ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

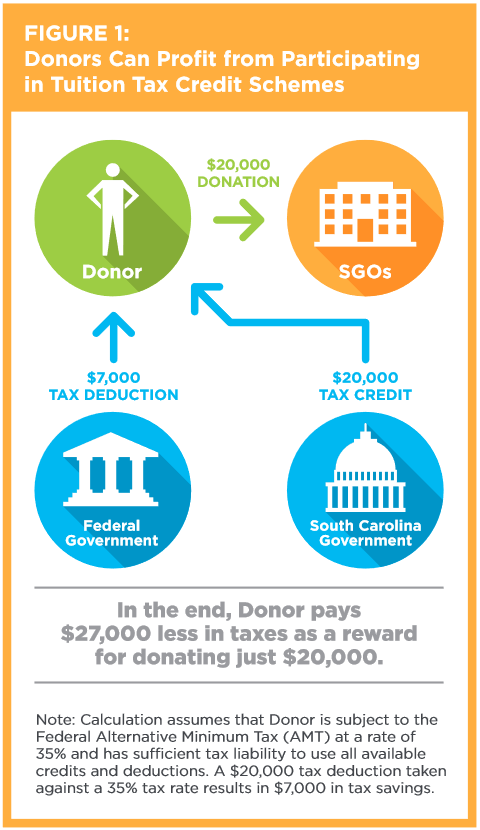

It’s a Fact: Voucher Tax Credits Offer Profits for Some “Donors”

August 9, 2017 • By Carl Davis

In nine states, tax rewards gained by donating to fund private K-12 vouchers are so oversized that “donors” can turn a profit. This is the shocking but true finding of a pair of studies released by ITEP over the last year.

State Rundown 8/2: Legislative Tax Debates Wind Down as Ballot Initiative Efforts Ramp Up

August 2, 2017 • By ITEP Staff

Budget deliberations continue in earnest this week in Alaska, Connecticut, Pennsylvania, and Rhode Island. In South Dakota and Utah, the focus is on gearing up for ballot initiative efforts to raise needed revenue, though be sure to read about legislators nullifying voter-approved initiatives in Maine and elsewhere in our "what we're reading" section.

States May Be Finally Learning Their Lesson on Back-To-School Sales Tax Holidays

July 21, 2017 • By Dylan Grundman O'Neill

State lawmakers face a dilemma when it comes to sales tax holidays, an attractive and popular policy that nonetheless proves to be a poor choice compared to developing thoughtful, targeted tax policies or investing in well-executed public services. Luckily, word seems to be getting out that the costs associated with these holidays far outweigh their purported benefits.

Trump Tax Proposals Would Provide Richest One Percent in Alaska with 45.9 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Alaska would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,400,500 in 2018. They would receive 45.9 percent of the tax cuts that go to Alaska’s residents and would enjoy an average cut of $134,060 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Indiana with 46.1 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Indiana would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,511,600 in 2018. They would receive 46.1 percent of the tax cuts that go to Indiana’s residents and would enjoy an average cut of $95,940 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Iowa with 44.7 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Iowa would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,164,200 in 2018. They would receive 44.7 percent of the tax cuts that go to Iowa’s residents and would enjoy an average cut of $84,860 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Hawaii with 42.4 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Hawaii would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,262,200 in 2018. They would receive 42.4 percent of the tax cuts that go to Hawaii’s residents and would enjoy an average cut of $71,280 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in the District of Columbia with 69.5 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Washginton, D.C., would not benefit equally from these proposals. The richest one percent of the District’s taxpayers are projected to make an average income of $2,998,900 in 2018. They would receive 69.5 percent of the tax cuts that go to D.C. residents and would enjoy an average cut of $245,770 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Florida with 60.4 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Florida would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $2,797,700 in 2018. They would receive 60.4 percent of the tax cuts that go to Florida’s residents and would enjoy an average cut of $193,570 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Georgia with 58.5 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Georgia would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,892,900 in 2018. They would receive 58.5 percent of the tax cuts that go to Georgia’s residents and would enjoy an average cut of $120,130 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Arkansas with 49.5 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Arkansas would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,340,600 in 2018. They would receive 49.5 percent of the tax cuts that go to Arkansas’s residents and would enjoy an average cut of $80,800 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Kansas with 52.3 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Kansas would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,825,100 in 2018. They would receive 52.3 percent of the tax cuts that go to Kansas’s residents and would enjoy an average cut of $132,080 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Colorado with 52.5 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Colorado would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,845,700 in 2018. They would receive 52.5 percent of the tax cuts that go to Colorado’s residents and would enjoy an average cut of $142,190 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Connecticut with 62.8 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Connecticut would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $3,682,800 in 2018. They would receive 62.8 percent of the tax cuts that go to Connecticut’s residents and would enjoy an average cut of $253,050 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Delaware with 46.6 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Delaware would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,798,100 in 2018. They would receive 46.6 percent of the tax cuts that go to Delaware’s residents and would enjoy an average cut of $84,310 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Arizona with 51 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Arizona would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,355,400 in 2018. They would receive 51 percent of the tax cuts that go to Arizona’s residents and would enjoy an average cut of $99,090 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in California with 64.7 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in California would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $2,746,600 in 2018. They would receive 64.7 percent of the tax cuts that go to California’s residents and would enjoy an average cut of $149,710 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Idaho with 48 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Idaho would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,418,700 in 2018. They would receive 48 percent of the tax cuts that go to Idaho’s residents and would enjoy an average cut of $90,670 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Illinois with 56.1 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Illinois would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $2,726,200 in 2018. They would receive 56.1 percent of the tax cuts that go to Illinois’s residents and would enjoy an average cut of $134,270 in 2018 alone.

State Rundown 7/19: Handful of States Still Have Their Hands Full with Tax and Budget Debates

July 19, 2017 • By ITEP Staff

Tax and budget debates drag on in several states this week, as lawmakers continue to work in Alaska, Connecticut, Rhode Island, Pennsylvania, Texas, and Wisconsin. And a showdown is brewing in Kentucky between a regressive tax shift effort and a progressive tax reform plan. Be sure to also check out our "What We're Reading" section for a historical perspective on federal tax reform, a podcast on lessons learned from Kansas and California, and more!

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 12, 2017 • By ITEP Staff

Sales taxes are an important revenue source, composing close to half of all state tax revenues. But sales taxes are also inherently regressive because the lower a family’s income, the more the family must spend on goods and services subject to the tax. Lawmakers in many states have enacted “sales tax holidays” (at least 16 states will hold them in 2017), to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. While these holidays may seem to lessen the regressive impacts of the sales tax, their benefits are minimal. This policy brief…

State Rundown 7/11: Some Legislatures Get Long Holiday Weekends, Others Work Overtime

July 11, 2017 • By ITEP Staff

Illinois and New Jersey made national news earlier this month after resolving their contentious budget stalemates. But they weren’t the only states working through (and in some cases after) the holiday weekend to resolve budget issues.

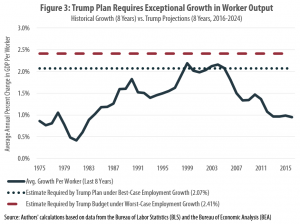

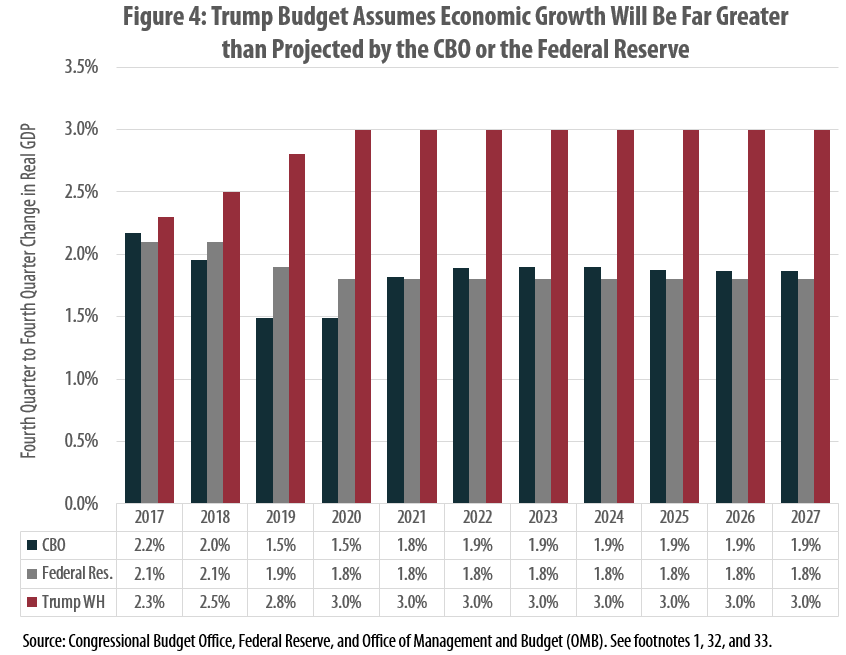

Last month, the Trump Administration released a budget proposal that relies on unrealistic projections of economic growth to create the illusion that it will balance the budget by 2027. By making the federal budget outlook appear more favorable than it actually is, the administration is seeking to bolster its case for enacting a multi-trillion-dollar tax cut. Fortunately, Congress has its own independent forecaster that just chimed in with a more rational assessment of the economy.

Trump Budget Uses Unrealistic Economic Forecast to Tee Up Tax Cuts

June 29, 2017 • By Carl Davis

The Trump Administration recently released its proposed budget for Fiscal Year 2018. The administration claims that its proposals would reduce the deficit in nearly every year over the next decade before eventually achieving a balanced budget in 2027, but the assumptions it uses to reach this conclusion are deeply flawed. This report explains these flaws and their consequences for the debate over major federal tax changes.

State Rundown 6/28: States Scramble to Finish Budgets Before July Deadlines

June 28, 2017 • By ITEP Staff

This week, several states attempt to wrap up their budget debates before new fiscal years (and holiday vacations) begin in July. Lawmakers reached at least short-term agreement on budgets in Alaska, New Hampshire, Rhode Island, and Vermont, but such resolution remains elusive in Connecticut, Delaware, Illinois, Maine, Pennsylvania, Washington, and Wisconsin.