ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

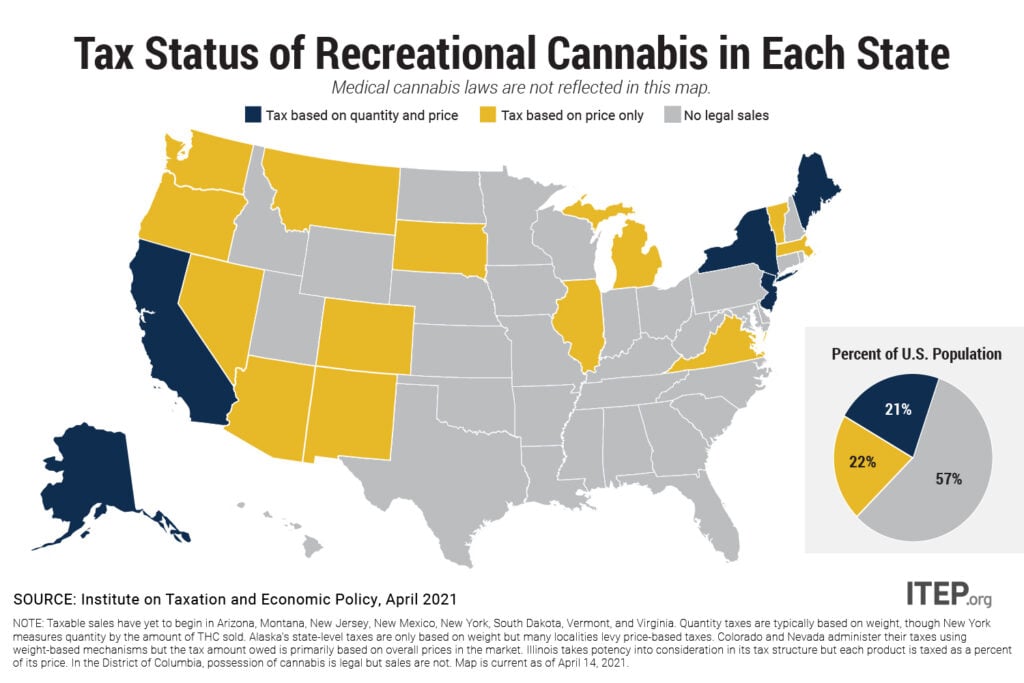

Eighteen states have legalized the sale of cannabis for general adult use and sales are already underway in 10 of those states. Every state allowing legal sales applies an excise tax to cannabis based on the product’s quantity, its price, or both. Quantity taxes are typically based on weight, though New York measures quantity by the amount of THC sold. ITEP research indicates that taxes based on quantity will be more sustainable over time because prices are widely expected to fall as the cannabis industry matures. Most states allowing for legal cannabis sales apply their general sales taxes to the…

Expert Quote

April 27, 2017 • By Alan Essig

“For the better part of the 20th century, the nation’s economic pie grew as did incomes for all Americans. But for the past 40 years, wages for ordinary Americans have stagnated while income growth and wealth have concentrated at the top. Our nation’s tax and other public policies play a big part in this damaging […]

Dylan Grundman O’Neill

April 21, 2017 • By ITEP Staff

Dylan is the “coach on the floor” of the ITEP state policy team. He provides hands-on analysis and support on tax policy issues to advocates and lawmakers in several states. He also supports and vets the work of ITEP's other state policy analysts as they do the same in their states, and he liaises between the state team and the data and model team to ensure quality and consistency in how ITEP models policies and presents data.

Matthew Gardner

April 21, 2017 • By ITEP Staff

Matt is a senior fellow at ITEP where he has worked since 1998. He previously served as ITEP’s executive director from 2006 to 2016. Mr. Gardner’s work focuses on federal, state and local tax systems, with a particular emphasis on the impact of tax policies on low- and moderate-income tax payers. He uses ITEP’s microsimulation model to produce economic projections and analyses on the effects of current and proposed federal and state tax and budget policies.

Carl Davis

April 21, 2017 • By ITEP Staff

Carl is the research director at ITEP, where he has worked since 2008. As ITEP’s research director, Carl is responsible for exploring new and emerging trends in tax policy. In this role, he has authored reports on proposals to legalize and tax cannabis sales, to implement vehicle-miles-traveled taxes, to update the tax treatment of the “gig economy,” and to improve the enforcement of sales taxes as they relate to online shopping. Carl has also conducted extensive research into private school tax credits. That research helped reveal the profitable tax shelters that these credits created for some upper-income donors to private…

Aidan Davis

April 21, 2017 • By ITEP Staff

Aidan is ITEP’s acting state policy director. She coordinates ITEP’s state tax policy research and advocacy agenda and works closely with policymakers, legislative staff, national and state organizations across the country to advance policy solutions that aim to achieve equitable and sustainable state and local tax systems.