate taxes until it is repatriated to this country. The profits are declared indefinitely, or permanently, reinvested, which means the companies say they will reinvest the money abroad. If a U.S. company does bring the money back to the […]

The Columbian: Republicans should stick to facts, not rhetoric, on topic of corporate taxes

September 1, 2017

House Speaker Paul Ryan’s visit to the Boeing plant in Everett last week contained plenty of ideology, politicking, and lobbying for Republican efforts to reconfigure the U.S. tax code. But it was woefully short on facts — a situation that should play a role in the upcoming congressional discussion about how much American corporations pay […]

CNBC: Corporate Tax Reform Could Leave These Companies Paying More

August 31, 2017

Earlier this year, the Institute on Taxation and Economic Policy, a nonpartisan think tank, combed through the financial filings of 258 major U.S. corporations to see how much tax they reported paying. The result: more than two-thirds of the companies paid less than 20 percent of their profits in taxes, on average, between 2008 and […]

Politico: Trump Wants to Slash America’s Corporate Tax Rate, But That Rate Is a Myth

August 31, 2017

The Institute on Taxation and Economic Policy examined 258 Fortune 500 companies that were profitable from 2008 to 2015 and found 100 companies paid zero — or less — in federal income taxes for at least one year. Some companies like PG&E (Pacific Gas and Electric Company) didn’t pay taxes at all. Plus, many received […]

Slate: Our Corporate Tax System Is a Mess. Republicans Might Just Make It Worse

August 31, 2017

Earlier this year, the left-leaning Institute on Taxation and Economic Policy released a report in which it analyzed the tax rates paid by members of the Fortune 500 between 2008 and 2015. The authors selected the 258 corporations that were profitable in all eight years to avoid dragging down the average with companies that paid […]

HuffPost: Soda Taxes Create Complicated Rules

August 31, 2017

The arcane rules for taxing beverages point to a broader taxation challenge: Unless state legislatures and city officials target broad categories, all gasoline sales, for example, their efforts to tax individual items often get hung up over how to define what’s taxed, as well as how to weigh concerns from competing constituencies. And the politics […]

Irish Times: Dublin Watches Nervously as Trump Pushes U.S. Tax Reform Agenda

August 31, 2017

A proposal to encourage companies to repatriate the trillions of dollars that are resting offshore is also up for discussion between the White House and Republicans on Capitol Hill, perhaps along the lines of the repatriation holiday offered by the Bush administration in 2004. Whether either of those changes would have a material impact on […]

Tax Reform Principles Released by GOP in August Raise More Questions Than They Answer

August 31, 2017 • By Steve Wamhoff

Before Wednesday, you may have forgotten about tax reform given that President Trump’s remarks on the Charlottesville white supremacist rally, as well as the first U.S. solar eclipse since 1979, and Hurricane Harvey, overshadowed most other news. But Republicans on the House Ways and Means Committee, which in theory is the starting place for any tax legislation, certainly tried to get the public to focus on their vision for tax reform. They released a “reason for tax reform” each day in August. Unfortunately, these “reasons” are a combination of ideas that their proposals fail to address and misleading assertions.

Vox: Trumps Says the U.S. Has the Highest Corporate Tax Rate in the World

August 31, 2017

Big multinational corporations commonly make use of the deferral loophole, which allows them to avoid taxes on profits made abroad. That exception creates incentives for corporations to use accounting gimmicks to shift profits made at home to overseas subsidiaries and to funnel money through foreign tax havens where they owe little to no tax. According […]

HuffPost: Here Are 4 Populist Tax Reforms Trump Could Adopt If He Really Cared About Working People

August 31, 2017

In fact, the evidence suggests that Trump’s tax cuts would line corporate CEOs’ pockets, while depleting the Treasury and doing little, if anything, to boost working class Americans’ bottom line.“Trump’s plan would double down on the anti-populist features of the current system,” said Matthew Gardner, a senior fellow at the progressive Institute on Taxation and […]

The Oklahoman: Tax Holiday Debate Splits Those on the Left

August 31, 2017

The liberal Institute on Taxation and Economic Policy has been among those urging repeal of sales tax holidays. In Georgia, the liberal Georgia Budget and Policy Institute promoted repeal. In an interview with Governing magazine, Wesley Tharpe, research director of the Georgia Budget and Policy Institute, appeared dismissive of the savings the holiday provided low-income […]

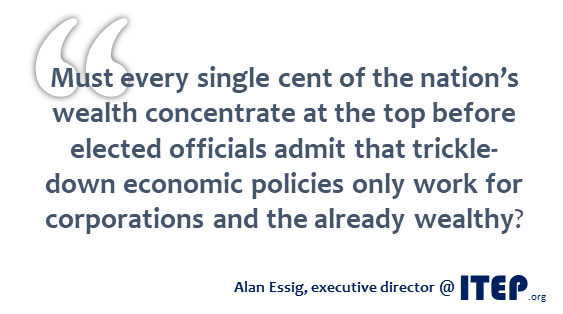

Fortune: Trump Doesn’t Want Us to See His Real Tax Plan

August 30, 2017

Following is an excerpt from a op-ed by Alan Essig, executive director of ITEP, published on Fortune. President Donald Trump and his allies in Congress are eager to turn our attention to tax changes. This Wednesday, Trump will head to Missouri to promote the supply-side argument for tax cuts. But he doesn’t want us to […]

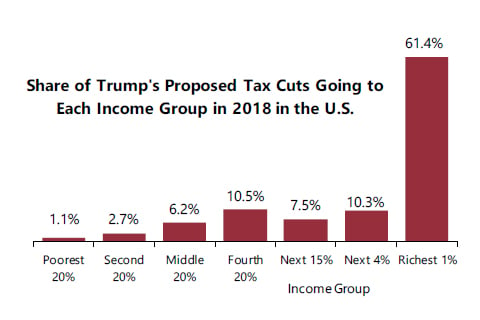

Quartz: Most of Trump’s Tax Cuts Would Go to Taxpayers Making over $599,300 a Year

August 30, 2017

He didn’t provide any specifics about how these things might happen however. So far, the most detail that’s been offered about Trump’s tax reform plan is a one-page, less-than 250 word outline handed out at a White House press briefing in April. Using that and subsequent statements from administration officials as a guide, the Institute […]

HuffPost: Donald Trump Kicks Off Push For Tax Reform In Missouri

August 30, 2017

The president spoke at an event at Loren Cook Co., which manufactures fans, blowers and lab exhaust systems. The company’s owner donated to Trump and to various Missouri GOP officials during the 2016 campaign cycle. We don’t know much yet about Trump’s plan for tax reform ― but based on the broad outlines released by the […]

Sorting Through the Fallacies in Trump’s Missouri Tax Speech

August 30, 2017 • By Steve Wamhoff

President Donald Trump spoke in Springfield, Missouri today about the need for a tax reform that provides “more jobs and higher wages for America” and “tax relief for middle-class families.” But the proposals the Trump administration has released so far would cut taxes for companies moving investment offshore and would provide most tax cuts to the richest one percent of taxpayers.

The Fiscal Times: Will Trump’s Corporate Tax Reform Really Boost the Economy?

August 30, 2017

A territorial tax system is still open to abuse: Although there may be benefits to changing the way foreign profits are taxed, there is no guarantee that tax dodging will be reduced. “It’s an endless cat-and-mouse game” that leaves countries racing to lower their business tax rates to zero, Matthew Gardner of the Institute on […]

The New York Times: Trump Tax Plan May Free Up Corporate Dollars, but Then What?

August 30, 2017

But skeptics worry that making the system airtight is impossible. “It’s an endless cat-and-mouse game,” said Matthew Gardner, senior fellow at the Institute on Taxation and Economic Policy, a research group based in Washington. “What’s driving companies to engage in paper transactions is not our 35 percent tax rate,” he said, but other countries’ willingness […]

The Washington Post: Trump Says a Corporate Tax Cut Would Create More Jobs. Economists Aren’t So Sure.

August 30, 2017

IPS used data from company filings — analyzed by the Institute on Taxation and Economic Policy, a left-leaning research organization — to make a list of publicly held firms that made a profit every year from 2008 to 2015 and that also paid less than 20 percent of their earnings in federal corporate income tax. Ninety-two companies fit that description, including […]

The New York Times: It’s a Myth That Corporate Tax Cuts Mean More Jobs

August 30, 2017

According to the Institute on Taxation and Economic Policy, AT&T enjoyed an effective tax rate of just 8 percent between 2008 and 2015, despite recording a profit in the United States each year, by exploiting tax breaks and loopholes. (The company argues that it pays significant taxes, at a rate close to 34 percent in […]

The Columbian: A Taxing Debate

August 30, 2017

The awe actually should be over Ryan’s selective use of facts. As Danny Westneat of The Seattle Times reported: “Not only is Boeing gushing cash, but its own financial documents show it has actually paid an average federal income tax of just 3.2 percent of profits over the past 15 years. That’s less than one-tenth […]

The Chicago Tribune: After the Rush Job to Use Public Money on Private Schools, Now We Wait

August 30, 2017

Third, the Illinois program specifies that donations to scholarship funds — up to $1,000 a year for an individual — are not eligible for the 75 percent state tax credit if the taxpayer also claims that donation as a charitable contribution for federal tax purposes. This provision eliminates the ability of donors in higher tax […]

The Street: Corporate Tax Cuts Promote CEO Pay Raises and Stock Buybacks, Not Jobs

August 30, 2017

A new study from the Institute for Policy Studies, a left-leaning think tank in Washington, D.C., analyzes data from the Institute on Taxation and Economic Policy to determine what companies that pay lower tax rates do with their extra earnings. Researchers looked at 92 publicly-held companies that reported a U.S. profit from 2008 to 2015 […]

ITEP on President Trump’s Missouri Visit: The Policy Doesn’t Match the Rhetoric

August 30, 2017 • By Alan Essig

Following is a statement by Alan Essig, executive director of the Institute on Taxation and Economic Policy, regarding President Trump’s visit to Springfield, Mo. The president is expected to tout his plans for overhauling the federal tax code. “Much like the GOP health plan was a tax cut for the wealthy masquerading as health reform, […]